2016 Managed Security Services in North America

2016 Managed Security Services in North America

Make Way for DDoS Attack Protection

08-Nov-2016

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

The challenges the cybersecurity discipline faces continue to ramp upward. Attackers are more sophisticated, funded, and crafty than ever before. On the defensive front, businesses are confronted with a byzantine assortment of security technologies, compliance requirements, and policies. At the same time, finding, training, and retaining InfoSec professionals is very difficult and the assets and business operations to protect are highly dynamic. Essentially, businesses and public entities need assistance in managing cybersecurity risk better. A do-it-yourself approach, for many, is inadequate. As this market analysis report quantifies, businesses and public entities of all sizes are turning to managed security service providers for an expanding array of services.

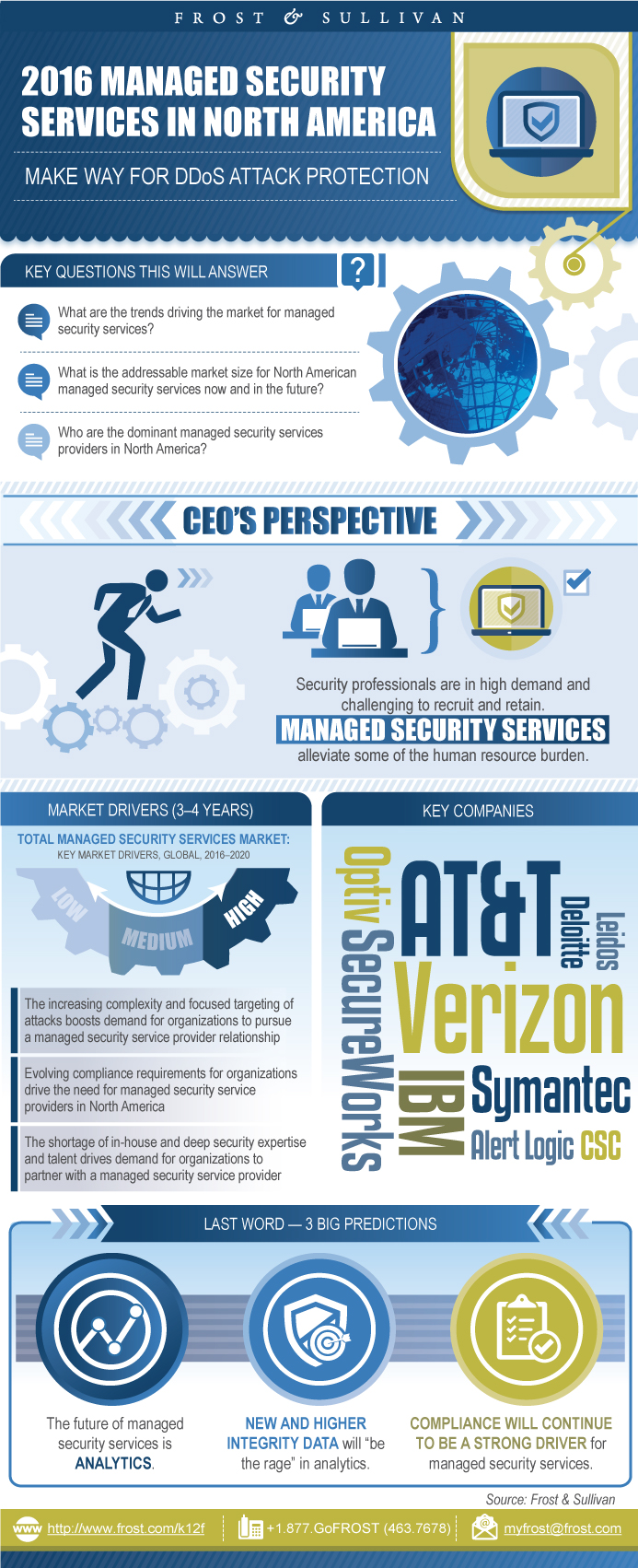

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Market Engineering Measurements

CEO’s Perspective

Introduction to the Research

Market Overview

Definitions

Forces at Work

Service Market Life Cycle Analysis

Service Technology Road Map

Distribution Channels

Drivers and Restraints

Revenue Forecast

Pricing Analysis

Percent Revenue Forecast by Product Segment (CPE & Hosted)

Percent Revenue Forecast by Product Type

Percent Revenue Forecast by Size of Business

Percent Revenue Forecast by Vertical Market

Vertical Market Analysis

Percent Revenue Forecast by Provider Type

Percent Revenue by Provider and Service Type, 2015

Competitive Analysis

Competitive Environment

Revenue Forecast

Competitive Analysis

Revenue Forecast

Competitive Analysis

Predictions

Recommendations

Legal Disclaimer

Above Security

Alert Logic

AT&T

CenturyLink

Cisco

CSC

Digital Shadows

EarthLink

eSentire

Hawaiian Telcom

Hewlett Packard Enterprise

IBM

Leidos

Level 3

Lumen21

Masergy

Nuspire Networks

Optiv

Orange Business Services

Proficio

Raytheon Foreground Security

Red Canary

Rogers Communications

Secure Designs

SecureWorks

Solutionary (NTT Group Security)

Symantec

TELUS Security

Terra Verde

Trustwave

Unisys

Verizon

Market Engineering Methodology

Additional Sources of Information on Study Topic Area

Partial List of Companies Interviewed

List of Companies Included in “Others”

Learn More—Next Steps

- 1. Total Managed Security Services Market: Key Market Drivers and Restraints, Global, 2016–2020

- 2. Total Managed Security Services Market: Average Annual Contract Prices by Business Size (representative categories), North America, 2015

- 3. Total Managed Security Services Market: Competitive Structure, North America, 2015

- 1. Total Managed Security Services Market: Market Engineering Measurements, North America, 2015

- 2. Total Managed Security Services Market: Key Factors, North America, 2015

- 3. Total Managed Security Services Market: Market Life Cycle Analysis, North America, 2015

- 4. Total Managed Security Services Market: Service Technology Road Map, North America, 2009–2020

- 5. Total Managed Security Services Market: Distribution Channel Analysis, North America, 2015

- 6. Total Managed Security Service Market: Revenue Forecast, North America, 2012–2020

- 7. Total Managed Security Services Market: Percent Revenue Forecast by Product Segment, North America, 2015

- 8. Total Managed Security Services Market: Percent Revenue Forecast by Product Type, North America, 2015

- 9. Total Managed Security Services Market: Percent Revenue Forecast by Product Type, North America, 2020

- 10. Total Managed Security Services Market: Percent Revenue Forecast by Size of Business, North America, 2015

- 11. Total Managed Security Services Market: Percent Revenue Forecast by Size of Business, North America, 2020

- 12. Total Managed Security Services Market: Percent Revenue Forecast by Vertical Market, North America, 2015

- 13. Total Managed Security Services Market: Percent Revenue Forecast by Vertical Market, North America, 2020

- 14. Total Managed Security Services Market: Legislative Trends, North America, 2015

- 15. Total Managed Security Services Market: Percent Revenue Forecast by Provider Type, North America, 2015

- 16. Total Managed Security Services Market: Percent Revenue Forecast by Provider Type, North America, 2020

- 17. Total Managed Security Services for Security Specialists: Percent Revenue by Service Type, North America, 2015

- 18. Total Managed Security Services for Communication Service Providers: Percent Revenue by Service Type, North America, 2015

- 19. Total Managed Security Services Market: Percent of Revenue, North America, 2015

- 20. Total Managed Security Services Market: Percent of Revenue for Notable “Other” Market Participants, North America, 2015

- 21. Total Managed Security Service Market: Revenue Forecast, Canada, 2012–2020

- 22. Total Managed Security Services Market: Percent of Revenue, Canada, 2015

- 23. Total Managed Security Service Market: Revenue Forecast, United States of America, 2012–2020

- 24. Total Managed Security Services Market: Percent of Revenue, United States, 2015

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Market Engineering Measurements~ || CEO’s Perspective~ | Market Overview~ || Introduction to the Research~ || Market Overview~ || Definitions~ || Forces at Work~ || Service Market Life Cycle Analysis~ || Service Technology Road Map~ || Distribution Channels~ | Market and Technology Trends~ | External Challenges: Drivers and Restraints—Total Managed Security Services Market~ || Drivers and Restraints~ | Forecasts and Trends—Total Managed Security Services Market~ || Revenue Forecast~ || Pricing Analysis~ || Percent Revenue Forecast by Product Segment (CPE & Hosted)~ || Percent Revenue Forecast by Product Type~ || Percent Revenue Forecast by Size of Business~ || Percent Revenue Forecast by Vertical Market~ || Vertical Market Analysis~ || Percent Revenue Forecast by Provider Type~ || Percent Revenue by Provider and Service Type, 2015~ | Market Share and Competitive Analysis~ || Competitive Analysis~ || Competitive Environment~ | Regional Assessment: Canada~ || Revenue Forecast~ || Competitive Analysis~ | Regional Assessment: United States~ || Revenue Forecast~ || Competitive Analysis~ | The Last Word~ || Predictions~ || Recommendations~ || Legal Disclaimer~ | Vendor Profiles~ || Above Security~ || Alert Logic~ || AT&T~ || CenturyLink~ || Cisco~ || CSC~ || Digital Shadows~ || EarthLink~ || eSentire~ || Hawaiian Telcom~ || Hewlett Packard Enterprise~ || IBM~ || Leidos~ || Level 3~ || Lumen21~ || Masergy~ || Nuspire Networks~ || Optiv~ || Orange Business Services~ || Proficio~ || Raytheon Foreground Security~ || Red Canary~ || Rogers Communications~ || Secure Designs~ || SecureWorks~ || Solutionary (NTT Group Security)~ || Symantec~ || TELUS Security~ || Terra Verde~ || Trustwave~ || Unisys~ || Verizon~ | Appendix~ || Market Engineering Methodology~ || Additional Sources of Information on Study Topic Area~ || Partial List of Companies Interviewed~ || List of Companies Included in “Others”~ || Learn More—Next Steps~ |

| List of Charts and Figures | 1. Total Managed Security Services Market: Key Market Drivers and Restraints, Global, 2016–2020~ 2. Total Managed Security Services Market: Average Annual Contract Prices by Business Size (representative categories), North America, 2015~ 3. Total Managed Security Services Market: Competitive Structure, North America, 2015~| 1. Total Managed Security Services Market: Market Engineering Measurements, North America, 2015~ 2. Total Managed Security Services Market: Key Factors, North America, 2015~ 3. Total Managed Security Services Market: Market Life Cycle Analysis, North America, 2015~ 4. Total Managed Security Services Market: Service Technology Road Map, North America, 2009–2020~ 5. Total Managed Security Services Market: Distribution Channel Analysis, North America, 2015~ 6. Total Managed Security Service Market: Revenue Forecast, North America, 2012–2020~ 7. Total Managed Security Services Market: Percent Revenue Forecast by Product Segment, North America, 2015~ 8. Total Managed Security Services Market: Percent Revenue Forecast by Product Type, North America, 2015~ 9. Total Managed Security Services Market: Percent Revenue Forecast by Product Type, North America, 2020~ 10. Total Managed Security Services Market: Percent Revenue Forecast by Size of Business, North America, 2015~ 11. Total Managed Security Services Market: Percent Revenue Forecast by Size of Business, North America, 2020~ 12. Total Managed Security Services Market: Percent Revenue Forecast by Vertical Market, North America, 2015~ 13. Total Managed Security Services Market: Percent Revenue Forecast by Vertical Market, North America, 2020~ 14. Total Managed Security Services Market: Legislative Trends, North America, 2015 ~ 15. Total Managed Security Services Market: Percent Revenue Forecast by Provider Type, North America, 2015~ 16. Total Managed Security Services Market: Percent Revenue Forecast by Provider Type, North America, 2020~ 17. Total Managed Security Services for Security Specialists: Percent Revenue by Service Type, North America, 2015~ 18. Total Managed Security Services for Communication Service Providers: Percent Revenue by Service Type, North America, 2015~ 19. Total Managed Security Services Market: Percent of Revenue, North America, 2015~ 20. Total Managed Security Services Market: Percent of Revenue for Notable “Other” Market Participants, North America, 2015~ 21. Total Managed Security Service Market: Revenue Forecast, Canada, 2012–2020~ 22. Total Managed Security Services Market: Percent of Revenue, Canada, 2015~ 23. Total Managed Security Service Market: Revenue Forecast, United States of America, 2012–2020~ 24. Total Managed Security Services Market: Percent of Revenue, United States, 2015~ |

| Author | Frank Dickson |

| Industries | Information Technology |

| WIP Number | K12F-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB