European Bearings Market, Forecast to 2021

European Bearings Market, Forecast to 2021

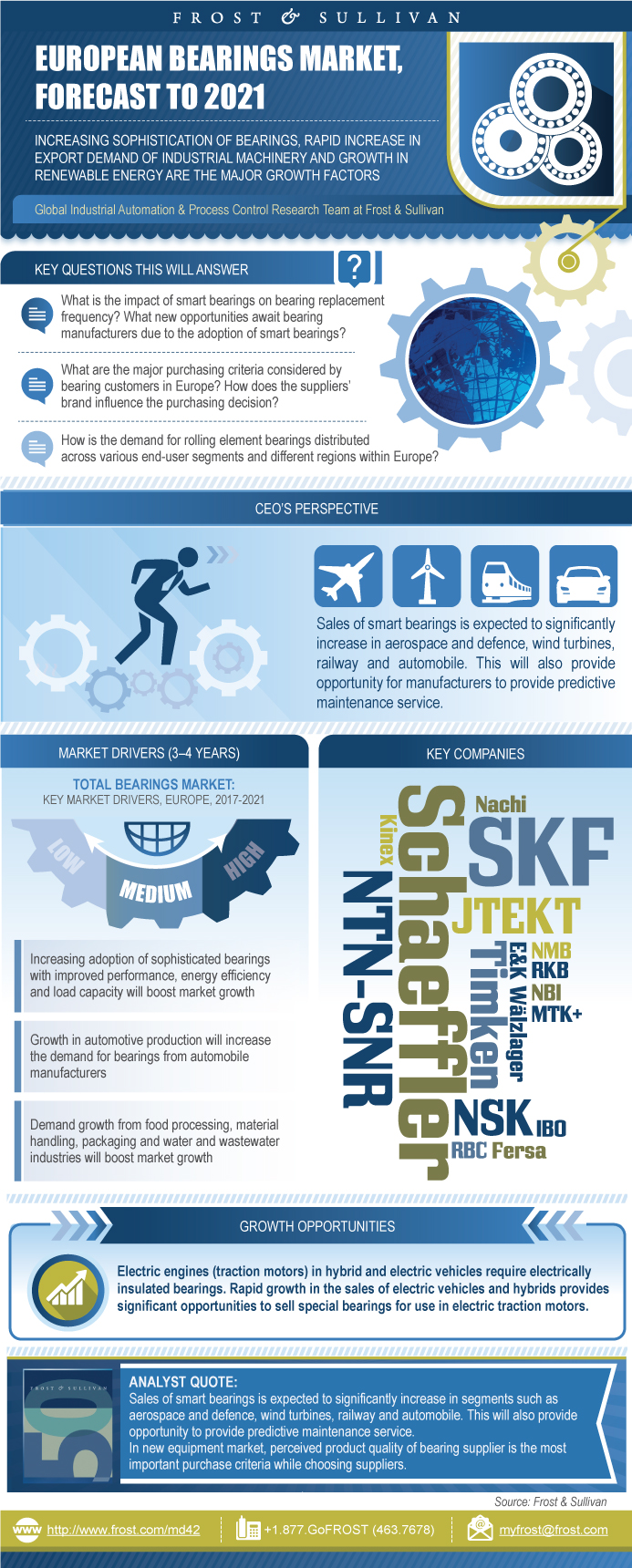

Increasing Sophistication of Bearings, Rapid Increase in Export Demand of Industrial Machinery and Growth in Renewable Energy are the Major Growth Fac

31-Oct-2017

Europe

$4,950.00

Special Price $3,712.50 save 25 %

Description

The research provides the European bearings market size estimate for 2016, historic data from 2013 to 2015 and provides market forecast from 2017 to 2021. Market revenue is provided in $ million for 2 product segments, 8 end-user segments and 9 regional segments in Europe.

Product technology include Ball bearings, Roller bearings, cylindrical roller bearings, Tapered roller bearings, Spherical roller bearings and Needle roller bearings. Regions include Germany, France, Italy, the United Kingdom, Scandinavia, Benelux, Iberia, Rest of Western Europe, Central and Eastern Europe. End users include: industrial (energy, heavy industries, general manufacturing, others) and mobile (automobile, aerospace and defence, off-highway and construction equipment, and railway).

The report gives detailed information on the revenues and growth rates of these end-user segments across regions. Competitor analyses and market shares for 2016 have been provided. The major companies covered in the report are SKF, Schaeffler AG, NSK Ltd, NTN-SNR, The Timken Company, JTEKT Corporation, Nachi Europe GmbH, Kinex Bearings and Fersa Bearings.

The European bearings market is dominated by 6 major global brands that have significant presence across all major end-user segments and regional segments.The bearings market is likely to be positively impacted by increasing demand for sophisticated bearings. In general, the demand for bearings with longer service life, higher efficiency and lower maintenance requirements is expected to grow significantly during the forecast period.

On the other hand, higher adoption of smart bearings is expected to reduce the replacement frequency of bearings, as smart bearings will be replaced on the basis of the actual condition of the bearing rather than on a predetermined replacement schedule. This trend is expected to reduce the growth in demand.

The research methodology is a combination of primary and secondary research. Secondary research involves desk-based research. Primary research involves interaction with market participants and getting their perspective and feedback on our analysis.

Key Questions Answered in the Report:

• Is the European bearings market growing? How long will it continue to grow, and at what rate?

• What is the impact of smart bearings on bearing replacement frequency? What new opportunities await bearing manufacturers due to the adoption of smart bearings?

• What are the major purchasing criteria considered by bearing customers in Europe? How does the suppliers’ brand influence the purchasing decision?

• What are the threats this market is likely to encounter?

• What are the factors that may drive the market?

• How is the demand for rolling element bearings distributed across the various end-user segments and regions within Europe?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Executive Summary—Key Findings

Executive Summary—Market Engineering Measurements

Executive Summary—CEO’s Perspective

Market Overview—Definitions

Market Overview—Geographic Scope

Market Overview—End-user Industry Scope

Market Overview—Segmentation

Market Overview—Distribution Channels

Market Drivers

Drivers Explained

Market Restraints

Restraints Explained

Market Engineering Measurements

Forecast Assumptions

Revenue Forecast

Percent Revenue Forecast by Region

Revenue Forecast by Region

Percent Revenue Forecast by End User

Revenue Forecast by End User

Key Purchasing Criteria

Automobile Industry End User—Revenue Forecast

General Engineering Industries End User—Revenue Forecast

Energy Industry End User—Revenue Forecast

Heavy Industries End User—Revenue Forecast

A&D Industry End User—Revenue Forecast

Railway Industry End User—Revenue Forecast

Off-Highway and Construction Industry End User—Revenue Forecast

Industrial: Others End User—Revenue Forecast

Competitive Analysis—Market Share

Market Share Evolution

Market Share Analysis

Competitive Environment

Top Competitors

Transformation in Bearings Market Ecosystem—2016

Growth Opportunity 1—Automobile Bearings

Growth Opportunity 2—Special Application Bearings

Strategic Imperatives for Success and Growth

Ball Bearings Segment Key Findings

Market Engineering Measurements

Revenue Forecast

Percent Revenue Forecast by Region

Revenue Forecast by Region

Roller Bearings Segment Key Findings

Market Engineering Measurements

Revenue Forecast

Percent Revenue Forecast by Region

Revenue Forecast by Region

Percent Revenue Forecast by Product Type

Revenue Forecast by Product Type

European Bearings Market—Sealed Roller Bearings

The Last Word—Three Big Predictions

Legal Disclaimer

Market Engineering Methodology

Additional Sources of Information on European Bearings Market

List of Key Market Participants

List of Companies in ‘Others’

Table of Acronyms Used

Learn More—Next Steps

- 1. Total Bearings Market: Key Market Drivers, Europe, 2017–2021

- 2. Total Bearings Market: Key Market Restraints, Europe, 2017–2021

- 3. Total Bearings Market: Market Engineering Measurements, Europe, 2016

- 4. Total Bearings Market: Revenue Forecast by Region, Europe, 2013–2021

- 5. Total Bearings Market: Company Market Share Analysis of Top 6 Participants, Europe, 2016

- 6. Total Bearings Market: Competitive Structure, Europe, 2016

- 7. Total Bearings Market: SWOT Analysis, Europe, 2016

- 8. Ball Bearings Segment: Market Engineering Measurements, Europe, 2016

- 9. Ball Bearings Segment: Revenue Forecast by Region, Europe, 2013–2021

- 10. Roller Bearings Segment: Market Engineering Measurements, Europe, 2016

- 11. Roller Bearings Segment: Revenue Forecast by Region, Europe, 2013–2021

- 12. Roller Bearings Segment: Revenue Forecast by Product Type, Europe, 2013–2021

- 13. Bearings Market: Relubrication-free Sealed Roller Bearings—Key Industries/ Regions, Europe, 2016

- 1. Total Bearings Market: Market Engineering Measurements, Europe, 2016

- 2. Total Bearings Market: Percent Sales Breakdown, Europe, 2016

- 3. Total Bearings Market: Distribution Channel Analysis, Europe, 2016

- 4. Total Bearings Market: Revenue Forecast, Europe, 2013–2021

- 5. Total Bearings Market: Percent Revenue Forecast by Region, Europe, 2013–2021

- 6. Total Bearings Market: Percent Revenue Forecast by End User, Europe, 2013–2021

- 7. Total Bearings Market: Revenue Forecast by End User, Europe, 2013–2021

- 8. Total Bearings Market: Key Purchasing Criteria, Europe, 2016

- 9. Total Bearings Market: Revenue Forecast for Automobile Industry, Europe, 2013–2021

- 10. Total Bearings Market: Revenue Forecast for General Engineering Industries, Europe, 2013–2021

- 11. Total Bearings Market: Revenue Forecast for Energy Industry, Europe, 2013–2021

- 12. Total Bearings Market: Revenue Forecast for Heavy Industries, Europe, 2013–2021

- 13. Total Bearings Market: Revenue Forecast for A&D Industry, Europe, 2013–2021

- 14. Total Bearings Market: Revenue Forecast for Railway Industry, Europe, 2013–2021

- 15. Total Bearings Market: Revenue Forecast for Off-Highway and Construction Industry, Europe, 2013–2021

- 16. Total Bearings Market: Revenue Forecast for Other* Industries, Europe, 2013–2021

- 17. Total Bearings Market: Percent of Sales, Europe, 2016

- 18. Total Bearings Market: Absolute Market Share Trend, Europe, 2015 and 2016

- 19. Total Bearings Market: Percent Market Share Trend, Europe, 2015 and 2016

- 20. Ball Bearings Segment: Revenue Forecast, Europe, 2013–2021

- 21. Ball Bearings Segment: Percent Revenue Forecast by Region, Europe, 2013–2021

- 22. Roller Bearings Segment: Percent Revenue Breakdown, Europe, 2016

- 23. Roller Bearings Segment: Revenue Forecast, Europe, 2013–2021

- 24. Roller Bearings Segment: Percent Revenue Forecast by Region, Europe, 2013–2021

- 25. Roller Bearings Segment: Percent Revenue Forecast by Product Type, Europe, 2013–2021

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Executive Summary—Key Findings~ || Executive Summary—Market Engineering Measurements~ || Executive Summary—CEO’s Perspective~ | Market Overview~ || Market Overview—Definitions~ || Market Overview—Geographic Scope~ || Market Overview—End-user Industry Scope~ || Market Overview—Segmentation~ || Market Overview—Distribution Channels~ | External Challenges: Drivers and Restraints—Total Bearings Market~ || Market Drivers~ || Drivers Explained~ || Market Restraints~ || Restraints Explained~ | Forecasts and Trends—Total Bearings Market~ || Market Engineering Measurements~ || Forecast Assumptions~ || Revenue Forecast~ || Percent Revenue Forecast by Region~ || Revenue Forecast by Region~ || Percent Revenue Forecast by End User~ || Revenue Forecast by End User~ || Key Purchasing Criteria~ | Demand Analysis—Total Bearings Market~ || Automobile Industry End User—Revenue Forecast~ || General Engineering Industries End User—Revenue Forecast~ || Energy Industry End User—Revenue Forecast~ || Heavy Industries End User—Revenue Forecast~ || A&D Industry End User—Revenue Forecast~ || Railway Industry End User—Revenue Forecast~ || Off-Highway and Construction Industry End User—Revenue Forecast~ || Industrial: Others End User—Revenue Forecast~ | Market Share and Competitive Analysis—Total Bearings Market~ || Competitive Analysis—Market Share~ || Market Share Evolution~ || Market Share Analysis~ || Competitive Environment~ || Top Competitors~ | Growth Opportunities and Companies to Action~ || Transformation in Bearings Market Ecosystem—2016~ || Growth Opportunity 1—Automobile Bearings~ || Growth Opportunity 2—Special Application Bearings~ || Strategic Imperatives for Success and Growth~ | Ball Bearings Segment Breakdown~ || Ball Bearings Segment Key Findings~ || Market Engineering Measurements~ || Revenue Forecast~ || Percent Revenue Forecast by Region~ || Revenue Forecast by Region~ | Roller Bearings Segment Breakdown~ || Roller Bearings Segment Key Findings~ || Market Engineering Measurements~ || Revenue Forecast~ || Percent Revenue Forecast by Region~ || Revenue Forecast by Region~ || Percent Revenue Forecast by Product Type~ || Revenue Forecast by Product Type~ || European Bearings Market—Sealed Roller Bearings~ | The Last Word~ || The Last Word—Three Big Predictions~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ || Additional Sources of Information on European Bearings Market~ || List of Key Market Participants~ || List of Companies in ‘Others’~ || Table of Acronyms Used~ || Learn More—Next Steps~ |

| List of Charts and Figures | 1. Total Bearings Market: Key Market Drivers, Europe, 2017–2021~ 2. Total Bearings Market: Key Market Restraints, Europe, 2017–2021~ 3. Total Bearings Market: Market Engineering Measurements, Europe, 2016~ 4. Total Bearings Market: Revenue Forecast by Region, Europe, 2013–2021~ 5. Total Bearings Market: Company Market Share Analysis of Top 6 Participants, Europe, 2016~ 6. Total Bearings Market: Competitive Structure, Europe, 2016~ 7. Total Bearings Market: SWOT Analysis, Europe, 2016~ 8. Ball Bearings Segment: Market Engineering Measurements, Europe, 2016~ 9. Ball Bearings Segment: Revenue Forecast by Region, Europe, 2013–2021~ 10. Roller Bearings Segment: Market Engineering Measurements, Europe, 2016~ 11. Roller Bearings Segment: Revenue Forecast by Region, Europe, 2013–2021~ 12. Roller Bearings Segment: Revenue Forecast by Product Type, Europe, 2013–2021~ 13. Bearings Market: Relubrication-free Sealed Roller Bearings—Key Industries/ Regions, Europe, 2016~| 1. Total Bearings Market: Market Engineering Measurements, Europe, 2016~ 2. Total Bearings Market: Percent Sales Breakdown, Europe, 2016~ 3. Total Bearings Market: Distribution Channel Analysis, Europe, 2016~ 4. Total Bearings Market: Revenue Forecast, Europe, 2013–2021~ 5. Total Bearings Market: Percent Revenue Forecast by Region, Europe, 2013–2021~ 6. Total Bearings Market: Percent Revenue Forecast by End User, Europe, 2013–2021~ 7. Total Bearings Market: Revenue Forecast by End User, Europe, 2013–2021~ 8. Total Bearings Market: Key Purchasing Criteria, Europe, 2016~ 9. Total Bearings Market: Revenue Forecast for Automobile Industry, Europe, 2013–2021~ 10. Total Bearings Market: Revenue Forecast for General Engineering Industries, Europe, 2013–2021~ 11. Total Bearings Market: Revenue Forecast for Energy Industry, Europe, 2013–2021~ 12. Total Bearings Market: Revenue Forecast for Heavy Industries, Europe, 2013–2021~ 13. Total Bearings Market: Revenue Forecast for A&D Industry, Europe, 2013–2021~ 14. Total Bearings Market: Revenue Forecast for Railway Industry, Europe, 2013–2021~ 15. Total Bearings Market: Revenue Forecast for Off-Highway and Construction Industry, Europe, 2013–2021~ 16. Total Bearings Market: Revenue Forecast for Other* Industries, Europe, 2013–2021~ 17. Total Bearings Market: Percent of Sales, Europe, 2016~ 18. Total Bearings Market: Absolute Market Share Trend, Europe, 2015 and 2016~ 19. Total Bearings Market: Percent Market Share Trend, Europe, 2015 and 2016~ 20. Ball Bearings Segment: Revenue Forecast, Europe, 2013–2021~ 21. Ball Bearings Segment: Percent Revenue Forecast by Region, Europe, 2013–2021~ 22. Roller Bearings Segment: Percent Revenue Breakdown, Europe, 2016~ 23. Roller Bearings Segment: Revenue Forecast, Europe, 2013–2021~ 24. Roller Bearings Segment: Percent Revenue Forecast by Region, Europe, 2013–2021~ 25. Roller Bearings Segment: Percent Revenue Forecast by Product Type, Europe, 2013–2021~ 26. |

| Author | Krishna Raman |

| Industries | Industrial Automation |

| WIP Number | MD42-01-00-00-00 |

| Keyword 1 | Bearings |

| Keyword 2 | European Bearings |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB