Iranian Automotive Market, Forecast to 2022

Iranian Automotive Market, Forecast to 2022

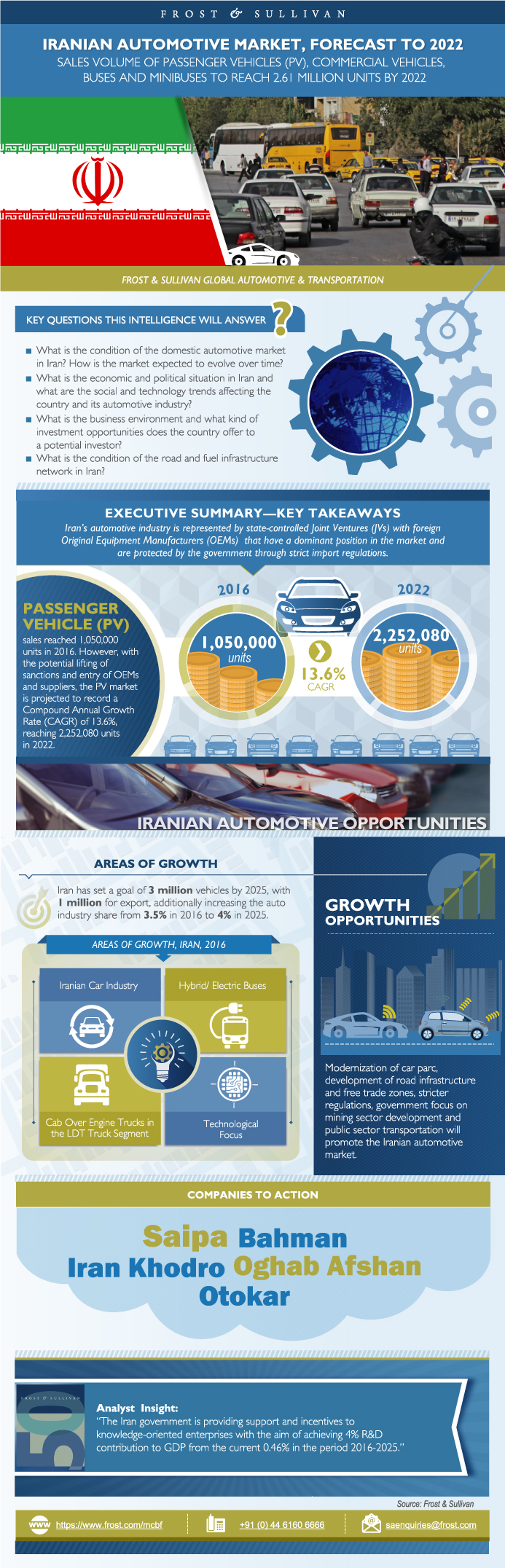

Sales Volume of Passenger Vehicles, Commercial Vehicles, and Buses and Minibuses to Reach 2.61 Million Units by 2022

19-Feb-2018

South Asia, Middle East & North Africa

$4,950.00

Special Price $3,712.50 save 25 %

Description

The Iranian passenger vehicles (PV) market is projected to grow, recording a compound annual growth rate (CAGR) of 13.6% during 2016–2022 with the potential lifting of sanctions and the entry of foreign original equipment manufacturers (OEMs) and suppliers. By 2022, the B segment, with a 46% market share, will be most preferred segment cannibalising on the D segment for its value-added features. The B and D segments are dominated predominantly by Iranian OEMs and locally built cars, whilst the premium segments include foreign participants.

The Iranian government has introduced strong initiatives to cut emissions and modernise the car parc, which provides strong opportunities for local production. Iran disposed of about 320,000 ‘end of life’ PVs as part of its scrappage programme in 2015 to reduce pollution and fuel consumption. The country plans to decrease the average passenger parc age to 20 years by the end of 2020 and to 15 years by the end of 2025.

IKCO and SAIPA have a dominant position in the PV parc. The Light Duty Truck (LDT) market is fragmented amongst three state-controlled OEMs that operate across all segments. IKCO and SAIPA have more than 90% market share in the LDT segment. The domination of pickups and vans in the LDT segment will be challenged with the increasing penetration of COE trucks from Japanese brands. In the Medium and Heavy Duty Truck (M&HDT) segment, Bahman and SAIPA have a share of more than 70%. Iranian government initiatives towards the opening up of the mining sector for foreign investors will drive the demand for commercial vehicles in the mining and construction segment. Foreign brands such as Dongfeng, IVECO, and Volvo dominate the HDT segment due to the higher tonnage and power requirements. Local brands are preferred for distributing lighter materials.

Due to its strategic location, Iran has the potential for accounting for a substantial share of international transit trade with the development of proper infrastructure. According to the 6th Development Plan, the country aims to construct over 1,500 km of free highways. At present, Iran has over 2,400 km of freeways, which are expected to increase to over 4,000 km by the end of 2020. Additionally, the country seeks to support knowledge-oriented enterprises for new and advanced technology development. The aim is to achieve a 4% research and development (R&D) contribution to the country’s gross domestic product (GDP).

The government plans to encourage producers to allocate 25% of their revenues to R&D activities in future. Foreigners will receive extra tax exemption if they can export 30–40% of their products out of Iran. Iran’s seven free trade zones (FTZs) are placed at strategic geographical locations to act as hubs for imports and exports. Special bylaws regulate import, export, investment, banking, and labour laws.

Research Scope

This research report includes following segments:

- Passenger Cars

- Light duty truck (LDT)

- Medium duty truck (MDT)

- Heavy duty truck (HDT)

- Bus

Research Benefits

What makes our reports unique?

- We provide the longest market segmentation chain in this industry.

- We provide 10% customization. Our customization will ensure that you necessarily get the market intelligence you are looking for and we get a loyal customer.

- We conduct detailed market positioning, product positioning, and competitive positioning. Entry strategies, gaps and opportunities are identified for all stakeholders.

Key Issues Addressed

- What is the condition of the domestic automotive market in Iran? How automotive market is expected to evolve over time?

- What is the economic and political situation in Iran and what are the social and technology trends affecting the country and the automotive industry?

- What is the business environment and what kind of investment opportunities does the country have to offer to a potential investor?

- What is the condition of the road and fuel infrastructure network in Iran?

- What are the key policies, taxation regulations and economic incentives in the automotive industry?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Executive Summary—Key Takeaways

Executive Summary—Automotive Sector in Iran: A Snapshot

Executive Summary—Passenger Vehicles Market Breakdown by OEMs

Executive Summary—Automobile Market: Areas of Growth

Executive Summary—Findings and Future Outlook

Research Scope

Research Aims and Objectives

Vehicle Scope and Definitions in Iran

Key Questions this Study will Answer

Research Background

Research Methodology

Iran—Mega Trends

Iran—Key Macroeconomic Figures

Iran—Demographic Trends

Iran—Political and Historical Background

Iran—Geographical View

Iran—Road Network

Iran—Fuel Infrastructure

Investment Climate—R&D Incentives

Investment Climate—Cost of Doing Business

Free Trade Zones

Investment Climate—Trade Policies

Technology Agreements

Automotive Market—Policies in the Country

Automotive Market—Policies in the Country (continued)

Automotive Industry Hourly Wages

Passenger Vehicles—Taxation Structure

Used Vehicle—Trade Regulations

Passenger Vehicles—Market Special Conditions

Passenger Vehicles (PV)—Parc

Passenger Vehicles—Market Trends

Commercial Vehicles (CV)—Parc

Commercial Vehicles + Buses and Minibuses—Market Trends

Passenger Vehicles—Segmentation

Passenger Vehicles—Key Models

Passenger Vehicles—Customer Needs

Commercial Vehicles + Buses and Minibuses—Key Models

Commercial Vehicles + Buses and Minibuses—Customer Needs

Iran Auto Components Production Map

Passenger Vehicles—Unit Shipment Forecast

Passenger Vehicles—Unit Shipment Breakdown by OEMs

Passenger Vehicles—Unit Shipment Forecast by Vehicle Segment

Passenger Vehicles—Percent Unit Shipment Forecast by Powertrain

Passenger Vehicles—Percent Unit Shipment Forecast Transmission

Passenger Vehicles—Percent Unit Shipment Forecast Fleet Ownership Structure

Commercial Vehicles—Unit Shipment Forecast

Commercial Vehicles—Unit Shipment Forecast by Vehicle Segment

Commercial Vehicles—Percent Unit Shipment Breakdown by Vehicle Segment and Powertrain

Commercial Vehicles—Percent Unit Shipment Forecast by Wheelbase

Commercial Vehicles—Percent Unit Shipment Forecast by Intended Use

Buses and Minibuses—Unit Shipment Forecast

Buses and Minibuses—Percent Unit Shipment Forecast by Vehicle Segment

Buses and Minibuses—Percent Unit Shipment by Powertrain

Buses and Minibuses—Percent Unit Shipment Forecast by Tonnage

Buses and Minibuses—Percent Unit Shipment Forecast by Wheelbase

Buses and Minibuses—Percent Unit Shipment Forecast by Intended Use

CV + Buses and Minibuses—Sales Channels

Commercial Vehicles + Buses and Minibuses—Fleet Sales Analysis

Commercial Vehicles + Buses and Minibuses—Sales Network

Commercial Vehicles + Buses and Minibuses—Vehicle Body Producers

Passenger Vehicles—Top-selling Models

Passenger Vehicles—Financial Solutions

Average Prices—Commercial Vehicles + Bus + Minibus

Commercial Vehicles + Buses and Minibuses—Financial Solutions

Passenger Vehicles—SAIPA: Business Model

Passenger Vehicles—Distribution Channel Structure

Passenger Vehicles—OEM and Aftermarket Distribution Network

Aftermarket Distribution Structure

OEM Competitive Analysis

IKCO-Diesel

SAIPA Diesel

Growth Opportunity—Growing Segment and Alternative Technology

Strategic Imperatives for Success and Growth

Key Conclusions

The Last Word—3 Big Predictions

Legal Disclaimer

Abbreviations and Acronyms Used

Market Engineering Methodology

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

Popular Topics

Research Scope

This research report includes following segments:

- Passenger Cars

- Light duty truck (LDT)

- Medium duty truck (MDT)

- Heavy duty truck (HDT)

- Bus

Research Benefits

What makes our reports unique?

- We provide the longest market segmentation chain in this industry.

- We provide 10% customization. Our customization will ensure that you necessarily get the market intelligence you are looking for and we get a loyal customer.

- We conduct detailed market positioning, product positioning, and competitive positioning. Entry strategies, gaps and opportunities are identified for all stakeholders.

Key Issues Addressed

- What is the condition of the domestic automotive market in Iran? How automotive market is expected to evolve over time?

- What is the economic and political situation in Iran and what are the social and technology trends affecting the country and the automotive industry?

- What is the business environment and what kind of investment opportunities does the country have to offer to a potential investor?

- What is the condition of the road and fuel infrastructure network in Iran?

- What are the key policies, taxation regulations and economic incentives in the automotive industry?

| No Index | No |

|---|---|

| Podcast | No |

| Author | Saideep Sudhakar |

| Industries | Automotive |

| WIP Number | MCBF-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9B01-A6,9963-A6,9883-A6,9889-A6,9AF6-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB