Global Autonomous Driving Market Outlook, 2018

Global Autonomous Driving Market Outlook, 2018

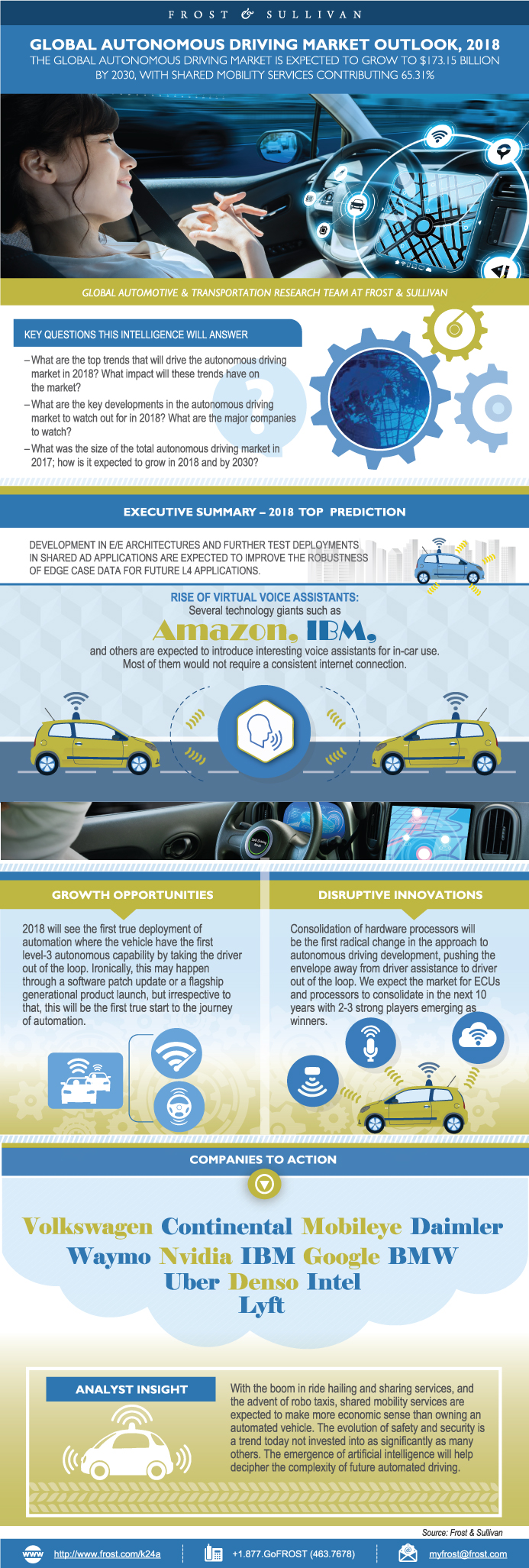

The Global Autonomous Driving Market is Expected Grow up to $173.15 B by 2030, with Shared Mobility Services Contributing to 65.31%

15-Mar-2018

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

2018 will see the first true deployment of automation where the vehicle will tell the driver with the first level 3 (L3) autonomous capability by taking the driver out of the loop to be introduced next year. Ironically, this may happen through a software patch update or a flagship generational product launch. Regardless of the medium through which this happens, it will be the first true start to the journey of automation. Currently most major OEMs and tier 1 suppliers are looking at exploring the benefits of developing applications focused on the convergence of the three technology pillars: Connected, Autonomous, and Electric. However, the true potential of each of these technology pillars can be tapped only by the marriage of technology and service pillars of the industry. Within the service pillar, there are elements – firstly, the vehicle itself [leasing]; secondly, the services that can be leveraged by the vehicle [mobility]; and thirdly, data-driven services [IoT Platforms].

There is a growing need for improving vehicle perception capabilities, which will create opportunities for both existing sensors to proliferate as well as new sensing technologies to emerge. Bad and complex driving conditions are still not addressed by today's autonomous test systems and one of the keys to real-world deployment would be the improvement of visions applications. Within this growth of sensors per car, many OEMs will be finalizing their sensor suite by L3 and incrementally adding sensors to address other levels. For example, Tesla has already frozen its suite for L3 and L4 automation, while others are expected to have diverse sensor suite designs for fully autonomous and partial autonomous applications. There can possibly be no one winner in the autonomous race but the true possibility of tapping the potential on autonomous technology is by creating a strong ecosystem with the customer being at the center. For this, it will be essential to look outside of the value chain focused on service-centric solutions with a partnership-based value chain. Between now and the 2030 milestone, there are numerous hurdles, both quantitative and qualitative, that the industry will need to tackle if autonomous driving has to bring a long-lasting impact to make safe, clean, and lean transportation a reality. The biggest hurdle today though is the lack of clear regulatory frameworks that define the outlines of how these products can be made available to the consumers. Statistically, even in a mid scenario, where autonomous emergency braking is mandated before 2020 and fully autonomous technology is made available commercially in the next decade, it will take more than 25 years from then to bring road fatalities to zero.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

2017 Key Highlights

2018–2019 Top-of-Mind Issues for Senior Management

Leading Players in terms of AD Patents Filed in 2017

Sensors Currently Used Across Applications

Next Generations of Sensor Fusion

Future Approach in Hardware and Software toward L5 Automation

Level 3 Automated Vehicles—What could be new?

2018 Top 5 Predictions

Research Scope

Vehicle Segmentation

Market Definition—Rise of Automation

Key Questions this Study will Answer

Transformational Impact of Automation on the Industry

Impact on the Development of Next-Generation Depth Sensing

Impact on Ownership and User-ship Structures

Impact of Autonomous Driving on Future Vehicle Design

Impact of Investments on Technology Development

Top Trends Driving the Autonomous Driving Market—2018

1. Autonomous Shared Mobility Solutions

Case Study—Waymo

2. Collective Intelligence for Fleet Management

Case Study—BestMile

3. Cyber Security of Autonomous Cars

Case Study—Karamba Security

1. Convergence of Artificial Intelligence and Automated Driving

Case Study—Mobileye

2. Domain Controllers

Case Study—Audi zFAS (zentrale Fahrerassistenzsteuergerät )

3. Driver Monitoring System

Case Study—General Motors’ Driver Attention System

Feature Roadmap—Autonomous Driving

Major OEM Outlook—1: Global

Major OEM Outlook—2: Global

Autonomous Shared Mobility—Competition Landscape

Technology Enablers and Major Suppliers

Region-wise Estimation of AD Unit Shipments—Market Leaders

Region-wise Estimation of AD Unit Shipments—Market Followers

Total Market Size Autonomous Vehicles (Ownership)

Automated Driving—Shared Mobility: Taxi, By Rides

Automated Driving—Shared Mobility: Shuttles, By Rides

Frost & Sullivan's Key Criteria to Shortlist Companies

Capabilities of Shortlisted Start-ups—ADAS Sensors

Capabilities of Shortlisted Start-ups—Computer Vision Software

Capabilities of Shortlisted Start-ups—Other Systems

European Automated Market—Overview

North American Automated Market—Overview

APAC (China and Japan) Automated Market—Overview

Transformation in Autonomous Driving Ecosystem—2018

Growth Opportunity—Investments and Partnerships From OEMs/TSPs

Strategic Imperatives for Success and Growth

The Last Word—Three Big Predictions

Legal Disclaimer

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

The Frost & Sullivan Story

Value Proposition—Future of Your Company & Career

Global Perspective

Industry Convergence

360º Research Perspective

Implementation Excellence

Our Blue Ocean Strategy

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Anirudh Venkitaraman |

| Industries | Automotive |

| WIP Number | K24A-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9673-A6,9674-A6,9694,9800-A6,9807-A6,9813-A6,9968-A6,9AF6-A6,9B07-C1,9B13-A6,9B15-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB