Indian Touch Technology Market, Forecast to FY 2022

Indian Touch Technology Market, Forecast to FY 2022

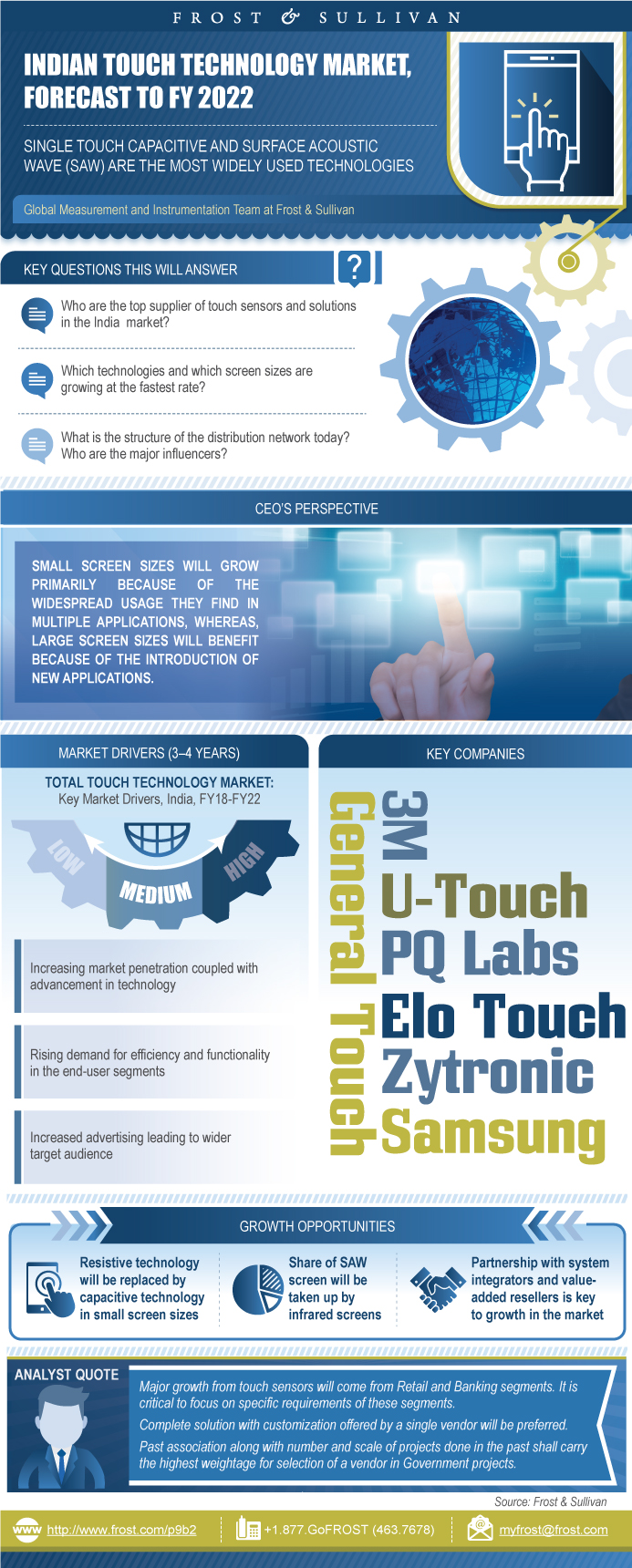

Single Touch Capacitive and Surface Acoustic Wave (SAW) are the Most Widely Used Technologies

19-Jan-2018

South Asia, Middle East & North Africa

$4,950.00

Special Price $3,712.50 save 25 %

Description

Touch screens are increasing experiencing high uptake in India market. With the availability of touch panels that can integrate seamlessly with the existing systems, they have caught the imagination of the end-users. Higher penetration of technology in everyday life, rise of Gen-Y, decline in prices, availability of robust technology and rising demand in end-user segments – government, banks, retail, gaming among others are the primary reasons of foreseen growth.

Touch screen market is defined by 5 technologies (Resistive, Single Touch Capacitive, Multi-Touch Capacitive, SAW and Infrared) and screen sizes ranging from sub 15 inches to higher than 100 inches. Touch screens is predominantly an import driven market in India and can be categorized as organized and un-organized market. Organized segment constitutes 41.6% while the un-organized segment constitutes 58.4% of the total market. The un-organized segment comprises imports from China, Taiwan and Korea. Within the organized segment of the market, the Indian touch technology market is relatively consolidated with the top 5 companies accounting for 90% of the organized segment. The most significant market participants in the organized segment are 3M, PQ Labs, Samsung, General Touch Technology and Elo Touch Solutions.

Indian Touch Technology market’s size is INR 259.1 Million in FY17 growing at a CAGR of 15.2% to reach a size of INR 525.3 Million in FY22. Number of units sold are 27,125 in FY17 growing at a CAGR of 18.3% to reach 62,967 in FY22. The market volume is likely to grow at the rate of 25.9% to reach 85,679 in FY22. Similarly, market value if likely to show a growth of 20.6% to reach a size of INR 661.1 Million in FY22. Retail segment will show the highest growth with a CAGR of 19.1%, followed by Banking segment with a CAGR of 14.9%. These two will be followed by Hospitality (14.8%), Railways & Metro (11.5%), Entertainment (11.3%) and Road Transport & Airport (9.9%).

Research Scope

The report describes the touch screen market from all dimensions thereby providing a holistic view enabling informed decisions for the existing and aspiring market participants. It covers the 5 technologies - Resistive, Single Touch Capacitive, Multi-Touch Capacitive, SAW and Infrared. Screen sizes covered are 15 inches and above and end-user segments covered are Banking, Retail, Railways & Metro, Hospitality, Entertainment, Road Transport & Airport and Others.

The fiscal year runs from April to March

Geographic coverage: India

Study period: FY 2017-FY 2022

Base year: FY 20167

Forecast period: FY 2018-FY 2022

Monetary Unit: INR

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Revenue Forecast by Technology—Realistic Scenario

Market Engineering Measurements

CEO’s Perspective

Market Definitions

Market Segmentation

Market Distribution Channels

Market Drivers

Market Restraints

Market Engineering Measurements

Unit Shipment and Revenue Forecast

Pricing Trends and Forecast

Volume Forecast by Vertical Market—Realistic Scenario

Revenue Forecast by Vertical Market—Realistic Scenario

Volume Forecast by Vertical Market—Optimistic Scenario

Revenue Forecast by Vertical Market—Optimistic Scenario

Volume Forecast by Screen Size—Realistic Scenario

Revenue Forecast by Screen Size—Realistic Scenario

Volume Forecast by Screen Size—Optimistic Scenario

Revenue Forecast by Screen Size—Optimistic Scenario

Volume Forecast by Technology—Realistic Scenario

Revenue Forecast by Technology—Realistic Scenario

Volume Forecast by Technology—Optimistic Scenario

Revenue Forecast by Technology—Optimistic Scenario

Market Share

Market Share Analysis

Market Share Analysis—Breakup by Technology

Competitive Environment

Top Competitors

Product Highlights

Growth Opportunities and Companies to Action

Growth Opportunity 1—Volume-based Market Expansion

Growth Opportunity 2—Create Differentiation in Large Screen Applications

Growth Opportunity 3—Partnership is Critical to Success

Strategic Imperatives for Success and Growth

India Mega Trends

Key Mega Trends Relevant to Touch Technolog

Mega Trend Impact on the Touch Technology Market

Connectivity and Convergence

Infrastructure Development

Social Trends in India

Bricks and Clicks

Rise of a Manufacturing Economy

Key Findings

Market Engineering Measurements

Unit Shipment and Revenue Forecast—Realistic Scenario

Unit Shipment and Revenue Forecast—Optimistic Scenario

Key Findings

Market Engineering Measurements

Unit Shipment and Revenue Forecast—Realistic Scenario

Unit Shipment and Revenue Forecast—Optimistic Scenario

Key Findings

Market Engineering Measurements

Unit Shipment and Revenue Forecast—Realistic Scenario

Unit Shipment and Revenue Forecast—Optimistic Scenario

Key Findings

Market Engineering Measurements

Unit Shipment and Revenue Forecast—Realistic Scenario

Unit Shipment and Revenue Forecast—Optimistic Scenario

Key Findings

Market Engineering Measurements

Unit Shipment and Revenue Forecast—Realistic Scenario

Unit Shipment and Revenue Forecast—Optimistic Scenario

Market Engineering Measurements

Unit Shipment and Revenue Forecast—Realistic Scenario

Unit Shipment and Revenue Forecast—Optimistic Scenario

The Last Word—3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

List of Companies in “Others”

Partial List of Companies Interviewed

Definitions

- 1. Total Touch Technology Market: Key Market Drivers, India, FY18-FY22

- 2. Total Touch Technology Market: Key Market Restraints, India, FY18-FY22

- 3. Total Touch Technology Market: Market Engineering Measurements, India, FY17

- 4. Total Touch Technology Market: Company Market Share Analysis of Top 7 Participants, India, FY17

- 5. Total Touch Technology Market: Technology wise Market Share, India, FY17

- 6. Total Touch Technology Market: Competitive Structure, India, FY17

- 7. Total Touch Technology Market: SWOT Analysis, India, FY17

- 8. Total Touch Technology Market: Top Company Product Highlights, India, FY17

- 9. Potential in Key Mobile-based Industries, India, 2020

- 10. Cumulative Infrastructure Planned Outlay by Segment, India, 2013–2017

- 11. Banking Segment: Market Engineering Measurements, India, FY17

- 12. Retail Segment: Market Engineering Measurements, India, FY17

- 13. Railways and Metro Segment: Market Engineering Measurements, India, FY17

- 14. Hospitality Segment: Market Engineering Measurements, India, FY17

- 15. Entertainment Segment: Market Engineering Measurements, India, FY17

- 16. Road Transport and Airport Segment: Market Engineering Measurements, India, FY17

- 1. Total Touch Technology Market: Revenue Forecast by Technology, India, FY14–FY22

- 2. Total Touch Technology Market: Market Engineering Measurements, India, FY17

- 3. Total Touch Technology Market: Percent Volume Breakdown by End-user Segment, India, FY17

- 4. Total Touch Technology Market: Percent Revenue Breakdown by End-user Segment, India, FY17

- 5. "Total Touch Technology Market: Percent Volume Breakdown by Screen Size, India, FY17"

- 6. "Total Touch Technology Market: Percent Revenue Breakdown by Screen Size, India, FY17"

- 7. Total Touch Technology Market: Percent Volume Breakdown by Technology, India, FY17

- 8. Total Touch Technology Market: Percent Revenue Breakdown by Technology, India, FY17

- 9. Total Touch Technology Market: Distribution Channel Analysis, India, FY17

- 10. Total Touch Technology Market: Unit Shipment and Revenue Forecast, India, FY14–FY22

- 11. Total Touch Technology Market: Average Price for Touch Technology, India, FY14-FY22

- 12. Total Touch Technology Market: Volume Forecast by Vertical Market, India, FY14–FY22

- 13. Total Touch Technology Market: Revenue Forecast by Vertical Market, India, FY14–FY22

- 14. Total Touch Technology Market: Volume Forecast by Vertical Market, India, FY14–FY22

- 15. Total Touch Technology Market: Revenue Forecast by Vertical Market, India, FY14–FY22

- 16. Total Touch Technology Market: Volume Forecast by Screen Size, India, FY14–FY22

- 17. Total Touch Technology Market: Revenue Forecast by Screen Size, India, FY14–FY22

- 18. Total Touch Technology Market: Volume Forecast by Screen Size, India, FY14–FY22

- 19. Total Touch Technology Market: Revenue Forecast by Screen Size, India, FY14–FY22

- 20. Total Touch Technology Market: Volume Forecast by Technology, India, FY14–FY22

- 21. Total Touch Technology Market: Revenue Forecast by Technology, India, FY14–FY22

- 22. Total Touch Technology Market: Volume Forecast by Technology, India, FY14–FY22

- 23. Total Touch Technology Market: Revenue Forecast by Technology, India, FY14–FY22

- 24. Total Touch Technology Market: Percent Revenue Forecast by Distribution Channel, India, FY14–FY22

- 25. Total Touch Technology Market: Percent Revenue Breakdown, India, 2016

- 26. Total Touch Technology Market: Organized vs Unorganized Market Share, India, FY17

- 27. Infrastructure Planned Outlay, India, 2013–2017

- 28. Retailing Formats, India, 2015–2025

- 29. Nominal GDP, India, 2011–2020

- 30. Manufacturing Contribution to GDP, India, 2015–2022

- 31. Banking Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22

- 32. Banking Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22

- 33. Retail Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22

- 34. Retail Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22

- 35. Railways and Metro Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22

- 36. Railways and Metro Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22

- 37. Hospitality Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22

- 38. Hospitality Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22

- 39. Entertainment Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22

- 40. Entertainment Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22

- 41. Road Transport and Airport Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22

- 42. Road Transport and Airport Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22

Popular Topics

Research Sco

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || Revenue Forecast by Technology—Realistic Scenario~ || Market Engineering Measurements~ || CEO’s Perspective~ | Market Overview~ || Market Definitions~ || Market Segmentation~ || Market Distribution Channels~ | Drivers and Restraints—Total Touch Technology Market~ || Market Drivers~ || Market Restraints~ | Forecasts and Trends—Total Touch Technology Market~ || Market Engineering Measurements~ || Unit Shipment and Revenue Forecast~ || Pricing Trends and Forecast~ || Volume Forecast by Vertical Market—Realistic Scenario~ || Revenue Forecast by Vertical Market—Realistic Scenario~ || Volume Forecast by Vertical Market—Optimistic Scenario~ || Revenue Forecast by Vertical Market—Optimistic Scenario~ || Volume Forecast by Screen Size—Realistic Scenario~ || Revenue Forecast by Screen Size—Realistic Scenario~ || Volume Forecast by Screen Size—Optimistic Scenario~ || Revenue Forecast by Screen Size—Optimistic Scenario~ || Volume Forecast by Technology—Realistic Scenario~ || Revenue Forecast by Technology—Realistic Scenario~ || Volume Forecast by Technology—Optimistic Scenario~ || Revenue Forecast by Technology—Optimistic Scenario~ | Market Share and Competitive Analysis—Total Touch Technology Market~ || Market Share~ || Market Share Analysis~ || Market Share Analysis—Breakup by Technology~ || Competitive Environment~ || Top Competitors~ || Product Highlights~ | Competitive Factors and Assessment~ || Growth Opportunities and Companies to Action~ || Growth Opportunity 1—Volume-based Market Expansion~ || Growth Opportunity 2—Create Differentiation in Large Screen Applications~ || Growth Opportunity 3—Partnership is Critical to Success~ || Strategic Imperatives for Success and Growth ~ | Mega Trends and Industry Convergence Implications~ || India Mega Trends~ || Key Mega Trends Relevant to Touch Technolog~ || Mega Trend Impact on the Touch Technology Market~ || Connectivity and Convergence~ || Infrastructure Development~ || Social Trends in India~ || Bricks and Clicks~ || Rise of a Manufacturing Economy~ | Banking Segment Analysis~ || Key Findings~ || Market Engineering Measurements~ || Unit Shipment and Revenue Forecast—Realistic Scenario~ || Unit Shipment and Revenue Forecast—Optimistic Scenario~ | Retail Segment Analysis~ || Key Findings~ || Market Engineering Measurements~ || Unit Shipment and Revenue Forecast—Realistic Scenario~ || Unit Shipment and Revenue Forecast—Optimistic Scenario~ | Railways and Metro Segment Analysis~ || Key Findings~ || Market Engineering Measurements~ || Unit Shipment and Revenue Forecast—Realistic Scenario~ || Unit Shipment and Revenue Forecast—Optimistic Scenario~ | Hospitality Segment Analysis~ || Key Findings~ || Market Engineering Measurements~ || Unit Shipment and Revenue Forecast—Realistic Scenario~ || Unit Shipment and Revenue Forecast—Optimistic Scenario~ | Entertainment Segment Analysis~ || Key Findings~ || Market Engineering Measurements~ || Unit Shipment and Revenue Forecast—Realistic Scenario~ || Unit Shipment and Revenue Forecast—Optimistic Scenario~ | Road Transport and Airport Segment Analysis~ | Key Findings~ || Market Engineering Measurements~ || Unit Shipment and Revenue Forecast—Realistic Scenario~ || Unit Shipment and Revenue Forecast—Optimistic Scenario~ | The Last Word~ || The Last Word—3 Big Predictions~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ || List of Companies in “Others”~ || Partial List of Companies Interviewed~ || Definitions~ |

| List of Charts and Figures | 1. Total Touch Technology Market: Key Market Drivers, India, FY18-FY22~ 2. Total Touch Technology Market: Key Market Restraints, India, FY18-FY22~ 3. Total Touch Technology Market: Market Engineering Measurements, India, FY17~ 4. Total Touch Technology Market: Company Market Share Analysis of Top 7 Participants, India, FY17~ 5. Total Touch Technology Market: Technology wise Market Share, India, FY17~ 6. Total Touch Technology Market: Competitive Structure, India, FY17~ 7. Total Touch Technology Market: SWOT Analysis, India, FY17~ 8. Total Touch Technology Market: Top Company Product Highlights, India, FY17~ 9. Potential in Key Mobile-based Industries, India, 2020~ 10. Cumulative Infrastructure Planned Outlay by Segment, India, 2013–2017~ 11. Banking Segment: Market Engineering Measurements, India, FY17~ 12. Retail Segment: Market Engineering Measurements, India, FY17~ 13. Railways and Metro Segment: Market Engineering Measurements, India, FY17~ 14. Hospitality Segment: Market Engineering Measurements, India, FY17~ 15. Entertainment Segment: Market Engineering Measurements, India, FY17~ 16. Road Transport and Airport Segment: Market Engineering Measurements, India, FY17~| 1. Total Touch Technology Market: Revenue Forecast by Technology, India, FY14–FY22~ 2. Total Touch Technology Market: Market Engineering Measurements, India, FY17~ 3. Total Touch Technology Market: Percent Volume Breakdown by End-user Segment, India, FY17~ 4. Total Touch Technology Market: Percent Revenue Breakdown by End-user Segment, India, FY17~ 5. "Total Touch Technology Market: Percent Volume Breakdown by Screen Size, India, FY17"~ 6. "Total Touch Technology Market: Percent Revenue Breakdown by Screen Size, India, FY17"~ 7. Total Touch Technology Market: Percent Volume Breakdown by Technology, India, FY17~ 8. Total Touch Technology Market: Percent Revenue Breakdown by Technology, India, FY17~ 9. Total Touch Technology Market: Distribution Channel Analysis, India, FY17~ 10. Total Touch Technology Market: Unit Shipment and Revenue Forecast, India, FY14–FY22~ 11. Total Touch Technology Market: Average Price for Touch Technology, India, FY14-FY22~ 12. Total Touch Technology Market: Volume Forecast by Vertical Market, India, FY14–FY22~ 13. Total Touch Technology Market: Revenue Forecast by Vertical Market, India, FY14–FY22~ 14. Total Touch Technology Market: Volume Forecast by Vertical Market, India, FY14–FY22~ 15. Total Touch Technology Market: Revenue Forecast by Vertical Market, India, FY14–FY22~ 16. Total Touch Technology Market: Volume Forecast by Screen Size, India, FY14–FY22~ 17. Total Touch Technology Market: Revenue Forecast by Screen Size, India, FY14–FY22~ 18. Total Touch Technology Market: Volume Forecast by Screen Size, India, FY14–FY22~ 19. Total Touch Technology Market: Revenue Forecast by Screen Size, India, FY14–FY22~ 20. Total Touch Technology Market: Volume Forecast by Technology, India, FY14–FY22~ 21. Total Touch Technology Market: Revenue Forecast by Technology, India, FY14–FY22~ 22. Total Touch Technology Market: Volume Forecast by Technology, India, FY14–FY22~ 23. Total Touch Technology Market: Revenue Forecast by Technology, India, FY14–FY22~ 24. Total Touch Technology Market: Percent Revenue Forecast by Distribution Channel, India, FY14–FY22~ 25. Total Touch Technology Market: Percent Revenue Breakdown, India, 2016~ 26. Total Touch Technology Market: Organized vs Unorganized Market Share, India, FY17~ 27. Infrastructure Planned Outlay, India, 2013–2017 ~ 28. Retailing Formats, India, 2015–2025~ 29. Nominal GDP, India, 2011–2020~ 30. Manufacturing Contribution to GDP, India, 2015–2022~ 31. Banking Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22~ 32. Banking Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22~ 33. Retail Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22~ 34. Retail Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22~ 35. Railways and Metro Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22~ 36. Railways and Metro Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22~ 37. Hospitality Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22~ 38. Hospitality Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22~ 39. Entertainment Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22~ 40. Entertainment Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22~ 41. Road Transport and Airport Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22~ 42. Road Transport and Airport Segment: Unit Shipment and Revenue Forecast, India, FY14–FY22~ |

| Author | Manu Tiwari |

| Industries | Electronics and Sensors |

| WIP Number | P9B2-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB