US Population Health Management Market—Analysis and Competitive Landscape Assessment

US Population Health Management Market—Analysis and Competitive Landscape Assessment

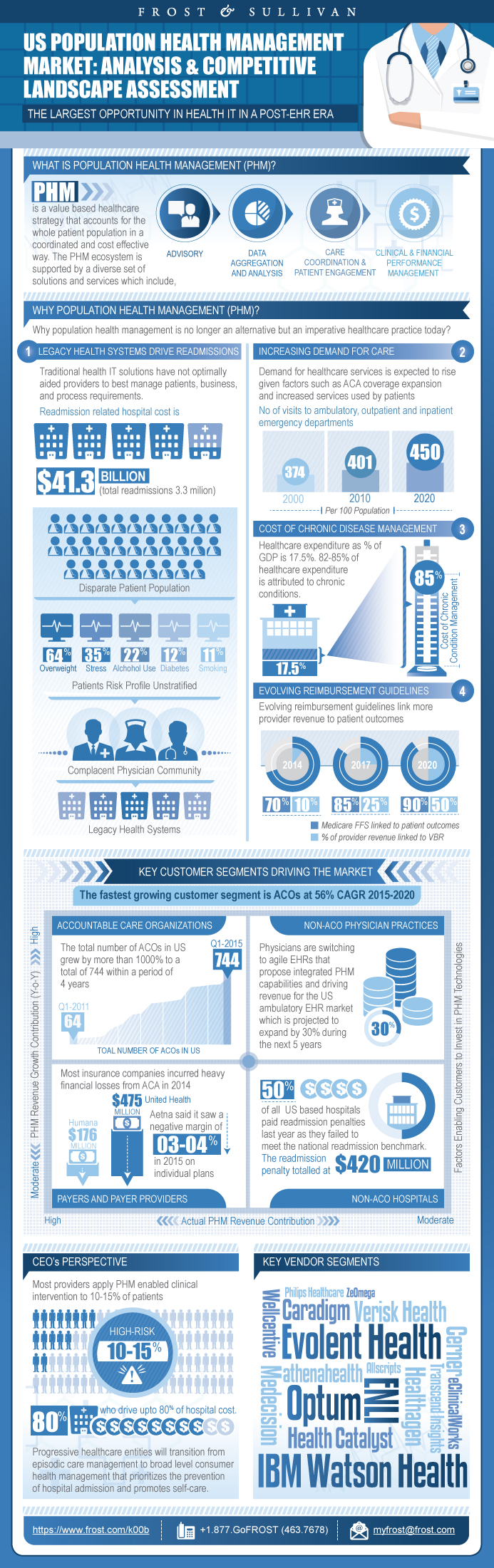

The Largest Opportunity in Health IT in a Post-EHR Era

20-May-2016

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

Research Overview

This Frost & Sullivan research service presents a comprehensive analysis of the market potential and dynamics of the population health management (PHM) market in the United States (US). The study provides a strategic PHM road map to progressive health entities that aspire to practice proactive care monitoring at a community level and synthesize clinical, administrative, and financial information to improve the well-being of the patient population while taking responsibility of a value-driven reimbursement relationship.

It includes market drivers, challenges, forecasts, and trends. This research examines the following market segments:

Services

• Advisory: Clinical & Financial Consulting

• Data Analysis: Data Aggregation & Management, Risk Stratification & Modeling

• Care Management: Care Coordination, Patient Engagement

• Performance Management: Clinical Performance Management, Financial Performance Management

Customers

• Accountable Care Organizations (ACO)

• Payers & Payer-Providers

• Hospitals outside of ACO contracts

• Physician practices outside of ACO contracts

Market Overview

Population health management is the leading growth opportunity in a post-EHR healthcare era.

The rising cost burden of chronic disease management coupled with evolving value-based payment programs supports the requirement of individualized digital interventions that aim to transform care delivery and improve chronic conditions at a population level.

The adoption of PHM solutions that demonstrate meaningful use of IT applications is expected to accelerate in 2016 through 2020. Patient care is moving into a broader but coordinated environment where routine, manual tasks are automated by PHM solutions that unify siloed systems, stratify comorbidities, empower patients through engagement, and benchmark outcomes at network, practice, and patient level.

Health systems, on the road to accountable care, are striving to identify appropriate care workflows, control readmissions, and promote self-care so that incoming patients heal quickly, transitioning patients avoid the need to be readmitted, and healthy populations stay healthy.

Payer, payer-provider, and ACO communities are the top promoters of PHM in the United States. Best-in-class solutions are sought to help track, monitor, analyze, and manage provider/member performance. These groups are expected to invest in technologies that support value-based contracts, set provider-specific quality goals, initiate member engagement, and minimize financial risk through episodic care management.

Additionally, the need to coordinate care departments, meet payer targets, and engage patients during, pre-, and post-care is expected to strongly accelerate investment in the non-ACO hospital segment. Non-ACO physician practices are challenged by growing competition, imposing regulations, and limited investment capabilities. However, as CMS drives new MU objectives that consider physician preferences, the adoption of PHM solutions across this segment is expected to be substantial during 2018–2020.

The US PHM supply market is at a nascent stage and a select few companies have managed to improve patient outcomes and minimize financial risk for their clients. Many providers and payers are in dire need of a suite of healthcare technology solutions and services that improve care delivery efficiency and enable transitions toward various value- or risk-based healthcare ecosystems. The market is likely to observe fierce competitive rivalry as small modular PHM firms compete against large, platform providers. Winners will successfully weigh in market needs and offer secure, interoperable, and highly customized PHM solutions that achieve the ever elusive goal of equilibrium between cost, quality, and accessibility.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings—The US PHM Market

- Assess Past Performances

- Identify Core Care Delivery Goals

- Investigate Operational and Technological Feasibility

- Define Short- and Long-term PHM goals

- PHM Customer Segments

- Contribution to Total PHM Market in 2015 ($ Million)

- Key PHM Requirements

Scope and Segmentation

Market Engineering Measurements

- Total Population Health Management Market, US, 2015

CEO’s Perspective

3 Big Predictions

Market Scope and Definition

Market Background

Top Healthcare Industry Imperatives—The United States

Transition to Accountable Care

Fundamental Characteristics Required to Facilitate PHM

Goals of PHM

Segmentations

Business Objectives by Key Customer Segments

Inefficiency in Traditional Healthcare Systems

Socioeconomic Indicators

Rising Demand for Healthcare

Growth of Chronic Diseases, US, 2000–2025

Cost of Chronic Disease Management, US, 2011

Rising National Health Expenditure

Evolving Reimbursement Frameworks Drive Accountable Care

Risk-Based Reimbursements

Evolving Payment Programs, US, 2016

Definition

Market Overview

Type of PHM Solutions

Evolution of PHM

Market Maturity Indicator

Technology Roadmap

Market Drivers

Market Restraints

Market Segmentation – By Category, US, 2015

Value Chain Analysis

Payer-Provider Collaboration to Pursue PHM, US, 2015

Traditional vs. PHM-enabled Care Delivery—Comparative Ecosystem

Patient Condition Management through Analytics—Contextual Framework

PHM Technology Ecosystem Aid Patient-Centered Care Delivery

Functional Architecture

Progressive PHM Approach by Care Settings

Technology Architecture, US, 2016

Top Investment Areas, US, 2015

Adoption of Major PHM Enablers among Survey Respondents, US, 2014

A Snapshot

Pricing Strategy for Specific Applications

Pricing Models

Software-license-based Pricing Tied to Coverage

Risk-based Pricing Tied to Outcomes

Revenue Forecast, US, 2015–2020

Pricing Analysis—Projected Unit Price Variance , US, 2015–2020

ACOs Segment

Payers & Payer-Providers Segment

Non-ACO Hospitals Segment

Non-ACO Physician Practices Segment

Penetration Analysis

Market Gaps in the United States

Recommendations for the US Market

Changes in the Supply Market Landscape—Analyst Perspective

Vendors Capability Matrix

Optum

Caradigm

Healthagen

Evolent Health

IBM Watson Health

Health Catalyst

ENLI

ZeOmega

3 Big Predictions

Legal Disclaimer

Additional Frost & Sullivan Sources of Information on Healthcare

Market Engineering Methodology

- 1. Market Engineering Measurements - Total Population Health Management Market: Market Engineering Measurements, US, 2015

- 2. Corporate objectives that trigger population health management

- 3. Goal of PHM—Shifting Emphasis from Immediate Care to Prevention

- 4. The Road to Accountable Care—US PHM Market

- 5. Population Health Management Market: Category Segmentation, US, 2015

- 6. Total Population Health Management Market: Customer Segmentation, US, 2015

- 7. Clinical Approach of a Traditional Health System

- 8. Population Health Management Market: Mortality Rates, US, 2000–2010

- 9. Population Health Management Market: Growth of Chronic Diseases, US, 2000–2025

- 10. Population Health Management Market: Cost of Chronic Disease Management, US, 2011

- 11. Projected Average Annual Growth for GDP and Select NHE Categories, US, 2014–2020

- 12. Population Health Management Market: Evolving Payment Programs, US, 2016

- 13. Population Health Management Market: Advanced PHM Solutions, US, 2014–2020

- 14. Total Population Health Management Market: Key Drivers, US, 2016–2020

- 15. Total Population Health Management Market: Key Restraints, US, 2016–2020

- 16. Population Health Management Market: Category Segmentation, US, 2015

- 17. Population Health Management Market: Patient Engagement Strategy Outlook, US, 2005–2025+

- 18. Population Health Management Market: Payer-Provider Collaboration to Pursue PHM, US, 2015

- 19. Population Health Management Market: Typical Patient Composition within a Hospital System, US, 2015

- 20. Population Health Management Market: PHM by Type of Healthcare Facility, US, 2016–2020

- 21. Population Health Management Market: Technology Architecture, US, 2016

- 22. Population Health Management Market: Top Investment Areas, US, 2015

- 23. Population Health Management Market: Adoption of Major PHM Enablers among Survey Respondents, US, 2014

- 24. Population Health Management Market: Supply–Demand Dynamics, US, 2015

- 25. Total Population Health Management Market: Revenue Forecast, US, 2015–2020

- 26. Population Health Management Market: Market Summary, US, 2015–2020

- 27. Total Population Health Management Market: Percent Revenue Forecast by Segment, US, 2015–2020

- 28. Total Population Health Management Market: Revenue Forecast by Segment, US, 2015–2020

- 29. Total Population Health Management Market: Pricing Analysis, US, 2015–2020

- 30. ACOs Segment: Market Engineering Measurements, US, 2015

- 31. ACOs Segment: Revenue Forecast, US, 2015–2020

- 32. Payers & Payer-Providers Segment: Market Engineering Measurements, US, 2015

- 33. Payers & Payer-Providers Segment: Revenue Forecast, US, 2015–2020

- 34. Non-ACO Hospital Segment: Market Engineering Measurements, US, 2015

- 35. Non-ACO Hospitals Segment: Revenue Forecast, US, 2015–2020

- 36. Non-ACO Physician Practice Segment: Market Engineering Measurements, US, 2015

- 37. Non-ACO Physician Practices Segment: Revenue Forecast, US, 2015–2020

- 38. ACOs Segment: Penetration Analysis, US, 2015

- 39. Payers & Payer-Providers Segment: Penetration Analysis, US, 2015

- 40. Non-ACO Hospitals Segment: Penetration Analysis, US, 2015

- 41. Non-ACO Physician Practices Segment: Penetration Analysis, US, 2015

- 42. Total Population Health Management Market: Top Vendors, US, 2015

- 43. Total PHM Market: Select Market Participants by Tiers of Competition, US, 2015

- 44. Total PHM Market: Competitive Market Structure, US, 2015

- 45. Total Population Health Management Market: Notable Industry Deals, US, 2014–2015

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings—The US PHM Market~ ||| Assess Past Performances~ ||| Identify Core Care Delivery Goals~ ||| Investigate Operational and Technological Feasibility~ ||| Define Short- and Long-term PHM goals~ ||| PHM Customer Segments~ ||| Contribution to Total PHM Market in 2015 ($ Million)~ ||| Key PHM Requirements~ || Scope and Segmentation~ || Market Engineering Measurements~ ||| Total Population Health Management Market, US, 2015~ |||| Market Overview~ |||| Competitor Overview~ |||| Total Addressable Market~ || CEO’s Perspective~ || 3 Big Predictions~ | Market Overview - US Population Health Management Market~ || Market Scope and Definition~ || Market Background~ || Top Healthcare Industry Imperatives—The United States~ || Transition to Accountable Care~ || Fundamental Characteristics Required to Facilitate PHM~ || Goals of PHM~ || Segmentations~ ||| By Category, US, 2015~ |||| Advisory~ |||| Data & Analysis~ |||| Care Management~ |||| Performance Management~ ||| Customer Segmentation and Definitions~ |||| ACO’s~ |||| Payers & Payer-Providers~ |||| Non-ACO Hospitals~ |||| Non-ACO Physician Practices~ || Business Objectives by Key Customer Segments~ ||| Network Management~ ||| Practice Management~ ||| Risk Adjusted Revenue Management~ | Macro Conditions Prompting Population Health Management~ || Inefficiency in Traditional Healthcare Systems~ || Socioeconomic Indicators~ ||| Economic~ ||| Demographic~ ||| Transformative~ || Rising Demand for Healthcare~ ||| Mortality Rates, US, 2000–2010~ ||| Key Causes of Death~ || Growth of Chronic Diseases, US, 2000–2025~ || Cost of Chronic Disease Management, US, 2011~ || Rising National Health Expenditure~ || Evolving Reimbursement Frameworks Drive Accountable Care~ ||| Ongoing transition~ ||| Expected transition~ || Risk-Based Reimbursements~ || Evolving Payment Programs, US, 2016~ | Introduction to Population Health Management~ || Definition~ || Market Overview~ || Type of PHM Solutions~ || Evolution of PHM~ || Market Maturity Indicator~ || Technology Roadmap~ || Market Drivers~ || Market Restraints~ | PHM Segment Level Analysis~ || Market Segmentation – By Category, US, 2015~ ||| Advisory~ ||| Data Aggregation and Management~ |||| Key Goals~ |||| Evolving Service Models~ |||| Key Market Observations~ ||| Risk Stratification~ |||| Key Goals~ |||| Framework that Enables PHM~ ||| Care Coordination~ ||| Patient Engagement~ |||| Key Goals~ |||| A Key Focus Area across All Stakeholders~ |||| Behavioral Change for Patients and Their Providers~ |||| Past and Future Approaches~ |||| Basic-to-Advanced Patient Engagement Guidelines~ |||| Patient Engagement Strategy Outlook, US, 2005–2025+~ ||| Performance Management~ | Implementation of PHM~ || Value Chain Analysis~ || Payer-Provider Collaboration to Pursue PHM, US, 2015~ || Traditional vs. PHM-enabled Care Delivery—Comparative Ecosystem~ || Patient Condition Management through Analytics—Contextual Framework~ || PHM Technology Ecosystem Aid Patient-Centered Care Delivery~ || Functional Architecture~ || Progressive PHM Approach by Care Settings~ || Technology Architecture, US, 2016~ || Top Investment Areas, US, 2015~ || Adoption of Major PHM Enablers among Survey Respondents, US, 2014~ | Procurement of PHM Services~ || A Snapshot~ ||| Supply—Demand Dynamics~ ||| Engagement Strategy~ ||| Contract Strategy~ ||| Sourcing Strategy~ ||| Procurement Quick Wins~ | Pricing Models for PHM Solutions~ || Pricing Strategy for Specific Applications~ ||| Opportunity Analysis~ ||| Longitudinal Patient Record~ ||| Evidence Based Care~ ||| Care Coordination~ ||| Patient Engagement~ ||| Performance Analysis~ || Pricing Models~ ||| Existing~ ||| Emerging~ || Software-license-based Pricing Tied to Coverage ~ ||| Contract Structure~ ||| Governing Committee~ || Risk-based Pricing Tied to Outcomes~ ||| Contract Structure~ ||| Governing Committee~ | Forecasts and Trends—Total Population Health Management Market~ || Revenue Forecast, US, 2015–2020~ ||| Market Summary~ ||| Percent Revenue Forecast by Customer Segment~ ||| Revenue Forecast by Segment~ ||| 3 Factors That Influence Revenue- Penetration, Scalability and Price~ || Pricing Analysis—Projected Unit Price Variance , US, 2015–2020~ | Forecasts and Trends—Market Segments~ || ACOs Segment~ ||| Market Measurements, US, 2015~ ||| Revenue Forecast, US, 2015–2020~ || Payers & Payer-Providers Segment~ ||| Market Measurements, US, 2015~ ||| Revenue Forecast, US, 2015–2020~ || Non-ACO Hospitals Segment~ ||| Market Measurements, US, 2015~ ||| Revenue Forecast, US, 2015–2020~ || Non-ACO Physician Practices Segment~ ||| Market Measurements, US, 2015~ ||| Revenue Forecast, US, 2015–2020~ | Demand Analysis~ || Penetration Analysis~ ||| ACO’s~ ||| Payers & Payer-Providers~ ||| Non-ACO Hospitals~ ||| Non-ACO Physician Practices~ | Competitive Environment~ || Market Gaps in the United States~ || Recommendations for the US Market~ || Changes in the Supply Market Landscape—Analyst Perspective~ || Vendors Capability Matrix~ ||| Definitions~ ||| A Snapshot~ ||| Key Observations~ ||| Mapping of Leading Ecosystem Players~ ||| Complex Supply Dynamics of the US PHM Market~ ||| Select PHM Companies and Products~ ||| Competitive Market Structure~ ||| Recent Notable M&As—Investment and Withdrawals~ ||| Top Companies to Watch~ |||| IBM Watson Health~ |||| Optum~ |||| Caradigm~ |||| Health catalyst~ |||| Evolent health~ |||| Others~ | Selected Vendor Profiles~ || Optum~ ||| Corporate Background~ ||| PHM Value Chain~ ||| SWOT Analysis~ || Caradigm~ || Healthagen~ || Evolent Health~ || IBM Watson Health~ || Health Catalyst ~ || ENLI~ || ZeOmega~ | Future Perspectives~ || 3 Big Predictions ~ || Legal Disclaimer~ | Appendix~ || Additional Frost & Sullivan Sources of Information on Healthcare~ || Market Engineering Methodology~ |

| List of Charts and Figures | 1. Market Engineering Measurements - Total Population Health Management Market: Market Engineering Measurements, US, 2015~ 2. Corporate objectives that trigger population health management~ 3. Goal of PHM—Shifting Emphasis from Immediate Care to Prevention~ 4. The Road to Accountable Care—US PHM Market~ 5. Population Health Management Market: Category Segmentation, US, 2015~ 6. Total Population Health Management Market: Customer Segmentation, US, 2015~ 7. Clinical Approach of a Traditional Health System~ 8. Population Health Management Market: Mortality Rates, US, 2000–2010~ 9. Population Health Management Market: Growth of Chronic Diseases, US, 2000–2025 ~ 10. Population Health Management Market: Cost of Chronic Disease Management, US, 2011~ 11. Projected Average Annual Growth for GDP and Select NHE Categories, US, 2014–2020~ 12. Population Health Management Market: Evolving Payment Programs, US, 2016~ 13. Population Health Management Market: Advanced PHM Solutions, US, 2014–2020~ 14. Total Population Health Management Market: Key Drivers, US, 2016–2020~ 15. Total Population Health Management Market: Key Restraints, US, 2016–2020~ 16. Population Health Management Market: Category Segmentation, US, 2015~ 17. Population Health Management Market: Patient Engagement Strategy Outlook, US, 2005–2025+~ 18. Population Health Management Market: Payer-Provider Collaboration to Pursue PHM, US, 2015~ 19. Population Health Management Market: Typical Patient Composition within a Hospital System, US, 2015 ~ 20. Population Health Management Market: PHM by Type of Healthcare Facility, US, 2016–2020~ 21. Population Health Management Market: Technology Architecture, US, 2016~ 22. Population Health Management Market: Top Investment Areas, US, 2015~ 23. Population Health Management Market: Adoption of Major PHM Enablers among Survey Respondents, US, 2014~ 24. Population Health Management Market: Supply–Demand Dynamics, US, 2015~ 25. Total Population Health Management Market: Revenue Forecast, US, 2015–2020~ 26. Population Health Management Market: Market Summary, US, 2015–2020~ 27. Total Population Health Management Market: Percent Revenue Forecast by Segment, US, 2015–2020~ 28. Total Population Health Management Market: Revenue Forecast by Segment, US, 2015–2020~ 29. Total Population Health Management Market: Pricing Analysis, US, 2015–2020~ 30. ACOs Segment: Market Engineering Measurements, US, 2015~ 31. ACOs Segment: Revenue Forecast, US, 2015–2020~ 32. Payers & Payer-Providers Segment: Market Engineering Measurements, US, 2015~ 33. Payers & Payer-Providers Segment: Revenue Forecast, US, 2015–2020~ 34. Non-ACO Hospital Segment: Market Engineering Measurements, US, 2015~ 35. Non-ACO Hospitals Segment: Revenue Forecast, US, 2015–2020~ 36. Non-ACO Physician Practice Segment: Market Engineering Measurements, US, 2015~ 37. Non-ACO Physician Practices Segment: Revenue Forecast, US, 2015–2020~ 38. ACOs Segment: Penetration Analysis, US, 2015~ 39. Payers & Payer-Providers Segment: Penetration Analysis, US, 2015~ 40. Non-ACO Hospitals Segment: Penetration Analysis, US, 2015~ 41. Non-ACO Physician Practices Segment: Penetration Analysis, US, 2015~ 42. Total Population Health Management Market: Top Vendors, US, 2015 ~ 43. Total PHM Market: Select Market Participants by Tiers of Competition, US, 2015~ 44. Total PHM Market: Competitive Market Structure, US, 2015~ 45. Total Population Health Management Market: Notable Industry Deals, US, 2014–2015~ |

| Author | Koustav Chatterjee |

| WIP Number | K00B-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9564-B1,9600-B1,9612-B1 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB