Mobile Apps in the North American Trucking Industry, 2016–2017

Mobile Apps in the North American Trucking Industry, 2016–2017

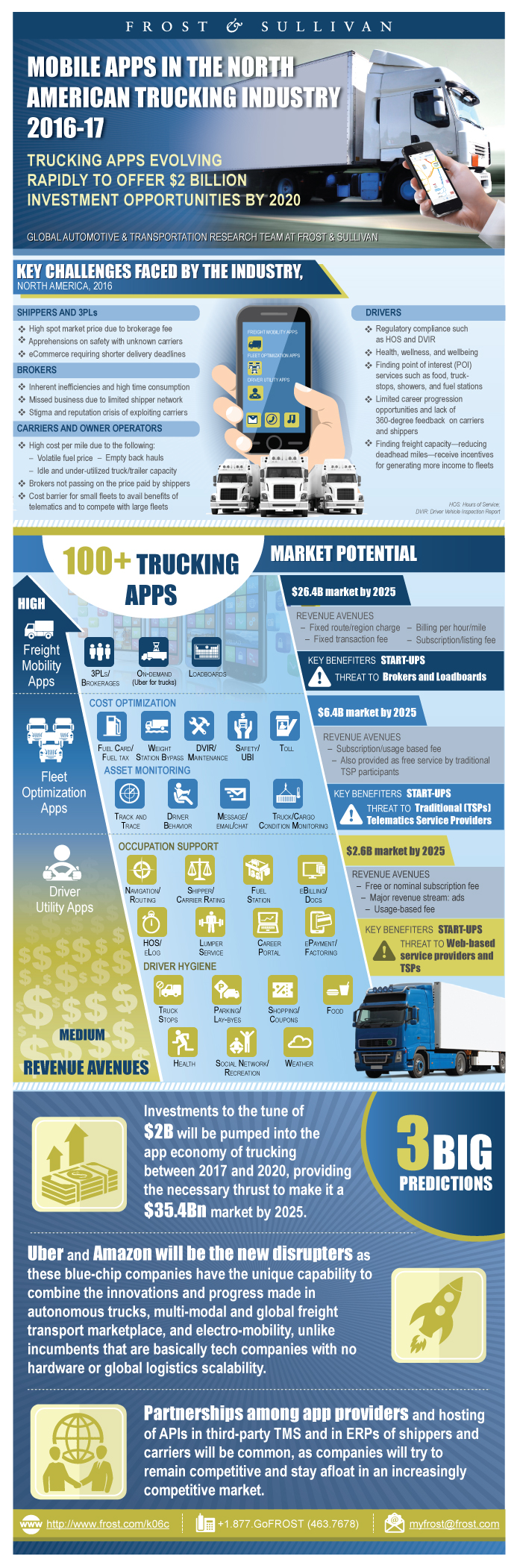

Trucking Apps Evolving Rapidly to Offer $2 Billion Investment Opportunities by 2020

06-Apr-2017

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

Smartphones are not only a gateway for information, they are also increasingly becoming business enablers for the trucking industry. They are driving up efficiency and opening up new opportunities in the trucking ecosystem with a spurt in the growth of dedicated mobile apps for trucking. While only a few drivers attached to large fleets get access to telematics services, owner operators and drivers of small fleets are likely to gain from a slew of mobile-based services due to over 80% smartphone penetration.

The North American trucking apps market is becoming an increasingly crowded space, with more than 70 major dedicated trucking apps and a host of new apps being launched every day. Stakeholders across the supply chain—including manufacturers, warehouses, 3PLs, shippers, brokers, carriers, drivers, owner operators, truck stops, fuel stations, repair shops, and end customers—are set to benefit profoundly due to these dedicated services at their fingertips.

While on-demand freight matching apps are likely to disrupt the on-road logistics industry, the innovation of fleet optimization apps and driver utility apps are expected to bring in efficiency, convenience, and visibility at various levels for all stakeholders like never before—helping trucking become more nimble and dynamic in response to present day real-time and just-in-time transportation management needs.

The North American trucking apps ecosystem has the potential to become a $35.4 billion market by 2025. New participants backed by blue-chip companies and OEMs with large purses are likely to be major disrupters, having the advantage of learning from the mistakes/best practices of the incumbents.

This research service is based on trucking apps available as of 2016, and their sustainability is assessed for the period 2017–2020. The geographic scope is North America.

Key Questions this Study Will Answer:

1) What are the challenges in the North American trucking industry and how can mobile technology help overcome them?

2) How can the app ecosystem be segmented and what services do these app segments offer?

3) What is the revenue/growth potential of the app segments?

4) What are the key apps in the market and what are their unique service propositions?

5) What are the top 20 apps to watch for during 2016–2020?

6) What new apps likely to be launched during 2017–2020 are expected to disrupt the trucking app ecosystem?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Top 8 Transformational Shifts Shaping the Future of Commercial Trucking

Digital Transformation in Trucking

Revenue Avenues in Trucking Apps

Future of Mobile Apps: Single Platform Solution

List of Key Trucking Apps by User Segment

Current and Future Outlook

Research Scope

Research Aims and Objectives

Research Background

Research Methodology

Definition of Apps—Target User Base

Classification Based on App Providers

Selection Criteria to Shortlist Final List of Trucking Apps

Why Mobile Apps for Trucking? What Can They Offer?

What Services Can Mobile Apps Offer?

Where Lies the Potential in Mobile Apps, and for Whom?

Overview of Challenges for Freight Mobility

Key Drivers for Digitalization of Freight Mobility

Mobile-based Freight Mobility Services

Broad Classification

Key App Providers

Market Overview

Shortlisting of Freight Mobility Apps

Frost & Sullivan Evaluation Radar Scorecard

Frost & Sullivan Evaluation Radar Plot

Overview of Challenges for Fleet Optimization

Broad Classification

Benchmarking Key App Providers

Market Overview

Shortlisting of Fleet Optimization Apps

Frost & Sullivan Evaluation Radar Scorecard

Frost & Sullivan Evaluation Radar Plot

Overview of Challenges for Truck Drivers

Smartphone Penetration among Commercial Truck Drivers

Broad Classification

Benchmarking Key App Providers

Market Overview

Shortlist of Driver Utility Apps

Frost & Sullivan Evaluation Radar Scorecard

Frost & Sullivan Evaluation Radar Plot

Frost & Sullivan's Criteria to Shortlist Key Apps

Frost & Sullivan Trucking Mobile Apps Evaluation Radar—Plot

Frost & Sullivan Sustainability Index for Trucking Apps

Transformation in North American Trucking Apps Ecosystem—2016

Growth Opportunity—Disruption Apps, Business Model, and Value-add Services

Strategic Imperatives for Success and Growth

Trucking Apps—Top 5 Insights

Potential New Entrants in 2017—Movers and Shakers

The Last Word—3 Big Predictions

Overview of Convoy

Overview of Cargo Chief

Overview of Loadsmart

Overview of Next Trucking

Overview of Overhaul

Overview of Transfix

Overview of Truckloads

Overview of Truckstop Mobile

Overview of myPilot

Overview of Blue Bloodhound

Overview of KeepTruckin

Overview of MyLumper

Overview of My ONE20

Overview of TruckerLine

Overview of Trucker Path

Overview of Drivewyze

Overview of Gorilla Safety

Overview of GreenRoad

Overview of MineFleetLite

Overview of PedalCoach

Abbreviations and Acronyms Used

Legal Disclaimer

- 1. Mobile Apps Transforming the Trucking Industry: Revenue Avenues, North America, 2016

- 2. Mobile Apps Transforming the Trucking Industry: One Platform Solution, North America, 2016

- 3. Mobile Apps Transforming the Trucking Industry: Key Apps by User Segment, North America, 2016

- 4. Mobile Apps Transforming the Trucking Industry: Current and Future Outlook, North America, 2016 and 2025

- 5. Partial List of Companies Contacted for Primary Research, North America, 2016

- 6. Mobile Apps Transforming the Trucking Industry: Definition by User Base, North America, 2016

- 7. Key Challenges Faced by the Industry, North America, 2016

- 8. Mobile Apps Transforming the Trucking Industry: Freight Brokerage Services, North America, 2016

- 9. Mobile Apps Transforming the Trucking Industry: Benchmarking of Fleet Optimization Apps, North America, 2016

- 10. Mobile Apps Transforming the Trucking Industry: Shortlisting Key Freight Mobility Apps, North America, 2016

- 11. Mobile Apps Transforming the Trucking Industry: Scorecard of Key Freight Mobility Apps, North America, 2016

- 12. Mobile Apps Transforming the Trucking Industry: Broad Classification of Fleet Optimization Apps, North America, 2016

- 13. Mobile Apps Transforming the Trucking Industry: Benchmarking of Fleet Optimization Apps, North America, 2016

- 14. Mobile Apps Transforming the Trucking Industry: Shortlisting of Key Fleet Optimization Apps, North America, 2016

- 15. Mobile Apps Transforming the Trucking Industry: Scorecard on Key Fleet Optimization Apps, North America, 2016

- 16. Key Challenges for Truck Drivers, North America, 2016

- 17. Broad Classification of Driver Utility Apps, North America, 2016

- 18. Mobile Apps Transforming the Trucking Industry: Benchmarking of Driver Utility Apps, North America, 2016

- 19. Mobile Apps Transforming the Trucking Industry: Shortlist of Key Driver Utility Apps, North America, 2016

- 20. Mobile Apps Transforming the Trucking Industry: Scorecard of Key Driver Utility Apps,

- 21. North America, 2016

- 22. Mobile Apps Transforming the Trucking Industry: Criteria to Shortlist Key Apps, North America, 2016

- 23. Mobile Apps Transforming the Trucking Industry: Frost & Sullivan Sustainability Index, North America, 2017–2020

- 24. Mobile Apps Transforming the Trucking Industry: Strategic Imperatives, North America, 2016

- 25. Mobile Apps Transforming the Trucking Industry: Top 5 Insights, North America, 2016

- 26. Mobile Apps Transforming the Trucking Industry: Potential New Entrants, North America, 2017

- 1. Evolution of Digital Technologies in Trucks, Global, 2010–2025

- 2. Heavy Truck/Long-haul Capacity Utilization: Full and Less than Truckload, North America, 2015

- 3. For-Hire Market: Brokerage and Dedicated, North America, 2015 and 2025

- 4. Trucking Industry: Demand and Supply of For-Hire Drivers, Canada, 2012 and 2020

- 5. Mobile Apps Transforming the Trucking Industry: Key Apps Providing Each Freight Mobility Service, North America, 2016

- 6. Mobile Apps Transforming the Trucking Industry: Plot of Key Freight Mobility Apps, North America, 2016

- 7. Mobile Apps Transforming the Trucking Industry: Key Apps Providing Each Fleet Optimization Service, North America, 2016

- 8. Mobile Apps Transforming the Trucking Industry: Plot of Key Fleet Optimization Apps, North America, 2016

- 9. Commercial Vehicle Telematics Market: Solution Type Breakdown, North America, 2015 and 2022

- 10. Commercial Vehicle Telematics Market: Vehicle Type Breakdown, North America, 2015

- 11. Mobile Apps Transforming the Trucking Industry: Key Apps Providing Each Driver Utility Service, North America, 2016

- 12. Mobile Apps Transforming the Trucking Industry: Plot of Key Driver Utility Apps, North America, 2016

- 13. Mobile Apps Transforming the Trucking Industry: Plot, North America, 2016

Popular Topics

Aim:

• The aim of this study is to map mobile apps serving the trucking community in North America, gauge the type of services with high growth potential, benchmark and rank the apps to identify the success potential, and build detailed profiles of the shortlisted apps and the services they provide.

Key Questions This Study Will Answer:

• What are the current challenges in the North American trucking industry and how can mobile technology help overcome these challenges?

• How can the app ecosystem be segmented and what are the services they offer? What is the current revenue potential of these app segments?

• What are the key apps in the market and what are their unique service propositions?

• How have the shortlisted apps performed so far in terms of technology, installed-base, business models, partnerships made and investments they have attracted?

• What are the top performing apps to watch out for in 2016-17 based on Growth Index (GI) versus Innovation Index (II)?

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary ~ || Top 8 Transformational Shifts Shaping the Future of Commercial Trucking~ || Digital Transformation in Trucking~ || Revenue Avenues in Trucking Apps~ || Future of Mobile Apps: Single Platform Solution~ || List of Key Trucking Apps by User Segment~ || Current and Future Outlook~ | Research Scope, Objectives, Background, and Methodology~ || Research Scope~ || Research Aims and Objectives~ || Research Background~ || Research Methodology~ | Definitions and Segmentation~ || Definition of Apps—Target User Base~ || Classification Based on App Providers~ || Selection Criteria to Shortlist Final List of Trucking Apps~ | Opportunities in Mobile Apps~ || Why Mobile Apps for Trucking? What Can They Offer?~ || What Services Can Mobile Apps Offer?~ || Where Lies the Potential in Mobile Apps, and for Whom?~ | Freight Mobility Apps~ || Overview of Challenges for Freight Mobility~ || Key Drivers for Digitalization of Freight Mobility~ || Mobile-based Freight Mobility Services~ || Broad Classification~ ||| Traditional Freight Broker~ ||| Loadboard~ ||| On-demand~ || Key App Providers~ || Market Overview~ || Shortlisting of Freight Mobility Apps~ || Frost & Sullivan Evaluation Radar Scorecard~ || Frost & Sullivan Evaluation Radar Plot~ | Fleet Optimization Apps~ || Overview of Challenges for Fleet Optimization~ || Broad Classification~ ||| Cost Optimization~ ||| Asset Monitoring~ || Benchmarking Key App Providers~ || Market Overview~ || Shortlisting of Fleet Optimization Apps~ || Frost & Sullivan Evaluation Radar Scorecard~ || Frost & Sullivan Evaluation Radar Plot~ | Driver Utility Apps~ || Overview of Challenges for Truck Drivers~ || Smartphone Penetration among Commercial Truck Drivers~ || Broad Classification~ || Benchmarking Key App Providers~ || Market Overview~ || Shortlist of Driver Utility Apps~ || Frost & Sullivan Evaluation Radar Scorecard~ || Frost & Sullivan Evaluation Radar Plot~ | Frost & Sullivan Trucking Apps Evaluation Radar~ || Frost & Sullivan's Criteria to Shortlist Key Apps~ || Frost & Sullivan Trucking Mobile Apps Evaluation Radar—Plot~ || Frost & Sullivan Sustainability Index for Trucking Apps~ | Growth Opportunities and Companies to Action~ || Transformation in North American Trucking Apps Ecosystem—2016~ || Growth Opportunity—Disruption Apps, Business Model, and Value-add Services~ || Strategic Imperatives for Success and Growth~ | Conclusions~ || Trucking Apps—Top 5 Insights~ || Potential New Entrants in 2017—Movers and Shakers~ || The Last Word—3 Big Predictions~ | ~ | Top Freight Mobility App Profiles~ || Overview of Convoy~ || Overview of Cargo Chief~ || Overview of Loadsmart~ || Overview of Next Trucking~ || Overview of Overhaul~ || Overview of Transfix~ || Overview of Truckloads~ || Overview of Truckstop Mobile~ | Top Driver Utility App Profiles~ || Overview of myPilot~ || Overview of Blue Bloodhound~ || Overview of KeepTruckin~ || Overview of MyLumper~ || Overview of My ONE20~ || Overview of TruckerLine~ || Overview of Trucker Path~ | Top Fleet Optimization App Profiles~ || Overview of Drivewyze~ || Overview of Gorilla Safety~ || Overview of GreenRoad~ || Overview of MineFleetLite~ || Overview of PedalCoach~ | Appendix~ || Abbreviations and Acronyms Used~ || Legal Disclaimer~ | The Frost & Sullivan Story~ |

| List of Charts and Figures | 1. Mobile Apps Transforming the Trucking Industry: Revenue Avenues, North America, 2016~ 2. Mobile Apps Transforming the Trucking Industry: One Platform Solution, North America, 2016~ 3. Mobile Apps Transforming the Trucking Industry: Key Apps by User Segment, North America, 2016~ 4. Mobile Apps Transforming the Trucking Industry: Current and Future Outlook, North America, 2016 and 2025 ~ 5. Partial List of Companies Contacted for Primary Research, North America, 2016~ 6. Mobile Apps Transforming the Trucking Industry: Definition by User Base, North America, 2016~ 7. Key Challenges Faced by the Industry, North America, 2016~ 8. Mobile Apps Transforming the Trucking Industry: Freight Brokerage Services, North America, 2016~ 9. Mobile Apps Transforming the Trucking Industry: Benchmarking of Fleet Optimization Apps, North America, 2016~ 10. Mobile Apps Transforming the Trucking Industry: Shortlisting Key Freight Mobility Apps, North America, 2016~ 11. Mobile Apps Transforming the Trucking Industry: Scorecard of Key Freight Mobility Apps, North America, 2016~ 12. Mobile Apps Transforming the Trucking Industry: Broad Classification of Fleet Optimization Apps, North America, 2016~ 13. Mobile Apps Transforming the Trucking Industry: Benchmarking of Fleet Optimization Apps, North America, 2016~ 14. Mobile Apps Transforming the Trucking Industry: Shortlisting of Key Fleet Optimization Apps, North America, 2016~ 15. Mobile Apps Transforming the Trucking Industry: Scorecard on Key Fleet Optimization Apps, North America, 2016~ 16. Key Challenges for Truck Drivers, North America, 2016~ 17. Broad Classification of Driver Utility Apps, North America, 2016~ 18. Mobile Apps Transforming the Trucking Industry: Benchmarking of Driver Utility Apps, North America, 2016~ 19. Mobile Apps Transforming the Trucking Industry: Shortlist of Key Driver Utility Apps, North America, 2016~ 20. Mobile Apps Transforming the Trucking Industry: Scorecard of Key Driver Utility Apps,~ 21. North America, 2016~ 22. Mobile Apps Transforming the Trucking Industry: Criteria to Shortlist Key Apps, North America, 2016~ 23. Mobile Apps Transforming the Trucking Industry: Frost & Sullivan Sustainability Index, North America, 2017–2020~ 24. Mobile Apps Transforming the Trucking Industry: Strategic Imperatives, North America, 2016~ 25. Mobile Apps Transforming the Trucking Industry: Top 5 Insights, North America, 2016~ 26. Mobile Apps Transforming the Trucking Industry: Potential New Entrants, North America, 2017~| 1. Evolution of Digital Technologies in Trucks, Global, 2010–2025~ 2. Heavy Truck/Long-haul Capacity Utilization: Full and Less than Truckload, North America, 2015~ 3. For-Hire Market: Brokerage and Dedicated, North America, 2015 and 2025~ 4. Trucking Industry: Demand and Supply of For-Hire Drivers, Canada, 2012 and 2020~ 5. Mobile Apps Transforming the Trucking Industry: Key Apps Providing Each Freight Mobility Service, North America, 2016~ 6. Mobile Apps Transforming the Trucking Industry: Plot of Key Freight Mobility Apps, North America, 2016~ 7. Mobile Apps Transforming the Trucking Industry: Key Apps Providing Each Fleet Optimization Service, North America, 2016~ 8. Mobile Apps Transforming the Trucking Industry: Plot of Key Fleet Optimization Apps, North America, 2016~ 9. Commercial Vehicle Telematics Market: Solution Type Breakdown, North America, 2015 and 2022~ 10. Commercial Vehicle Telematics Market: Vehicle Type Breakdown, North America, 2015~ 11. Mobile Apps Transforming the Trucking Industry: Key Apps Providing Each Driver Utility Service, North America, 2016~ 12. Mobile Apps Transforming the Trucking Industry: Plot of Key Driver Utility Apps, North America, 2016~ 13. Mobile Apps Transforming the Trucking Industry: Plot, North America, 2016~ |

| Author | Chandramowli Kailasam |

| Industries | Automotive |

| WIP Number | K06C-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB