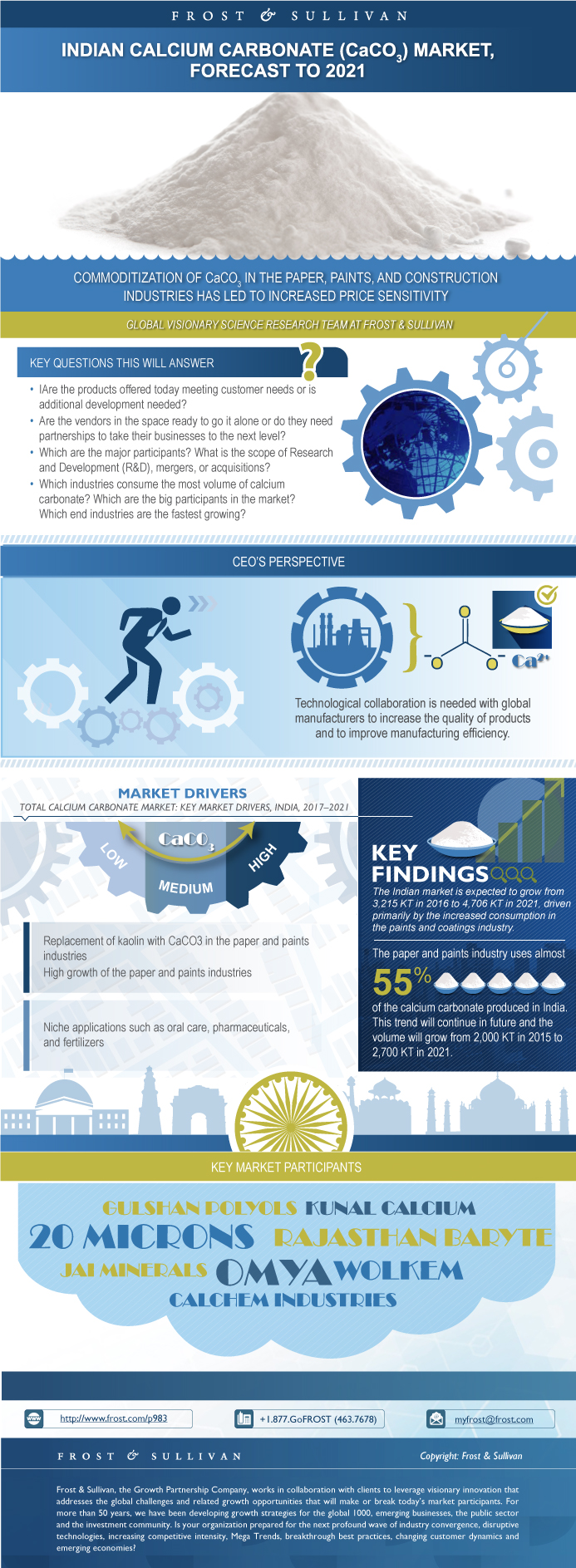

Indian Calcium Carbonate (CaCO3) Market, Forecast to 2021

Indian Calcium Carbonate (CaCO3) Market, Forecast to 2021

Commoditization of CaCO3 in the Paper, Paints, and Construction Industries has led to Increased Price Sensitivity

27-Dec-2017

South Asia, Middle East & North Africa

Description

Calcium carbonate has historically been one of the preferred fillers for the paper industry. In recent years, it has also become a preferred filler for the paint industry, heavily substituting kaolin in this application. While the primary reason has been the unavailability of high-quality kaolin, customers are also shifting due to the better opacity, gloss, and scrub resistance provided by calcium carbonate. While paint and paper are likely to remain the main application focus for calcium carbonate, relatively higher growth in segments such as Poly Vinyl Chloride (PVC) and masterbatches offer significant potential for a supplier to target, primarily due to the large expansion plans of companies such as Plastiblends and Finolex in India. Additionally, there is significant import substitution potential for steric coated grades of Ground Calcium Carbonate (GCC) and Precipitated Calcium Carbonate (PCC) in masterbatches and PVC applications.

The key challenge suppliers face today is delivering high product performance in what has become a highly commoditized market. Inclusion of niche grades (such as steric coated for masterbatches and PVC) and application development along with the end user has to be the focus for suppliers looking to make premium offerings and improving their margins. However, this can only be in addition to the high-volume sales of commodity grades, as the potential to make premium calcium carbonate offerings in India remains low.

The demand for PCC is limited by its niche application segments and its price. Even though PCC finds niche usage in applications such as pharmaceuticals and oral care, there are alternate fillers also which are also fulfilling the needs of the respective industry. As a result, GCC accounts for 85% of the calcium carbonate consumed today, while PCC is only 15% of the nearly 3 million MT market size. This market is serviced by 4 large-scale calcium carbonate producers that account for around 30% of the market and an additional 20%–22% of the demand is met by imports. The remainder of the market is fragmented and is catered to by medium, small-scale, and unorganized producers.

Research Scope:

This study covers the Indian market for both types of calcium carbonate in India and provides strategic insights with respect to growth opportunities. The study further captures the value chain of the Indian Calcium Carbonate market and looks to understand the projected market value by type and application. Additionally, it provides an overview of the key trends, drivers and restraints, and critical success factors for calcium carbonate manufacturers supplying to the Indian market. Overall, this study aims to assess the potential of calcium carbonate in India and understand how it is expected to evolve in the near future.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Market Engineering Measurements

CEO’s Perspective

Market Definitions

Product Definitions

Market Trends

Key Questions This Study Will Answer

Market Segmentation

Market Segmentation—GCC

Market Segmentation—PCC

Market Distribution Channels

Market Drivers

Drivers Explained

Market Restraints

Restraints Explained

Market Engineering Measurements

Forecast Assumptions

Volume Forecast

GCC Percent Volume Forecast by Segment

PCC Percent Volume Forecast by Segment

Key Trends Driving the GCC and PCC Markets

Market Share—Total Calcium Carbonate Market

Market Share—GCC Market

Market Share—PCC Market

Market Share Analysis—GCC Market

Market Share Analysis—PCC Market

Competitive Environment

Top Competitors

Competitive Factors and Assessment

Growth Opportunity: Infrastructure Growth

Growth Opportunity: Growth in Major End-Use Industries

Growth Opportunity: Import Substitution

Growth Opportunity: Kaolin Substitution

Growth Opportunity: India’s Focus on Becoming a Manufacturing Hub

Strategic Imperatives for CaCO3 Manufacturers

Market Engineering Measurements

Volume Forecast

Key Upcoming Plants in the Paper Industry

Market Engineering Measurements

Volume Forecast

Key Upcoming Plants in the Paints Industry

Market Engineering Measurements

Volume Forecast

Key Upcoming Plants in the Plastics Industry

Market Engineering Measurements

Volume Forecast

The Last Word—3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

Abbreviations and Acronyms Used

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Govind Ramakrishnan |

| Industries | Chemicals and Materials |

| WIP Number | P983-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB