US DoD Training And Simulation Market, Forecast to 2020

US DoD Training And Simulation Market, Forecast to 2020

Renewed Focus on Readiness and Mixed Reality Training Investments to Support Growth

24-Mar-2016

North America

Description

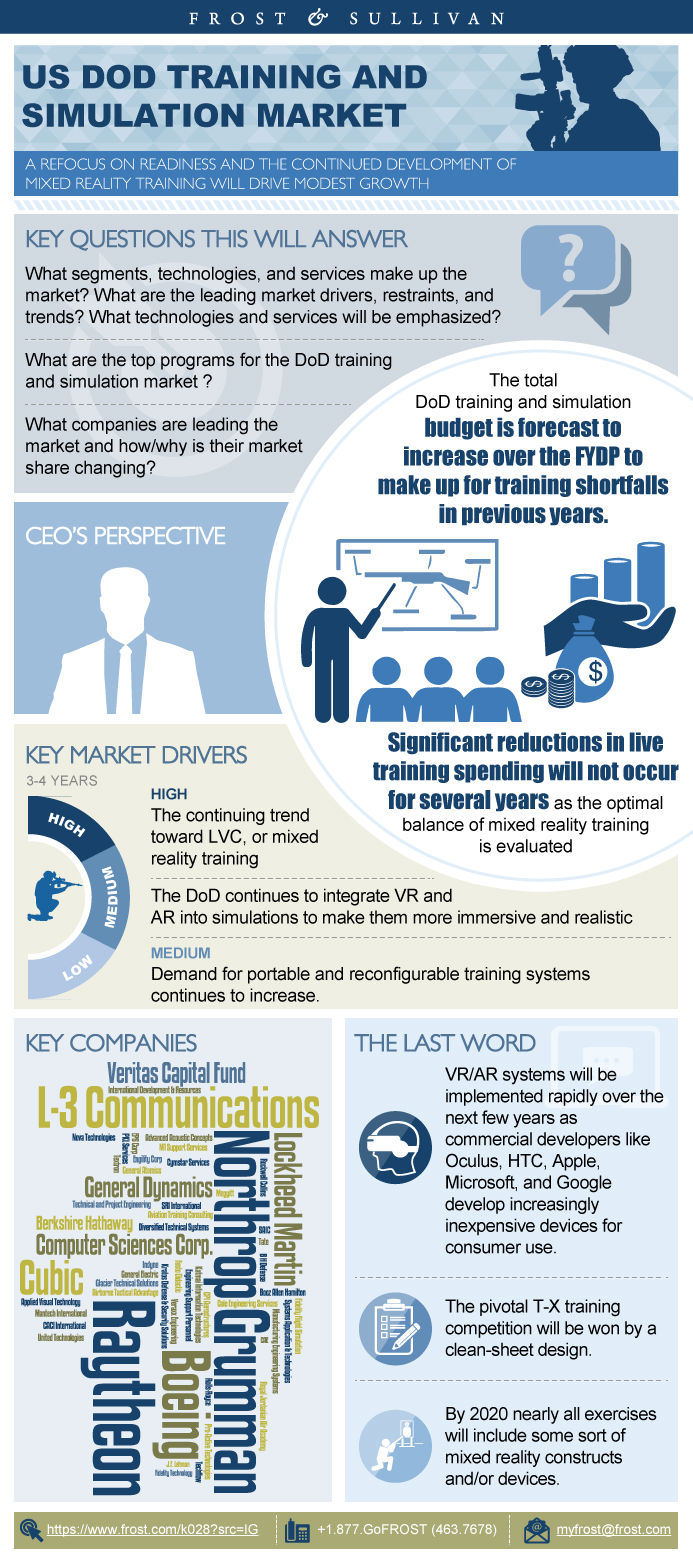

This Frost & Sullivan research service provides an in-depth analysis of the US DoD training and simulation market. It also examines the drivers and restraints and provides a competitive analysis of the market participants. The total DoD training and simulation budget is forecast to increase over the fiscal years defense plan (FYDP) to make up for training shortfalls in previous years. Significant reductions in live training spending will not occur for several years, as the optimal balance of mixed reality training will be continuously evaluated. The continuing trend toward live, virtual, and constructive (LVC), or mixed reality training, is the main driver for investment and innovation in the military training and simulation industry.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Addressable DoD Training and Simulation Market: Market Engineering Measurements, US, 2015

CEO’s Perspective

Associated Multimedia

- Lead analyst quoted by Defense News, December 2015

- Frost & Sullivan video highlighting the Global Training and Simulation Market

Market Definitions

Market Segmentation

Key Market Drivers, US, 2016–2020

Key Market Restraints, US, 2016–2020

DoD Budget Forecast—Program Funding

Total DoD Training and Simulation Market: Percent Contract Sales by Company, US, 2015

Market Share Evolution

Company Market Share Analysis of Top 5 Participants, US, 2015

Market Revenue by Segment: Percent Contract Sales by Segment, US, 2015

Contract Spending by Month, US, 2015

Competitive Environment

- Raytheon

- Northrop Grumman

- Boeing

- L-3 Communications

- Others

Top Competitors: SWOT Analysis, US, 2015

- Absolute Market Share Trend, US, 2014 and 2015

- Percent Market Share Trend, US, 2014 and 2015

Competitive Factors and Assessment

Air/Missile Defense Training Contracts

Combat Vehicle Training Contracts

Computer Training Contracts

Fixed Wing Training Contracts

General Flight Training Contracts

Ground Combat Training Contracts

Ground Vehicle Training Contracts

Language Training Segment

Maintenance Training Segment

Medical Training Segment

Miscellaneous Training Segment

Parachute Training Segment

Rotary Wing Training Segment

Subsurface Combat Training Segment

Surface Combat Training Segment

Trainer Aircraft Maintenance Segment

UAS Training Segment

Market Engineering Methodology

List of Exhibits

List of Other Companies—Market Share Slides

List of Other Companies and Programs—Computer Training Segment

Partial List of Companies Interviewed

- 1. Total DoD Training and Simulation Market: Market Engineering Measurements, US, 2015

- 2. Addressable DoD Training and Simulation Market: Market Engineering Measurements, US, 2015

- 3. Total DoD Training and Simulation Market: Key Market Drivers, US, 2016–2020

- 4. Total DoD Training and Simulation Market: Key Market Restraints, US, 2016–2020

- 5. Total DoD Training and Simulation Market: Funding Forecast by Department, US, 2015–2020

- 6. Total DoD Training and Simulation Market: Funding Forecast by Category, US, 2015–2020

- 7. Total DoD Training and Simulation Market: Funding Forecast by Service, US, 2015–2020

- 8. Total DoD Training and Simulation Market: Procurement and RDT&E Funding Forecast by Segment, US, 2015–2020

- 9. Total DoD Training and Simulation Market: Procurement and RDT&E by Segment (with trend lines)

- 10. Total DoD Training and Simulation Market: Company Market Share Analysis of Top 5 Participants, US, 2015

- 11. Total DoD Training and Simulation Market: Competitive Structure, US, 2015

- 12. Total DoD Training and Simulation Market: SWOT Analysis, US, 2015

- 13. DoD Training and Simulation Market: Air/Missile Defense Training Contracts by Program, US, 2015

- 14. DoD Training and Simulation Market: Air/Missile Defense Training Contracts by Company, US, 2015

- 15. DoD Training and Simulation Market: Combat Vehicle Training Contracts by Program, US, 2015

- 16. DoD Training and Simulation Market: Combat Vehicle Training Contracts by Company, US, 2015

- 17. DoD Training and Simulation Market: Computer Training Contracts by Program, US, 2015

- 18. DoD Training and Simulation Market: Computer Training Contracts by Company, US, 2015

- 19. DoD Training and Simulation Market: Fixed Wing Training Contracts by Program/Platform, US, 2015

- 20. DoD Training and Simulation Market: Fixed Wing Training Contracts by Company, US, 2015

- 21. DoD Training and Simulation Market: General Flight Training Contracts by Program, US, 2015

- 22. DoD Training and Simulation Market: General Flight Training Contracts by Company, US, 2015

- 23. DoD Training and Simulation Market: Ground Combat Training Contracts by Program, US, 2015

- 24. DoD Training and Simulation Market: Ground Combat Training Contracts by Company, US, 2015

- 25. DoD Training and Simulation Market: Ground Vehicle Training Contracts by Program, US, 2015

- 26. DoD Training and Simulation Market: Ground Vehicle Training Contracts by Company, US, 2015

- 27. DoD Training and Simulation Market: Language Training Contracts by Program, US, 2015

- 28. DoD Training and Simulation Market: Language Training Contracts by Company, US, 2015

- 29. DoD Training and Simulation Market: Maintenance Training Contracts by Program, US, 2015

- 30. DoD Training and Simulation Market: Maintenance Training Contracts by Company, US, 2015

- 31. DoD Training and Simulation Market: Medical Training Contracts by Program, US, 2015

- 32. DoD Training and Simulation Market: Medical Training Contracts by Company, US, 2015

- 33. DoD Training and Simulation Market: Miscellaneous Training Contracts by Company, US, 2015

- 34. DoD Training and Simulation Market: Parachute Training Contracts by Program, US, 2015

- 35. DoD Training and Simulation Market: Parachute Training Contracts by Company, US, 2015

- 36. DoD Training and Simulation Market: Rotary Wing Training Contracts by Program/Platform, US, 2015

- 37. DoD Training and Simulation Market: Rotary Wing Training Contracts by Company, US, 2015

- 38. DoD Training and Simulation Market: Subsurface Combat Training Contracts by Program, US, 2015

- 39. DoD Training and Simulation Market: Subsurface Combat Training Contracts by Company, US, 2015

- 40. DoD Training and Simulation Market: Surface Combat Training Contracts by Program, US, 2015

- 41. DoD Training and Simulation Market: Surface Combat Training Contracts by Company, US, 2015

- 42. DoD Training and Simulation Market: Trainer Aircraft Maintenance Contracts by Program/Platform, US, 2015

- 43. DoD Training and Simulation Market: Trainer Aircraft Maintenance Contracts by Company, US, 2015

- 44. DoD Training and Simulation Market: UAS Training Contracts by Platform, US, 2015

- 45. DoD Training and Simulation Market: UAS Training Contracts by Company, US, 2015

- 1. Total DoD Training and Simulation Market: Percent Budget Breakdown by Segment, US,2015

- 2. Total DoD Training and Simulation Market: Percent Procurement and RDT&E Budget Breakdown by Segment, US, 2015

- 3. Total DoD Training and Simulation Market: Procurement and RDT&E Budget Breakdown by Traditional Segments, US, 2015

- 4. Total DoD Training and Simulation Market: Funding Forecast, US, 2014–2020

- 5. Total DoD Training and Simulation Market: Funding Forecast by Category, US, 2015–2020

- 6. Addressable DoD Training and Simulation Market: Addressable Funding Forecast by Category, US, 2015–2020

- 7. Total DoD Training and Simulation Market: Percent Contract Sales by Company, US, 2015

- 8. Total DoD Training and Simulation Market: Absolute Market Share Trend, US, 2014 and 2015

- 9. Total DoD Training and Simulation Market: Percent Market Share Trend, US, 2014 and 2015

- 10. Total DoD Training and Simulation Market: Percent Contract Sales by Segment, US, 2015

- 11. Total DoD Training and Simulation Market: Contract Spending by Month, US, 2015

Popular Topics

- Surface combat training

- Fixed wing training

- Ground combat training

- Rotary wing training

- Miscellaneous training

- Other training

Market Overview

Mixed Reality Training is Set to Dominate DoD Training and Simulation Market

The DoD training and simulation budget is projected to increase steadily, in accordance with the Fiscal Years Defense Plan (FYDP), to compensate for the training shortfalls in the previous years. In addition, the research development test and evaluation (RDT&E) funding for the advanced T-X trainer program in the Air Force is poised to increase, which will further enhance the training and simulation market.

There is a constant need for a large number of combat-ready troops and assets, due to the crises in Eastern Europe and the Middle East. This demand can be tapped by employing robust mixed reality exercises and portable equipment in training and simulation. Mixed reality training is poised to become a prominent trend in the military training and simulation market, driving investments and innovation. This will enhance the opportunities for the virtual reality (VR) and augmented reality (AR) device suppliers. VR systems, which currently dominate the training landscape, will soon extend its application scope into virtual environments. Meanwhile, innovations in AR technology will enhance its see-through capability to support features such as normal vestibular function and haptic feedback. Eventually, AR will outstrip VR and lead the training and simulation market.

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || Addressable DoD Training and Simulation Market: Market Engineering Measurements, US, 2015~ || CEO’s Perspective~ || Associated Multimedia~ ||| Lead analyst quoted by Defense News, December 2015~ ||| Frost & Sullivan video highlighting the Global Training and Simulation Market ~ | Market Overview~ || Market Definitions~ || Market Segmentation ~ ||| Total DoD Training and Simulation Market: Percent Budget Breakdown by Segment, US, 2015~ ||| Percent Procurement and RDT&E Budget Breakdown by Segment, US, 2015~ ||| Procurement and RDT&E Budget Breakdown by Traditional Segments, US, 2015~ | Drivers and Restraints—Total DoD Training and Simulation Market~ || Key Market Drivers, US, 2016–2020~ ||| The continuing trend toward LVC, or mixed reality training, is the main driver for investment~ ||| The DoD continues to integrate VR and AR into simulations to make them more immersive and realistic~ ||| Demand for portable and reconfigurable training systems continues to increase~ ||| The desire to make simulations more realistic and immersive is driving some investment and innovation~ || Key Market Restraints, US, 2016–2020~ ||| Spending cuts, foreign and domestic, and uncertain future DoD funding levels are hampering the military’s ability to invest~ ||| The acquisition cycle for new or upgraded training systems is still too time consuming.~ ||| The most talented engineers and innovators are gravitating more toward the commercial sector rather than defence.~ ||| There are many technical challenges including common standards, open architecture, security, and interoperability.~ | Forecast and Trends~ || DoD Budget Forecast—Program Funding~ ||| Funding Forecast by Category, US, 2015–2020~ ||| Addressable DoD Training and Simulation Market: Addressable Funding Forecast by Category, US, 2015–2020~ ||| Funding Forecast by Department, US, 2015–2020~ ||| Funding Forecast by Service, US, 2015–2020~ ||| Procurement and RDT&E Funding Forecast by Segment, US, 2015–2020~ ||| Procurement and RDT&E by Segment (with trend lines)~ | Market Share and Competitive Analysis~ || Total DoD Training and Simulation Market: Percent Contract Sales by Company, US, 2015~ ||| Raytheon~ ||| Northrop Grumman ~ ||| Boeing~ ||| L-3 Communications~ ||| Others~ || Market Share Evolution~ ||| Absolute Market Share Trend, US, 2014 and 2015~ ||| Percent Market Share Trend, US, 2014 and 2015~ || Company Market Share Analysis of Top 5 Participants, US, 2015~ || Market Revenue by Segment: Percent Contract Sales by Segment, US, 2015~ || Contract Spending by Month, US, 2015~ || Competitive Environment~ ||| Number of Companies in the Market ~ ||| Competitive Factors ~ ||| Key End-user Groups ~ ||| Major Market Participants ~ ||| Distribution Structure ~ ||| Notable Acquisitions and Mergers ~ || Top Competitors: SWOT Analysis, US, 2015~ || Competitive Factors and Assessment~ | Air/Missile Defense Training Segment Breakdown~ || Air/Missile Defense Training Contracts~ ||| Air/Missile Defense Training Contracts by Program, US, 2015~ ||| Air/Missile Defense Training Contracts by Company, US, 2015~ | Combat Vehicle Training Segment Breakdown~ || Combat Vehicle Training Contracts~ ||| Combat Vehicle Training Contracts by Program, US, 2015~ ||| Combat Vehicle Training Contracts by Company, US, 2015~ | Computer Training Segment Breakdown~ || Computer Training Contracts~ ||| Computer Training Contracts by Program, US, 2015~ ||| Computer Training Contracts by Company, US, 2015~ | Fixed Wing Training Segment Breakdown~ || Fixed Wing Training Contracts~ ||| Fixed Wing Training Contracts by Program/Platform, US, 2015~ ||| Fixed Wing Training Contracts by Company, US, 2015~ | General Flight Training Segment Breakdown~ || General Flight Training Contracts~ ||| General Flight Training Contracts by Program, US, 2015~ ||| General Flight Training Contracts by Company, US, 2015~ | Ground Combat Training Segment Breakdown~ || Ground Combat Training Contracts~ ||| Ground Combat Training Contracts by Program, US, 2015~ ||| Ground Combat Training Contracts by Company, US, 2015~ | Ground Vehicle Training Segment Breakdown~ || Ground Vehicle Training Contracts~ ||| Ground Vehicle Training Contracts by Program, US, 2015~ ||| Ground Vehicle Training Contracts by Company, US, 2015~ | Training Contracts by Program and Company and segment breakdown of:~ || Language Training Segment ~ || Maintenance Training Segment ~ || Medical Training Segment ~ || Miscellaneous Training Segment ~ || Parachute Training Segment ~ || Rotary Wing Training Segment ~ || Subsurface Combat Training Segment ~ || Surface Combat Training Segment ~ || Trainer Aircraft Maintenance Segment ~ || UAS Training Segment ~ | The Last Word- 3 Big Predictions~ | Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ || List of Exhibits~ || List of Other Companies—Market Share Slides~ || List of Other Companies and Programs—Computer Training Segment~ || Partial List of Companies Interviewed ~ ||| Action Target~ ||| CACI~ ||| CAE~ ||| Others~ |

| List of Charts and Figures | 1. Total DoD Training and Simulation Market: Market Engineering Measurements, US, 2015~ 2. Addressable DoD Training and Simulation Market: Market Engineering Measurements, US, 2015~ 3. Total DoD Training and Simulation Market: Key Market Drivers, US, 2016–2020~ 4. Total DoD Training and Simulation Market: Key Market Restraints, US, 2016–2020~ 5. Total DoD Training and Simulation Market: Funding Forecast by Department, US, 2015–2020~ 6. Total DoD Training and Simulation Market: Funding Forecast by Category, US, 2015–2020~ 7. Total DoD Training and Simulation Market: Funding Forecast by Service, US, 2015–2020~ 8. Total DoD Training and Simulation Market: Procurement and RDT&E Funding Forecast by Segment, US, 2015–2020~ 9. Total DoD Training and Simulation Market: Procurement and RDT&E by Segment (with trend lines)~ 10. Total DoD Training and Simulation Market: Company Market Share Analysis of Top 5 Participants, US, 2015~ 11. Total DoD Training and Simulation Market: Competitive Structure, US, 2015~ 12. Total DoD Training and Simulation Market: SWOT Analysis, US, 2015~ 13. DoD Training and Simulation Market: Air/Missile Defense Training Contracts by Program, US, 2015~ 14. DoD Training and Simulation Market: Air/Missile Defense Training Contracts by Company, US, 2015~ 15. DoD Training and Simulation Market: Combat Vehicle Training Contracts by Program, US, 2015 ~ 16. DoD Training and Simulation Market: Combat Vehicle Training Contracts by Company, US, 2015~ 17. DoD Training and Simulation Market: Computer Training Contracts by Program, US, 2015~ 18. DoD Training and Simulation Market: Computer Training Contracts by Company, US, 2015~ 19. DoD Training and Simulation Market: Fixed Wing Training Contracts by Program/Platform, US, 2015~ 20. DoD Training and Simulation Market: Fixed Wing Training Contracts by Company, US, 2015~ 21. DoD Training and Simulation Market: General Flight Training Contracts by Program, US, 2015~ 22. DoD Training and Simulation Market: General Flight Training Contracts by Company, US, 2015~ 23. DoD Training and Simulation Market: Ground Combat Training Contracts by Program, US, 2015~ 24. DoD Training and Simulation Market: Ground Combat Training Contracts by Company, US, 2015~ 25. DoD Training and Simulation Market: Ground Vehicle Training Contracts by Program, US, 2015~ 26. DoD Training and Simulation Market: Ground Vehicle Training Contracts by Company, US, 2015~ 27. DoD Training and Simulation Market: Language Training Contracts by Program, US, 2015~ 28. DoD Training and Simulation Market: Language Training Contracts by Company, US, 2015~ 29. DoD Training and Simulation Market: Maintenance Training Contracts by Program, US, 2015~ 30. DoD Training and Simulation Market: Maintenance Training Contracts by Company, US, 2015~ 31. DoD Training and Simulation Market: Medical Training Contracts by Program, US, 2015~ 32. DoD Training and Simulation Market: Medical Training Contracts by Company, US, 2015~ 33. DoD Training and Simulation Market: Miscellaneous Training Contracts by Company, US, 2015~ 34. DoD Training and Simulation Market: Parachute Training Contracts by Program, US, 2015~ 35. DoD Training and Simulation Market: Parachute Training Contracts by Company, US, 2015~ 36. DoD Training and Simulation Market: Rotary Wing Training Contracts by Program/Platform, US, 2015~ 37. DoD Training and Simulation Market: Rotary Wing Training Contracts by Company, US, 2015~ 38. DoD Training and Simulation Market: Subsurface Combat Training Contracts by Program, US, 2015~ 39. DoD Training and Simulation Market: Subsurface Combat Training Contracts by Company, US, 2015~ 40. DoD Training and Simulation Market: Surface Combat Training Contracts by Program, US, 2015~ 41. DoD Training and Simulation Market: Surface Combat Training Contracts by Company, US, 2015~ 42. DoD Training and Simulation Market: Trainer Aircraft Maintenance Contracts by Program/Platform, US, 2015~ 43. DoD Training and Simulation Market: Trainer Aircraft Maintenance Contracts by Company, US, 2015~ 44. DoD Training and Simulation Market: UAS Training Contracts by Platform, US, 2015~ 45. DoD Training and Simulation Market: UAS Training Contracts by Company, US, 2015~| 1. Total DoD Training and Simulation Market: Percent Budget Breakdown by Segment, US,2015 ~ 2. Total DoD Training and Simulation Market: Percent Procurement and RDT&E Budget Breakdown by Segment, US, 2015~ 3. Total DoD Training and Simulation Market: Procurement and RDT&E Budget Breakdown by Traditional Segments, US, 2015~ 4. Total DoD Training and Simulation Market: Funding Forecast, US, 2014–2020~ 5. Total DoD Training and Simulation Market: Funding Forecast by Category, US, 2015–2020~ 6. Addressable DoD Training and Simulation Market: Addressable Funding Forecast by Category, US, 2015–2020~ 7. Total DoD Training and Simulation Market: Percent Contract Sales by Company, US, 2015~ 8. Total DoD Training and Simulation Market: Absolute Market Share Trend, US, 2014 and 2015~ 9. Total DoD Training and Simulation Market: Percent Market Share Trend, US, 2014 and 2015~ 10. Total DoD Training and Simulation Market: Percent Contract Sales by Segment, US, 2015~ 11. Total DoD Training and Simulation Market: Contract Spending by Month, US, 2015~ |

| Industries | Aerospace, Defence and Security |

| WIP Number | K028-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB