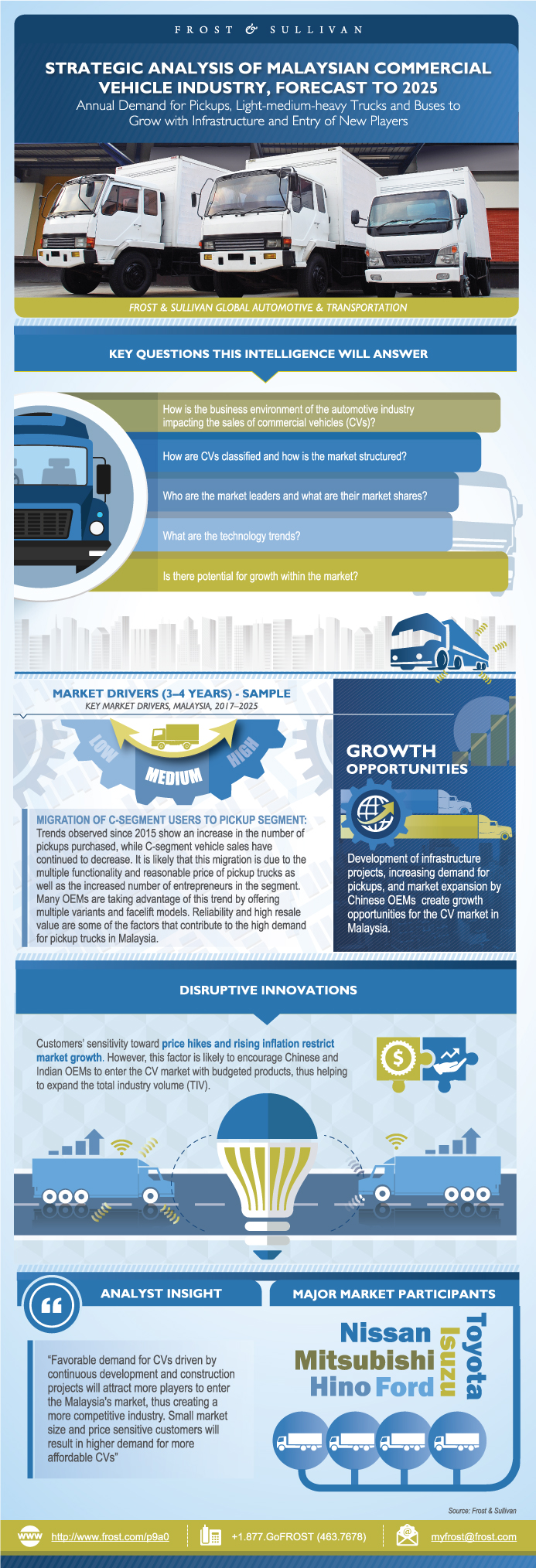

Strategic Analysis of Malaysian Commercial Vehicle Industry, Forecast to 2025

Strategic Analysis of Malaysian Commercial Vehicle Industry, Forecast to 2025

Annual Demand for Pickups, Light-medium-heavy Trucks and Buses to Grow With Infrastructure Growth and Entry of New Players by 2025

27-Feb-2018

Asia Pacific

$3,000.00

Special Price $2,250.00 save 25 %

Description

Malaysia is the third largest commercial vehicle (CV) market in Asia Pacific after Indonesia and Thailand and is at the beginning of a rapid growth phase. The Total Industry Volume (TIV) has continued to decrease since 2013 due to slow economic growth and a depreciating Ringgit that has impacted business confidence and purchasing power. Consequently, production has also declined over the years. Pickups account for the largest segment, in terms of both sales and production.

Japanese brands have the widest CV distribution and service network in Malaysia. During the forecast period, the Malaysian CV market is expected to experience positive growth despite challenges related to the depreciating Ringgit value and price hike, import of rebuilt trucks and stringent credit approval criteria. Due to the economic crisis in 2015, Malaysia’s GDP growth declined from 6% in 2014 to 5% and then 4.5% in 2015 and 2016, respectively. The Consumer Price Index rose to 5.1% in March 2017, recording its highest level in eight years. Higher retail fuel prices have increased inflation. The biggest sector that has been affected is transport, with an increase of 23% when compared on a year-to-year basis. Besides, in 2015, the Ringgit depreciated against the USD, EURO, THB, JPY, CNY and IDR. This, together with its slow improvement in 2016, also hindered customers’ decision to purchase new vehicles/fleets.

However, OEMs can overcome these challenges due to the various trends supporting the growth of the CV market. These include migration of C-segment users to the pickup segment, continuous infrastructure projects and market penetration by new players. Since 2015, there has been a significant increase in preference for pickups as opposed to C-segment vehicles. It is likely that this migration has been triggered by the multiple functionality that pickup trucks offer, the increased number of entrepreneurs in this space, and the availability of reasonably priced pickup trucks. Many OEMs are taking advantage of this trend by offering multiple variants and facelift models. Reliability and high resale value are among the factors that are contributing to the high demand for pickup trucks in Malaysia.

Research Scope

This study aims to research, analyze and forecast the commercial vehicles market in Malaysia during 2012-2025. The scope of the study includes:

- Strategic overview of the CV market, including key technology trends, market trends, and market drivers and restraints

- Market size and forecasts for pickups, light trucks, medium trucks, heavy trucks and bus segments by OEM and sales breakdown for 2012–2016

- Current and future forecasts by segments until 2025

- Competitor analysis, including competitive factors, competitor market shares, and product portfolio analysis and capabilities

- Analysis of OEM’s perspective of the CV market

Key Issues Addressed

- How is the business environment of the automotive industry impacting the sales of CVs?

- How are CVs classified and how is the market structured?

- Who are the market leaders and what are their market shares?

- What are the technology trends?

- Is there potential for growth within the market?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Market Engineering Measurements

Total Commercial Vehicles Market Sales Snapshot

Competitive Environment—Commercial Vehicles Market

Market and Technology Trends

Total Commercial Vehicles Market—Sales Scenario Analysis

Research Scope

Research Aims and Objectives

Key Questions this Study Will Answer

Research Methodology

Key OEM/Participant Groups Compared in this Study

Vehicle Definitions

Vehicle Segmentation

Commercial Vehicles Market—Sales Breakdown by Segments

Commercial Vehicles Market—Sales Breakdown by Brands

Commercial Vehicles Market—Sales Breakdown by States

Commercial Vehicles Market—Production Breakdown by Segments

Commercial Vehicles Market—Production Breakdown by Brands

Powertrain Mix by Fuel Type

Commercial Vehicles Age Analysis

Commercial Vehicles Age Analysis—New Versus Used

Commercial Vehicles Fleet Type and Size

Malaysian Commercial Vehicles Market—Lifecycle Analysis

The Malaysian Commercial Vehicles Industry—Outlook of Value Chain by 2025

Applications of Commercial Vehicles by Fleet Type

Commercial Vehicles Market—Dealership Analysis

Commercial Vehicles Market—Dealership Analysis by State

Commercial Vehicles Market—Major Dealers

Emission Norms and Legislations

Applicable National Standards / Global Standards

Safety and Fuel Efficiency Regulations

Key Industries Impacting Malaysia’s Commercial Vehicle Market

Key Industries Impacting Malaysia’s Commercial Vehicle Market (continued)

Agriculture Industry—Development and Impact

Agriculture Industry—Future Growth

Manufacturing Industry—Development and Impact

Manufacturing Industry—Future Growth

Construction Industry—Development and Impact

Construction Industry—Future Growth

Market Drivers

Drivers Explained

Drivers Explained (continued)

Market Restraints

Restraints Explained

Restraints Explained (continued)

Market Engineering Measurements

Total Commercial Vehicles Market—Sales Scenario Analysis

Total Commercial Vehicles Market—Optimistic Scenario Analysis

Total Commercial Vehicles Market—Frost & Sullivan Scenario Analysis

Total Commercial Vehicles Market—Conservative Scenario Analysis

Total Commercial Vehicles Market Sales Snapshot

Competitive Environment—Commercial Vehicles Market

Pickup Segment—Unit Sales by OEMs

Pickup Segment—Competitive Environment

Pickup Segment—Key Best Selling Models

Small Commercial Vehicle Segment— Unit Sales by OEM

Small Commercial Vehicle Segment—Competitive Environment

Small Commercial Vehicle Segment—Key Best Selling Models

Light Truck Segment—Unit Sales by OEM

Light Truck Segment—Competitive Environment

Light Truck Segment—Key Best Selling Models

Medium Commercial Vehicle Segment—Unit Sales by OEM

Medium Commercial Vehicle Segment—Competitive Environment

Medium Commercial Vehicle Segment—Key Best Selling Models

Heavy Commercial Vehicle Segment—Unit Sales by OEM

Heavy Commercial Vehicle Segment—Competitive Environment

Heavy Commercial Vehicle Segment—Key Best Selling Models

Light Bus Segment—Unit Sales by OEM

Light Bus Segment—Competitive Environment

Light Bus Segment—Key Best Selling Models

Medium/Heavy Bus Segment—Unit Sales by OEM

Medium/Heavy Bus Segment—Competitive Environment

Medium/Heavy Bus Segment—Key Best Selling Models

Top Market Participants

Top Market Participants (continued)

Manufacturing Locations

Commercial Vehicles Manufacturers—UMW Holdings Berhad

Commercial Vehicles Manufacturers—Isuzu Malaysia Sdn Bhd

Commercial Vehicles Manufacturers—Tan Chong Motor Holdings Berhad

Commercial Vehicles Manufacturers—Sime Darby Berhad

Commercial Vehicles Manufacturers—Hino Motor Sales (M) Sdn Bhd

Recent Activities

Recent Activities (continued)

Recent Activities (continued)

Growth Opportunity 1—Infrastructure Projects

Growth Opportunity 2—Increasing Demand for Pickups

Growth Opportunity 3—Market Expansion by Chinese Companies

Growth Opportunity 4—Growth in Manufacturing Industry

Strategic Imperatives for Success and Growth

Key Conclusions and Future Outlook

Strategic Recommendations for Global OEMs

Commercial Vehicle Market—Recommended Dealership Locations

The Last Word—3 Big Predictions

Legal Disclaimer

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

Table of Acronyms Used

Table of Acronyms Used (continued)

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Nur Afiqah Mohamad |

| Industries | Automotive |

| WIP Number | P9A0-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9673-A6,9800-A6,9963-A6,9AF6-A6,9B01-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB