Strategic Analysis of the Mexican Tire Aftermarket

Strategic Analysis of the Mexican Tire Aftermarket

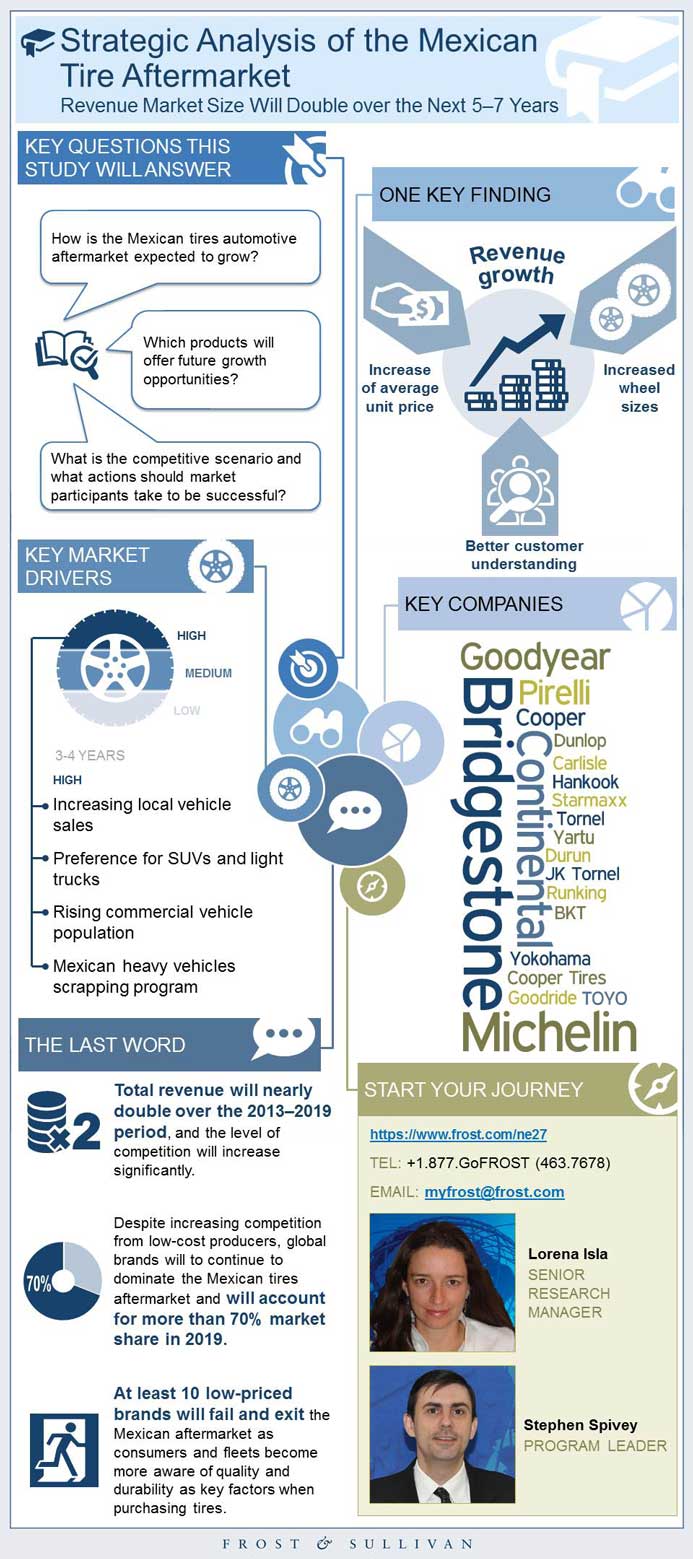

Revenue Market Size Will Double over the Next 5–7 Years

18-Sep-2015

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

Larger wheel sizes and increasing demand for quality from customers drive prices and revenue higher in the Mexican tires aftermarket. This research analyzes demand for replacement tires for passenger vehicles and commercial trucks in Mexico's 3 largest cities. It covers growth opportunities in emerging segments such as retreading. The research includes unit shipment and revenue forecasts, market drivers and restraints, industry challenges, averaging pricing, and market share analyses. It also segments the market to include forecasts by vehicle and tire type, wheel diameter, and speed rating. Conclusions and future outlook are also provided.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Unit Shipment and Revenue Forecast

Competitive Analysis

Research Scope

Research Aim and Objectives

Research Background

- Geographic Scope

- Market & Product Scope

- Vehicle Scope

- Output of the Study

Research Methodology

Key Market Participant Compared in This Study

Product Segmentation, Mexico, 2014

Product Definitions

Vehicle Segmentation

PESTLE Analysis

Industry Overview, Mexico, 2014

Vehicle Sales and Sales Forecast

Production Facilities

Production Trends

Market Share Analysis

Industry Trends

Industry Challenges, Mexico, 2015–2019

Market Drivers

Market Restraints

PC and LCV Tire Demand Analysis

PC and LCV Tire Aftermarket

Average Pricing Analysis

Average Pricing Trend Analysis by Vehicle Category

Market Share Analysis

Distribution Channel Layout, Mexico, 2014

Overview of Major Competitors

Market Trends—Medium and Heavy Commercial Vehicles (MCV and HCV)

Industry Challenges, Mexico, 2015–2019

Market Drivers

Market Restraints

Total Mexico

Mexico DF

Guadalajara

Monterrey

MCV and HCV Tire Aftermarket

Market Share Analysis

Distribution Channel Layout, Mexico, 2014

Overview of the Top Competitors

Overview of Retread Activities in the Mexican HCV Tire Market

Key Conclusions and Future Outlook

The Last Word—3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

List of Abbreviations and Acronyms Used

Vehicle Brands in the Mexican Market

Companies Offering Retread Tires in Mexico

Glossary of Terms

- 1. Total Tire Aftermarket: Production Facilities, Mexico, 2014

- 1. Total Tire Aftermarket: Unit Shipment and Revenue Forecast, Mexico, 2008–2019

- 2. Total Tire Aftermarket: Company Market Share by Revenue, Mexico, 2014

- 3. Total Tire Aftermarket: Company Market Share by Unit Shipment, Mexico, 2014

- 4. Total Tire Aftermarket: Vehicle Sales Forecast, Mexico, 2006–2019

- 5. PC and LCV Tire Aftermarket: Company Market Share by Unit Shipment, Mexico, 2014

- 6. Total Tire Aftermarket: Company Market Share by Revenue, Mexico, 2014

- 7. MCV and HCV Tire Aftermarket: Company Market Share by Unit Shipment, Mexico, 2014

- 8. Total Mexico, Vehicle Registration, 2014

- 9. Total Mexico, Tire Units and Revenue, 2014

- 10. Mexico DF, Vehicle Registration, 2014

- 11. Mexico DF, Tire Units and Revenue, 2014

- 12. Guadalajara, Vehicle Registration, 2014

- 13. Guadalajara, Tire Units and Revenue, 2014

- 14. Monterrey, Vehicle Registration, 2014

- 15. Monterrey, Tire Units and Revenue, 2014

- 16. PC and LCV Tire Aftermarket: Unit Shipment and Revenue Forecast, Mexico, 2008–2019

- 17. PC and LCV Tire Aftermarket: Unit Shipment and Revenue Forecast by Vehicle Category,

- 18. PC and LCV Tire Aftermarket: Unit Shipment and Revenue Forecast by Speed Rating,

- 19. PC and LCV Tire Aftermarket: Unit Shipment Forecast by Wheel Diameter, Mexico, 2008–2019

- 20. PC and LCV Tire Aftermarket: Unit Shipment Forecast by Product Category, Mexico, 2008–2019

- 21. PC and LCV Tire Aftermarket: Average Pricing Analysis, Mexico, 2008–2019

- 22. PC and LCV Tire Aftermarket: Average Pricing Analysis by Vehicle Category, Mexico, 2008–2019

- 23. PC and LCV Tire Aftermarket: Company Market Share by Unit Shipment, Mexico, 2014

- 24. PC and LCV Tire Aftermarket: Company Market Share by Revenue, Mexico, 2014

- 25. MCV Tire Demand Analysis—Total Mexico, Vehicle Registration, 2014

- 26. MCV Tire Demand Analysis—Total Mexico ,Tire Units and Revenue, 2014

- 27. HCV Tire Demand Analysis—Total Mexico, Vehicle Registration, 2014

- 28. HCV Tire Demand Analysis—Total Mexico, Tire Units and Revenue, 2014

- 29. MCV Tire Demand Analysis—Mexico DF, Vehicle Registration, 2014

- 30. MCV Tire Demand Analysis—Mexico DF, Tire Units and Revenue, 2014

- 31. MCV Tire Demand Analysis—Guadalajara, Vehicle Registration, 2014

- 32. MCV Tire Demand Analysis—Guadalajara, Tire Units and Revenue, 2014

- 33. HCV Tire Demand Analysis—Guadalajara, Vehicle Registration, 2014

- 34. HCV Tire Demand Analysis—Guadalajara, Tire Units and Revenue, 2014

- 35. MCV Tire Demand Analysis—Monterrey, Vehicle Registration, 2014

- 36. MCV Tire Demand Analysis—Monterrey, Tire Units and Revenue, 2014

- 37. HCV Tire Demand Analysis—Monterrey, Vehicle Registration, 2014

- 38. HCV Tire Demand Analysis—Monterrey, Tire Units and Revenue, 2014

- 39. MC and HCV Tire Aftermarket: Unit Shipment and Revenue Forecast, Mexico, 2008–2019

- 40. MC and HCV Tire Aftermarket: Unit Shipment and Revenue Forecast by Vehicle Class, Mexico, 2008–2019

- 41. MC and HCV Tire Aftermarket: Unit Shipment and Revenue Forecast by Vehicle Application, Mexico, 2008–2019

- 42. MC and HCV Tire Aftermarket: Unit Shipment and Revenue Forecast by Load Index, Mexico, 2008–2019

- 43. MC and HCV Tire Aftermarket: Unit Shipment and Revenue Forecast by Speed Rating, Mexico, 2008–2019

- 44. MC and HCV Tire Aftermarket: Unit Shipment and Revenue Forecast by Wheel Diameter, Mexico, 2008–2019

- 45. MC and HCV Tire Aftermarket: Average Pricing Analysis, Mexico, 2008–2019

- 46. MCV Tire Aftermarket: Company Market Share by Unit Shipment, Mexico, 2014

- 47. MCV Tire Aftermarket: Company Market Share by Revenue, Mexico, 2014

- 48. HCV Tire Aftermarket: Company Market Share by Unit Shipment, Mexico, 2014

- 49. HCV Tire Aftermarket: Company Market Share by Unit Shipment, Mexico, 2014

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || Unit Shipment and Revenue Forecast~ || Competitive Analysis~ | Research Methodology~ || Research Scope~ ||| Geographic Scope~ ||| Market & Product Scope~ ||| Vehicle Scope~ ||| Output of the Study~ || Research Aim and Objectives~ || Research Background~ || Research Methodology~ ||| Secondary Research~ ||| Primary Research~ ||| Total Tire Aftermarket: Key Industry Participants, Mexico, 2014~ |||| Bridgestone~ |||| Michelin~ |||| Continental~ |||| Goodyear~ |||| Others~ || Key Market Participant Compared in This Study~ | Definitions and Segmentation~ || Product Segmentation, Mexico, 2014~ || Product Definitions~ || Vehicle Segmentation~ | Overview of the Mexican Tire Aftermarket~ || PESTLE Analysis~ ||| Political~ ||| Economic~ ||| Social~ ||| Technological~ ||| Legislative~ ||| Environmental~ || Industry Overview, Mexico, 2014~ || Vehicle Sales and Sales Forecast~ || Production Facilities~ || Production Trends~ || Market Share Analysis~ | Passenger Car and LCV Tire Aftermarket~ || Industry Trends~ || Industry Challenges, Mexico, 2015–2019~ || Market Drivers ~ ||| Poor road quality~ ||| Preference for SUVs and light trucks~ ||| Exchange rate~ ||| Increasing local vehicle sales~ || Market Restraints~ ||| Lack of customer understanding of tire quality~ ||| Entrance of low-cost Asian brands and imported used tires~ ||| High global commodity prices and scarcity~ || PC and LCV Tire Demand Analysis~ ||| Total Mexico~ |||| Distribution Trends~ |||| Top 5 Participants~ ||| Mexico DF~ |||| Distribution Trends~ |||| City-specific Drivers and Restraints~ ||| Guadalajara~ |||| Distribution Trends~ |||| City-specific Drivers and Restraints~ ||| Monterrey~ |||| Distribution Trends~ |||| City-specific Drivers and Restraints~ || PC and LCV Tire Aftermarket~ ||| Unit Shipment and Revenue Forecast~ ||| Unit Shipment and Revenue Forecast by Vehicle Category~ ||| Unit Shipment and Revenue Forecast by Speed Rating~ ||| Unit Shipment Forecast by Wheel Diameter~ ||| Unit Shipment Forecast by Product Category~ || Average Pricing Analysis~ || Average Pricing Trend Analysis by Vehicle Category~ || Market Share Analysis~ || Distribution Channel Layout, Mexico, 2014~ || Overview of Major Competitors~ | MCV and HCV Tire Aftermarket~ || Market Trends—Medium and Heavy Commercial Vehicles (MCV and HCV)~ || Industry Challenges, Mexico, 2015–2019~ || Market Drivers~ ||| Rising commercial vehicle population~ ||| Mexican heavy vehicles scrapping program (Chatarrizacion)~ ||| Strict Ministry of Transportation and Communications regulations for cargo transport~ ||| Increase in the number of non-specialized distributors with availability of tires for MCV and HCV segments~ || Market Restraints~ ||| Growing demand for retread tires~ ||| Low prices of tires imported from China~ ||| Higher tire prices in Mexico~ ||| Importation of tires stolen in the United States and sold at low prices~ || Total Mexico~ ||| MCV Tire Demand Analysis~ ||| HCV Tire Demand Analysis~ || Mexico DF~ ||| MCV Tire Demand Analysis~ ||| HCV Tire Demand Analysis~ || Guadalajara~ ||| MCV Tire Demand Analysis~ ||| HCV Tire Demand Analysis~ || Monterrey~ ||| MCV Tire Demand Analysis~ ||| HCV Tire Demand Analysis~ || MCV and HCV Tire Aftermarket ~ ||| Unit Shipment and Revenue Forecast~ ||| Unit Shipment and Revenue Forecast by Vehicle Class~ ||| Unit Shipment and Revenue Forecast by Vehicle Application~ ||| Unit Shipment and Revenue Forecast by Load Index~ ||| Unit Shipment and Revenue Forecast by Speed Rating~ ||| Unit Shipment and Revenue Forecast by Wheel Diameter~ ||| MCV and HCV Tire Aftermarket Average Pricing Analysis~ || Market Share Analysis~ ||| MCV~ ||| HCV~ || Distribution Channel Layout, Mexico, 2014~ || Overview of the Top Competitors~ ||| MCV and HCV Tire Aftermarket: Competitor Profiles, Mexico, 2014~ || Overview of Retread Activities in the Mexican HCV Tire Market~ | Conclusions and Future Outlook~ || Key Conclusions and Future Outlook~ || The Last Word—3 Big Predictions~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ || List of Abbreviations and Acronyms Used~ || Vehicle Brands in the Mexican Market~ || Companies Offering Retread Tires in Mexico~ || Glossary of Terms~ |

| List of Charts and Figures | 1. Total Tire Aftermarket: Production Facilities, Mexico, 2014~| 1. Total Tire Aftermarket: Unit Shipment and Revenue Forecast, Mexico, 2008–2019~ 2. Total Tire Aftermarket: Company Market Share by Revenue, Mexico, 2014~ 3. Total Tire Aftermarket: Company Market Share by Unit Shipment, Mexico, 2014~ 4. Total Tire Aftermarket: Vehicle Sales Forecast, Mexico, 2006–2019~ 5. PC and LCV Tire Aftermarket: Company Market Share by Unit Shipment, Mexico, 2014~ 6. Total Tire Aftermarket: Company Market Share by Revenue, Mexico, 2014~ 7. MCV and HCV Tire Aftermarket: Company Market Share by Unit Shipment, Mexico, 2014~ 8. Total Mexico, Vehicle Registration, 2014~ 9. Total Mexico, Tire Units and Revenue, 2014~ 10. Mexico DF, Vehicle Registration, 2014~ 11. Mexico DF, Tire Units and Revenue, 2014~ 12. Guadalajara, Vehicle Registration, 2014~ 13. Guadalajara, Tire Units and Revenue, 2014~ 14. Monterrey, Vehicle Registration, 2014~ 15. Monterrey, Tire Units and Revenue, 2014~ 16. PC and LCV Tire Aftermarket: Unit Shipment and Revenue Forecast, Mexico, 2008–2019~ 17. PC and LCV Tire Aftermarket: Unit Shipment and Revenue Forecast by Vehicle Category,~ 18. PC and LCV Tire Aftermarket: Unit Shipment and Revenue Forecast by Speed Rating,~ 19. PC and LCV Tire Aftermarket: Unit Shipment Forecast by Wheel Diameter, Mexico, 2008–2019~ 20. PC and LCV Tire Aftermarket: Unit Shipment Forecast by Product Category, Mexico, 2008–2019~ 21. PC and LCV Tire Aftermarket: Average Pricing Analysis, Mexico, 2008–2019~ 22. PC and LCV Tire Aftermarket: Average Pricing Analysis by Vehicle Category, Mexico, 2008–2019~ 23. PC and LCV Tire Aftermarket: Company Market Share by Unit Shipment, Mexico, 2014~ 24. PC and LCV Tire Aftermarket: Company Market Share by Revenue, Mexico, 2014~ 25. MCV Tire Demand Analysis—Total Mexico, Vehicle Registration, 2014~ 26. MCV Tire Demand Analysis—Total Mexico ,Tire Units and Revenue, 2014~ 27. HCV Tire Demand Analysis—Total Mexico, Vehicle Registration, 2014~ 28. HCV Tire Demand Analysis—Total Mexico, Tire Units and Revenue, 2014~ 29. MCV Tire Demand Analysis—Mexico DF, Vehicle Registration, 2014~ 30. MCV Tire Demand Analysis—Mexico DF, Tire Units and Revenue, 2014~ 31. MCV Tire Demand Analysis—Guadalajara, Vehicle Registration, 2014~ 32. MCV Tire Demand Analysis—Guadalajara, Tire Units and Revenue, 2014~ 33. HCV Tire Demand Analysis—Guadalajara, Vehicle Registration, 2014~ 34. HCV Tire Demand Analysis—Guadalajara, Tire Units and Revenue, 2014~ 35. MCV Tire Demand Analysis—Monterrey, Vehicle Registration, 2014~ 36. MCV Tire Demand Analysis—Monterrey, Tire Units and Revenue, 2014~ 37. HCV Tire Demand Analysis—Monterrey, Vehicle Registration, 2014~ 38. HCV Tire Demand Analysis—Monterrey, Tire Units and Revenue, 2014~ 39. MC and HCV Tire Aftermarket: Unit Shipment and Revenue Forecast, Mexico, 2008–2019~ 40. MC and HCV Tire Aftermarket: Unit Shipment and Revenue Forecast by Vehicle Class, Mexico, 2008–2019~ 41. MC and HCV Tire Aftermarket: Unit Shipment and Revenue Forecast by Vehicle Application, Mexico, 2008–2019~ 42. MC and HCV Tire Aftermarket: Unit Shipment and Revenue Forecast by Load Index, Mexico, 2008–2019~ 43. MC and HCV Tire Aftermarket: Unit Shipment and Revenue Forecast by Speed Rating, Mexico, 2008–2019~ 44. MC and HCV Tire Aftermarket: Unit Shipment and Revenue Forecast by Wheel Diameter, Mexico, 2008–2019~ 45. MC and HCV Tire Aftermarket: Average Pricing Analysis, Mexico, 2008–2019~ 46. MCV Tire Aftermarket: Company Market Share by Unit Shipment, Mexico, 2014~ 47. MCV Tire Aftermarket: Company Market Share by Revenue, Mexico, 2014~ 48. HCV Tire Aftermarket: Company Market Share by Unit Shipment, Mexico, 2014~ 49. HCV Tire Aftermarket: Company Market Share by Unit Shipment, Mexico, 2014~ |

| Author | Lorena Isla |

| Industries | Automotive |

| WIP Number | NE27-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB