Automotive Data Monetisation Pricing and Business Models

Automotive Data Monetisation Pricing and Business Models

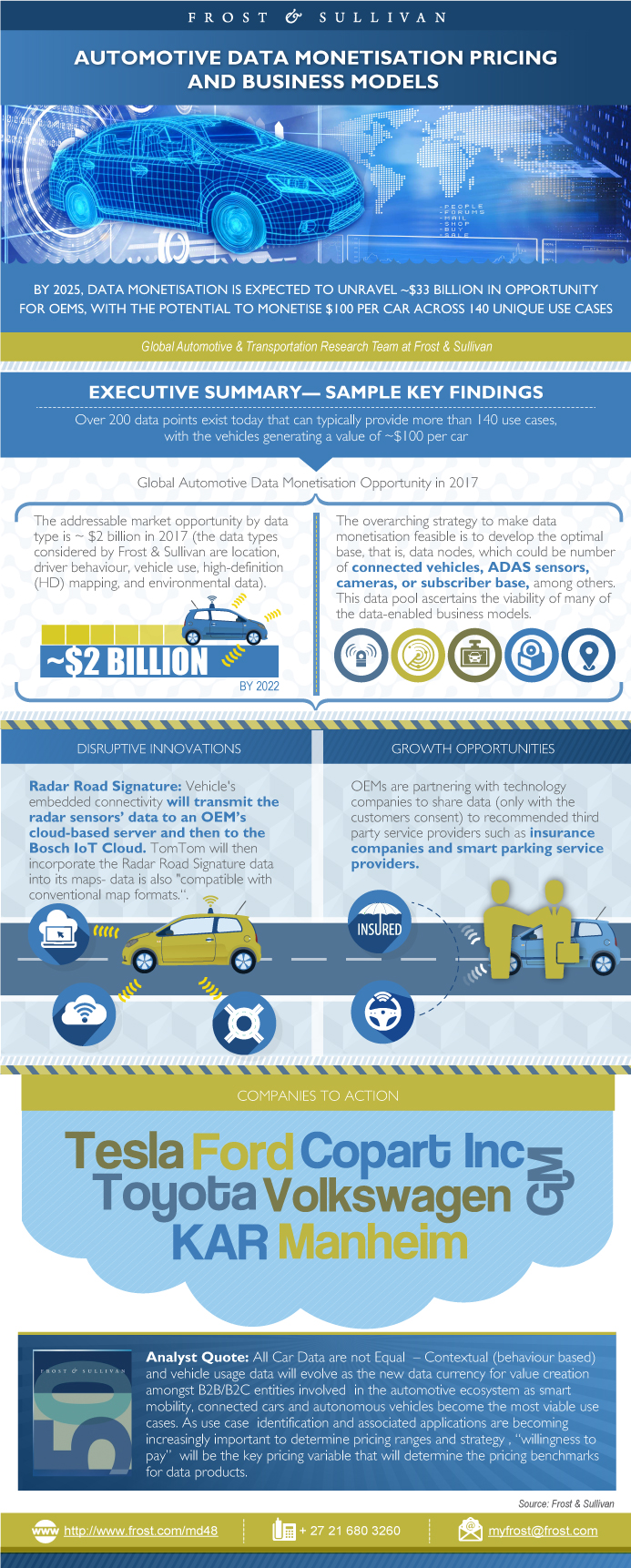

By 2025, Data Monetisation is Expected to Unravel ~$33 Billion in Opportunity for OEMs, with the Potential to Monetise $100 per Car Across 140 Unique Use Cases

25-Oct-2017

North America

$10,000.00

Special Price $7,500.00 save 25 %

Description

This study analyses the strategies, growth analysis, competitive landscape, business models, and future focus areas of OEMs, data aggregators, usage-based insurance (UBI) companies, and tier 1 suppliers. OEMs, tier 1s, insurance companies, and data aggregators must focus on data services around smart mobility, connected cars, and autonomous vehicles (AVs) and must introduce new business models between 2022 and 2030. UBI companies, data aggregators, and aftermarket OBD II companies and the rise of Uber, Apple, and Google in the automotive market are pushing OEMs to finally realise the true potential of harnessing data and turning the same into successful business models.

OEMs and tier 1 suppliers have realised that digitisation along with IoT, technology partnerships, software capabilities, and customised solutions will be the way forward for the global automotive industry. The growing number of digitalisation initiatives and pilot projects with a software-centric focus by automotive OEMs and tier 1s will increase automotive IT spending from $37.9 billion in 2015 to $168.8 billion in 2025 (CAGR of 16.1%). Connected cars, AVs, and ride sharing provides more use cases for data monetisation.

Over the next decade, OEMs, data consumers, and ecosystem participants must focus on business models around location data, driving behaviour, HD mapping, vehicle usage, and environmental data types. In addition to OEM, tier 1 supplier, and technology company initiatives, this study covers a detailed list of start-ups and technology companies focusing on analytics and data aggregation. The total number of connected vehicles, activation rate, and consent rate are some of the key factors that help determine the automotive data monetisation market across various data types. Frost & Sullivan expects UBI to be the most mature use case that brings in more value from a car/year for OEMs (ever since it transitioned from an aftermarket to an OEM data-enabled service).

In addition, this study analyses and answers the following key questions:

• What are the different data monetisation business models being discussed in the automotive industry and which ones will garner more value in

the current and future ecosystem?

• What are the various use cases and data types expected to create value in the automotive industry?

• What are the different pricing models being evaluated? What is the expected price per use case?

• What is the addressable opportunity from data monetisation in 2017 and in 2025?

• Who are the key stakeholders involved? What are the key partnerships that need to be built to be successful?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Executive Summary—Key Findings

Evolving Data Monetisation Business Models in the Auto Industry

Automotive Data-as-a-Service Types

Key Consumers of Vehicle Data

Automotive Data Monetisation Market—Data Types and Definitions

Total Addressable Market in 2017

Key Elements of a Data Monetisation Business Model

Automotive Data Monetisation—Use Case Grouping

Use Case Grouping Snapshot—UBI Focus on a Data-driven Future

Use Case Grouping Snapshot—Crash Reconstruction Role in AVs

BMW CarData Platform Case Study

Otonomo’s Data Exchange Platform

Commercial Data Types Tracked by Otonomo

Automotive Data Monetisation—Pricing Variables

Research Scope

Research Aims and Objectives

Key Questions this Study will Answer

Research Background

Related Frost & Sullivan Video Content Available for Support

Research Methodology

Snapshot of Frequently Used Input Streams for Data Capture

Data Monetisation Use Cases across Industries

Data Format and IoT Data Types

Data Monetisation Business Models—Non-automotive

Data Monetisation—Non-automotive Industry Highlights

Data Monetisation—Non-automotive Industry Examples

Case Study—Barclays Market and Customer Insight Service Offering

Automotive Data Monetisation—Key Challenges

EU General Data Protection Regulation (GDPR)—Key Principles

GDPR Principles and Compliances

GDPR Principles and Compliances (continued)

Data Monetisation—Direct and Indirect Revenue Opportunities

Snapshot of Direct Revenue Opportunities

Snapshot of Indirect Revenue Opportunities

Automotive Data Monetisation—Use Case Grouping

Use Case 1—UBI and Contextual Behaviour Intelligence

Use Case 1—Contextual Driver Behaviour Score

Use Case 1—Contextual Driver Behaviour

Use Case 2—Crash Reconstruction in a Virtual Driving Environment

Use Case 2—Proactive FNOL

Use Case 2—TSPs’ Crash Reconstruction Solutions

Use Case 3—Location and Mapping Services

Use Case 3—Harnessing Location Data

Use Case 3—HAD Maps for Autonomous Cars

Use Case 3—HERE’s Real-time Traffic Service

Use Case 4—Dealerships and Ecosystem Datasets and Initiatives

Use Case 4—Dealership Data Monetisation

Use Case 4—Vauxhall OnStar Portal

Use Case 4—Auction Companies

Use Case 5—Autonomous Vehicles

Use Case 5—Insurance Opportunity in AVs

Car Connectivity Consortium (CCC)—Car Data Solution Architecture

IBM Connected Solutions

GM Partnership with IBM Watson to Handle Data-Business In-house

Mercedes Benz—Leveraging OBD to Connect Legacy Vehicles

Ford Invests in AI and ML Companies

Ford Partnership with Pivotal

Volkswagen Data Lab Competencies

Volkswagen Digital Lab and Enhanced Digital Platform

Bosch Investments in iguazio, a Data-driven Innovative Company

Bosch and Tom Tom—Radar Road Signature

Delphi Automotive Software Suite

Delphi Offers a Holistic Connected Vehicle Platform

Dash Labs’ Business Model

Octo Telematics’ Business Model

Nexar’s Vision-based Driver Scoring

LexisNexis UBI Capability

The Floow—Helping OEMs Monetise Data

Automotive Data Monetisation Companies

Growth Opportunity—Partnerships and Business Models

New Business Models in Mobility will be Data-driven

Automotive Data Monetisation Recommendations

The Last Word—3 Big Predictions

Legal Disclaimer

Table of Acronyms Used

Market Engineering Methodology

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Sriram Venkatraman |

| Industries | Automotive |

| WIP Number | MD48-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB