Growth Opportunities in the Global Conferencing Services Market, Forecast to 2023

Growth Opportunities in the Global Conferencing Services Market, Forecast to 2023 Updated Research Available

Software-based Visual Collaboration Continues to Drive Growth

09-Mar-2018

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

The global conferencing Services market experienced a growth of 4.6 percent and garnered revenues of $8.0 billion in 2016. The maturity of audio conferencing services combined with the growth of VoIP access at the expense of PSTN, and the shift from attended to automated audio conferencing compressed the demand for stand-alone audio conferencing which still constitutes the majority of overall conferencing revenues. In addition, weak economic situation and Euro currency depreciation against the US Dollar resulted in lower foreign exchange and impacted the market sentiment.

On the other hand, the cloud web and video conferencing services market experienced a healthy growth of 16 percent in 2016 owing to increased user comfort with collaborating over video, improved usability and intuitive user interfaces of video clients. The visual collaboration growth could be further attributed to the massive shift in demand from on-premises conferencing and collaboration solutions to cloud services due to the cost-effectiveness, scalability and flexibility of cloud architectures.

In 2016, audio conferencing accounted for 50.9 percent of the global conferencing services market, cloud web & video conferencing 40.1 percent, and managed video conferencing 9.0 percent, in terms of revenue. These proportions are expected to change significantly by 2023 with cloud web & video conferencing services representing 61.6 percent of total conferencing services revenue. The overall market is expected to grow gradually and reach $11 bn. at a 7-year CAGR of 4.6 percent by 2023.

The overall conferencing services market is getting increasingly commoditized due to feature parity between services provided by multiple providers. Therefore, with little feature differentiation, focusing on strengthening customer service will be critical for further growth in this market. In particular, the cloud web and video conferencing services market is a highly fragmented market fraught with a good mix of pure-play video conferencing participants; and telecom service providers reselling cloud software. Leading participants in the cloud web and video conferencing market include Cisco and LogMeIn(consolidated Join.me, Citrix GoTo and Jive portfolio). Key notable market disruptors include Zoom, BlueJeans, Fuze and Videxio.

Research Scope

This research service identifies key growth opportunities and explains how market participants should action to capitalize on the opportunities available in the conferencing services market. This research service captures the market opportunity for the period 2016-2023 for audio, cloud web and video conferencing and managed video conferencing sub-segments.

Key Issues Addressed

- Drivers and Restraints impacting the conferencing services market

- Current state and addressable market opportunity for audio conferencing, cloud web and video conferencing and managed video conferencing services

- Market leaders in the overall conferencing services market

- Revenue contribution from NA, EMEA, APAC and Latin America regions

- Growth Opportunities existing in the conferencing services market

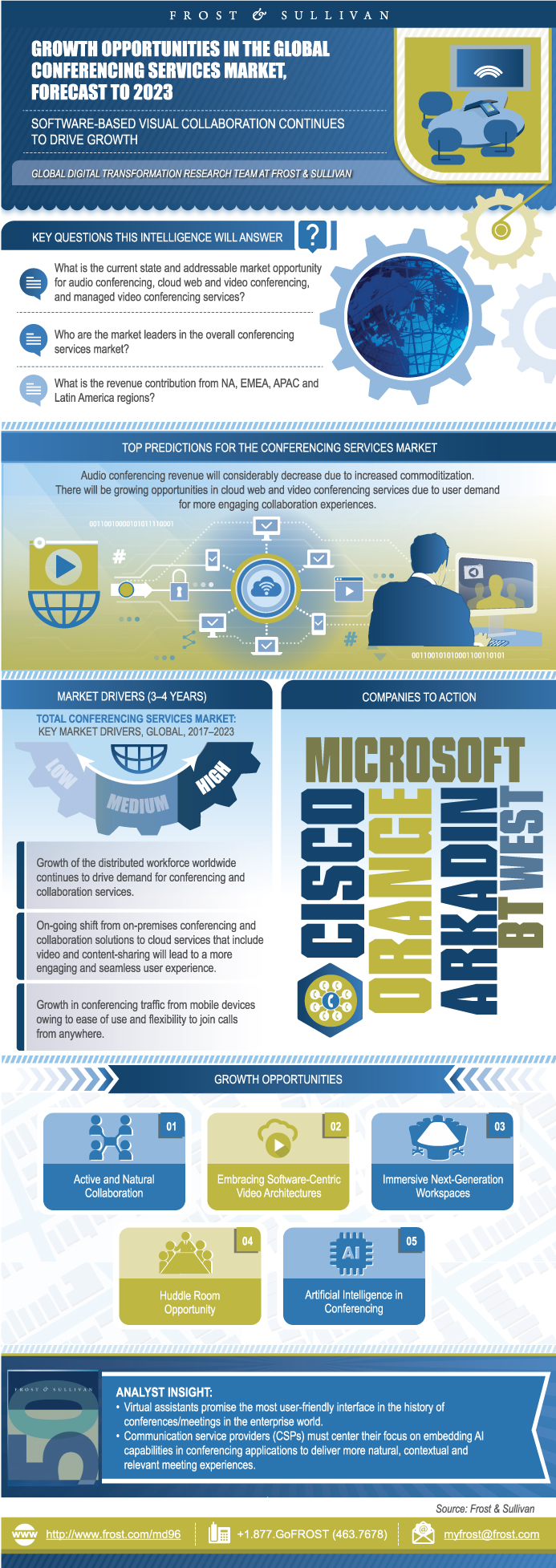

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Purpose of this Experiential Study

5 Step Process to Transformational Growth

Strategic Imperatives for Conferencing Service Providers

Scope and Market Definitions

Market Definitions

Market Definitions (continued)

Market Definitions (continued)

Enterprise Communications and Collaboration Landscape

Conferencing Services Provider Landscape

State of the Market

State of the Market (continued)

State of the Market (continued)

State of the Market (continued)

State of the Market (continued)

Market Drivers

Market Restraints

Revenue Forecast—Global Conferencing Services Market

Percent Revenue by Service Segment

Percent Revenue by Region

Percent Revenue by Vendor—Audio Conferencing Services

Percent Revenue by Vendor—Cloud Web and Video Conferencing Services

Percent Revenue by Vendor—Managed Video Conferencing Services

Unit Forecast—Audio Conferencing Services Market

Unit Forecast—Cloud Web and Video Conferencing Services Market

Macro to Micro Visioning

Top Predictions for the Conferencing Services Market

Levers for Growth

Growth Opportunity 1—Natural Visual Collaboration

Growth Opportunity 2—Embracing Software-Centric Video Architectures

Growth Opportunity 3—Huddle Room Opportunity

Growth Opportunity 4—Next-Generation Team Collaboration Workspaces

Growth Opportunity 5—End-to-end UC&C Stack

Growth Opportunity 6—Artificial Intelligence in Collaboration

Growth Opportunity 7—Actionable Analytics

Growth Opportunity 8—HD Audio

Growth Opportunity 9—Emergence of Purpose-built Systems

Growth Opportunity 10—IoT opportunity

Growth Opportunity 11—Channel Marketing

Growth Opportunity 12—Innovation and Transformation

Growth Opportunity 13—Sales and Marketing Use Cases

Growth Opportunity 14—Social Media Marketing

Identifying Your Company’s Growth Zone

Total Growth Opportunity Matrix 1–9: Vision and Strategy

Total Growth Opportunity Matrix 10–14: Brand and Demand

Total Growth Opportunities Matrix Chart

Growth Strategies for Your Company

Prioritized Opportunities through Implementation

Legal Disclaimer

Abbreviations and Acronyms Used

Other Vendors of Audio Conferencing Services

Other Vendors of Cloud Web and Video Conferencing Services

Other Vendors of Managed Video Conferencing Services

List of Exhibits

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Vaishno Devi Srinivasan |

| Industries | Telecom |

| WIP Number | MD96-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9656,9705-C1,9717-C3 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB