Growth Opportunities in the Chinese Fuel Additives Market

Growth Opportunities in the Chinese Fuel Additives Market

Focus Products—Lubricity Improvers and Cold Flow Additives for Diesel

13-Nov-2017

Asia Pacific

$4,950.00

Special Price $3,712.50 save 25 %

Description

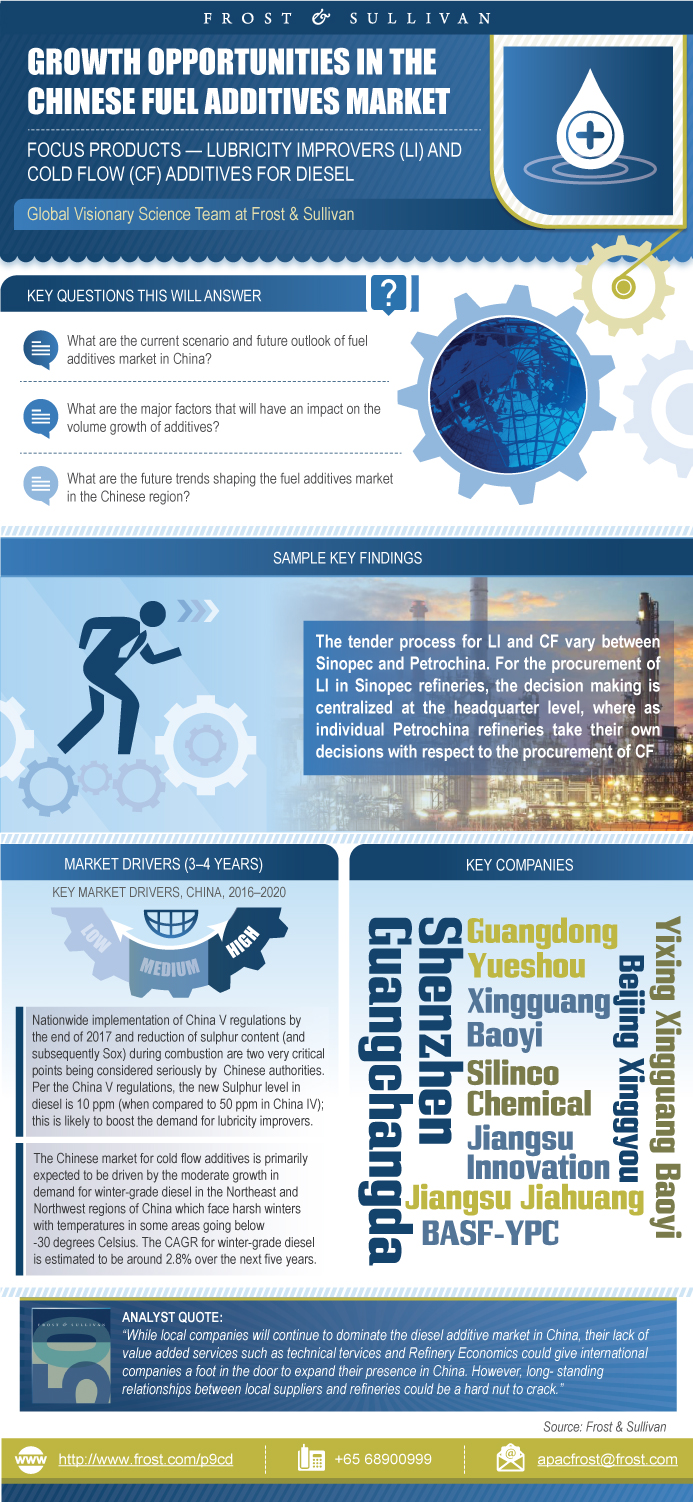

The Chinese diesel market is set to grow at a robust pace over the next 5 to 7 seven years as production of diesel vehicles increases and the introduction of China V specifications takes center stage. The implementation of China V regulations is key to the consumption of diesel, and in turn, lubricity improvers (LI) and cold flow (CF) additives. Lubricity improvers are estimated to grow at a strong CAGR of 11.9% between 2016 and 2022 while cold flow additives, which are predominantly used in winter diesel, will grow at a lower CAGR of 2.8%. Excess kerosene availability in China will also be a challenge for the growth of cold flow additives, as it is a cheap alternative. Local players in China currently dominate the supply of LI and CF additives to Sinopec and Petrochina.

The local players that dominate the market have excellent relationships with both Sinopec and Petrochina. These relationships are long-standing ones which gives them an edge over new entrants. New companies trying to tap opportunities in the LI and CF market in China are advised to partner with the domestic players, as it will enable them to get a ‘ foot in the door’ with the state-owned enterprises. Owing to these long-standing relationships, the technical specifications set by the refineries are published in such a way that most of these domestic players will qualify. International additive companies have superior technical specifications as compared to domestic players, but these improved specifications are often perceived as premium or expensive.

The procurement process for LI and CF is different between Sinopec and Petrochina. While Sinopec is predominantly a consumer of LI, Petrochina is a large consumer of CF, as Petrochina produces larger quantities of winter-grade diesel due to its locations in colder regions across China. While the procurement process for Sinopec is done completely at the headquarter level, the process for the procurement of CF is left to individual Petrochina refineries. This difference in the tender processes has made domestic additive manufacturers increase their sales and marketing staff in order to have a constant presence at the location of various refineries.

There are however interesting ways by which international LI and CF players can enter the China market and be successful. One of them is to partner with a strong domestic additive manufacturer. The other option is to provide value-added services such as refinery economics exercises, training workshops for refinery personnel on the advantages of using CF over kerosene as well as joint R&D exercises. These services will go a long way in building relationships with refineries, which is the cornerstone of success in the diesel additive market in China.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

LI & CF Market Information Snapshot

Macroeconomic Outlook

Diesel and Kerosene Production and Consumption

LI Market Outlook

LI Value Chain Analysis

LI Typical Route to Market

Top LI Manufacturers in China

Refinery Procurement Practices

CF Market Outlook

CF Value Chain Analysis

CF Typical Route to Market

Top CF Manufacturers in China

CF Procurement Process

China V Implementation Impact

Emission Limits for China V

Incentives for Refineries to switch to China V

China Refining Capacity

Refinery Utilization Trends

China V Implementation Map

Diesel Outlook—Refining Capacity

Diesel Outlook—Backward Capacity Elimination

Winter Diesel Outlook

Other Demand Drivers for Diesel

Aviation Kerosene

PetroChina Diesel and Kerosene Outlook, 2016 to 2020

China Refinery Expansion Plans

China Refinery Expansion Plans

LI Market in China

Key Drivers for the LI Market in China

Key Challenges for the LI Market in China

Market Outlook for LI—Conditions for Ester Adoption

Market Share Analysis per LI Type

Distributor Criteria for Selecting a LI Manufacturer

Value Chain Analysis

Value Chain Analysis for LI Additives in China

Raw Material Analysis

Alternative Raw Materials for Lubricity Improvers

TOFA Imports into China

Typical Route to Market

Refinery Procurement Practices

Supplier Selection Criteria—Refinery Viewpoint

Supplier Selection Criteria—Manufacturer Viewpoint

Acid vs. Ester Product Awareness—Refineries

Ester-based LI Adoption

Top 5 LI Manufacturers

Local LI Manufacturer Capabilities

Market Outlook

Winter Diesel and Usage of Cold Flow Additives

Key Drivers for the CF Market in China

Key Challenges for the CF Market in China

Key Takeaways from China’s 13th Five-Year Plan

Refinery Configuration—Hydrocracking Capacities

Distributor Criteria for Selecting a Manufacturer of CF

Value Chain Analysis

Import of Aviation Kerosene by Country

Cold Flow—Typical Route to Market

Cold Flow—Procurement Process

Supplier Selection Criteria—Refinery Requirement

Product Awareness—Refineries

Top CF Manufacturers in China

Porter’s 5 Forces Analysis for the LI Market

Opportunity for Emerging Players and Industry Threat

Porter’s 5 Forces Analysis for the CF Market

Opportunity for Emerging Players and Threats

Growth Opportunity

Strategic Imperatives for Success and Growth

3 Key Takeaways

Legal Disclaimer

Definitions and Abbreviations

Learn More—Next Steps

- 1. Fuel Additives Market: LI & CF Snapshot, China, 2017

- 2. Fuel Additives Market: Top 5 Manufacturers, China, 2017

- 3. Fuel Additives Market: Top 5 CF Manufacturers, China, 2017

- 4. Fuel Additives Market: Diesel Fuel Quality Roadmap, China, 2017

- 5. Fuel Additives Market: Emission Limit by Vehicle Type, China 2017

- 6. Fuel Additives Market: Implementation Timeline of Fuel Standards by Region, China, 2017

- 7. Fuel Additives Market: PetroChina Diesel and Kerosene Outlook, China, 2016–2020

- 8. Fuel Additives Market: Refinery Expansion Plans, China, 2017

- 9. LI Segment: Drivers, China, 2016–2020

- 10. LI Segment: Challenges, China, 2016–2020

- 11. LI Segment: Distributor Criteria for Selecting a Manufacturer, China 2017

- 12. LI Segment: TOFA Imports, China, 2017

- 13. LI Segment: Supplier Selection Criteria of Refineries, China, 2017

- 14. LI Segment: Supplier Selection Criteria of Manufacturers, China, 2017

- 15. LI Segment: Top 5 Manufacturers, China, 2017

- 16. CF Segment: Drivers, China, 2016–2020

- 17. CF Segment: Challenges, China, 2016–2020

- 18. CF Segment: Hydrocracking Capacity of Refineries, China, 2017

- 19. CF Segment: Distributor Criteria for Selecting a CF Manufacturer, China, 2017

- 20. CF Segment: Aviation Kerosene Import Breakdown by Select Country, Global, 2011–2017

- 21. CF Segment: Supplier Selection Criteria of Refineries, China, 2017

- 22. CF Segment: Top 5 Manufacturers, China, 2017

- 1. Macroeconomic Growth Outlook, China, 2015–2020

- 2. Diesel Production and Consumption Forecast, China, 2015–2020

- 3. Kerosene Production and Consumption Forecast, China, 2015–2020

- 4. Lubricity Improver Demand, China, 2015–2020

- 5. Fuel Additives Market: LI Value Chain, China, 2017

- 6. Fuel Additives Market: LI Route to Market, China, 2017

- 7. Cold Flow Demand, China, 2015–2020

- 8. Fuel Additives Market: CF Value Chain, China, 2017

- 9. Fuel Additives Market: CF Route to Market, China, 2017

- 10. Fuel Additives Market: CF Procurement Process, China, 2017

- 11. Number of Refineries*, China, 2015

- 12. Refinery Utilization Trend, China, 2010–2015

- 13. Diesel Production—Scenario 1, China, 2015–2020

- 14. Diesel Production—Scenario 2, China, 2015–2020

- 15. Winter Diesel Outlook, China, 2016–2020

- 16. Heavy Commercial Vehicle Outlook, China, 2015–2020

- 17. Aviation Kerosene Imports, China, 2011 to 2015

- 18. LI Segment: Base Case Scenario, China, 2015–2020

- 19. LI Segment: Demand* Forecast, China, 2015–2020

- 20. LI Segment: Market Share by LI Type, China, 2015, 2017, and 2020

- 21. LI Segment: Value Chain, China, 2017

- 22. LI Segment: Route to Market, China, 2017

- 23. CF Segment: Demand Forecast, China, 2015–2020

- 24. CF Segment: Value Chain, China, 2017

- 25. CF Segment: Route to Market, China, 2017

- 26. CF Segment: Procurement Process, China, 2017

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || LI & CF Market Information Snapshot~ || Macroeconomic Outlook~ || Diesel and Kerosene Production and Consumption~ || LI Market Outlook~ || LI Value Chain Analysis~ || LI Typical Route to Market~ || Top LI Manufacturers in China~ || Refinery Procurement Practices~ || CF Market Outlook~ || CF Value Chain Analysis~ || CF Typical Route to Market~ || Top CF Manufacturers in China~ || CF Procurement Process~ | Diesel Regulations in China for Conversion from China IV to China V and China VI~ || China V Implementation Impact~ || Emission Limits for China V~ || Incentives for Refineries to switch to China V~ || China Refining Capacity~ || Refinery Utilization Trends~ || China V Implementation Map~ | China Diesel and Kerosene Outlook to 2020~ || Diesel Outlook—Refining Capacity~ || Diesel Outlook—Backward Capacity Elimination~ || Winter Diesel Outlook~ || Other Demand Drivers for Diesel~ || Aviation Kerosene~ || PetroChina Diesel and Kerosene Outlook, 2016 to 2020~ || China Refinery Expansion Plans~ || China Refinery Expansion Plans~ | Lubricity Improvers—Market Assessment~ || LI Market in China~ || Key Drivers for the LI Market in China~ || Key Challenges for the LI Market in China~ || Market Outlook for LI—Conditions for Ester Adoption~ || Market Share Analysis per LI Type~ || Distributor Criteria for Selecting a LI Manufacturer~ | Lubricity Improvers—Value Chain Assessment~ || Value Chain Analysis~ || Value Chain Analysis for LI Additives in China~ || Raw Material Analysis~ || Alternative Raw Materials for Lubricity Improvers~ || TOFA Imports into China~ || Typical Route to Market~ || Refinery Procurement Practices~ || Supplier Selection Criteria—Refinery Viewpoint~ || Supplier Selection Criteria—Manufacturer Viewpoint~ || Acid vs. Ester Product Awareness—Refineries~ || Ester-based LI Adoption~ | Lubricity Improvers—Competitor Assessment~ || Top 5 LI Manufacturers~ || Local LI Manufacturer Capabilities~ | Cold Flow Additives—Market Assessment~ || Market Outlook~ || Winter Diesel and Usage of Cold Flow Additives~ || Key Drivers for the CF Market in China~ || Key Challenges for the CF Market in China~ || Key Takeaways from China’s 13th Five-Year Plan~ || Refinery Configuration—Hydrocracking Capacities~ || Distributor Criteria for Selecting a Manufacturer of CF~ | Cold Flow Additives—Value Chain Assessment~ || Value Chain Analysis~ || Import of Aviation Kerosene by Country~ || Cold Flow—Typical Route to Market~ || Cold Flow—Procurement Process~ || Supplier Selection Criteria—Refinery Requirement~ || Product Awareness—Refineries~ | Cold Flow Additives—Competitive Assessment~ || Top CF Manufacturers in China~ | Conclusion~ || Porter’s 5 Forces Analysis for the LI Market~ || Opportunity for Emerging Players and Industry Threat~ || Porter’s 5 Forces Analysis for the CF Market~ || Opportunity for Emerging Players and Threats~ | Growth Opportunities and Companies to Action~ || Growth Opportunity~ || Strategic Imperatives for Success and Growth~ | The Last Word~ || 3 Key Takeaways~ || Legal Disclaimer~ | Appendix~ || Definitions and Abbreviations~ || Learn More—Next Steps~ |

| List of Charts and Figures | 1. Fuel Additives Market: LI & CF Snapshot, China, 2017~ 2. Fuel Additives Market: Top 5 Manufacturers, China, 2017~ 3. Fuel Additives Market: Top 5 CF Manufacturers, China, 2017~ 4. Fuel Additives Market: Diesel Fuel Quality Roadmap, China, 2017~ 5. Fuel Additives Market: Emission Limit by Vehicle Type, China 2017~ 6. Fuel Additives Market: Implementation Timeline of Fuel Standards by Region, China, 2017~ 7. Fuel Additives Market: PetroChina Diesel and Kerosene Outlook, China, 2016–2020~ 8. Fuel Additives Market: Refinery Expansion Plans, China, 2017~ 9. LI Segment: Drivers, China, 2016–2020~ 10. LI Segment: Challenges, China, 2016–2020~ 11. LI Segment: Distributor Criteria for Selecting a Manufacturer, China 2017~ 12. LI Segment: TOFA Imports, China, 2017~ 13. LI Segment: Supplier Selection Criteria of Refineries, China, 2017~ 14. LI Segment: Supplier Selection Criteria of Manufacturers, China, 2017~ 15. LI Segment: Top 5 Manufacturers, China, 2017~ 16. CF Segment: Drivers, China, 2016–2020~ 17. CF Segment: Challenges, China, 2016–2020~ 18. CF Segment: Hydrocracking Capacity of Refineries, China, 2017~ 19. CF Segment: Distributor Criteria for Selecting a CF Manufacturer, China, 2017~ 20. CF Segment: Aviation Kerosene Import Breakdown by Select Country, Global, 2011–2017 ~ 21. CF Segment: Supplier Selection Criteria of Refineries, China, 2017 ~ 22. CF Segment: Top 5 Manufacturers, China, 2017~| 1. Macroeconomic Growth Outlook, China, 2015–2020~ 2. Diesel Production and Consumption Forecast, China, 2015–2020~ 3. Kerosene Production and Consumption Forecast, China, 2015–2020~ 4. Lubricity Improver Demand, China, 2015–2020~ 5. Fuel Additives Market: LI Value Chain, China, 2017~ 6. Fuel Additives Market: LI Route to Market, China, 2017~ 7. Cold Flow Demand, China, 2015–2020~ 8. Fuel Additives Market: CF Value Chain, China, 2017~ 9. Fuel Additives Market: CF Route to Market, China, 2017~ 10. Fuel Additives Market: CF Procurement Process, China, 2017~ 11. Number of Refineries*, China, 2015~ 12. Refinery Utilization Trend, China, 2010–2015~ 13. Diesel Production—Scenario 1, China, 2015–2020~ 14. Diesel Production—Scenario 2, China, 2015–2020~ 15. Winter Diesel Outlook, China, 2016–2020 ~ 16. Heavy Commercial Vehicle Outlook, China, 2015–2020~ 17. Aviation Kerosene Imports, China, 2011 to 2015 ~ 18. LI Segment: Base Case Scenario, China, 2015–2020~ 19. LI Segment: Demand* Forecast, China, 2015–2020~ 20. LI Segment: Market Share by LI Type, China, 2015, 2017, and 2020~ 21. LI Segment: Value Chain, China, 2017~ 22. LI Segment: Route to Market, China, 2017~ 23. CF Segment: Demand Forecast, China, 2015–2020~ 24. CF Segment: Value Chain, China, 2017 ~ 25. CF Segment: Route to Market, China, 2017 ~ 26. CF Segment: Procurement Process, China, 2017 ~ |

| Author | Nikhil Vallabhan |

| Industries | Chemicals and Materials |

| WIP Number | P9CD-01-00-00-00 |

| Keyword 1 | Chinese Fuel Additives |

| Keyword 2 | Fuel Additives |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB