Future Trends in Luxury Electric Vehicle Market in North America and Europe, 2016–2025

Future Trends in Luxury Electric Vehicle Market in North America and Europe, 2016–2025

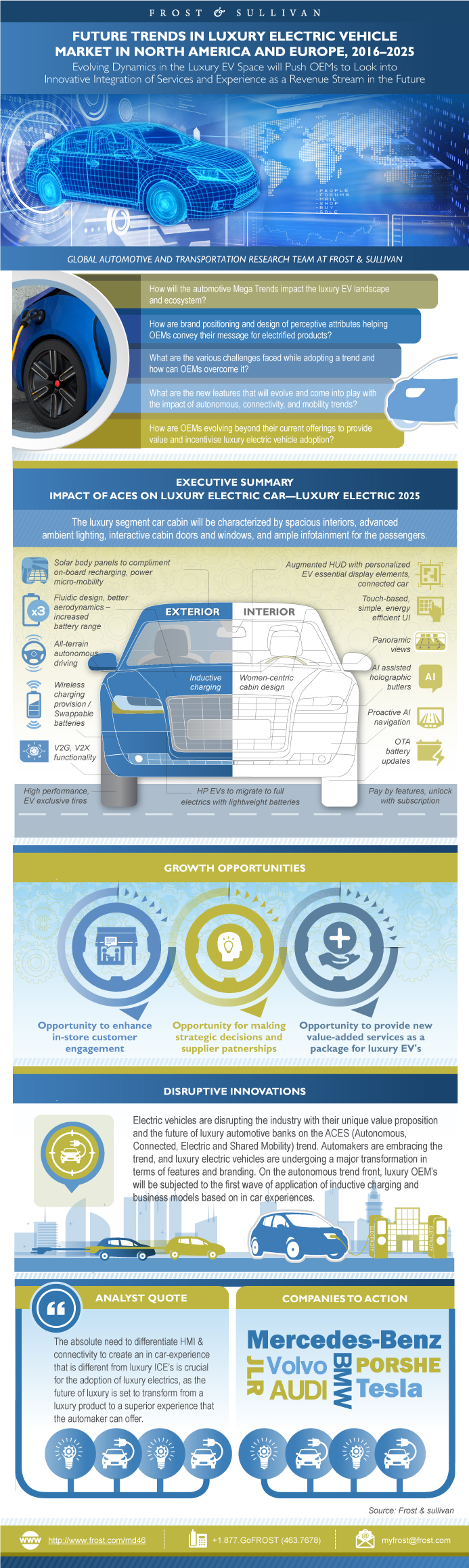

Evolving Dynamics in the Luxury EV Space will Push OEMs to Look into Innovative Integration of Services and Experience as a Revenue Stream in the Future

08-Dec-2017

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

Stringent emission regulations have pushed luxury OEMs to electrify their offerings to adhere to the standards. Although battery electric vehicles and plug-in hybrids are being touted as sustainable alternative transportation solutions, low adoption can be attributed to lack of consumer awareness and common misconceptions about electric range and e-technology. While a set of tech savvy consumers and green environmentalists are the early adopters, OEMs need to offer more than a product to attract consumers across varying demographic segments. Moreover, the luxury space is evolving more rapidly than its internal-engine powered counterpart owing to the influential impact of the ACEC trend.

The future of luxury automotive banks on the Autonomous, Connected, Electric, and Shared Mobility (ACES) trend. Automakers are ever agile in the space of luxury electric cars, integrating next-gen technological features owing to the support of autonomous, connectivity, and mobility trends. Automakers are embracing these trends and luxury electric vehicles are undergoing a major transformation in terms of features and branding. On the autonomous trend front, luxury OEMs will be subjected to a first wave of application of inductive charging and business models based on in-car experiences. But the impact on connectivity and HMI innovations is vital for brands looking towards differentiating themselves. AI-based personal assistance and AI-based proactive navigation to eliminate range anxiety and optimal use of battery charge will be a few examples of features included in the car. With regards to HMI, intuitive touch-based systems are set to become a norm. Women-centric designs will also be in the radar of premium makers, especially in the SUV segments. In the prospect of autonomous shared mobility economy only 2 distinctive segments will survive—premium and low cost. Therefore, it becomes essential for OEMs to look beyond the product and lean on customer experience (CX) to not only better enable a sustainable revolution but to also diversify their offerings to stay ahead of the competition.

Research Benefits

This study captures future trends in luxury electric vehicles and discusses about challenges to OEM's and their remediation strategies.

Key Issues Addressed

- How will the automotive Mega Trends impact the luxury EV landscape and ecosystem?

- How are brand positioning and design of perceptive attributes helping OEMs convey their message for electrified products?

- What are the various challenges faced while adopting a trend and how can OEMs overcome it?

- What are the new features that will evolve and come into play with the impact of autonomous, connectivity, and mobility trends?

- How are the OEMs evolving beyond their current offerings to provide value and incentive luxury electric vehicle adoption?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Executive Summary—Key Findings

Executive Summary—Premium Luxury Brand Timeline

Customer Strategy—EV Brand Positioning

Women as Customers—Design Trends

Electrification—Future Vehicle Segment Analysis

HMI—A Look into Future Trends

Body Design & Styling—Luxury Electric 2025

Leasing Features Analysis—Identifying the Grey Area

Region-wise Analysis of OEMs’ Mobility Business Models

Building Better CX—Possible Customer Service Business Models

Proposition Analysis—Owning the ACES Space

Research Scope

Research Aims and Objectives

Key Questions this Study will Answer

Research Methodology

Product Segmentation

EV Segmentation

Classification of Premium & High Performance Vehicles

Forecast Summary—Premium & High Performance Vehicles

Why Luxury EVs?

Key Trends that Impact the Luxury Electric Vehicle Market

Boom in Luxury EV Investments and New Market Entrants

How Tesla Creates an Ecosystem of Green Mobility

Consumer Analysis—Demographics Classification

Customer Preference—Electric Vehicles

Customer Strategy—EV Brand Positioning

Women as Customers—Snapshot

Women as Customer—Design Trends

Product Launch Map of Luxury BEV Launches

Product Launch Map of Luxury PHEV Launches

Product Launch Map of Luxury PHEV Launches (continued)

Long-range Luxury BEVs to Rule the Market

ACES Interest Mapping

Threat from Tech Companies in Luxury EV Segment

Evolution of Supplier Value Chain

Electrification—Luxury EV Market

Electrification—Luxury EV Platform Strategies

Electrification—Market Overview

Electrification—Future Vehicle Segment Analysis

Luxury EV—Europe and North America Landscape

Luxury EV—OEM Market Share

Electrification—Trend Progression

Autonomous—Future Trends in Luxury

Autonomy—Challenges to Luxury EV and Remediation Strategies

Autonomy—Future OEM Strategies

Connectivity & HMI

HMI—A Look into Future Trends

Predictive Analytics—AI in the Future of Luxury Electric Cars

Inside Faraday Future and Lucid Motors

Connectivity and HMI—Trend Progression

Body Design and Styling—Design Challenges

Body Design and Styling—Luxury Electric 2025

Future Battery Chemistries—Market Introduction Roadmap

Luxury Electric Vehicle—Battery Trends

End-of-Lifecycle Analysis—Lifecycle of Batteries

Luxury Electric Vehicle—Charging Trends

Battery and Charging in Luxury EV—Trend Progression

Changing Ownership Trends

OEM Marketing Mix—Comparative Landscape

Trends in Automotive Retail Stores

EV only Retail Store or Mixed Retailing Concept?

OEM Retail Strategies

Recommended EV Retail Elements—Critical Success Factors

Financial Lease Type Segmentation

Financial Feature Analysis

Leasing Features Analysis—Identifying the Grey Area

Future Innovations

Retail Trends in Luxury EV—Trend Progression

Consumer Perception—New Mobility Acceptance

Mobility as a Service (MaaS)

Region-wise Analysis of OEMs’ Mobility Business Models

Exhibit C—Maven Electric Carsharing

Exhibit D: Subscription Based Business Model

Building Better CX—Possible Customer Service Business Models

Mobility—Trend Progression

EV Product Positioning—Price vs Range

EV Product Positioning—Battery Capacity vs Range

Proposition Analysis—Owning the ACES Space

Growth Opportunity—Social Collaboration

Strategic Imperatives for Global Luxury EV Industry

Conclusion

Future of Luxury Electric Vehicle—Snapshot (2025)

Global Luxury EV Market—3 Big Predictions

Legal Disclaimer

Abbreviations and Acronyms Used

EV Incentives—North America

EV Incentives—North America (continued)

EV Incentives—Europe

EV Incentives—Europe (continued)

EV Incentives—Europe (continued)

EV Incentives—Asia

Market Engineering Methodology

Popular Topics

Research Benefits

This study captures future trends in luxury electric vehicles and discusses about challenges to OEM's and their remediation strategies.

Key Issues Addressed

- How will the automotive Mega Trends impact the luxury EV landscape and ecosystem?

- How are brand positioning and design of perceptive attributes helping OEMs convey their message for electrified products?

- What are the various challenges faced while adopting a trend and how can OEMs overcome it?

- What are the new features that will evolve and come into play with the impact of autonomous, connectivity, and mobility trends?

- How are the OEMs evolving beyond their current offerings to provide value and incentive luxury electric vehicle adoption?

| No Index | No |

|---|---|

| Podcast | No |

| Author | Pooja Bethi |

| Industries | Automotive |

| WIP Number | MD46-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9807-A6,9813-A6,9882-A6,9AF6-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB