Strategic Analysis of Remanufacturing in Global Automotive Aftermarket

Strategic Analysis of Remanufacturing in Global Automotive Aftermarket

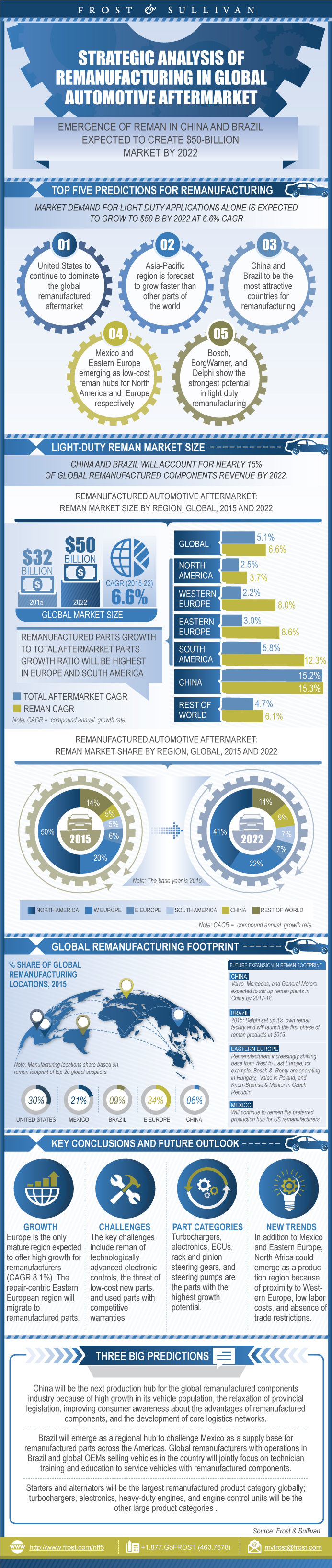

Emergence of Reman in China and Brazil Expected to Create $50-Billion Market by 2022

06-Jun-2016

Global

$4,950.00

Special Price $3,712.50 save 25 %

Description

The emergence of re-manufactured parts production and sales in Brazil, China, and other regions will result in an approximately $50-billion industry globally by 2022. The research service analyzes how maturation of the vehicle parts and service industry will increase the availability of lower priced products in the future. Although the United States still accounts for a majority of the remanufactured automotive aftermarket revenue globally, Frost & Sullivan analysts have highlighted opportunities in Europe, Asia-Pacific, and South America that will support future industry growth. The study also analyzes which products and suppliers are driving the development in each region, and it includes profiles of key industry participants. The base year is 2015.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Top Five Predictions for Remanufacturing

Regional Attractiveness for Remanufacturing

Light-Duty Reman Market Size (Manufacturer-level)

Key Regional Highlights

Global Legislative Landscape and Ease of Remanufacturing

Key Global Competitors

Comparative Benchmarking of Key Remanufacturers

Best Practices Implemented by Remanufacturers—Key Exhibits

Key Remanufacturing Priorities

Research Scope & Definitions

Vehicle Classification

Remanufacturing versus Rebuilding/Repair–Key Features

Core Supply Chain Definitions

Research Aims and Objectives

Research Background

Research Methodology

Key Remanufacturer/Participant Groups Compared in this Study

Global Light Vehicles in Operation (VIO)

Manufacturer-level Reman Revenue by Region (Light-duty)

Global Remanufacturing Footprint

Remanufactured Automotive Aftermarket: Growth Drivers

Key Challenges in Core Procurement/Management

Major Core Management Practices

Remanufactured Areas of Growth

Reman Price Positioning versus Competing Products

Key Global Remanufacturers in Operation

Remanufactured Automotive Aftermarket: Key Acquisitions, Global

Light Vehicles in Operation (VIO) by Country

Average Light Vehicle Age (Trends)

Light Vehicles in Operation by Brand

Medium and Heavy Trucks in Operation by Class

Manufacturer-level Reman Revenue by Country (Light-duty)

New Remanufacturing Law in the United States

Manufacturer-level Revenue of Key Remanufactured Parts

Revenue Share by Distribution Channel of Key Reman Parts (Light-duty)

Key Remanufacturers in Operation

Future of Remanufacturing in North America

Conclusions

Light Vehicles in Operation (VIO) by Country

Light Average Vehicle Age (Trends)

Light Vehicles in Operation by Brand

Medium and Heavy Commercial Vehicles in Operation (VIO) by Country

Manufacturer-level Reman Revenue by Country (Light-Duty)

Remanufacturers of Top Product Categories

Remanufacturers of Top Product Categories (continued)

Distribution Channel Analysis by Country, Europe (Light-Duty)

Challenges and Opportunities

Future of Remanufacturing in Europe

Conclusions

Vehicles in Operation (VIO) by Country

Average Vehicle Age Trends (China)

Vehicles in Operation by Brand (China)

PESTLE Analysis—China

Manufacturer-level Reman Revenue by Country (Light-Duty)

Market Attractiveness—China

Future of Remanufacturing in Asia-Pacific

Conclusions

Vehicles in Operation (VIO) by Country

Vehicles in Operation (Brazil)

Challenges and Opportunities

Remanufacturers of Top Product Categories

Distribution Channel Environment

Future of Remanufacturing in South America

Conclusions

Remanufacturer Profile

Key Conclusions and Future Outlook

3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

Table of Acronyms Used

- 1. Remanufactured Automotive Aftermarket: Regional Attractiveness, Global, 2015–2022

- 2. Remanufactured Automotive Aftermarket: Reman Market Size by Region, Global, 2015 and 2022

- 3. Remanufactured Automotive Aftermarket: Key Regional Highlights, Global, 2015

- 4. Remanufactured Automotive Aftermarket: Comparative Benchmarking of Key Remanufacturers, Global, 2015

- 5. Remanufactured Automotive Aftermarket: Vehicle Segmentation, Global, 2015

- 6. Remanufactured Automotive Aftermarket: Light Vehicles in Operation, Global, 2015 and 2022

- 7. Remanufactured Automotive Aftermarket: Regional Reman Plants by Remanufacturer, Global, 2015

- 8. Remanufactured Automotive Aftermarket: Footprint by Region for Top Remanufacturers, Global, 2015

- 9. Remanufactured Automotive Aftermarket: Growth Drivers, Global, 2015

- 10. Remanufactured Automotive Aftermarket: Key Challenges in Core Procurement/Management, Global, 2015

- 11. Remanufactured Automotive Aftermarket: Core Management Practices, Global, 2015

- 12. Remanufactured Automotive Aftermarket: Areas of Growth, Global, 2015

- 13. Remanufactured Automotive Aftermarket: Relative Price Position by Part Categories, Global, 2015

- 14. Remanufactured Automotive Aftermarket: Remanufacturers in Operation, Global, 2015

- 15. Remanufactured Automotive Aftermarket: Key Acquisitions, Global, 2010–2015

- 16. Remanufactured Automotive Aftermarket: Vehicles in Operation by Country, North America, 2012–2022

- 17. Remanufactured Automotive Aftermarket: Average Vehicle Age, North America, 2012–2022

- 18. Remanufactured Automotive Aftermarket: Vehicles in Operation by Age, US, 2015

- 19. Remanufactured Automotive Aftermarket: Vehicles in Operation by Brand, US, 2015

- 20. Remanufactured Automotive Aftermarket: Vehicles in Operation by Truck Class, North America, 2012–2022

- 21. Remanufactured Automotive Aftermarket: Manufacturer-level Revenue of Key Light-duty Parts, North America, 2015–2022

- 22. Remanufactured Automotive Aftermarket: Percent of Revenue by Product Type and Distribution Channel, North America, 2015

- 23. Remanufactured Automotive Aftermarket: Remanufacturers in Operation, North America, 2015

- 24. Remanufactured Automotive Aftermarket: Future of Remanufacturing , North America, 2016 to 2022

- 25. Remanufactured Automotive Aftermarket: Vehicles in Operation (VIO) Forecast by Country, *Europe, 2012–2022

- 26. Remanufactured Automotive Aftermarket: Average Vehicle Age by Country, Europe, 2012–2022

- 27. Remanufactured Automotive Aftermarket: Vehicles in Operation by Age, Europe, 2015

- 28. Remanufactured Automotive Aftermarket: VIO by Brand, Western Europe, 2015

- 29. Remanufactured Automotive Aftermarket: VIO by Brand, Eastern Europe, 2015

- 30. Remanufactured Aftermarket: M&HCV in Operation (VIO) Forecast by Country, Europe, 2012–2022

- 31. Remanufactured Automotive Aftermarket: Remanufacturers by Top Product Categories, Europe, 2015

- 32. Remanufactured Automotive Aftermarket: Percent of Revenue by Distribution Channel and Country, Europe, 2015

- 33. Remanufactured Automotive Aftermarket: Challenges and Opportunities, Europe, 2015

- 34. Remanufactured Automotive Aftermarket: Future of Remanufacturing, Europe, 2016 to 2022

- 35. Remanufactured Automotive Aftermarket: Vehicle in Operation (VIO) Forecast by Country, Asia-Pacific, 2015–2022

- 36. Remanufactured Automotive Aftermarket: Percent Share of VIO by Age, China, 2013–2021

- 37. Remanufactured Automotive Aftermarket: VIO Share by Brand, China, 2015–2022

- 38. Remanufactured Automotive Aftermarket: PESTLE Analysis, China, 2015

- 39. Remanufactured Automotive Aftermarket: Future of Remanufacturing, Asia-Pacific, 2016 to 2022

- 40. Remanufactured Automotive Aftermarket: Vehicles in Operation by Country, South America, 2012–2022

- 41. Remanufactured Automotive Aftermarket: Light Vehicle Average Age, Brazil, 1990–2017

- 42. Remanufactured Automotive Aftermarket: Percent of VIO Under Warranty, Brazil, 2012

- 43. Remanufactured Automotive Aftermarket: Percent of VIO Under Warranty, Brazil, 2017

- 44. Remanufactured Automotive Aftermarket: Remanufacturers by Top Product Categories, South America, 2015

- 45. Remanufactured Automotive Aftermarket: Future of Remanufacturing, South America, 2016 to 2022

- 46. Remanufactured Automotive Aftermarket: Key Conclusions and Future Outlook, Global, 2015–2022

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Top Five Predictions for Remanufacturing~ || Regional Attractiveness for Remanufacturing~ || Light-Duty Reman Market Size (Manufacturer-level)~ || Key Regional Highlights~ || Global Legislative Landscape and Ease of Remanufacturing~ || Key Global Competitors~ || Comparative Benchmarking of Key Remanufacturers~ || Best Practices Implemented by Remanufacturers—Key Exhibits~ || Key Remanufacturing Priorities~ | Research Scope, Definitions, and Segmentation~ || Research Scope & Definitions~ || Vehicle Classification~ || Remanufacturing versus Rebuilding/Repair–Key Features~ || Core Supply Chain Definitions~ | Research Objectives, Background, and Methodology~ || Research Aims and Objectives~ || Research Background~ || Research Methodology~ || Key Remanufacturer/Participant Groups Compared in this Study~ | Remanufactured Automotive Aftermarket Global~ || Global Light Vehicles in Operation (VIO)~ || Manufacturer-level Reman Revenue by Region (Light-duty)~ || Global Remanufacturing Footprint~ || Remanufactured Automotive Aftermarket: Growth Drivers~ || Key Challenges in Core Procurement/Management~ || Major Core Management Practices~ || Remanufactured Areas of Growth~ || Reman Price Positioning versus Competing Products~ || Key Global Remanufacturers in Operation~ || Remanufactured Automotive Aftermarket: Key Acquisitions, Global~ | Remanufactured Automotive Aftermarket North America~ || Light Vehicles in Operation (VIO) by Country~ || Average Light Vehicle Age (Trends)~ || Light Vehicles in Operation by Brand~ || Medium and Heavy Trucks in Operation by Class~ || Manufacturer-level Reman Revenue by Country (Light-duty)~ || New Remanufacturing Law in the United States~ || Manufacturer-level Revenue of Key Remanufactured Parts~ || Revenue Share by Distribution Channel of Key Reman Parts (Light-duty)~ || Key Remanufacturers in Operation~ || Future of Remanufacturing in North America~ || Conclusions~ | Remanufactured Automotive Aftermarket Europe~ || Light Vehicles in Operation (VIO) by Country~ || Light Average Vehicle Age (Trends)~ || Light Vehicles in Operation by Brand~ || Medium and Heavy Commercial Vehicles in Operation (VIO) by Country~ || Manufacturer-level Reman Revenue by Country (Light-Duty)~ || Remanufacturers of Top Product Categories~ || Remanufacturers of Top Product Categories (continued)~ || Distribution Channel Analysis by Country, Europe (Light-Duty)~ || Challenges and Opportunities~ || Future of Remanufacturing in Europe~ || Conclusions~ | Remanufactured Automotive Aftermarket Asia-Pacific~ || Vehicles in Operation (VIO) by Country~ || Average Vehicle Age Trends (China)~ || Vehicles in Operation by Brand (China)~ || PESTLE Analysis—China~ || Manufacturer-level Reman Revenue by Country (Light-Duty)~ || Market Attractiveness—China~ || Future of Remanufacturing in Asia-Pacific~ || Conclusions~ | Remanufactured Automotive Aftermarket South America~ || Vehicles in Operation (VIO) by Country~ || Vehicles in Operation (Brazil)~ || Challenges and Opportunities~ || Remanufacturers of Top Product Categories~ || Distribution Channel Environment~ || Future of Remanufacturing in South America~ || Conclusions~ | Global Remanufacturer Profiles~ || Remanufacturer Profile~ ||| Bosch~ ||| CARDONE~ ||| Delphi~ ||| BBB Industries~ ||| BorgWarner~ ||| Meritor~ ||| Caterpillar Reman~ ||| Bendix~ | Conclusions and Future Outlook~ || Key Conclusions and Future Outlook~ || 3 Big Predictions~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ || Table of Acronyms Used~ |

| List of Charts and Figures | 1. Remanufactured Automotive Aftermarket: Regional Attractiveness, Global, 2015–2022~ 2. Remanufactured Automotive Aftermarket: Reman Market Size by Region, Global, 2015 and 2022~ 3. Remanufactured Automotive Aftermarket: Key Regional Highlights, Global, 2015~ 4. Remanufactured Automotive Aftermarket: Comparative Benchmarking of Key Remanufacturers, Global, 2015~ 5. Remanufactured Automotive Aftermarket: Vehicle Segmentation, Global, 2015 ~ 6. Remanufactured Automotive Aftermarket: Light Vehicles in Operation, Global, 2015 and 2022~ 7. Remanufactured Automotive Aftermarket: Regional Reman Plants by Remanufacturer, Global, 2015~ 8. Remanufactured Automotive Aftermarket: Footprint by Region for Top Remanufacturers, Global, 2015~ 9. Remanufactured Automotive Aftermarket: Growth Drivers, Global, 2015~ 10. Remanufactured Automotive Aftermarket: Key Challenges in Core Procurement/Management, Global, 2015~ 11. Remanufactured Automotive Aftermarket: Core Management Practices, Global, 2015~ 12. Remanufactured Automotive Aftermarket: Areas of Growth, Global, 2015~ 13. Remanufactured Automotive Aftermarket: Relative Price Position by Part Categories, Global, 2015 ~ 14. Remanufactured Automotive Aftermarket: Remanufacturers in Operation, Global, 2015~ 15. Remanufactured Automotive Aftermarket: Key Acquisitions, Global, 2010–2015~ 16. Remanufactured Automotive Aftermarket: Vehicles in Operation by Country, North America, 2012–2022~ 17. Remanufactured Automotive Aftermarket: Average Vehicle Age, North America, 2012–2022~ 18. Remanufactured Automotive Aftermarket: Vehicles in Operation by Age, US, 2015~ 19. Remanufactured Automotive Aftermarket: Vehicles in Operation by Brand, US, 2015~ 20. Remanufactured Automotive Aftermarket: Vehicles in Operation by Truck Class, North America, 2012–2022~ 21. Remanufactured Automotive Aftermarket: Manufacturer-level Revenue of Key Light-duty Parts, North America, 2015–2022~ 22. Remanufactured Automotive Aftermarket: Percent of Revenue by Product Type and Distribution Channel, North America, 2015~ 23. Remanufactured Automotive Aftermarket: Remanufacturers in Operation, North America, 2015~ 24. Remanufactured Automotive Aftermarket: Future of Remanufacturing , North America, 2016 to 2022~ 25. Remanufactured Automotive Aftermarket: Vehicles in Operation (VIO) Forecast by Country, *Europe, 2012–2022 ~ 26. Remanufactured Automotive Aftermarket: Average Vehicle Age by Country, Europe, 2012–2022~ 27. Remanufactured Automotive Aftermarket: Vehicles in Operation by Age, Europe, 2015~ 28. Remanufactured Automotive Aftermarket: VIO by Brand, Western Europe, 2015~ 29. Remanufactured Automotive Aftermarket: VIO by Brand, Eastern Europe, 2015~ 30. Remanufactured Aftermarket: M&HCV in Operation (VIO) Forecast by Country, Europe, 2012–2022 ~ 31. Remanufactured Automotive Aftermarket: Remanufacturers by Top Product Categories, Europe, 2015~ 32. Remanufactured Automotive Aftermarket: Percent of Revenue by Distribution Channel and Country, Europe, 2015~ 33. Remanufactured Automotive Aftermarket: Challenges and Opportunities, Europe, 2015~ 34. Remanufactured Automotive Aftermarket: Future of Remanufacturing, Europe, 2016 to 2022~ 35. Remanufactured Automotive Aftermarket: Vehicle in Operation (VIO) Forecast by Country, Asia-Pacific, 2015–2022 ~ 36. Remanufactured Automotive Aftermarket: Percent Share of VIO by Age, China, 2013–2021~ 37. Remanufactured Automotive Aftermarket: VIO Share by Brand, China, 2015–2022~ 38. Remanufactured Automotive Aftermarket: PESTLE Analysis, China, 2015~ 39. Remanufactured Automotive Aftermarket: Future of Remanufacturing, Asia-Pacific, 2016 to 2022~ 40. Remanufactured Automotive Aftermarket: Vehicles in Operation by Country, South America, 2012–2022~ 41. Remanufactured Automotive Aftermarket: Light Vehicle Average Age, Brazil, 1990–2017~ 42. Remanufactured Automotive Aftermarket: Percent of VIO Under Warranty, Brazil, 2012~ 43. Remanufactured Automotive Aftermarket: Percent of VIO Under Warranty, Brazil, 2017~ 44. Remanufactured Automotive Aftermarket: Remanufacturers by Top Product Categories, South America, 2015~ 45. Remanufactured Automotive Aftermarket: Future of Remanufacturing, South America, 2016 to 2022~ 46. Remanufactured Automotive Aftermarket: Key Conclusions and Future Outlook, Global, 2015–2022~ |

| Author | Avijit Ghosh |

| Industries | Automotive |

| WIP Number | NFF5-01-00-00-00 |

| Keyword 1 | Remanufacturing for the automotive after |

| Keyword 2 | Light-Duty Reman |

| Keyword 3 | Automotive After in Remanufacturing |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB