Growth Opportunity Assessment of Healthcare IT Market in France, Forecast to 2021

Growth Opportunity Assessment of Healthcare IT Market in France, Forecast to 2021

eHealth Strategy 2020 and Digital Hospital Programme to Elevate Maturity of HCIT in France

25-Sep-2017

Europe

Description

UK, Germany, France and Spain collectively spend more than $6 billion on healthcare information technology (healthcare IT) while regional adoption stands at almost 80%. Healthcare IT markets in these countries are ready to embark upon the next level of digitalisation where providers move from data capturing solutions to those that can derive value from data through improving information sharing, analytics and clinical decision support.

France embarked upon the Digital Hospital Strategy as part of its five-year plan (from 2012 to 2017) with the goal of fully digitizing the care delivery system by the end of this period. In spite of a high level of EMR adoption, the country suffers from delays and cost over-runs in comparison to the initial digitalisation plans and intends to rapidly progress towards Stage 5–7 EMRs over the next three years. Integrating care delivery is a key priority for the health system as a whole, which includes developing facets like remote health monitoring, telemedicine, mHealth and IoMT, which enable care delivery outside the hospital.

Between December 2016 and March 2017, Frost & Sullivan conducted a survey of IT managers from 198 hospitals across Western European countries. Findings of the survey were further investigated through in-depth discussions with market vendors and Frost & Sullivan industry thought leaders. Outcomes of the research have been collated into a 4-part series detailing the HCIT landscape across EU4 (The United Kingdom, Germany, France and Spain).

Our research found that only a little more than 15% of large hospitals across EU share data beyond their organization. This has been a huge detriment to efficient and productive health data utilization across all countries included in this study. However, with changing care paradigms, such as focus on patient-centricity, innovation in care delivery models, and demand for workflow efficiency, improving health data continuity will be a key goal for both governments and providers over the next five years. As a result, interoperability, and standards development and adoption will be major priorities across health systems.

France is also targeting improving collaboration and data sharing between healthcare providers and care settings, especially to enable remote care for the elderly and the chronically ill. Inconsistent implementation of initiatives, such as the Dossier Medical Patient (DMP), for establishment of HCIT infrastructure has resulted in fragmented adoption and created complex data silos. To achieve the goal of improving population health, France will need a more harmonized approach to healthcare digitalisation. The eHealth Strategy 2020 has resulted in a business environment conducive to the growth of eHealth vendors. Business models that demonstrate positive clinical and financial outcomes along with partnerships with key stakeholders will be the key to success.

Consumers are playing an increasingly evident role in managing their own health. More than 20% of patients in France use connected devices with a high propensity for using them for chronic disease management. France also showcases an unusually high affinity amongst physicians to advocate use of connected devices to support home monitoring. As a result, telehealth technologies and remote care delivery models will emerge as a key growth opportunity and the government is already working towards establishing a regulatory framework that makes sustainable business models through reimbursements possible in this arena.

This is only a sample of insights that you can gain through our research. Key questions answered in this study include:

• What are the current trends, challenges and drivers for healthcare IT investment?

• What will be the most promising growth opportunities and key investment areas over the next five years?

• How is health IT adoption evolving?

• What will be the impact and adoption of new technologies? How will these change current industry paradigms and/or bring in new business

models?

• How are the initiatives at the national and the regional level for eHealth adoption impacting the market?

• What are the current vendor landscape and the tiers of competition in select segments (e.g., Total Health IT, EHR, PCIS)? How are they

expected to evolve over the next five years?

• What do healthcare providers expect when investing in healthcare?

• What are the key vendor-/solution-selection criteria of providers while investing in health IT?

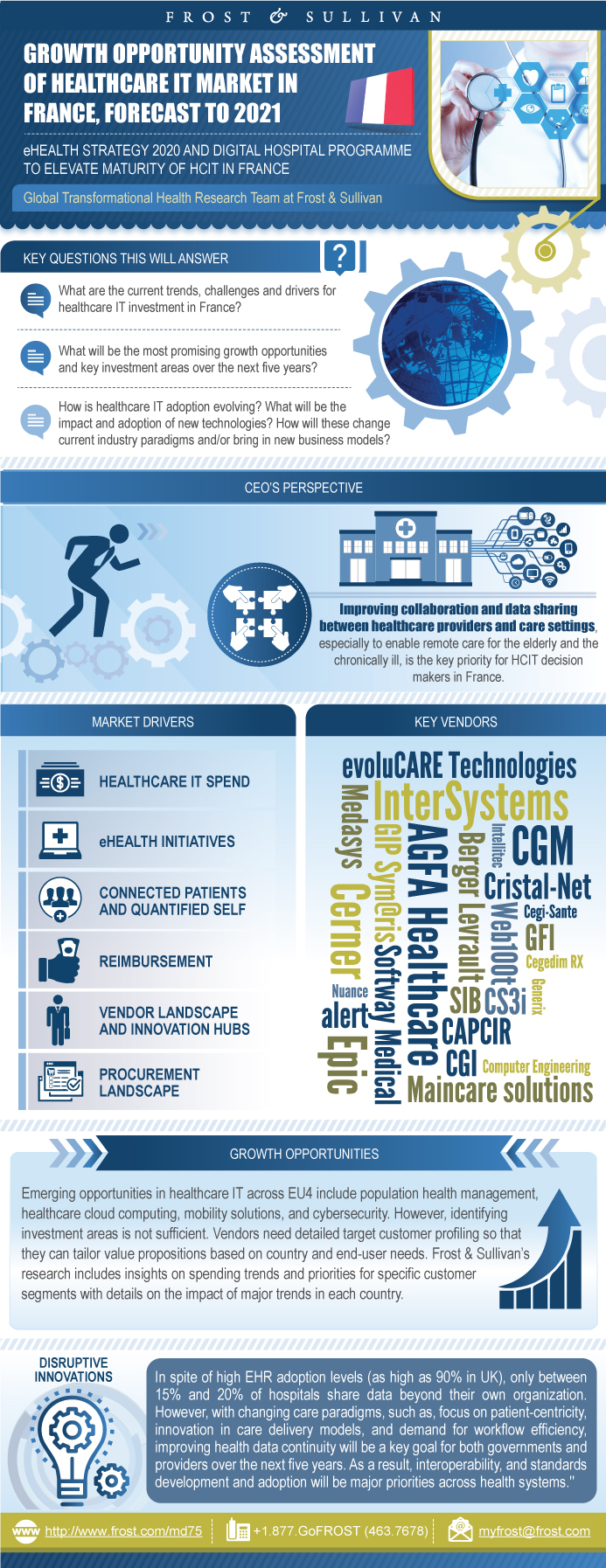

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Research Methodology

Forecast Methodology

Market Snapshot

Scope and Segmentation

Frost & Sullivan Hospital HCIT Survey—Respondents’ Profile

Growth Opportunities in the French Healthcare IT Market

CEO’s Perspective

Market Background

Market Definition and Segmentation

Healthcare IT Market Analysis—Top 4 Markets in Europe

Macro-Level Trends Driving Care Delivery Transformation

Drivers for Healthcare IT Adoption in France

Healthcare IT Market Analysis––Adoption

Hospital Healthcare IT Market in France—Revenue Forecast

Primary Care HCIT Market in France —Major Trends

Overview of the Healthcare Landscape in France

Healthcare IT Landscape—Government Initiatives

Healthcare IT Landscape—Future Plans & Initiatives

Key Findings—Notable Vendor Activities

Key Vendors Overview—Tiers of Competition

Electronic Health Records—Market Share and Position

Primary Care Information System—Market Share and Position

ePrescribing/Pharmacy Information Systems (PhIS)—Market Share and Position

Strategic Imperatives for Healthcare IT Vendors in France

End-user Analysis—Adoption of Hospital HCIT Solutions

End-user Analysis—Hospital HCIT Budgeting Trends

End-user Analysis—Hospitals’ EMR Readiness

End-user Analysis—Future Trends on Replacement and Upgrades of IT Systems

End-user Analysis—Analyst Insight on the French Hospital HCIT Market

Factors Influencing the Future of Healthcare IT in France

Key Conclusions and Recommendations

Legal Disclaimer

Relevant Frost & Sullivan Studies

Abbreviations and Acronyms Used

- 1. Healthcare IT Market: Top 4 Markets, Western Europe, 2016–2021

- 2. Percentage Adoption of Healthcare IT Systems, France, 2017

- 3. Total HCIT Market: Progression of HCIT, France, 2017–2020

- 1. Total Healthcare IT Market: Frost & Sullivan Research Methodology, France, 2017

- 2. Total Hospital HCIT Market: Frost & Sullivan Forecast Methodology, Western Europe, 2016

- 3. Total Hospital HCIT Market: Revenue Snapshot, France, 2016 and 2021

- 4. Total Healthcare IT Market: Leading Vendors, France, 2016

- 5. Total Hospital HCIT Market: Respondent’s Distribution by Region, Europe, 2017

- 6. Total Hospital HCIT Market: Respondent’s Distribution by Ownership, France, 2017

- 7. Total Hospital HCIT Market: Respondent’s Distribution by Specialization, France, 2017

- 8. Total Healthcare IT Market: Market Segmentation, France, 2016

- 9. Hospital HCIT Market: Revenue Forecast, France, 2016–2021

- 10. Healthcare System, France, 2017

- 11. Healthcare IT Market: Key Vendors, France, 2017

- 12. Healthcare IT Market: Major Vendors by Tiers of Competition, France, 2017

- 13. Total Healthcare IT Market: EHR Major Vendors by Tiers of Competition, France, 2016

- 14. Total Healthcare IT Market: EHR Market Share by Top Vendor, France, 2016

- 15. Total Healthcare IT Market: ePrescribing/PhIS Major Vendors by Tiers of Competition, France, 2016

- 16. Total Healthcare IT Market: ePrescribing/PhIS Market Share by Top Vendors, France, 2016

- 17. Total Hospital HCIT Market: HCIT Solution Adoption by Hospitals, France, 2017

- 18. Total Hospital HCIT Market: Percentage of Budget Allocated to IT Solutions, France, 2017

- 19. Total Hospital HCIT Market: Expected Increase in Hospital HCIT Budget, France, 2017

- 20. Total Hospital HCIT Market: EMR Readiness Across Hospital, France, 2017

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | || Research Methodology~ || Forecast Methodology~ | Executive Summary~ || Market Snapshot~ || Scope and Segmentation~ || Frost & Sullivan Hospital HCIT Survey—Respondents’ Profile~ || Growth Opportunities in the French Healthcare IT Market~ || CEO’s Perspective~ | Market Analysis of Healthcare IT in France~ || Market Background~ || Market Definition and Segmentation~ || Healthcare IT Market Analysis—Top 4 Markets in Europe~ || Macro-Level Trends Driving Care Delivery Transformation~ || Drivers for Healthcare IT Adoption in France~ || Healthcare IT Market Analysis––Adoption~ || Hospital Healthcare IT Market in France—Revenue Forecast~ || Primary Care HCIT Market in France —Major Trends~ | Government Initiatives Driving Healthcare IT Adoption in France~ || Overview of the Healthcare Landscape in France~ || Healthcare IT Landscape—Government Initiatives~ || Healthcare IT Landscape—Future Plans & Initiatives~ | Competitive Landscape~ || Key Findings—Notable Vendor Activities~ || Key Vendors Overview—Tiers of Competition~ || Electronic Health Records—Market Share and Position~ || Primary Care Information System—Market Share and Position~ || ePrescribing/Pharmacy Information Systems (PhIS)—Market Share and Position~ || Strategic Imperatives for Healthcare IT Vendors in France~ | End-user Analysis—Hospital HCIT Usage and Adoption Trends~ || End-user Analysis—Adoption of Hospital HCIT Solutions~ || End-user Analysis—Hospital HCIT Budgeting Trends~ || End-user Analysis—Hospitals’ EMR Readiness~ || End-user Analysis—Future Trends on Replacement and Upgrades of IT Systems~ || End-user Analysis—Analyst Insight on the French Hospital HCIT Market~ | The Last Word~ || Factors Influencing the Future of Healthcare IT in France~ || Key Conclusions and Recommendations~ || Legal Disclaimer~ | Appendix~ || Relevant Frost & Sullivan Studies~ || Abbreviations and Acronyms Used~ | The Frost & Sullivan Story~ |

| List of Charts and Figures | 1. Healthcare IT Market: Top 4 Markets, Western Europe, 2016–2021~ 2. Percentage Adoption of Healthcare IT Systems, France, 2017~ 3. Total HCIT Market: Progression of HCIT, France, 2017–2020~| 1. Total Healthcare IT Market: Frost & Sullivan Research Methodology, France, 2017~ 2. Total Hospital HCIT Market: Frost & Sullivan Forecast Methodology, Western Europe, 2016~ 3. Total Hospital HCIT Market: Revenue Snapshot, France, 2016 and 2021~ 4. Total Healthcare IT Market: Leading Vendors, France, 2016~ 5. Total Hospital HCIT Market: Respondent’s Distribution by Region, Europe, 2017~ 6. Total Hospital HCIT Market: Respondent’s Distribution by Ownership, France, 2017~ 7. Total Hospital HCIT Market: Respondent’s Distribution by Specialization, France, 2017~ 8. Total Healthcare IT Market: Market Segmentation, France, 2016~ 9. Hospital HCIT Market: Revenue Forecast, France, 2016–2021~ 10. Healthcare System, France, 2017~ 11. Healthcare IT Market: Key Vendors, France, 2017~ 12. Healthcare IT Market: Major Vendors by Tiers of Competition, France, 2017~ 13. Total Healthcare IT Market: EHR Major Vendors by Tiers of Competition, France, 2016~ 14. Total Healthcare IT Market: EHR Market Share by Top Vendor, France, 2016~ 15. Total Healthcare IT Market: ePrescribing/PhIS Major Vendors by Tiers of Competition, France, 2016~ 16. Total Healthcare IT Market: ePrescribing/PhIS Market Share by Top Vendors, France, 2016~ 17. Total Hospital HCIT Market: HCIT Solution Adoption by Hospitals, France, 2017~ 18. Total Hospital HCIT Market: Percentage of Budget Allocated to IT Solutions, France, 2017~ 19. Total Hospital HCIT Market: Expected Increase in Hospital HCIT Budget, France, 2017~ 20. Total Hospital HCIT Market: EMR Readiness Across Hospital, France, 2017~ |

| Author | Shruthi Parakkal |

| Industries | Healthcare |

| WIP Number | MD75-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB