East African Knee and Hip Replacement Products Markets, Forecast to 2020

East African Knee and Hip Replacement Products Markets, Forecast to 2020

Demographic and Economic Changes Spark New, High-Growth Investment Opportunities

17-May-2016

Africa

Description

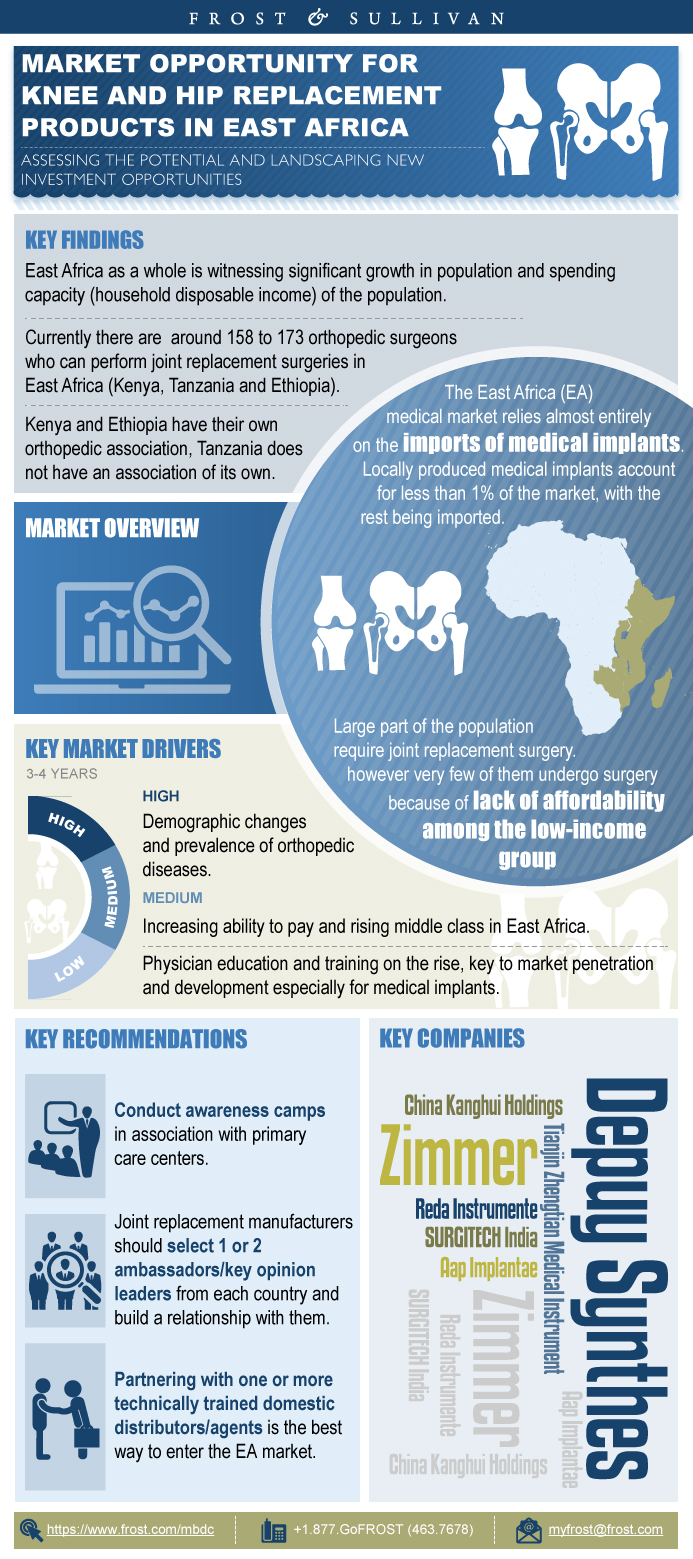

The study analyses the East African joint replacement market to establish the current operating environment and market dynamics. Furthermore, this research service analyses the drivers, restraints, and reimbursement scenario, and scrutinizes relevant upcoming projects. The research methodology of this study is based on primary interviews and secondary sources. The study will provide insights to investors that plan to enter the East African joint replacement market, as well as help existing participants understand the competition and opportunities in the market. The study delivers a list of three, high-potential countries, together with supporting data for market entry consideration.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Scope

- Geographic Scope

- Target Respondents

- Product

Aim and Objectives

Market Overview

Key Drivers, East Africa, 2016–2020

Key Restraints, East Africa, 2016–2020

Methodology of Selection

Top 3 countries

Macroeconomic Indicators

Country Demographics Analysis

Supply Side Analysis

Market Size Analysis

Reimbursement and Funding Scenario

Regulatory Scenario

Strategic Plan for Medical Tourism

- Key Healthcare Facilities, Joint Replacement Surgeries, Kenya, 2015

- Human Resources

- Organisations and Committees

- The Managed Medical Equipment Services (MES) project

- Training Facilities

- Current Scenario

Upcoming Projects

Macroeconomic Indicators

Country Demographics Analysis

Age-Sex Structure

Supply Side Analysis

Reimbursement and Funding Scenario

Regulatory Scenario

Upcoming Projects

Macroeconomic Indicators

Country Demographics Analysis

Age-Sex Structure

Supply-side Analysis

Reimbursement and Funding Scenario

Regulatory Scenario

Upcoming Projects

Macroeconomic Indicators

Demographic Indicators

Procurement and Distribution Process

Competitive Landscape—East Africa

Regulatory and Licensing Structure Comparison

Tax Structure Comparison

Regional Hotspots—Kenya

Regional Hotspots—Tanzania

Regional Hotspots—Ethiopia

City-wise Population Growth in East Africa

How Joint Replacement Manufacturers Penetrate East Africa?

Potential Ambassadors or Key Opinion Leaders

Strategic Recommendations

Market Engineering Methodology

- 1. Research And Consulting Team

- 2. Project Aim and Objectives

- 3. Total Knee and Hip Replacement Market: Key Drivers, East Africa, 2016–2020

- 4. Total Knee and Hip Replacement Market: Key Restraints, East Africa, 2016–2020

- 5. Top 5 Ranking of Countries Based on Total Weighted Score, East Africa, 2015

- 6. Demographic and Economic Indicators, Kenya, 2010–2014

- 7. Total Population by Province, Kenya, 2015

- 8. Key Healthcare Facilities, Joint Replacement Surgeries, Kenya, 2015

- 9. Leasing deal, MES, Kenya, 2015

- 10. Total number of joint replacements per year

- 11. Cost of a Knee Replacement Surgery in Kenya

- 12. Cost of a Hip Replacement Surgery in Kenya

- 13. Total Population by Region, Tanzania, 2014

- 14. Key Healthcare Facilities, Joint Replacement Surgeries, Tanzania, 2014

- 15. Cost of a Knee/Hip Replacement Surgery in Tanzania

- 16. STEMM in Tanzania, 2010

- 17. Insurance Scheme, Eligibility and Contribution rate

- 18. Type of tax/duty/profit margin and Tax value (%)

- 19. Total Population by Province, Ethiopia, 2014

- 20. Key Healthcare Facilities, Joint Replacement Surgeries, Ethiopia, 2014

- 21. Cost of a Knee/Hip Replacement Surgery Ethiopia

- 22. Type of Tax/Duty/Profit Margin and Tax (%)

- 23. Country and CAGR of GDP, 2013 to 2020 (Expected)

- 24. Population CAGR by Country, East Africa, 2013–2020

- 25. Procurement and Distribution Process

- 26. Hip and Knee Replacement Market: Competitive Landscape, East Africa, 2015

- 27. Hip and Knee Replacement Market: Regulatory and Licensing Structure Comparison, East Africa, 2015

- 28. Hip and Knee Replacement Market: Tax Structure Comparison, East Africa, 2015

- 29. How Joint Replacement Manufacturers Penetrate East Africa?

- 30. Potential Ambassadors or Key Opinion Leaders

- 31. Market Challenges and Strategic Recommendations

- 1. Population Structure, Kenya, 2014

- 2. Population, Kenya, 2009–2016

- 3. Youth Population, Kenya, 2014

- 4. Distribution of Population, Kenya, 2014

- 5. Population Pyramid

- 6. The Kenyan Population Pyramid by Healthcare Businesses, Percentage, 2015

- 7. Orthopaedic Surgeons by Region, Percentage, Kenya, 2014

- 8. Type of Surgery by requirement, Joint Replacement, Kenya, 2015

- 9. Type of Surgery by body site, Joint Replacement, Kenya, 2015

- 10. Type of Surgery by Requirement, Joint Replacement, Tanzania, 2014

- 11. Structure of the Total Urban and Rural Population by Age and Sex, Tanzania, 2014

- 12. Structure of the Total Urban and Rural Population by Age and Sex, Ethiopia, 2014

- 13. Type of Surgery by Requirement, Joint Replacement, Ethiopia, 2014

- 14. Gross Domestic Product, Current Prices, East Africa, 2013–2020E

- 15. Inflation of Average Consumer Prices, East Africa, 2013–2020

- 16. Population, East Africa, 2013–2020

- 17. Population in Fastest Growing Cities, East Africa, 2010-2025

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Methodology~ | List of Abbreviations~ | Executive Summary~ || Key Findings~ || Scope~ ||| Geographic Scope~ ||| Target Respondents~ ||| Product~ || Aim and Objectives~ | Market Analysis—Knee and Hip Replacement Market~ || Market Overview~ | Drivers and Restraints—Total Knee and Hip Replacement Market~ || Key Drivers, East Africa, 2016–2020~ ||| Demographic changes and prevalence of orthopedic diseases~ ||| Increasing ability to pay and rising middle class in East Africa~ ||| Rising physician education and training which is the key to market penetration and development especially for medical implants~ || Key Restraints, East Africa, 2016–2020~ ||| Limited Infrastructure and low number of orthopaedic surgeons~ ||| Ability to pay and restricted funding and reimbursement for specialised surgical procedures limits the number of procedures~ | Country Selection~ || Methodology of Selection~ || Top 3 countries~ | Kenya—Knee and Hip Replacement Market~ || Macroeconomic Indicators~ || Country Demographics Analysis~ || Supply Side Analysis~ ||| Key Healthcare Facilities, Joint Replacement Surgeries, Kenya, 2015~ ||| Human Resources~ ||| Organisations and Committees~ ||| The Managed Medical Equipment Services (MES) project~ ||| Training Facilities~ ||| Current Scenario~ || Market Size Analysis~ || Reimbursement and Funding Scenario~ ||| Reimbursement~ ||| Public Insurance~ ||| Private Insurance~ ||| Funding~ || Regulatory Scenario~ ||| Local Authorised Representative~ ||| Tax and Duty~ || Strategic Plan for Medical Tourism~ || Upcoming Projects~ ||| Mathari Hospital Renovation Project~ ||| Kakamega Hospital Renovation Project~ | Tanzania—Knee and Hip Replacement Market~ || Macroeconomic Indicators~ || Country Demographics Analysis~ || Age-Sex Structure~ || Supply Side Analysis~ ||| Key Healthcare Facilities, Joint Replacement Surgeries, Tanzania, 2014~ ||| Human Resources~ ||| Organisations and Committees~ ||| Training Facilities~ ||| Current Scenario~ ||| Camps by Foreign Orthopaedic Surgeons~ ||| Women Orthopaedist Global Outreach, USA (WOGO)~ ||| Surgical Implant Generation Network (SIGN)~ ||| SIGN program at the Muhimbili Orthopedic Institute (MOI) in Dar es Salaam, Tanzania~ ||| Children Orthopaedics Education for Developing Nations (COEDN)—September 2015~ ||| Penn in Tanzania~ ||| Siouxland Tanzania Educational Medical Ministries (STEMM)~ || Reimbursement and Funding Scenario~ ||| Reimbursement~ ||| Public Insurance~ ||| Private Insurance~ || Regulatory Scenario~ ||| Local Responsible Person~ || Upcoming Projects~ ||| Aga Khan Hospital Renovation Project~ ||| Knight Support Services to partner with Aga Khan Hospital~ ||| Ilemela District Hospital (IDH)~ | Ethiopia—Knee and Hip Replacement Market~ || Macroeconomic Indicators~ || Country Demographics Analysis~ || Age-Sex Structure~ || Supply-side Analysis~ ||| Key Healthcare Facilities, Joint Replacement Surgeries, Ethiopia, 2014~ ||| Human Resources~ ||| Organisations and Committees~ ||| Market Size Analysis~ ||| Training Facilities~ ||| COSECSA Oxford Orthopaedic Link (COOL) Hip and Knee Arthroplasty Course~ ||| COSECSA Oxford Orthopaedic Link (COOL) Paediatrics Course~ || Reimbursement and Funding Scenario~ ||| Social Health Insurance Agency (FSHIA)~ ||| Community-based Health Insurance (CBHI)~ || Regulatory Scenario~ ||| Authorised Local Agent~ || Upcoming Projects~ ||| Ethio-American Doctors Group (EADG) Hospital~ ||| Wollo Tertiary Health Care and Teaching Hospital~ ||| Vision Maternity Care Renovation Project~ | Common Indicators—Kenya, Tanzania, and Ethiopia~ || Macroeconomic Indicators~ || Demographic Indicators ~ || Procurement and Distribution Process~ || Competitive Landscape—East Africa~ | Conclusions and Recommendations~ || Regulatory and Licensing Structure Comparison~ || Tax Structure Comparison~ || Regional Hotspots—Kenya~ ||| Nakuru, Kismu, and Eldoret~ ||| Nairobi and Kijabe~ ||| Mombasa~ || Regional Hotspots—Tanzania~ ||| Arusha and Mwanza~ ||| Dar es Salaam~ || Regional Hotspots—Ethiopia~ ||| Gondar and Mekelle~ ||| Dar es Salaam, Harari, and Dire Dawa~ || City-wise Population Growth in East Africa~ || How Joint Replacement Manufacturers Penetrate East Africa?~ || Potential Ambassadors or Key Opinion Leaders~ || Strategic Recommendations~ | Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ |

| List of Charts and Figures | 1. Research And Consulting Team~ 2. Project Aim and Objectives~ 3. Total Knee and Hip Replacement Market: Key Drivers, East Africa, 2016–2020~ 4. Total Knee and Hip Replacement Market: Key Restraints, East Africa, 2016–2020~ 5. Top 5 Ranking of Countries Based on Total Weighted Score, East Africa, 2015~ 6. Demographic and Economic Indicators, Kenya, 2010–2014~ 7. Total Population by Province, Kenya, 2015~ 8. Key Healthcare Facilities, Joint Replacement Surgeries, Kenya, 2015~ 9. Leasing deal, MES, Kenya, 2015~ 10. Total number of joint replacements per year~ 11. Cost of a Knee Replacement Surgery in Kenya~ 12. Cost of a Hip Replacement Surgery in Kenya~ 13. Total Population by Region, Tanzania, 2014~ 14. Key Healthcare Facilities, Joint Replacement Surgeries, Tanzania, 2014~ 15. Cost of a Knee/Hip Replacement Surgery in Tanzania~ 16. STEMM in Tanzania, 2010~ 17. Insurance Scheme, Eligibility and Contribution rate~ 18. Type of tax/duty/profit margin and Tax value (%)~ 19. Total Population by Province, Ethiopia, 2014~ 20. Key Healthcare Facilities, Joint Replacement Surgeries, Ethiopia, 2014~ 21. Cost of a Knee/Hip Replacement Surgery Ethiopia~ 22. Type of Tax/Duty/Profit Margin and Tax (%)~ 23. Country and CAGR of GDP, 2013 to 2020 (Expected)~ 24. Population CAGR by Country, East Africa, 2013–2020~ 25. Procurement and Distribution Process~ 26. Hip and Knee Replacement Market: Competitive Landscape, East Africa, 2015~ 27. Hip and Knee Replacement Market: Regulatory and Licensing Structure Comparison, East Africa, 2015~ 28. Hip and Knee Replacement Market: Tax Structure Comparison, East Africa, 2015~ 29. How Joint Replacement Manufacturers Penetrate East Africa?~ 30. Potential Ambassadors or Key Opinion Leaders~ 31. Market Challenges and Strategic Recommendations~| 1. Population Structure, Kenya, 2014~ 2. Population, Kenya, 2009–2016~ 3. Youth Population, Kenya, 2014~ 4. Distribution of Population, Kenya, 2014~ 5. Population Pyramid~ 6. The Kenyan Population Pyramid by Healthcare Businesses, Percentage, 2015~ 7. Orthopaedic Surgeons by Region, Percentage, Kenya, 2014~ 8. Type of Surgery by requirement, Joint Replacement, Kenya, 2015~ 9. Type of Surgery by body site, Joint Replacement, Kenya, 2015~ 10. Type of Surgery by Requirement, Joint Replacement, Tanzania, 2014~ 11. Structure of the Total Urban and Rural Population by Age and Sex, Tanzania, 2014~ 12. Structure of the Total Urban and Rural Population by Age and Sex, Ethiopia, 2014~ 13. Type of Surgery by Requirement, Joint Replacement, Ethiopia, 2014~ 14. Gross Domestic Product, Current Prices, East Africa, 2013–2020E~ 15. Inflation of Average Consumer Prices, East Africa, 2013–2020~ 16. Population, East Africa, 2013–2020~ 17. Population in Fastest Growing Cities, East Africa, 2010-2025~ |

| Lightbox Content | World Cancer Day 2019|Get 15% discount for all Healthcare studies |https://store.frost.com/contacts/?utm_source=PD&utm_medium=lightbox&utm_campaign=HEALTHCARE_CANCER2019 |

| Author | Saravanan Thangaraj |

| WIP Number | MBDC-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB