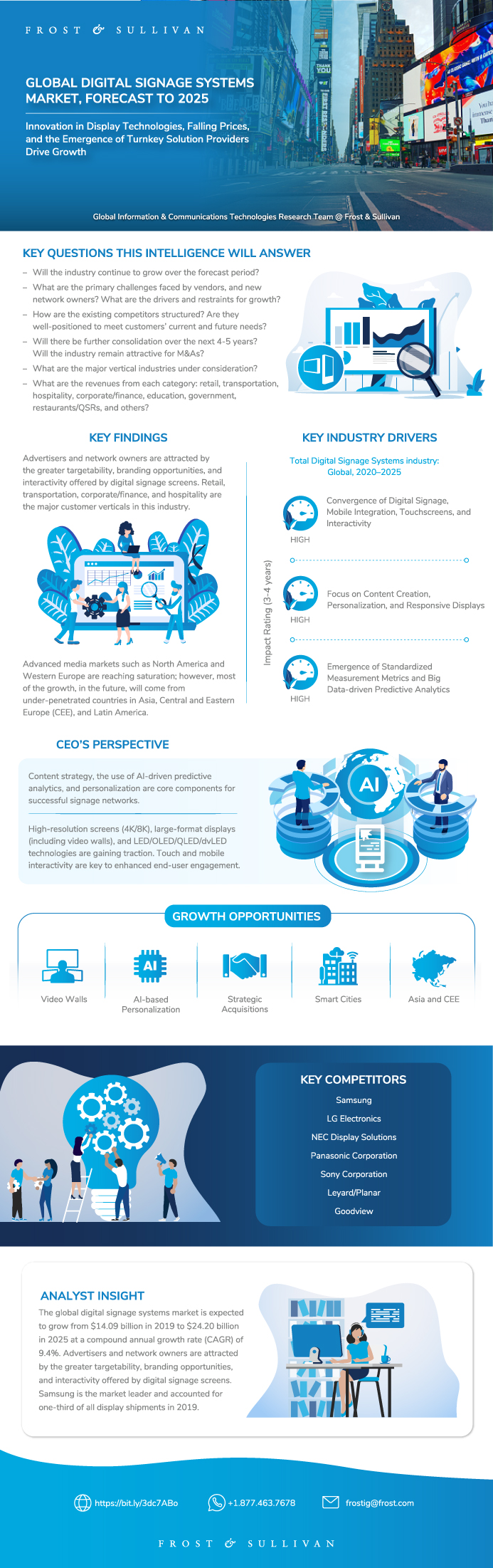

Global Digital Signage Systems Market, Forecast to 2025

Global Digital Signage Systems Market, Forecast to 2025

Innovation in Display Technologies, Falling Prices, and the Emergence of Turnkey Solution Providers Drive Growth

03-Jun-2020

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

Ad spending has been rapidly shifting away from traditional TV, radio, and newspapers to digital media platforms and solutions. Emerging branding/marketing vehicles, including digital signage and interactive kiosks, are gaining traction and hold immense potential for future growth. A key value proposition of signage networks is that they can be deployed by owners to serve multiple business models, such as pure-play advertising, merchandising and branding, entertainment, and/or information dissemination. ROI is measured in terms of both ad revenue and the impact on the customer experience.

The global digital signage systems market is expected to grow from $14.09 billion in 2019 to $24.20 billion in 2025 at a compound annual growth rate (CAGR) of 9.4%. Advertisers and network owners are attracted by the greater targetability, branding opportunities, and interactivity offered by digital signage screens. Samsung is the market leader and accounted for one-third of all display shipments in 2019.

This research service follows 2019 as the base year, and forecasts run up to 2025.

Geographic scope:

North America and Latin America (NALA)

Europe, the Middle East, and Africa (EMEA)

Asia-Pacific (APAC)

Research Scope

- Analysis of market trends, including drivers and restraints

- Examination of revenue forecasts by total market, by project component type (software, displays, media players, services), and by vertical market (includes retail, transportation, corporate/finance, and hospitality)

- Analysis of competitive landscape, including major participants and market share

Key Issues Addressed

- Will the market continue to grow over the forecast period?

- What are the primary challenges faced by vendors and new network owners? What are the drivers and restraints for growth?

- How are the existing competitors structured? Are they well-positioned to meet customers' current and future needs?

- Will there be further consolidation over the next 4-5 years? Will the market remain attractive for M&As?

- What are the major vertical markets under consideration? What does the revenue forecast look like?

- What is the revenue breakup by geography?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Market Engineering Measurements

Market Engineering Measurements (continued)

CEO’s Perspective

Frost & Sullivan Digital Media Value Chain Coverage

Market Overview

Research Scope

Geographic Scope

Market Definitions

Market Definitions (continued)

Vertical Market Definitions

Vertical Market Definitions (continued)

Business Models

Business Models (continued)

Usage Segmentation by Communication Context

User Segmentation by Communication Context

Digital Signage Evolution Trajectory

Digital Signage and Video Walls—Market Structure

Value Chain and Structure

Value Chain and Structure (continued)

TCO—An Overview

Regional Market Life Cycle Analysis

Regional Market Life Cycle Analysis Discussion

Key Market and Technology Trends

Key Market and Technology Trends (continued)

Key Market and Technology Trends (continued)

Key Questions This Study Will Answer

Market Drivers

Drivers Explained

Drivers Explained (continued)

Drivers Explained (continued)

Drivers Explained (continued)

Drivers Explained (continued)

Market Restraints

Restraints Explained

Restraints Explained (continued)

Restraints Explained (continued)

Restraints Explained (continued)

Restraints Explained (continued)

Forecast Assumptions

Forecast Assumptions (continued)

Revenue Forecast

Revenue Forecast Discussion

Revenue Forecast Discussion (continued)

Percent Revenue Forecast by Project Component

Revenue Forecast—Displays

Revenue Forecast—Media Players

Revenue Forecast—Software

Revenue Forecast—Services

Percent Revenue by Vertical Market

Percent Revenue Forecast by Vertical Market Discussion

Percent Revenue Forecast by Vertical Market Discussion (continued)

Percent Revenue Forecast by Vertical Market Discussion (continued)

Competitive Analysis—An Overview

Market Share

Market Share Analysis

Competitive Structure and Tiers of Competition

Competitive Environment

Competitive Landscape Analysis

Competitive Factors and Assessment

NALA Breakdown

Market Engineering Measurements

Revenue Forecast

Revenue Forecast Discussion

Percent Revenue Forecast by Project Component

Revenue Forecast—Displays

Revenue Forecast—Media Players

Revenue Forecast—Software

Revenue Forecast—Services

Revenue Forecast Discussion by Project Component

EMEA Breakdown

Market Engineering Measurements

Revenue Forecast

Revenue Forecast Discussion

Percent Revenue Forecast by Project Component

Revenue Forecast—Displays

Revenue Forecast—Media Players

Revenue Forecast—Software

Revenue Forecast—Services

Revenue Forecast Discussion by Project Component

APAC Breakdown

Market Engineering Measurements

Revenue Forecast

Revenue Forecast Discussion

Percent Revenue Forecast by Project Component

Revenue Forecast—Displays

Revenue Forecast—Media Players

Revenue Forecast—Software

Revenue Forecast—Services

Revenue Forecast Discussion by Project Component

Growth Opportunity 1—Video Walls

Growth Opportunity 2—AI-based Personalization

Growth Opportunity 3—Strategic Acquisitions

Growth Opportunity 4—Smart Cities

Growth Opportunity 5—Asia and CEE

Strategic Imperatives for Success and Growth

The Last Word—Predictions

Legal Disclaimer

Market Engineering Measurements

Market Engineering Measurements (continued)

Partial List of Other Companies

Partial List of Others (continued)

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

Popular Topics

Research Scope

- Analysis of market trends, including drivers and restraints

- Examination of revenue forecasts by total market, by project component type (software, displays, media players, services), and by vertical market (includes retail, transportation, corporate/finance, and hospitality)

- Analysis of competitive landscape, including major participants and market share

Key Issues Addressed

- Will the market continue to grow over the forecast period?

- What are the primary challenges faced by vendors and new network owners? What are the drivers and restraints for growth?

- How are the existing competitors structured? Are they well-positioned to meet customers' current and future needs?

- Will there be further consolidation over the next 4-5 years? Will the market remain attractive for M&As?

- What are the major vertical markets under consideration? What does the revenue forecast look like?

- What is the revenue breakup by geography?

| No Index | No |

|---|---|

| Podcast | No |

| Author | Melody Siefken |

| Industries | Entertainment and Media |

| WIP Number | K459-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9523-D1,9705-C1,9A3D-D1 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB