Global Market for Smart Handheld Metrology Devices, Forecast to 2023

Global Market for Smart Handheld Metrology Devices, Forecast to 2023

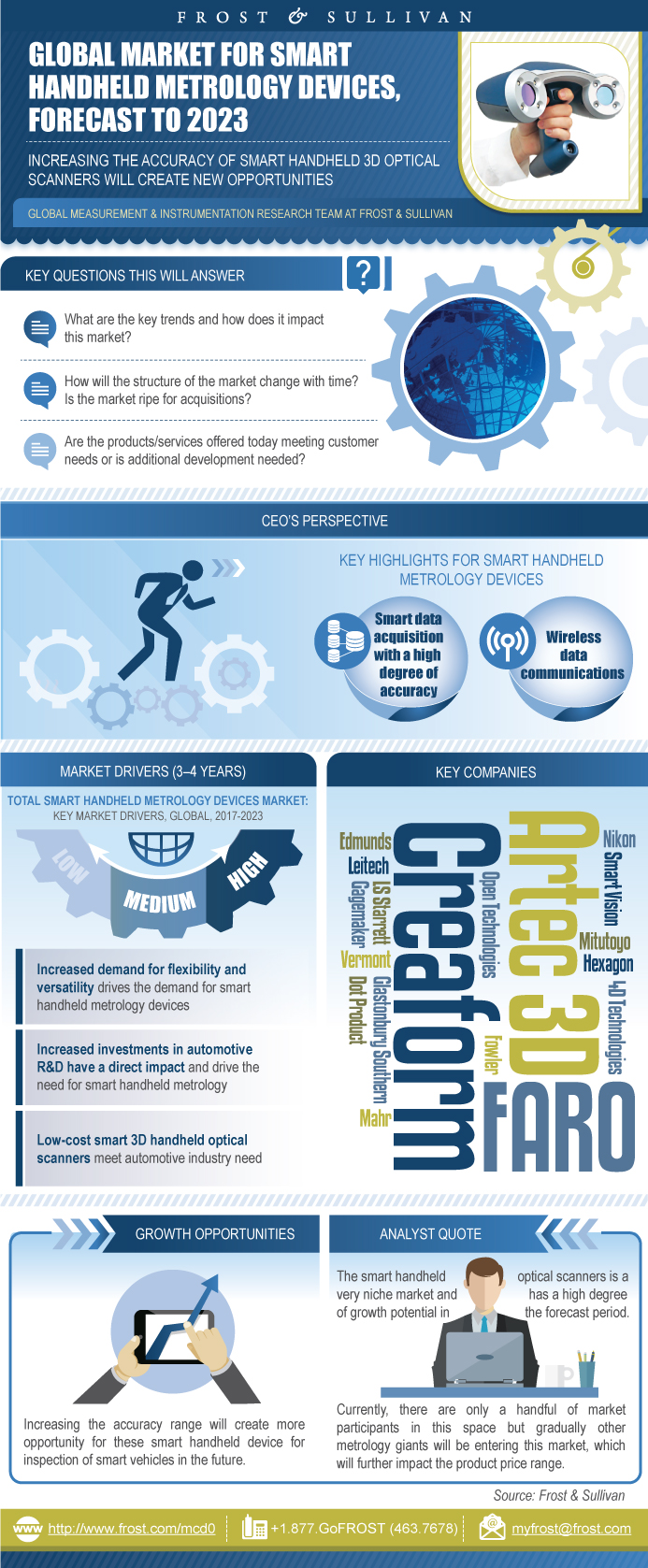

Increasing the Accuracy of Smart Handheld 3D Optical Scanners will Create New Opportunities

25-Apr-2017

Global

$4,950.00

Special Price $3,712.50 save 25 %

Description

This study discusses the opportunities and the evolution of smart metrology devices and their impact across various industry verticals till 2022. It analyzes recent market and technology trends, the significant proliferation of smart handheld metrology devices, and their future. Growing interest in industrial automation and enhanced quality inspection are driving the adoption of smart handheld metrology devices. The study also provides a regional and competitive analysis of the global metrology software market. In addition, key macroeconomic trends and their likely impact on the market are highlighted. These devices are likely to see increased uptake in future as a result of enhanced device functionalities and advancements in technology. This deliverable will provide key market participants with the necessary business intelligence to help them understand the future of the smart handheld metrology device market across applications.

Key questions this study will answer:

• Is the market growing, how long will it continue to grow, and at what rate?

• Are the existing competitors structured correctly to meet customer needs?

• What are the key trends and how does it impact this market?

• How will the structure of the market change with time? Is the market ripe for acquisitions?

• Are the products/services offered today meeting customer needs or is additional development needed?

• Are the vendors in the space ready to go it alone, or do they need partnerships to take their businesses to the next level?

Smart handheld metrology systems are in demand in North America and Europe as these regions invest highly in automotive and aerospace R&D inspection. Leading dimensional metrology vendors are likely to focus on selling high-precision smart handheld metrology devices for R&D inspection purposes. The main disadvantage of these devices is the limited awareness among end users. To overcome this challenge, manufacturers are actively trying to sell more products by educating end users. They are focusing their R&D to boost their handheld product accuracy to that of a fixed system. The devices will be disruptive for certain application areas when they achieve a high degree of accuracy.

Wireless data transfer capability for measurement gauges has increased the need. The rise in demand is mainly due to the replacement of traditional measurement gauges. This wireless data transfer capability will improve inspection capability (minimum error). The market will mature once traditional gauges are replaced by wireless measurement gauges.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Market Engineering Measurements

CEO’s Perspective

Market Definitions

Market Segmentation

Market Distribution Channels

Dimensional Metrology Technologies—Product Lifecycle

Emerging Application Areas for Optical Scanners—Beyond Traditional Boundaries

Key Market Trends

Handheld 3D Optical Scanners versus Fixed and Portable 3D Optical Scanners

Market Drivers

Market Restraints

Market Engineering Measurements

Forecast Assumptions

Revenue Forecast

Pricing Trends

Technology Adoption

Percent Revenue Forecast by Region

Revenue Forecast by Region

Global Hot Spots

Revenue Forecast by Vertical Market

Market Share

Market Share Analysis

Competitive Environment

Top Competitors

Transformation in the Smart Handheld Metrology Device Ecosystem—2016

Growth Opportunity—Smart Handheld 3D Optical Scanners

5 Major Growth Opportunities

Strategic Imperatives for Success and Growth

Mega Trends and Industry Convergence Implications

Automotive Industry Demand for Smart Handheld Metrology Devices

Wireless Connectivity, Accuracy, and Portability in Demand

Software Boosts Product Value and Performance

Industry 4.0—The Vision and its Implications

Metrology Service 2.0

Technology Lifecycle Analysis

Key Findings

Market Engineering Measurements

Revenue Forecast

Key Findings

Market Engineering Measurements

Revenue Forecast

Key Findings

Market Engineering Measurements

Revenue Forecast

Key Findings

Market Engineering Measurements

Revenue Forecast

Key Findings

Market Engineering Measurements

Revenue Forecast

Key Findings

Market Engineering Measurements

Revenue Forecast

The Last Word—3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

List of Companies in Others

Partial List of Companies Interviewed

- 1. Total Smart Handheld Metrology Devices Market: Distribution Channel Analysis, Global, 2016

- 2. Total Smart Handheld Metrology Devices Market: Key Market Drivers, Global, 2017–2023

- 3. R&D Spending by Top 10 Automotive Manufacturers, Global, 2016

- 4. Total Smart Handheld Metrology Devices Market: Key Market Restraints, Global, 2017–2023

- 5. Total Smart Handheld Metrology Devices Market: Market Engineering Measurements, Global, 2016

- 6. Total Smart Handheld Metrology Devices Market: Revenue Forecast by Region, Global, 2013–2023

- 7. Total Smart Handheld Metrology Devices Market: Company Market Share Analysis of Top 3 Participants, Global, 2016

- 8. Total Smart Handheld Metrology Devices Market: Competitive Structure, Global, 2016

- 9. Total Smart Handheld Metrology Devices Market: SWOT Analysis, Global, 2016

- 10. Total Smart Handheld Metrology Devices Market: Mega Trend Impact, Global, 2016

- 11. Total Smart Handheld Metrology Devices Market: R&D Spending by Top 10 Automotive Manufacturers, Global, 2016

- 12. Smart Handheld Metrology Devices in the Automotive Segment: Market Engineering Measurements, Global, 2016

- 13. Smart Handheld Metrology Devices in the Industrial Design Segment: Market Engineering Measurements, Global, 2016

- 14. Smart Handheld Metrology Devices in the Architecture, Engineering, and Construction Segment: Market Engineering Measurements, Global, 2016

- 15. Smart Handheld Metrology Devices in the Aerospace and Defense Segment: Market Engineering Measurements, Global, 2016

- 16. Smart Handheld Metrology Devices in the Forensic/Research and Education Segment: Market Engineering Measurements, Global, 2016

- 17. Smart Handheld Metrology Devices in the Others Segment: Market Engineering Measurements, Global, 2016

- 1. Total Smart Handheld Metrology Devices Market: Market Engineering Measurements, Global, 2016

- 2. Total Smart Handheld Metrology Devices Market: Percent Revenue Breakdown by Vertical Market, Global, 2016

- 3. Total Smart Handheld Metrology Devices Market: Product Lifecycle, Global, 2016

- 4. Total Smart Handheld Metrology Devices Market: Emerging Application Areas for Optical Scanners, Global, 2013–2023

- 5. Total Smart Handheld Metrology Devices Market: Key Market Trends, Global, 2013–2023

- 6. Total Smart Handheld Metrology Devices Market: Revenue Forecast, Global, 2013–2023

- 7. Total Smart Handheld Metrology Devices Market: Revenue Forecast, Global, 2016 and 2023

- 8. Total Smart Handheld Metrology Devices Market: Percent Revenue Forecast by Region,

- 9. Global, 2013–2023

- 10. Total Smart Handheld Metrology Devices Market: Revenue Forecast by Vertical Market, Global, 2013–2023

- 11. Total Smart Handheld Metrology Devices Market: Percent Revenue Breakdown, Global, 2016

- 12. Total Smart Handheld Metrology Devices Market: Technology Lifecycle Analysis, Global, 2016

- 13. Smart Handheld Metrology Devices in the Automotive Segment: Percent Revenue Breakdown, Global, 2016

- 14. Smart Handheld Metrology Devices in the Automotive Segment: Revenue Forecast, Global, 2013–2023

- 15. Smart Handheld Metrology Devices in the Industrial Design Segment: Percent Revenue Breakdown, Global, 2016

- 16. Smart Handheld Metrology Devices in the Industrial Design Segment: Revenue Forecast, Global, 2013–2023

- 17. Smart Handheld Metrology Devices in the Architecture, Engineering, and Construction Segment: Percent Revenue Breakdown, Global, 2016

- 18. Smart Handheld Metrology Devices in the Architecture, Engineering, and Construction Segment: Revenue Forecast, Global, 2013–2023

- 19. Smart Handheld Metrology Devices in the Aerospace and Defense Segment: Percent Revenue Breakdown, Global, 2016

- 20. Smart Handheld Metrology Devices in the Aerospace and Defense Segment: Revenue Forecast, Global, 2013–2023

- 21. Smart Handheld Metrology Devices in the Forensic/Research and Education Segment: Percent Revenue Breakdown, Global, 2016

- 22. Smart Handheld Metrology Devices in the Forensic/Research and Education Segment: Revenue Forecast, Global, 2013–2023

- 23. Smart Handheld Metrology Devices in the Others Segment: Percent Revenue Breakdown, Global, 2016

- 24. Smart Handheld Metrology Devices in the Others Segment: Revenue Forecast, Global, 2013–2023

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Key Findings~ || Market Engineering Measurements~ || CEO’s Perspective~ | Market Overview~ || Market Definitions~ || Market Segmentation~ || Market Distribution Channels~ || Dimensional Metrology Technologies—Product Lifecycle~ || Emerging Application Areas for Optical Scanners—Beyond Traditional Boundaries~ || Key Market Trends~ || Handheld 3D Optical Scanners versus Fixed and Portable 3D Optical Scanners~ | Drivers and Restraints—Total Smart Handheld Metrology Devices Market~ || Market Drivers~ || Market Restraints~ | Forecasts and Trends—Total Smart Handheld Metrology Devices Market~ || Market Engineering Measurements~ || Forecast Assumptions~ || Revenue Forecast~ || Pricing Trends~ || Technology Adoption~ || Percent Revenue Forecast by Region~ || Revenue Forecast by Region~ || Global Hot Spots~ || Revenue Forecast by Vertical Market~ | Market Share and Competitive Analysis—Total Smart Handheld Metrology Devices Market~ || Market Share~ || Market Share Analysis~ || Competitive Environment~ || Top Competitors~ | Growth Opportunities and Companies to Action~ || Transformation in the Smart Handheld Metrology Device Ecosystem—2016~ || Growth Opportunity—Smart Handheld 3D Optical Scanners~ || 5 Major Growth Opportunities~ || Strategic Imperatives for Success and Growth~ || Mega Trends and Industry Convergence Implications~ | Mega Trend Impact on the Smart Handheld Metrology Device Market~ || Automotive Industry Demand for Smart Handheld Metrology Devices~ || Wireless Connectivity, Accuracy, and Portability in Demand~ || Software Boosts Product Value and Performance~ || Industry 4.0—The Vision and its Implications~ || Metrology Service 2.0~ || Technology Lifecycle Analysis~ | Automotive Segment Analysis~ || Key Findings~ || Market Engineering Measurements~ || Revenue Forecast~ | Industrial Design Segment Analysis~ || Key Findings~ || Market Engineering Measurements~ || Revenue Forecast~ | Architecture, Engineering, and Construction Segment Analysis~ || Key Findings~ || Market Engineering Measurements~ || Revenue Forecast~ | Aerospace and Defense Segment Analysis~ || Key Findings~ || Market Engineering Measurements~ || Revenue Forecast~ | Forensic/Research and Education Segment Analysis~ || Key Findings~ || Market Engineering Measurements~ || Revenue Forecast~ | Others Segment Analysis~ || Key Findings~ || Market Engineering Measurements~ || Revenue Forecast~ | The Last Word~ || The Last Word—3 Big Predictions~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ || List of Companies in Others~ || Partial List of Companies Interviewed~ |

| List of Charts and Figures | 1. Total Smart Handheld Metrology Devices Market: Distribution Channel Analysis, Global, 2016~ 2. Total Smart Handheld Metrology Devices Market: Key Market Drivers, Global, 2017–2023 ~ 3. R&D Spending by Top 10 Automotive Manufacturers, Global, 2016~ 4. Total Smart Handheld Metrology Devices Market: Key Market Restraints, Global, 2017–2023 ~ 5. Total Smart Handheld Metrology Devices Market: Market Engineering Measurements, Global, 2016~ 6. Total Smart Handheld Metrology Devices Market: Revenue Forecast by Region, Global, 2013–2023~ 7. Total Smart Handheld Metrology Devices Market: Company Market Share Analysis of Top 3 Participants, Global, 2016~ 8. Total Smart Handheld Metrology Devices Market: Competitive Structure, Global, 2016~ 9. Total Smart Handheld Metrology Devices Market: SWOT Analysis, Global, 2016~ 10. Total Smart Handheld Metrology Devices Market: Mega Trend Impact, Global, 2016~ 11. Total Smart Handheld Metrology Devices Market: R&D Spending by Top 10 Automotive Manufacturers, Global, 2016~ 12. Smart Handheld Metrology Devices in the Automotive Segment: Market Engineering Measurements, Global, 2016~ 13. Smart Handheld Metrology Devices in the Industrial Design Segment: Market Engineering Measurements, Global, 2016~ 14. Smart Handheld Metrology Devices in the Architecture, Engineering, and Construction Segment: Market Engineering Measurements, Global, 2016~ 15. Smart Handheld Metrology Devices in the Aerospace and Defense Segment: Market Engineering Measurements, Global, 2016~ 16. Smart Handheld Metrology Devices in the Forensic/Research and Education Segment: Market Engineering Measurements, Global, 2016~ 17. Smart Handheld Metrology Devices in the Others Segment: Market Engineering Measurements, Global, 2016~| 1. Total Smart Handheld Metrology Devices Market: Market Engineering Measurements, Global, 2016~ 2. Total Smart Handheld Metrology Devices Market: Percent Revenue Breakdown by Vertical Market, Global, 2016~ 3. Total Smart Handheld Metrology Devices Market: Product Lifecycle, Global, 2016~ 4. Total Smart Handheld Metrology Devices Market: Emerging Application Areas for Optical Scanners, Global, 2013–2023~ 5. Total Smart Handheld Metrology Devices Market: Key Market Trends, Global, 2013–2023~ 6. Total Smart Handheld Metrology Devices Market: Revenue Forecast, Global, 2013–2023~ 7. Total Smart Handheld Metrology Devices Market: Revenue Forecast, Global, 2016 and 2023~ 8. Total Smart Handheld Metrology Devices Market: Percent Revenue Forecast by Region, ~ 9. Global, 2013–2023~ 10. Total Smart Handheld Metrology Devices Market: Revenue Forecast by Vertical Market, Global, 2013–2023~ 11. Total Smart Handheld Metrology Devices Market: Percent Revenue Breakdown, Global, 2016~ 12. Total Smart Handheld Metrology Devices Market: Technology Lifecycle Analysis, Global, 2016~ 13. Smart Handheld Metrology Devices in the Automotive Segment: Percent Revenue Breakdown, Global, 2016 ~ 14. Smart Handheld Metrology Devices in the Automotive Segment: Revenue Forecast, Global, 2013–2023~ 15. Smart Handheld Metrology Devices in the Industrial Design Segment: Percent Revenue Breakdown, Global, 2016~ 16. Smart Handheld Metrology Devices in the Industrial Design Segment: Revenue Forecast, Global, 2013–2023~ 17. Smart Handheld Metrology Devices in the Architecture, Engineering, and Construction Segment: Percent Revenue Breakdown, Global, 2016~ 18. Smart Handheld Metrology Devices in the Architecture, Engineering, and Construction Segment: Revenue Forecast, Global, 2013–2023 ~ 19. Smart Handheld Metrology Devices in the Aerospace and Defense Segment: Percent Revenue Breakdown, Global, 2016~ 20. Smart Handheld Metrology Devices in the Aerospace and Defense Segment: Revenue Forecast, Global, 2013–2023~ 21. Smart Handheld Metrology Devices in the Forensic/Research and Education Segment: Percent Revenue Breakdown, Global, 2016~ 22. Smart Handheld Metrology Devices in the Forensic/Research and Education Segment: Revenue Forecast, Global, 2013–2023~ 23. Smart Handheld Metrology Devices in the Others Segment: Percent Revenue Breakdown, Global, 2016~ 24. Smart Handheld Metrology Devices in the Others Segment: Revenue Forecast, Global, 2013–2023~ |

| Author | Viswam Sathiyanarayanan |

| Industries | Test and Measurement Instrumentation |

| WIP Number | MCD0-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB