Global Mobility Industry Outlook, 2018

Global Mobility Industry Outlook, 2018

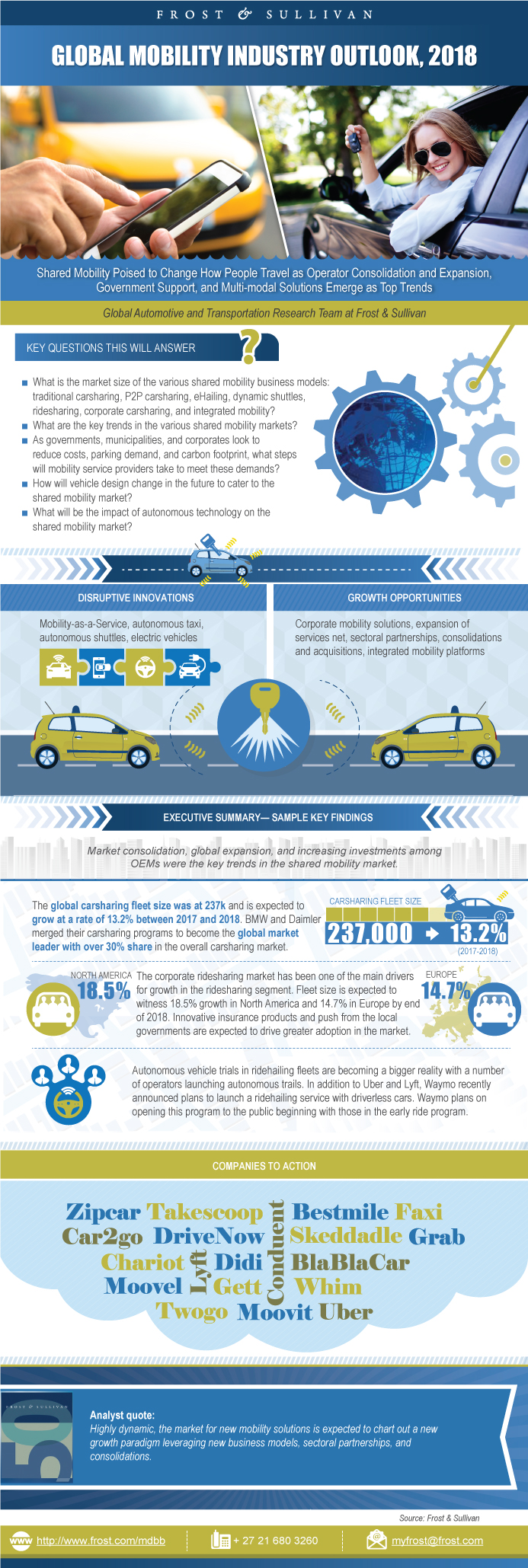

Shared Mobility Poised to Change How People Travel as Operator Consolidation and Expansion, Government Support, and Multi-modal Solutions Emerge as Top Trends

23-Apr-2018

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

This research service analyzes the global mobility market and offers a 2018 outlook. The study delves into the evolving business models in the shared mobility space, market consolidations and partnerships, regulatory reforms, and advanced technology trends. Readers who will benefit from this analysis include automotive value chain participants such as mobility service providers, OEMs, car rental and leasing companies, financial service providers, technology solution providers, and a host of other industry participants looking to understand current mobility market trends and their implications. Market analysis covers 2015 through 2018.

The study looks at 7 collaborative business models—carsharing, peer-to-peer (P2P) carsharing, corporate carsharing, eHailing, ridesharing, dynamic shuttle/demand responsive transit (DRT), and integrated mobility. One of the primary reasons for the growing popularity of these business models is that they help combat pressing issues such as congestion and pollution, which many cities across the globe are battling.

The key metrics discussed cover mobility participants and the vehicles involved with each applicable business model. The mobility market will see a lot of activity in terms of investments/mergers and acquisitions among the various stakeholders. Automakers will be among the most important stakeholders as they are exploring alternative streams of revenue from the mobility market. There is significant room for innovation in the shared mobility space, for both mobility operators and technology software providers who can keep updating their offerings to provide a more holistic customer experience.

Geographic Scope: For the carsharing, P2P carsharing, corporate carsharing, dynamic shuttle, integrated mobility, and eHailing market segments, the geographic scope covered is global while for ridesharing the scope is North America and Europe.

Key Issues Addressed

- What is the market size of the various shared mobility business models: traditional carsharing, P2P carsharing, eHailing, dynamic shuttles, ridesharing, corporate carsharing, and integrated mobility?

- What are the key trends in the various shared mobility markets?

- How will vehicle design change in the future to cater to the shared mobility market?

- As governments, municipalities, and corporates are looking to reduce costs, parking demand, and carbon footprint, what steps will mobility service providers take to meet these demands?

- What are the upcoming technology solutions influencing mobility market trends? How will existing service providers adapt to the shift in technology trends?

- What will be the impact of autonomous technology on the shared mobility market?

- Which OEMs are partnered with key global mobility service providers? Will the entry of more OEMs affect the growth of existing market participants?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings—Highlights 2017

Key Findings—2018 Outlook

Significant Growth Expected in the Mobility Market

Global Expansion to Drive Market Growth

Future Vehicle Concepts—Demand Responsive Transit (DRT) and Ridesharing

Future Vehicle Concepts—DRT and Ridesharing (continued)

Autonomous Vehicles in Mobility

Research Scope

Key Questions this Study will Answer

Research Background

Research Methodology

Traditional Carsharing

Traditional Carsharing—Global Membership and Fleet Size

Traditional Carsharing—Key 2017 Highlights and 2018 Outlook

P2P Carsharing

P2P Carsharing Market—Overview

P2P Carsharing—Key 2017 Highlights and 2018 Outlook

Corporate Carsharing

Corporate Carsharing (continued)

Definition of Ridesharing Types

Ridesharing Industry Overview—Europe and North America

Ridesharing—Key 2017 Highlights and 2018 Outlook

Definition of eHailing Business Models

eHailing—Connected Vehicles and Revenue

eHailing—Key 2017 Highlights and 2018 Outlook

The Concept of Demand Responsive Transit (DRT)

Demand Responsive Transit—Industry Overview

Demand Responsive Transit—Key 2017 Highlights and 2018 Outlook

Integrated Mobility Landscape

Mobility-as-a-Service—Key Partnerships and Investments

OEMs’ Shift towards CaaS—Futureproof Business

Growth Opportunity—Mobility Business Models

Strategic Imperatives for Success and Growth

Key Conclusions and Future Outlook

The Last Word—3 Big Predictions

Legal Disclaimer

Abbreviations and Acronyms Used

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

Popular Topics

Key Issues Addressed

- What is the market si

| No Index | No |

|---|---|

| Podcast | No |

| Author | Albert Geraldine Priya |

| Industries | Automotive |

| WIP Number | MDBB-01-00-00-00 |

| Keyword 1 | Mobility |

| Is Prebook | No |

| GPS Codes | 9673-A6,9800-A6,9807-A6,9813-A6,9965-A6,9A57-A6,9AF6-A6,9B07-C1,9B15-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB