Global Supplier Contribution to the Fastest Growing Automotive Technologies, 2012–2016

Global Supplier Contribution to the Fastest Growing Automotive Technologies, 2012–2016

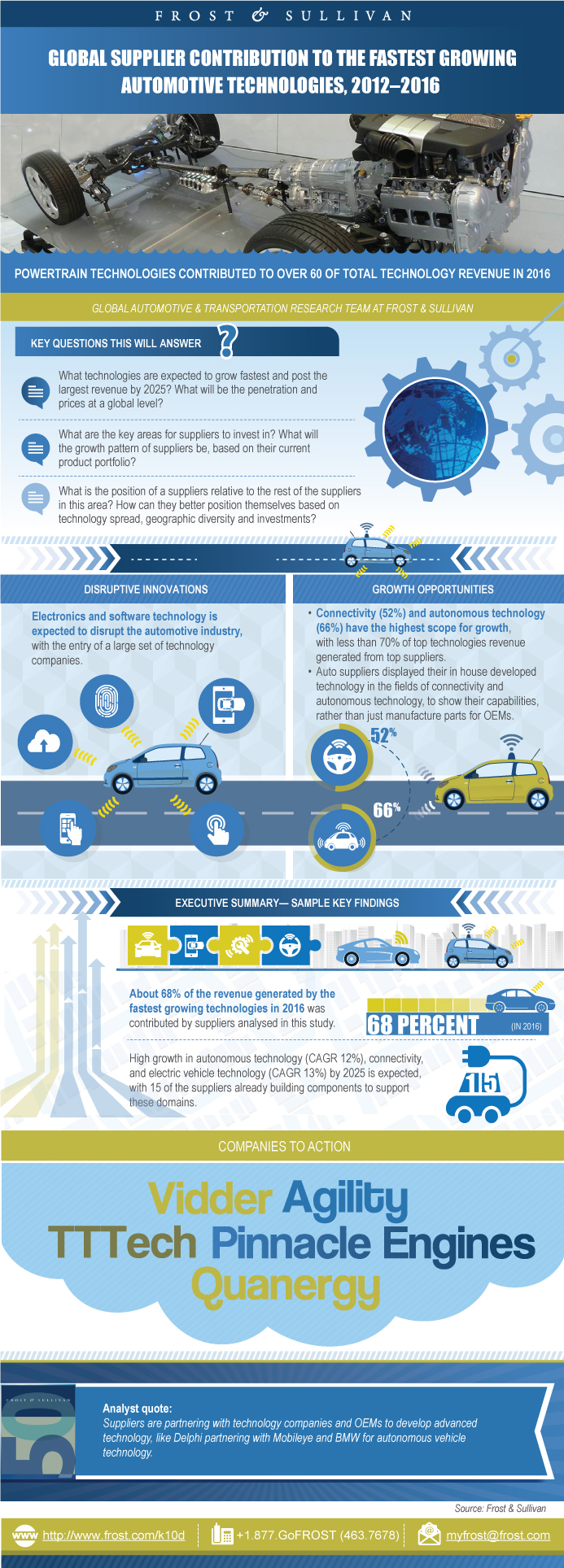

Powertrain Technologies Contributed to Over 60% of Total Technology Revenue in 2016

25-Sep-2017

Global

$3,000.00

Special Price $2,250.00 save 25 %

Description

This study identifies the contribution of selected list of 30 global automotive suppliers’ contribution in 2016, across financial parameters and technological portfolio. Among them, 10 are from the North America, 14 are from Europe, and 6 are from Asia. European suppliers have been the most successful among the suppliers with high involvement in top 25 fastest-growing technologies. North American suppliers have divested divisions and improved their financial performance through expansions and acquisitions. About 68% of the revenue generated by the fastest growing technologies in 2016 was contributed by suppliers analysed in this study. With the growing trends focused on electronics, the fastest growing technologies are segmented into four major groups – Autonomous, Connected, Powertrain, and Electric Vehicles. The study identifies the fastest growing technologies in 2025 and measures growth through suppliers' contributions in these technologies, financial performance, and geographical diversity.

Research Scope

The geographical scope of the study includes four major regions of the world (Europe, North America. Asia Pacific and Rest of the World).

Research Highlights

Suppliers involved in the study are from these domains :

- Comprehensive: Suppliers who have a presence in most major segments such as electronics and engine and chassis parts. These suppliers are generally in partnership with major automaker and supply a majority of components to all models across their product portfolio.

- Electronics: Suppliers who are predominantly focused on electronic systems and parts.

- Exterior & Interior: Suppliers involved in body panels, interior parts and seating.

- Tyres: Rubber parts suppliers who are the major suppliers of tyres to automakers.

- Chassis & Safety : Suppliers that manufacture all chassis components such as suspension, steering and other components.

Key Features

The suppliers are primarily from three major regions - North America (the United States and Canada) , Europe (France, Germany, Italy, Sweden, Spain, the United Kingdom) and Asia (Japan and South Korea). Technologies are broadly categorized into Powertrain, Electric Vehicle Technology, Autonomous technology and Connectivity. Powertrain : This category deals with engine systems that help improve vehicle fuel economy, with a focus on emission reduction. Electric Vehicle Technology : This category deals with the growing demand for electric vehicles worldwide and technology required to power an electric vehicle. Autonomous Technology : This category deals with safety systems, which can be used for autonomous driving. This category considers technologies as a whole rather than each individual component used for these systems. Connectivity: This category covers in-vehicle entertainment, convenience and safety features that are present in a vehicle.

Research Benefits

As these are the technologies that are expected to be present most vehicles of the future, the 20 fastest growing technologies are list in this study.

Key Issues Addressed

- What technologies are expected to grow fastest and post the largest revenue by 2025? What will be the penetration and prices at a global level?

- What are the key areas for suppliers to invest in? What will the growth pattern of suppliers be, based on their current product portfolio?

- How can suppliers better position themselves based on technology spread, geographic diversity and investments?

- How do different regions compare to others in terms of financial and technological investments?

Key Conclusion

Over 60% of total technology revenue was contributed by Powertrain technologies.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Executive Summary—Key Findings

Suppliers Performance in 2012 and 2016 with Future Outlook

Suppliers Compared in this Study

Fastest Growing Technologies—Segmentation

Financial Analysis—Key Takeaways

Snapshot of Supplier Financial Performance (2013–2016)

Analysis of Operating Margin by Region and Revenue Size (2013–2016)

Analysis of Research on Sales across Regions (2013–2016)

Analysis of Research on Sales across Company Size (2013–2016)

Analysis of CAPEX to Sales across Regions (2013–2016)

Analysis of CAPEX to Sales across Company Size (2013–2016)

Analysis of D/E Ratio across Regions (2013–2016)

Analysis of D/E Ratio across Company Size (2013–2016)

Technology Analysis—Key Takeaways

Fastest Growing Technologies Considered

Penetration Forecast of the Fastest Growing Technologies

Fastest Growing Technologies Market Revenue

Analysis of Market Revenue of Top 10 Fastest Growing Technologies

Technology Market Revenue from the Suppliers

Comparison of CAGR and Supplier Presence

Regional Segmentation of Fastest Growing Technologies

Forces Guiding Supplier Success in 2017–2025 Period Along Fastest Growing Technologies

Growth Opportunity for Suppliers

Strategic Imperatives for Success and Growth

Transformation in Automotive Supplier Ecosystem—2016

Automotive Supplier Performance—Key Conclusions

Automotive Supplier Performance—Future Outlook

Legal Disclaimer

- 1. Automotive Supplier Performance with Future Outlook, Global, 2012 and 2016

- 2. Financial Performance Snapshot, Global, 2013–2016

- 3. Fastest Growing Technologies, Global, 2016 and 2025

- 1. Key Takeaways, Global, 2016

- 2. Fastest Growing Technologies: Technology Segmentation, Global, 2016

- 3. Select Automotive Suppliers: Operating Margin of Automotive Suppliers by Region, Global, 2013–2016

- 4. Select Automotive Suppliers: Operating Margin of Automotive Suppliers by Revenue Size, Global, 2013–2016

- 5. Select Automotive Suppliers: Research on Sales of Automotive Suppliers by Region, Global, 2013–2016

- 6. Select Automotive Suppliers: Research on Sales of Automotive Suppliers by Company Size, Global, 2013–2016

- 7. Select Automotive Suppliers: CAPEX on Sales of Automotive Suppliers by Region, Global, 2013–2016

- 8. Select Automotive Suppliers: CAPEX on Sales of Automotive Suppliers by Company Size, Global, 2013–2016

- 9. Select Automotive Suppliers: D/E Ratio of Automotive Suppliers by Region, Global, 2013–2016

- 10. Select Automotive Suppliers: D/E Ratio of Automotive Suppliers by Company Size, Global, 2013–2016

- 11. Fastest Growing Technologies: Penetration of Fastest Growing Technologies, Global, 2025

- 12. Fastest Growing Technologies: Market Share of Fastest Growing Technologies, Global, 2016

- 13. Fastest Growing Technologies: Market Revenue of Top 10 Fastest Growing Technologies, Global, 2016 and 2025

- 14. Select Automotive Suppliers: Technology Market Revenue from Suppliers, Global, 2016

- 15. Technology Analysis, Global, 2016

- 16. Automotive Supplier Performance: Revenue from Fastest Growing Technologies, Global, 2016

- 17. Automotive OEM Strategic Imperatives for Success and Growth, Global, 2016

- 18. Automotive Supplier Performance—Key Conclusions, Global, 2016

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Executive Summary—Key Findings~ || Suppliers Performance in 2012 and 2016 with Future Outlook~ | Definition and Segmentation~ || Suppliers Compared in this Study~ || Fastest Growing Technologies—Segmentation~ | Analysis of Financial Data~ || Financial Analysis—Key Takeaways~ || Snapshot of Supplier Financial Performance (2013–2016)~ || Analysis of Operating Margin by Region and Revenue Size (2013–2016)~ || Analysis of Research on Sales across Regions (2013–2016)~ || Analysis of Research on Sales across Company Size (2013–2016)~ || Analysis of CAPEX to Sales across Regions (2013–2016)~ || Analysis of CAPEX to Sales across Company Size (2013–2016)~ || Analysis of D/E Ratio across Regions (2013–2016)~ || Analysis of D/E Ratio across Company Size (2013–2016)~ | Analysis of Technology Data~ || Technology Analysis—Key Takeaways~ || Fastest Growing Technologies Considered~ || Penetration Forecast of the Fastest Growing Technologies~ || Fastest Growing Technologies Market Revenue~ || Analysis of Market Revenue of Top 10 Fastest Growing Technologies~ || Technology Market Revenue from the Suppliers~ || Comparison of CAGR and Supplier Presence~ || Regional Segmentation of Fastest Growing Technologies~ || Forces Guiding Supplier Success in 2017–2025 Period Along Fastest Growing Technologies~ | Growth Opportunities and Companies to Action~ || Growth Opportunity for Suppliers~ || Strategic Imperatives for Success and Growth~ || Transformation in Automotive Supplier Ecosystem—2016~ | Conclusions and Future Outlook~ || Automotive Supplier Performance—Key Conclusions~ || Automotive Supplier Performance—Future Outlook~ || Legal Disclaimer~ | The Frost & Sullivan Story~ |

| List of Charts and Figures | 1. Automotive Supplier Performance with Future Outlook, Global, 2012 and 2016~ 2. Financial Performance Snapshot, Global, 2013–2016~ 3. Fastest Growing Technologies, Global, 2016 and 2025~| 1. Key Takeaways, Global, 2016~ 2. Fastest Growing Technologies: Technology Segmentation, Global, 2016~ 3. Select Automotive Suppliers: Operating Margin of Automotive Suppliers by Region, Global, 2013–2016~ 4. Select Automotive Suppliers: Operating Margin of Automotive Suppliers by Revenue Size, Global, 2013–2016~ 5. Select Automotive Suppliers: Research on Sales of Automotive Suppliers by Region, Global, 2013–2016~ 6. Select Automotive Suppliers: Research on Sales of Automotive Suppliers by Company Size, Global, 2013–2016~ 7. Select Automotive Suppliers: CAPEX on Sales of Automotive Suppliers by Region, Global, 2013–2016~ 8. Select Automotive Suppliers: CAPEX on Sales of Automotive Suppliers by Company Size, Global, 2013–2016~ 9. Select Automotive Suppliers: D/E Ratio of Automotive Suppliers by Region, Global, 2013–2016~ 10. Select Automotive Suppliers: D/E Ratio of Automotive Suppliers by Company Size, Global, 2013–2016~ 11. Fastest Growing Technologies: Penetration of Fastest Growing Technologies, Global, 2025~ 12. Fastest Growing Technologies: Market Share of Fastest Growing Technologies, Global, 2016~ 13. Fastest Growing Technologies: Market Revenue of Top 10 Fastest Growing Technologies, Global, 2016 and 2025~ 14. Select Automotive Suppliers: Technology Market Revenue from Suppliers, Global, 2016 ~ 15. Technology Analysis, Global, 2016~ 16. Automotive Supplier Performance: Revenue from Fastest Growing Technologies, Global, 2016~ 17. Automotive OEM Strategic Imperatives for Success and Growth, Global, 2016~ 18. Automotive Supplier Performance—Key Conclusions, Global, 2016~ |

| Author | Venkata Balakrishnan |

| Industries | Automotive |

| WIP Number | K10D-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB