Growth Opportunity Assessment of Healthcare IT Market in the United Kingdom, Forecast to 2021

Growth Opportunity Assessment of Healthcare IT Market in the United Kingdom, Forecast to 2021

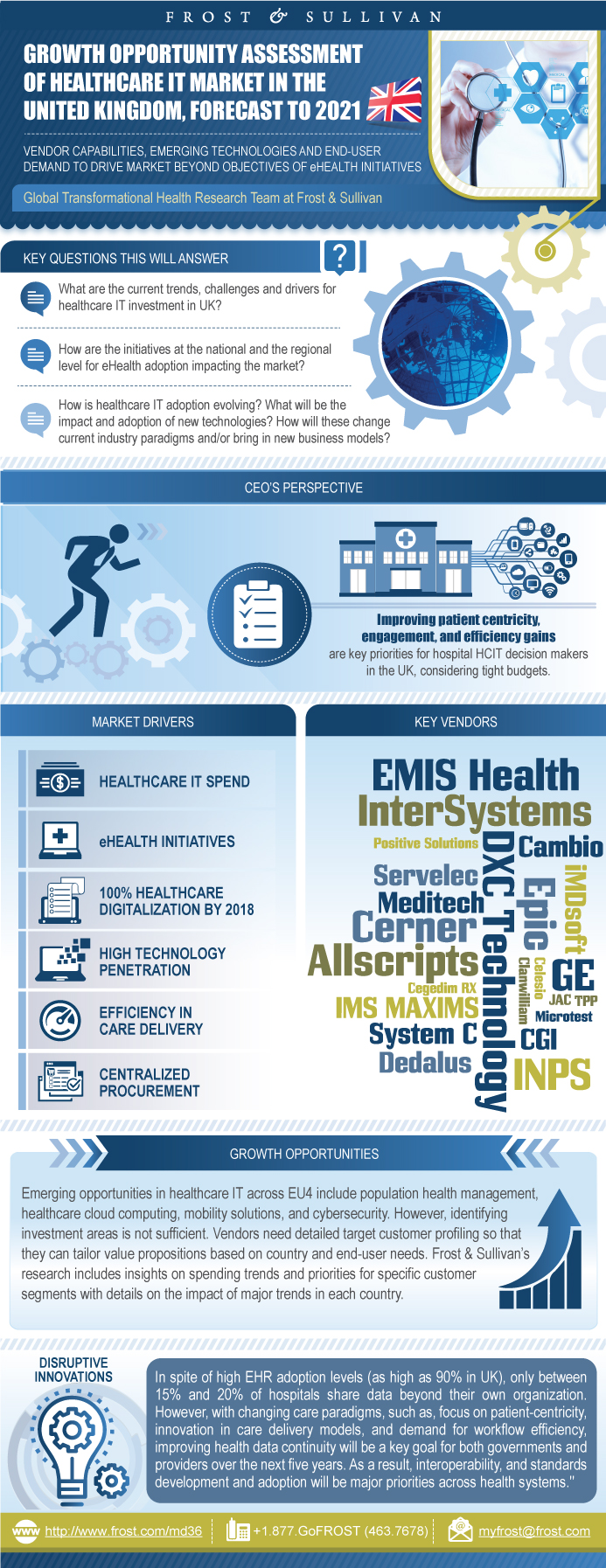

Vendor Capabilities, Emerging Technologies and End-user Demand to Drive Market Beyond Objectives of eHealth Initiatives

25-Sep-2017

Europe

Description

Key Growth Opportunities in the UK include data sharing and interoperability, cloud, mobility, as well as further new investment in core health IT solutions to best meet the needs of providers in a changing market environment. However, the identification of these Growth Opportunities is only the first step towards succeeding as a vendor in this market. The real demystification lies in understanding very specific target-customer needs and then building a value proposition that addresses those needs.

UK, Germany, France and Spain collectively spend over $6 billion on healthcare IT and the regional HCIT adoption stands at almost 80%. The focus of key decision makers in the region will shift from healthcare IT solutions that can capture data to solutions that can enable data sharing and clinical decision support.

Between December 2016 and March 2017, Frost & Sullivan conducted a survey of IT managers from 198 hospitals across Western European countries. Findings of the survey were further investigated through in-depth discussions with market vendors and Frost & Sullivan industry thought leaders. Outcomes of the research have been collated into a 4-part series detailing the HCIT landscape across EU4 (The United Kingdom, Germany, France and Spain).

Our research found that in spite of a high level of EMR adoption only a little more than 15% of large hospitals share data beyond their organization. This has been a huge detriment to efficient and productive health data utilization across all countries included in this study. However, with changing care paradigms, such as focus on patient-centricity, innovation in care delivery models and the demand for workflow efficiency, improving health data continuity will be a key goal for both governments and providers over the next five years. As a result, interoperability, and standards development and adoption will be major priorities across health systems.

Overall, the healthcare IT market in the UK will be driven by eHealth initiatives, changing procurement landscape and emerging digital health platforms that increase collaboration between care segments, enable patient centricity, and encourage high resource utilisation at optimised costs.

Vendors will have to consistently demonstrate their core competence by offering hospitals sustainable business models, centred on improved connectivity, accessibility and interoperability of healthcare. Emerging technologies such as cloud, healthcare business intelligence and data analytics will be in demand.

This is only a sample of insights that you can gain through our research. Key questions answered in this study include:

• What are the current trends, challenges and drivers for healthcare IT investment?

• What will be the most promising growth opportunities and key investment areas over the next five years?

• How is health IT adoption evolving?

• What will be the impact and adoption of new technologies? How will these change current industry paradigms and/or bring in new business

models?

• How are the initiatives at the national and the regional level for eHealth adoption impacting the market?

• What are the current vendor landscape and the tiers of competition in select segments (e.g., Total Health IT, EHR, PCIS)? How are they

expected to evolve over the next five years?

• What do healthcare providers expect when investing in healthcare IT and how has this evolved over the years?

• What is the forecast for hospital Health IT in the UK until 2021?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Research Methodology

Forecast Methodology

Market Snapshot

Scope and Segmentation

Frost & Sullivan Hospital HCIT Survey—Respondents’ Profile

Growth Opportunities in the UK Healthcare IT Market

CEO’s Perspective

Market Background

Market Definition and Segmentation

Healthcare IT Market Analysis—Top 4 Markets in Europe

Macro-Level Trends Driving Care Delivery Transformation

Drivers for Healthcare IT Adoption in the UK

Healthcare IT Market Analysis––Adoption

Hospital Healthcare IT Market in the UK—Revenue Forecast

Primary Care HCIT Market in the UK—Major Trends

Overview of the Healthcare Landscape in the UK

Healthcare IT Landscape—Government Initiatives

Healthcare IT Landscape—Future Plans & Initiatives

Key Findings—Notable Vendor Activities

Key Vendors Overview—Tiers of Competition

Electronic Health Records—Market Share and Position

Primary Care Information System—Market Share and Position

ePrescribing/Pharmacy Information Systems (PhIS)—Market Share and Position

Strategic Imperatives for Healthcare IT Vendors in the UK

End-user Analysis—Adoption of Hospital HCIT Solutions

End-user Analysis—Hospital HCIT Budgeting Trends

End-user Analysis—Hospitals’ EMR Readiness

End-user Analysis—Future Trends on Replacement and Upgrades of IT Systems

End-user Analysis—Analyst Insight on the UK Hospital HCIT Market

Factors Influencing the Future of Healthcare IT in the UK

Key Conclusions and Recommendations

Legal Disclaimer

Relevant Frost & Sullivan Studies

Abbreviations and Acronyms Used

- 1. Healthcare IT Market: Top 4 Markets, Western Europe, 2016–2021

- 2. Percentage Adoption of Healthcare IT Systems, UK, 2017

- 3. Total HCIT Market: Progression of HCIT, UK, 2017–2020

- 1. Total Healthcare IT Market: Frost & Sullivan Research Methodology, UK, 2017

- 2. Total Hospital HCIT Market: Frost & Sullivan Forecast Methodology, Western Europe, 2016

- 3. Total Hospital HCIT Market: Revenue Snapshot, UK, 2016 and 2021

- 4. Total Healthcare IT Market: Leading Vendors, UK, 2016

- 5. Total Hospital HCIT Market: Respondent’s Distribution by Region, Europe, 2017

- 6. Total Hospital HCIT Market: Respondent’s Distribution by Ownership, UK, 2017

- 7. Total Hospital HCIT Market: Respondent’s Distribution by Specialization, UK, 2017

- 8. Total Healthcare IT Market: Market Segmentation, UK, 2016

- 9. Hospital HCIT Market: Revenue Forecast, UK, 2016–2021

- 10. Healthcare System, UK, 2017

- 11. Healthcare IT Market: Key Vendors, UK, 2017

- 12. Healthcare IT Market: Major Vendors by Tiers of Competition, UK, 2017

- 13. Total Healthcare IT Market: EHR Major Vendors by Tiers of Competition, UK, 2016

- 14. Total Healthcare IT Market: EHR Market Share by Top Vendor, UK, 2016

- 15. Total Healthcare IT Market: PCIS Major Vendors by Tiers of Competition, UK, 2016

- 16. Total Healthcare IT Market: PCIS Market Share, UK, 2016

- 17. Total Healthcare IT Market: ePrescribing/PhIS Major Vendors by Tiers of Competition, UK, 2016

- 18. Total Healthcare IT Market: ePrescribing/PhIS Market Share, UK, 2016

- 19. Total Hospital HCIT Market: HCIT Solution Adoption by Hospitals, UK, 2017

- 20. Total Hospital HCIT Market: Percentage of Budget Allocated to IT Solutions, UK, 2017

- 21. Total Hospital HCIT Market: Expected Increase in Hospital HCIT Budget, UK, 2017

- 22. Total Hospital HCIT Market: EMR Readiness Across Hospital, UK, 2017

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | || Research Methodology~ || Forecast Methodology~ | Executive Summary~ || Market Snapshot~ || Scope and Segmentation~ || Frost & Sullivan Hospital HCIT Survey—Respondents’ Profile~ || Growth Opportunities in the UK Healthcare IT Market~ || CEO’s Perspective~ | Market Analysis of Healthcare IT in the UK~ || Market Background~ || Market Definition and Segmentation~ || Healthcare IT Market Analysis—Top 4 Markets in Europe~ || Macro-Level Trends Driving Care Delivery Transformation~ || Drivers for Healthcare IT Adoption in the UK~ || Healthcare IT Market Analysis––Adoption~ || Hospital Healthcare IT Market in the UK—Revenue Forecast~ || Primary Care HCIT Market in the UK—Major Trends~ | Government Initiatives Driving Healthcare IT Adoption in the UK~ || Overview of the Healthcare Landscape in the UK~ || Healthcare IT Landscape—Government Initiatives~ || Healthcare IT Landscape—Future Plans & Initiatives~ | Competitive Landscape~ || Key Findings—Notable Vendor Activities~ || Key Vendors Overview—Tiers of Competition~ || Electronic Health Records—Market Share and Position~ || Primary Care Information System—Market Share and Position~ || ePrescribing/Pharmacy Information Systems (PhIS)—Market Share and Position~ || Strategic Imperatives for Healthcare IT Vendors in the UK~ | End-user Analysis—Hospital HCIT Usage and Adoption Trends~ || End-user Analysis—Adoption of Hospital HCIT Solutions~ || End-user Analysis—Hospital HCIT Budgeting Trends~ || End-user Analysis—Hospitals’ EMR Readiness~ || End-user Analysis—Future Trends on Replacement and Upgrades of IT Systems~ || End-user Analysis—Analyst Insight on the UK Hospital HCIT Market~ | The Last Word~ || Factors Influencing the Future of Healthcare IT in the UK~ || Key Conclusions and Recommendations~ || Legal Disclaimer~ | Appendix~ || Relevant Frost & Sullivan Studies~ || Abbreviations and Acronyms Used~ | The Frost & Sullivan Story~ |

| List of Charts and Figures | 1. Healthcare IT Market: Top 4 Markets, Western Europe, 2016–2021~ 2. Percentage Adoption of Healthcare IT Systems, UK, 2017~ 3. Total HCIT Market: Progression of HCIT, UK, 2017–2020~| 1. Total Healthcare IT Market: Frost & Sullivan Research Methodology, UK, 2017~ 2. Total Hospital HCIT Market: Frost & Sullivan Forecast Methodology, Western Europe, 2016~ 3. Total Hospital HCIT Market: Revenue Snapshot, UK, 2016 and 2021~ 4. Total Healthcare IT Market: Leading Vendors, UK, 2016~ 5. Total Hospital HCIT Market: Respondent’s Distribution by Region, Europe, 2017~ 6. Total Hospital HCIT Market: Respondent’s Distribution by Ownership, UK, 2017~ 7. Total Hospital HCIT Market: Respondent’s Distribution by Specialization, UK, 2017~ 8. Total Healthcare IT Market: Market Segmentation, UK, 2016~ 9. Hospital HCIT Market: Revenue Forecast, UK, 2016–2021~ 10. Healthcare System, UK, 2017~ 11. Healthcare IT Market: Key Vendors, UK, 2017~ 12. Healthcare IT Market: Major Vendors by Tiers of Competition, UK, 2017~ 13. Total Healthcare IT Market: EHR Major Vendors by Tiers of Competition, UK, 2016~ 14. Total Healthcare IT Market: EHR Market Share by Top Vendor, UK, 2016~ 15. Total Healthcare IT Market: PCIS Major Vendors by Tiers of Competition, UK, 2016~ 16. Total Healthcare IT Market: PCIS Market Share, UK, 2016~ 17. Total Healthcare IT Market: ePrescribing/PhIS Major Vendors by Tiers of Competition, UK, 2016~ 18. Total Healthcare IT Market: ePrescribing/PhIS Market Share, UK, 2016~ 19. Total Hospital HCIT Market: HCIT Solution Adoption by Hospitals, UK, 2017~ 20. Total Hospital HCIT Market: Percentage of Budget Allocated to IT Solutions, UK, 2017~ 21. Total Hospital HCIT Market: Expected Increase in Hospital HCIT Budget, UK, 2017~ 22. Total Hospital HCIT Market: EMR Readiness Across Hospital, UK, 2017~ |

| Author | Shruthi Parakkal |

| Industries | Healthcare |

| WIP Number | MD36-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB