Digital Business Models Mitigating COVID-19 Implications on Global Aftermarket Performance in 2020

Digital Business Models Mitigating COVID-19 Implications on Global Aftermarket Performance in 2020

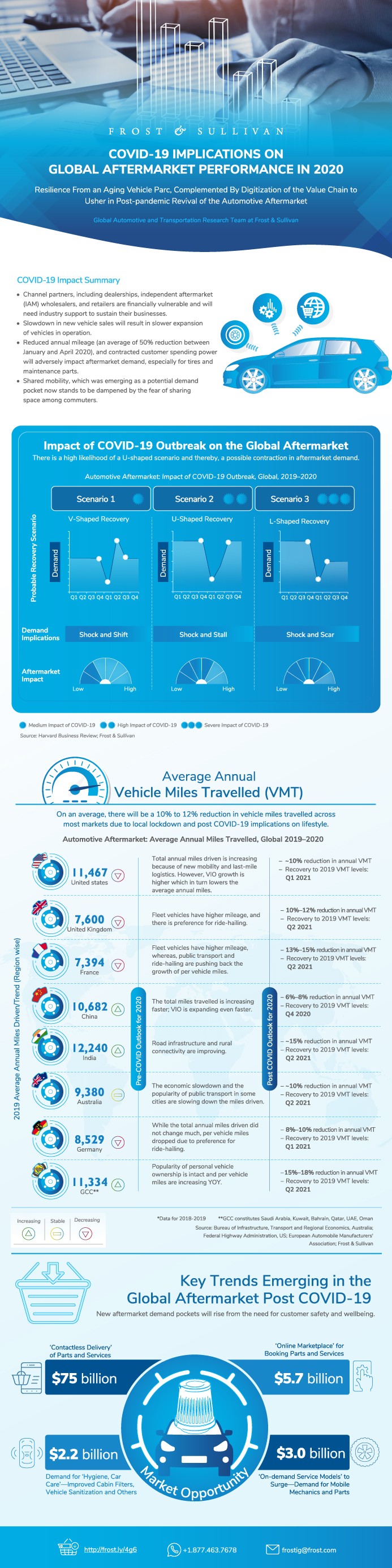

Resilience From an Aging Vehicle Parc, Complemented By Digitization of the Value Chain to Usher in Post-pandemic Revival of the Automotive Aftermarket

19-Aug-2020

Global

$4,950.00

Special Price $3,712.50 save 25 %

Description

This study evaluates the trajectories of global economic recovery in the aftermath of the pandemic and elucidates the medium-term impact of muted demand and supply on aftermarket revenues for 2020. Taking the long-term view, the study also underscores growth opportunities and evolving business models that, if leveraged on, will aid the aftermarket’s resurgence when the global economy is restored to pre-pandemic levels.

According to Frost and Sullivan’s analysis, aftermarket revenue expanded by 4.1% in 2019. This was largely driven by a 3.2% growth in vehicles in operation, with the contraction in global gross domestic product (GDP) growth stifling consumer expenditure on new vehicle purchases. Slowdown in new vehicle sales also meant increased focus on the aftermarket from all stakeholders, more so from the OES channel, to sustain business at the dealer level by offering new vehicle services. This translated into the development of newer partnerships and evolution of newer channels to the market. For 2020, Frost and Sullivan had initially forecast a 4.0% growth in aftermarket revenues, with India and China leading the growth. The COVID-19 pandemic has put paid to these hopes, and the global automotive aftermarket will have to pull through headwinds that will result in the industry posting a de-growth, ranging between 4.9% and 11.6%, depending on the nature of the ensuing economic recovery across regions.

Research Scope

The study aims to gauge the severity of the impact of the ongoing COVID-19 pandemic on the global automotive aftermarket in 2020.

Although automotive sales had slackened in 2019, resilience from the global vehicle stock was expected to fuel growth opportunities for aftermarket stakeholders in 2020. With disruptions to businesses from fears of contagion snowballing into an economic crisis the world over, the aftermarket will also have to pull through its share of headwinds.

Research Highlights

- To ascertain the impact of the COVID 19 pandemic on aftermarket revenues across regions and part categories

- To understand how the aftermarket ecosystem is responding to mitigate the impact of the pandemic on businesses

- To determine the trajectory of post-pandemic recovery across regions and segments

- To highlight the upcoming business models that will see adoption in the wake of the pandemic

Key Issues Addressed

- What are the main factors that will drive and restrain the size of the global automotive aftermarket in 2020?

- How will the virus’ impact on the general macroeconomic performance translate into the global automotive aftermarket business?

- How does the effect of the pandemic on aftermarket performance vary from region to region?

- What is the region-wise outlook for emerging growth opportunities such as digitization and sanitization services against the backdrop of the pandemic?

- Which companies are likely to gain the first-mover advantage in the recovery phase owing to early reorientation in their existing business models?

Author: Anuj Monga

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

COVID-19 Impact on World GDP Growth

COVID-19 Impact on Key Regions and Countries

Economic Stimulus Across Virus Hit Economies

COVID-19 Impact on Industries

2019 in Numbers—Key Highlights

2019 in Trends—Key Highlights

2020 in Numbers—Key Predictions

2020 in Trends—Key Predictions

Impact of covid-19 outbreak on the Global Aftermarket

Global Light Vehicle in Operation

Global Aftermarket Revenue Market Size Potential

Global Aftermarket—Impact Analysis

Global Automotive Vehicle Parc Average Age

Average Annual Vehicle Miles Travelled (VMT)

Global Aftermarket Outlook 2020 Overview

Key Implications on Automotive Aftermarket

Stakeholder-level Impact and Opportunity Assessment

Impact of COVID-19 on Key Demand Influencers

Key Trends Emerging in the Aftermarket After COVID-19 in the Global Market

Digital Opportunity Business Model 1: Digital Adoption for Sale of Online Parts and Accessories

Digital Opportunity Business Model 2: Online Marketplaces

Digital Opportunity Business Model 3: On-demand Services Open Up Another Digitized Installer Channel

Health Wellness and Wellbeing Products for IAM

2020 Aftermarket Outlook—North America

2020 Aftermarket Outlook—Europe

Implications of Mot-related Extension (UK)

2020 Aftermarket Outlook—Latin America

2020 Aftermarket Outlook—India

2020 Aftermarket Outlook—China

Chinese Aftermarket Revival in Motion

Chinese Aftermarket Revival in Motion (continued)

Chinese Aftermarket Revival in Motion (continued)

Growth Opportunity 1: Eretailing of Replacement Parts and Accessories, 2019

Growth Opportunity 1: Eretailing of Replacement Parts and Accessories, 2019 (continued)

Growth Opportunity 2: Service Aggregation for Vehicle Repair and Maintenance, 2019

Growth Opportunity 2: Service Aggregation for Vehicle Repair and Maintenance, 2019 (continued)

Growth Opportunity 3: On-demand Vehicle Services Models to Answer Customer Fears Around Contamination Fear in Workshops

Growth Opportunity 3: On-demand Vehicle Services Models to Answer Customer Fears Around Contamination Fear in Workshops (continued)

Growth Opportunity 4: Demand for Health Wellness and Wellbeing Parts and Accessories Will Create Niche Product Categories

Growth Opportunity 4: Demand for Health Wellness and Well-being Parts and Accessories Will Create Niche Product Categories (continued)

Companies to Action

2020 Aftermarket Outlook: Understanding Scenarios

2020 Aftermarket Outlook: Factors in Consideration

Lockdown Details Considered in Demand Estimation Revision

Impact of covid-19 on Global Crude Oil Demand

Fuel Demand and Covid-19 Impact in India

Exhibit 8: Global Smartphone Penetration—Driver for Aftermarket Digitization

Glossary

About the Growth Pipeline Engine™

Next Steps

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

Legal Disclaimer

Popular Topics

Research Scope

The study aims to gauge the severity of the impact of the ongoing COVID-19 pandemic on the global automotive aftermarket in 2020.

Although automotive sales had slackened in 2019, resilience from the global vehicle stock was expected to fuel growth opportunities for aftermarket stakeholders in 2020. With disruptions to businesses from fears of contagion snowballing into an economic crisis the world over, the aftermarket will also have to pull through its share of headwinds.

Research Highlights

- To ascertain the impact of the COVID 19 pandemic on aftermarket revenues across regions and part categories

- To understand how the aftermarket ecosystem is responding to mitigate the impact of the pandemic on businesses

- To determine the trajectory of post-pandemic recovery across regions and segments

- To highlight the upcoming business models that will see adoption in the wake of the pandemic

Key Issues Addressed

- What are the main factors that will drive and restrain the size of the global automotive aftermarket in 2020?

- How will the virus’ impact on the general macroeconomic performance translate into the global automotive aftermarket business?

- How does the effect of the pandemic on aftermarket performance vary from region to region?

- What is the region-wise outlook for emerging growth opportunities such as digitization and sanitization services against the backdrop of the pandemic?

- Which companies are likely to gain the first-mover advantage in the recovery phase owing to early reorientation in their existing business models?

Author: Anuj Monga

| No Index | No |

|---|---|

| Podcast | No |

| Author | Anuj Monga |

| Industries | Automotive |

| WIP Number | K527-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9801-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB