Indian Electric Vehicle (EV) Growth Opportunities

Indian Electric Vehicle (EV) Growth Opportunities

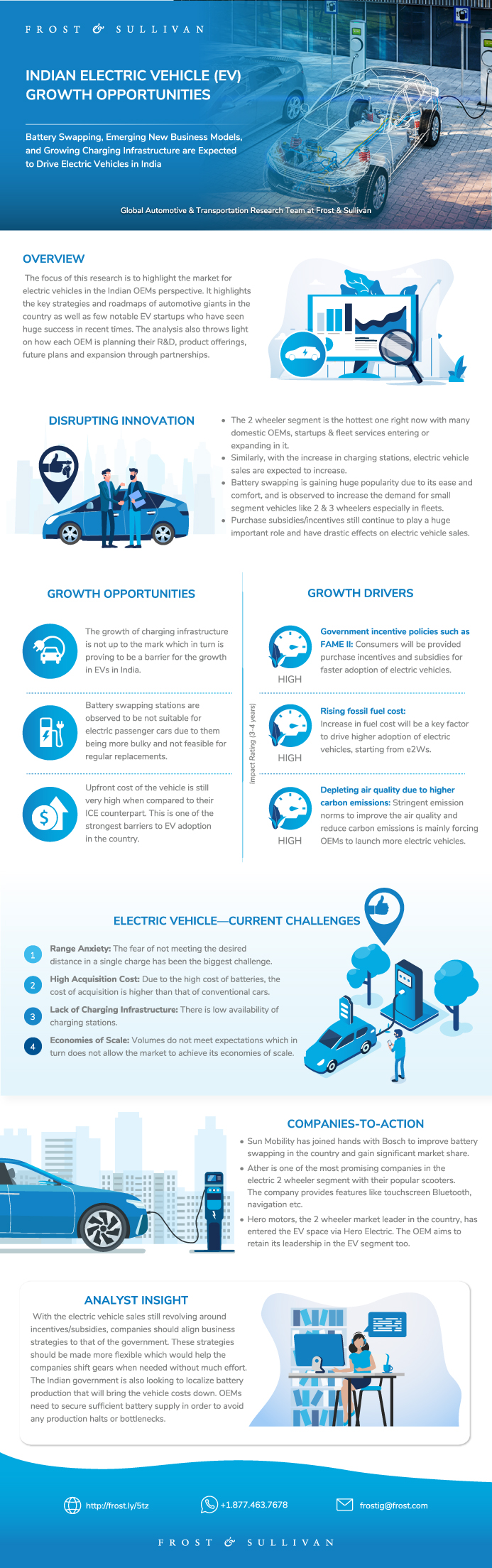

Battery Swapping, Emerging New Business Models, and Growing Charging Infrastructure are Expected to Drive Electric Vehicles in India

03-Jun-2021

South Asia, Middle East & North Africa

Description

Battery Swapping, Emerging New Business Models & Growing Charging Infrastructure are expected to drive the Electric Vehicle Industry in India

Automotive industry is rapidly evolving in terms of technology as well as tackling environmental issues. Electric vehicles have been introduced as a clean energy initiative, as they have low or zero emissions and have come a long way to become an integral part of OEM’s business strategies. Automakers are creating separate EV business units to be prepared for the expected EV boom in the future. However, the surge in EV demand will create a huge need for charging infrastructure and safety regulations and standards.

India is expected to aggressively push itself toward electrification, especially in the automotive and transportation sector. Stringent emission regulations, liberal incentives and subsidies for consumers and manufacturers, high level of localization, concrete safety standards, and established technology roadmaps are few key steps that are either already taken or need to be taken by the government to ensure the success of electric vehicles in the coming years.

Domestic OEMs such as Tata Motors and Mahindra & Mahindra and foreign OEMs such as Hyundai and MG have already entered the market with their flagship EVs. They have announced ambitious sales targets and are expected to launch a many new and constructive electric vehicle models (from city suited to long-range and powerful). Charging infrastructure, which is one of the major factors to drive EV adoption, are also picking up pace, with many new companies entering this space. It has opened up new business models that enable companies to position themselves either as manufacturers, operators, or payment gateways.

The study provides a detailed analysis of the current and future prospects of EVs and adjacent markets. It throws light on the various segments in the market such as two-wheelers, three-wheelers, four-wheelers, and heavy-duty vehicles.

Key Issues Addressed

- What are the various incentive schemes, both state and nationwide, in the country?

- How are various segments—two-wheelers, auto rickshaws, rickshaws, passenger cars, and buses—performing in the country?

- What are the various start-ups in the industry?

- What is the historic and current charging infrastructure scenario, and what can be expected in the coming years?

- What growth opportunities lie in the region, and what are the critical success factors to exploit them?

Author: Prajyot Sathe

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Electrification Roadmap—Vision 2030

Electric Four-wheeler Market Outlook in India

Key Offerings by Product Innovators—e2W Start-ups

Key Parameters—Satisfaction Versus Importance

EV Localization

Component Localization Roadmap to be Driven by Shared Mobility

Why is it Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top-three Strategic Imperatives on the Indian Electric Vehicle Industry

Growth Opportunities Fuel the Growth Pipeline Engine™

Indian Electric Vehicle Market Overview

Electric Vehicle Market Segmentation

Key Mega Trends Impacting Mobility in India

Country Profile—India: The Change-driving Consumer

Urban Mobility Modal Share—2019

Electrification in India—Driven by Incentives and New Business Models

Growth Drivers for the Electric Vehicle Market

Growth Restraints for the Electric Vehicle Market

Electric Vehicle—Current challenges

Electric Vehicle—Scenarios

Electric Vehicles in India—First Wave Already Underway

Factors Driving Electrification

Targeting Specific Electric Vehicle Market Segments Based on Economics to Drive and Hasten National Adoption

Market Forecast to 2025

Market Size of the EV Component Industry in 2025

FAME II—Incentive Structure

Summary of Government Incentives in India

States Chipping With EV Policies and Investments

State Government EV Policies

State-wise Regulations to Promote and Organize the eRickshaws Market

State-wise Regulations to Promote and Organize the eRickshaws Market (continued)

Emission Norms—India

Technology Requirements and Cost of Compliance—BS VI (IC Engines)

Cost of Compliance BS VI—Comparison

Diesel Cars

Summary—Emission Norms in India

Current EV Charging Stations in India—An Overview

Charging Infrastructure in India—Challenges

Why Battery Swapping?

EVSE Types With Connector Types

Public and Private Charging Infrastructure Standards and Implementation

Charging Station Supplier Network

Incentives for Charging Stations

Future Charging Stations

Future Charging Stations (continued)

Future Charging Stations (continued)

e4W Forecast and Market Overview (Includes HEV)

Electric Motors for e4W

EV—Product Portfolio and Launch Roadmap

Summary—e4W Market

Two-wheeler—Overview

e2W—Market Scenario

e2W Market size

Motor Power Offerings by e2W Manufacturers in India

Summary—e2W Market

eRickshaws—Market Size and Market Overview

Market Insights

Key eRickshaw Markets in India

eRickshaw—Market Split Based on Battery Type

Summary—eRickshaw Market

Indian Auto Rickshaw Market—Key insights

Factors Driving Market Growth

eAuto—Market size

Summary—eAuto Market

Indian Electric Bus Market

Electric Bus—Total Unit Forecast

Summary—Electric Bus Market

Lithium-ion Battery Industry in India—Partnerships

Li-ion Production Expansion Plans, India

EV Localization

Component Localization Roadmap to be Driven by Shared Mobility

Competitor Benchmarking

Competitor Benchmarking (continued)

Key Participants in the Bearing Industry in India

Current Landscape of Key EV Component Manufacturers in India

Current Landscape of Key EV Component Manufacturers in India (continued)

Current Landscape of Key EV Component Manufacturers in India (continued)

Growth Opportunity 1—Strategic Partnering for Technological Advancements, 2019

Growth Opportunity 1—Strategic Partnering for Technological Advancements, 2019 (continued)

Growth Opportunity 2—New Product Launch

Growth Opportunity 2—New Product Launch (continued)

Growth Opportunity 3—Customer and Branding

Growth Opportunity 3—Customer and Branding (continued)

Your Next Steps

Why Frost, Why Now?

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

Legal Disclaimer

Glossary of Terms

Popular Topics

Key Issues Addressed

- What are the various incentive schemes, both state and nationwide, in the country?

- How are various segments—two-wheelers, auto rickshaws, rickshaws, passenger cars, and buses—performing in the country?

- What are the various start-ups in the industry?

- What is the historic and current charging infrastructure scenario, and what can be expected in the coming years?

- What growth opportunities lie in the region, and what are the critical success factors to exploit them?

Author: Prajyot Sathe

| No Index | No |

|---|---|

| Podcast | No |

| Author | Prajyot Sathe |

| Industries | Automotive |

| WIP Number | K593-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9801-A6,9882-A6,9B02-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB