Indian Electricity Growth Opportunities

Indian Electricity Growth Opportunities

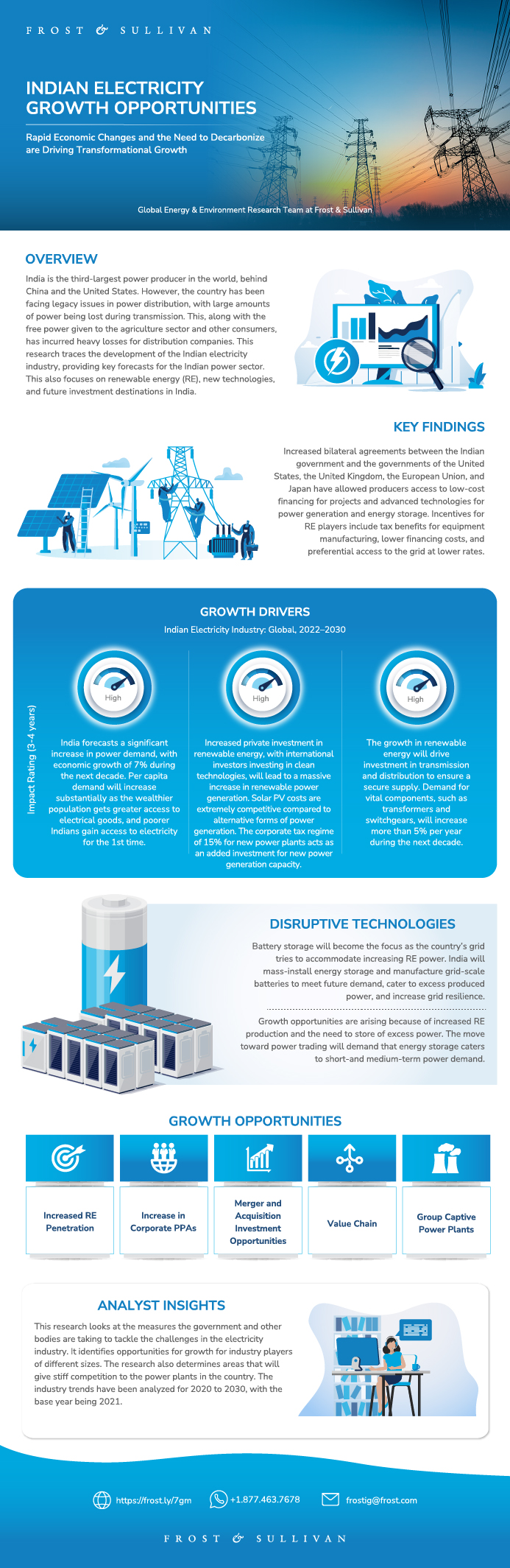

Rapid Economic Changes and the Need to Decarbonize are Driving Transformational Growth

08-Jul-2022

South Asia, Middle East & North Africa

$2,450.00

Special Price $2,082.50 save 15 %

Description

The study traces the development of the Indian electricity market, providing key forecasts for the Indian power sector. The study focuses on renewable energy (RE), new technologies, and future investment destinations in India.

India is the third-largest power producer in the world, behind China and the United States. However, the country has been facing legacy issues in power distribution, with large amounts of power being lost during transmission. This, along with the free power given to the agriculture sector and other consumers, has incurred heavy losses for distribution companies.

This study looks at the measures the government and other bodies are taking to tackle the challenges in the electricity market. It identifies opportunities for growth for market players of different sizes. The study also determines areas that will give stiff competition to the power plants in the country. The market trends have been analyzed for 2020 to 2030, with the base year being 2021.

Key Issues Addressed

- What is the current state of the market? How strong will growth be between 2020 and 2050?

- What is the state of the various power sources in the country? How will they evolve?

- How and why does coal power dominate the market? How will the use of coal power reduce by 2050?

- Which are the key regions for the growth of the RE power market? How is it going to transform in the future? Who are the key competitors in the market?

- How is power trading evolving? How is it expected to change the electricity market in the future?

- What are the new technologies that are being installed in the metering and energy storage spaces?

- What are the key growth opportunities in the market?

Author: Manoj Shankar

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why is it Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top 3 Strategic Imperatives on the Indian Electricity Market

Growth Opportunities Fuel the Growth Pipeline Engine™

Main Findings

Scope of Analysis

Market Segment Definitions

Key Competitors

Structure of the Indian Power Market

The Structure of the Indian Power Market (continued)

The Timeline of the Power Sector in India

Growth Drivers for the Indian Electricity Market

Growth Restraints for the Indian Electricity Market

Major Trends Shaping the Indian Power Market

Major Trends Shaping the Indian Power Market (continued)

Strong Electricity Demand Growth—Per Capita Consumption to Increase from a Low Volume

Strong Growth in Electricity Demand—Significant Increase in Installed Capacity

The Rise of Renewables—Solar to Dominate Capacity Increases

The Rise of Renewables—Incentives Essential to Overall Growth

The Rise of Renewables—Solar and Wind Dominating New Installations

The Rise of Renewables—Significant Hydropower Potential

The Rise of Renewables—Solar Opportunities

The Rise of Renewables—Wind Opportunities

The Rise of Renewables—Competitive Landscape

Coal’s Main Role—Preference for Coal Despite Climate Concerns

Coal’s Vital Role—New Plants Moving Online throughout the Decade

Coal’s Main Role—Coal Opportunities

Coal’s Main Role—Economics of Coal

The Continued Expansion of the Free Power Market

The Continued Expansion of the Free Power Market—The Future of the Market

The Power Trading Increases—The Expansion of India’s Power Exchanges

The Increase of Power Trading—RECs and ESCerts

The Increase in Power Trading—Open Access

The Increase in Power Trading—Open Access (continued)

The Grid’s Main Challenges—Increasing T&D Networks

The Grid’s Main Challenges—Discoms in Disarray

The Grid’s Main Challenges—Discom Losses Mount

The Grid’s Main Challenges—Discom Losses Mount (continued)

The Grid’s Main Challenges—Important State Losses

Mass Deployment of Smart Metering—Essential Steps to Reduce Losses

Mass Deployment of Smart Metering—The Status Today

Mass Deployment of Smart Metering—250 Million Meters in 8 Years

Mass Deployment of Smart Metering—Main Benefits

Energy Storage Increase

Energy Storage Increase

Energy Storage Increase—Important Battery Storage Projects in India

Energy Storage Increase—Opportunities in India

Energy Storage Increase—Battery Storage Opportunities in India

Battery Storage Increase—Important Companies in India

Growth Opportunity 1—Increased RE Penetration

Growth Opportunity 1—Increased RE Penetration (continued)

Growth Opportunity 2—Increase in Corporate PPAs

Growth Opportunity 2—Increase in Corporate PPAs (continued)

Growth Opportunity 3—Merger and Acquisition Investment Opportunities

Growth Opportunity 3—Merger and Acquisition Investment Opportunities (continued)

Growth Opportunity 4—Value Chain

Growth Opportunity 4—Value Chain (continued)

Growth Opportunity 5—Group Captive Power Plants

Growth Opportunity 5—Group Captive Power Plants (continued)

Abbreviations

List of Exhibits

Legal Disclaimer

Popular Topics

Key Issues Addressed

- What is the current state of the market How strong will growth be between 2020 and 2050

- What is the state of the various power sources in the country How will they evolve

- How and why does coal power dominate the market How will the use of coal power reduce by 2050

- Which are the key regions for the growth of the RE power market How is it going to transform in the future Who are the key competitors in the market

- How is power trading evolving How is it expected to change the electricity market in the future

- What are the new technologies that are being installed in the metering and energy storage spaces

- What are the key growth opportunities in the market

Author: Manoj Shankar

| Author | Manoj Shankar |

|---|---|

| Industries | Energy |

| No Index | No |

| Is Prebook | No |

| Podcast | No |

| WIP Number | MGA8-01-00-00-00 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB