Small-satellite Launch Services Market, Quarterly Update Q3 2018, Forecast to 2030

Small-satellite Launch Services Market, Quarterly Update Q3 2018, Forecast to 2030

State of the Small-satellite Industry in Q3, 2018

11-Dec-2018

Global

Description

Small-satellites are at the spotlight of the evolution of space industry. Small-satellite ecosystem is expanding at an increasing pace, with new entrants offering new space solutions and existing players expanding their portfolio by investments in the small-satellite value chain. It becomes very important to investigate the past and current state of the small satellite market and forecast the future scenarios. Many small satellite constellation operators have advanced in their development processes and will generate continuous and recurring launch demand for their constellation installation and replacement missions. At present nearly all small satellites use the rideshare capacity as a secondary payload on the existing launch vehicles. This makes their project schedule and mission requirements dependent on the primary payload. Moreover, the existing rideshare capacity will not be sufficient to address all the small satellite launch demand in future. Many incumbent and new players have sensed the upcoming small satellite demand and have started planning for providing dedicated services and launch flexibility to the small satellite operators, in order to capture the future small satellite launch market.

What makes this report unique?

The report tracks the changing dynamics every quarter and updates the forecast based on the latest events. The report exposes the readers to the latest forecast numbers and the major changes, empowering them to the most informed decision making. A bottom up and detailed approach is applied to forecast the small satellite launch demand. The study defines multiple forecast scenarios based on the maturity of satellite operators. More than 250 operators across the user segments are considered for the forecast. A large number of small satellites, payload mass, and launch revenue have been forecast on the basis of defined scenarios, satellite mass classes and user segments. The study also includes the launch capacity forecast for both rideshare and dedicated launch services segment and analyses the alignment between the small satellite launch demand and capacity supply.

Research Scope

- Product scope: Small-satellite launch services market

- Geographic scope: Global

- End-user scope: All companies related to space industry

This study forecasts small satellite launch demand based on Operators' maturity, mass classes and user segments. It also details the projected small satellite launch capacity supply and analyses the alignment of launch demand and supply for multiple forecast scenarios. The study includes the new developments in the small satellite value chain for Q1 2018.

Key Issues Addressed

- What are the changes that have resulted in the change of the previously forecasted numbers?

- What is the future demand for launching small satellites, based on user segments and mass classes and operators maturity, in the forecast period 2018-2030?

- What is the future payload mass demand for launching the small satellites in the forecast period?

- What is the projected revenue of the small satellite launch market?

- What is the forecasted launch capacity supply and how aligned is it with the small satellite launch demand?

- What are the key small satellite and launch vehicle developments in the first quarter of 2018?

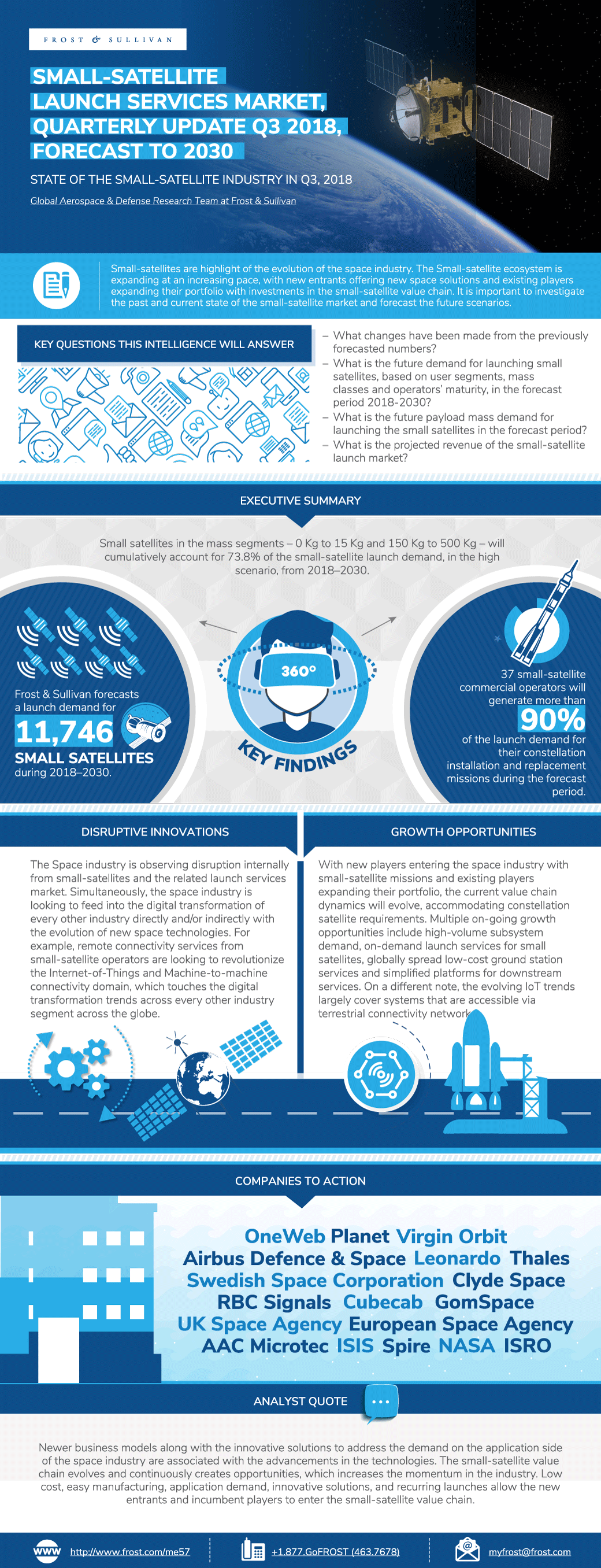

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Small Satellites—Definition and Forecast Scenarios

Segmentation of Small-satellite Users and Mass Classes

Small-satellite and Launch Capacity Forecast

Q3, 2018 Forecast with Respect to Q2, 2018 Forecast

Q3, 2018 Forecast with Respect to Q2, 2018 Forecast (continued)

Demand Forecast

Low- and Mid-Scenario Demand Forecast by User Segment

High-Scenario Demand Forecast by User Segment

Low- & Mid-Scenario Demand Forecast by Mass Class

High-Scenario Demand Forecast by Mass Class

Payload Mass Demand Forecast

Low- and Mid-Scenario Payload Mass Demand Forecast by User Segment

High-Scenario Payload Mass Demand Forecast by User Segment

Low- and Mid-Scenario Payload Mass Demand Forecast by Mass Class

High-Scenario Payload Mass Demand Forecast by Mass Class

Launch Demand Revenue Forecast

Low- and Mid-Scenario Launch Demand Revenue Forecast by User Segment

High-Scenario Launch Demand Revenue Forecast by User Segment

Low- and Mid-Scenario Launch Demand Revenue Forecast by Mass Class

High-Scenario Launch Demand Revenue Forecast by Mass Class

Launch Capacity Forecast Assumptions

Launch Capacity Supply Forecast

Launch Demand versus Capacity Supply

Key Small-satellite Launches in Q2 2018

Key Small-satellite Industry Developments Q2 2018

Key Launch Service Industry Developments Q2 2018

Conclusion

Legal Disclaimer

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

The Frost & Sullivan Story

Value Proposition—Future of Your Company & Career

Global Perspective

Industry Convergence

360º Research Perspective

Implementation Excellence

Our Blue Ocean Strategy

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Kamalanathan Kaspar |

| Industries | Aerospace, Defence and Security |

| WIP Number | ME57-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9000-A1 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB