Indian Passenger Vehicles Market, Forecast to 2020

Indian Passenger Vehicles Market, Forecast to 2020

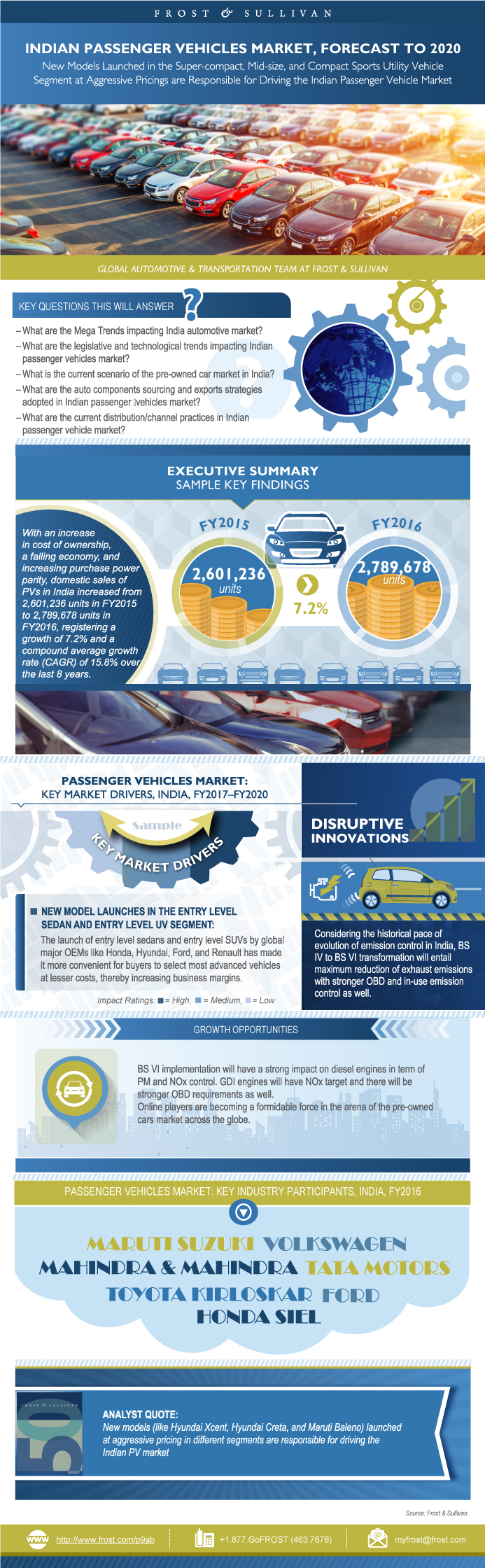

New Models Launched in the Super-compact, Mid-size, and Compact Sports Utility Vehicle Segment at Aggressive Pricings are Responsible for Driving the Indian Passenger Vehicle Market

23-Jan-2018

South Asia, Middle East & North Africa

Description

Driven by aggressive pricing and an increasing number of exports, passenger vehicle (PV) production in India is expected to grow at a CAGR of 9.0% from FY2015 to FY2020. New models—like Hyundai Xcent, Hyundai Creta, and Maruti Baleno—launched at aggressive pricing in different segments are responsible for driving the Indian PV market. Also, the launch of entry-level sedans and entry-level SUVs by major global OEMs like Honda, Hyundai, Ford, and Renault has made it more convenient for buyers to select the most advanced vehicles at lower costs, thereby increasing business margins. Rapid fluctuations in fuel prices and growth of public transport are expected to restrain the Indian PV market growth in the future. With the narrowing price difference between gasoline and diesel variant vehicles and newer technologies being introduced in gasoline engines, the share of diesel vehicles is likely to decline in the near future. The overall inflation remains high due to a persistent rise in fuel prices and this is expected to continue for the next few months or a year.

The used car market in India is set to grow at a CAGR of 11% from 3.45 million units in 2016 to 5.8 million units in 2021. The organized sector is expected to reach a market share of 25% in 2021 from 20% in 2016 due to the shift in focus where customers will be more likely to pay more to get reliable cars at a reasonable price than go for the cheapest, yet unreliable deals. Customers are increasingly using the online channel because they want to be better informed before making a decision. This also connects them to a seller at a quicker pace. The effect of this increasing use of the online players is such that around 10% to 20% of sales for unorganized dealers are currently completed with the help of online platforms.

Despite Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) incentives and the introduction of the Corporate Average Fuel Efficiency (CAFÉ) norm, the share of electric vehicles (EVs) and full hybrid electric vehicle (FHEV) is expected to remain low at around 1% to 2% even by 2020. The primary reason for this will be the sluggish infrastructure and possible high cost of batteries. Another reason is that average displacement of Indian engines is relatively low and they are typically fuel efficient, capable of achieving fuel efficiency with an expanded proportion of mild hybrid vehicles.

The aftermarket in India is currently unregulated for both parts and services. Because there is no mandatory standard for products sold in the aftermarket, the production and import of counterfeit products cannot be checked—a huge challenge. In parts manufacturing, the unorganized sector does not adhere to government stipulations and poses a significant threat to the organized sector due to price competitiveness.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Executive Summary—Key Findings

Executive Summary—Market Engineering Measurements

Executive Summary—PV Market Forecast

Executive Summary—Snapshot of Indian Manufacturing Segments

Research Scope

Research Aims and Objectives

Research Background

Research Methodology

Key OEMs or Participant Groups Compared in this Study

Passenger Vehicle Segment Categorization

Five Main Trends in Urbanization

India Urbanization Rate

Smart City Investment

Indian Infrastructure—Estimated Trillion Dollar Investment

India GDP Projections—India Needs to Grow 10% Per Annum

The Middle Bulge

Working Age Demographic Dividend

Aging India

Make in India—Insights Behind the Initiative

Snapshot of Indian Manufacturing Segments

Key Policy Announcements—Doing Business In India

Passenger Vehicles—Past Trends

Segment-wise Market Share—Domestic Sales FY2016

OEM-wise Share—Production, Domestic Sales, and Exports FY 2016

India’s Growth Outperformance Factors

Passenger Vehicles Market—Major Trends

Major Investments and Developments in the Indian PV Market

Market Drivers

Market Restraints

Market Engineering Measurements

Passenger Vehicles—Market Forecast

Opportunity Pyramid FY2016

Opportunity Pyramid FY2020

Gasoline Diesel Equation in India Market

Evolution of Bharat Stage VI Norms in India

BS IV to BS VI Transformation—Reduction in Emission Caps

Euro V and Euro VI Compliance—Technology Solutions

Impact of GST on Indian Automotive Industry

Global Development of Active Safety Regulations and Ratings

Bharat New Vehicle Safety Assessment Program (BNVSAP)

Region-wise Model and Brand Preferences

Key Global Used Car Markets

Online Selling Platform—Business Model

Used Car Price Analysis—Price Range vs Share

PV Sales Showroom of Major OEMs

Typical Revenue Streams in a Passenger Vehicle Dealership in India

Snapshots of New Formats of Auto Retail in India

Indian Auto Components Industry Overview

Aftermarket Auto Components Imports, FY2016

PV Component Potential

Current Trends in Auto Component Distribution and Retail

Current and Emerging Distribution Hubs

Top Reasons OEMs Choose India as Component Sourcing Base

Key Conclusions and Future Outlook

The Last Word—3 Big Predictions

Legal Disclaimer

List of Exhibits

- 1. Passenger Vehicles Market: Sales Forecast, India, FY2016–FY2020

- 2. Passenger Vehicles Market: Key Industry Participants, India, FY2016

- 3. Passenger Vehicles Market: Cumulative Infrastructure Planned Outlay by Segment, India, 2013–2017

- 4. Passenger Vehicles Market: Key Market Drivers, India, FY2017–FY2020

- 5. Passenger Vehicles Market: Key Market Restraints, India, FY2017–FY2020

- 6. Passenger Vehicles Market: Market Engineering Measurements, India, FY2016–FY2020

- 7. Passenger Vehicles Market: Sales Forecast, India, FY2016–FY2020

- 1. Passenger Vehicles Market: Market Engineering Measurements, India, FY2016–FY2020

- 2. Passenger Vehicles Market: Production Forecast, India, FY2016–FY2020

- 3. Passenger Vehicles Market: Sales Forecast, India, FY2016–FY2020

- 4. Passenger Vehicles Market: Exports Forecast, India, FY2016–FY2020

- 5. Passenger Vehicles Market: Passenger Vehicle Segment Categorization, India, FY2016

- 6. Passenger Vehicles Market: Urbanization Rate of Highly Urban States and Mega Cities, India, 2025

- 7. Passenger Vehicles Market: Total Infrastructure Investment Needed, India, FY2020

- 8. Urban Infrastructure Investment, India, FY2016

- 9. Passenger Vehicles Market: Infrastructure Planned Outlay, India, 2013–2017

- 10. Passenger Vehicles Market: Nominal GDP Current Trajectory, India, FY2011, FY2014, FY2017, and FY2020

- 11. Passenger Vehicles Market: Nominal GDP Accelerated Trajectory, India, FY2011, FY2014, FY2017, and FY2020

- 12. Passenger Vehicles Market: Income Pyramid, India, 2012 and 2020

- 13. Passenger Vehicles Market: Working Age Demographic Dividend, India, 2015 and 2023

- 14. Passenger Vehicles Market: Population Pyramid, India, 2015 and 2023

- 15. Passenger Vehicles Market: Income Pyramid, India, 2012 and 2020

- 16. Passenger Vehicles Market: Past Trends, India, FY2009–FY2016

- 17. Passenger Vehicles Market: Micro Segment—Percent Unit Sales Share, India, FY2016

- 18. Passenger Vehicles Market: Mini Segment—Percent Unit Sales Share, India, FY2016

- 19. Passenger Vehicles Market: Compact Segment—Percent Unit Sales Share, India, FY2016

- 20. Passenger Vehicles Market: Super-compact Segment—Percent Unit Sales Share, India, FY2016

- 21. Passenger Vehicles Market: Mid-size Segment—Percent Unit Sales Share, India, FY2016

- 22. Passenger Vehicles Market: Premium Segment—Percent Unit Sales Share, India, FY2016

- 23. Passenger Vehicles Market: Executive Segment—Percent Unit Sales Share, India, FY2016

- 24. Passenger Vehicles Market: UV Segment—Percent Unit Sales Share, India, FY2016

- 25. Passenger Vehicles Market: Vans Segment—Percent Unit Sales Share, India, FY2016

- 26. Passenger Vehicles Market: OEM-wise Production Share, India, FY2016

- 27. Passenger Vehicles Market: OEM-wise Domestic Sales Share, India, FY2016

- 28. Passenger Vehicles Market: OEM-wise Exports Share, India, FY2016

- 29. Passenger Vehicles Market: Production Forecast, India, FY2016–FY2020

- 30. Passenger Vehicles Market: Sales Forecast, India, FY2016–FY2020

- 31. Passenger Vehicles Market: Exports Forecast, India, FY2016–FY2020

- 32. Passenger Vehicles Market: Percent Unit Sales by Vehicle Segment, India, FY2016

- 33. Passenger Vehicles Market: Percent Unit Sales Forecast by Vehicle Segment, India, FY2020

- 34. Passenger Vehicles Market: Gasoline Diesel Share, India, FY2012–FY2016

- 35. Passenger Vehicles Market: Evolution of Bharat Stage Norms, India, FY2000–FY2020

- 36. Passenger Vehicles Market: Transformation from BS IV to BS VI, India, FY2016

- 37. Passenger Vehicles Market: Technology Solutions for Transformation, India, FY2016

- 38. Passenger Vehicles Market: Existing and Proposed GST Tax Scheme, India, 2017–2020

- 39. Passenger Vehicles Market: Safety Regulations and Ratings, Global, 2007–2020

- 40. Passenger Vehicles Market: Region-wise Model and Brand Preferences, FY2016

- 41. Passenger Vehicles Market: Sales Channels, US, FY2016

- 42. Passenger Vehicles Market: Sales Channels, UK, FY2016

- 43. Passenger Vehicles Market: Sales Channels, China, FY2016

- 44. Passenger Vehicles Market: Sales Channels, India, FY2016

- 45. Passenger Vehicles Market: Contribution from Various Channels, US, FY2016

- 46. Passenger Vehicles Market: Contribution from Various Channels, UK, FY2016

- 47. Passenger Vehicles Market: Contribution from Various Channels, China, FY2016

- 48. Passenger Vehicles Market: Contribution from Various Channels, India, FY2016

- 49. Passenger Vehicles Market: Online Selling Platform, India, FY2016

- 50. Passenger Vehicles Market: Used Car, Price Range vs Share, India, FY2016

- 51. Passenger Vehicles Market: Sales Showrooms of Major OEMs, India, FY2016

- 52. Passenger Vehicles Market: Percent Revenue Share, India, FY2016

- 53. Passenger Vehicles Market: Shares in Export Volumes by Geography, India, FY2016

- 54. Passenger Vehicles Market: Value of Auto Components Exports, India, FY2009–FY2016

- 55. Passenger Vehicles Market: Aftermarket Auto Components Imports Share, India, FY2016

- 56. Passenger Vehicles Market: Aftermarket Component Potential, India, FY2016

- 57. Passenger Vehicles Market: Current and Emerging Distribution Hubs, India, FY2016

- 58. Total Passenger Vehicles Market: Key Conclusions, India, FY2016

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Executive Summary—Key Findings~ || Executive Summary—Market Engineering Measurements~ || Executive Summary—PV Market Forecast~ || Executive Summary—Snapshot of Indian Manufacturing Segments~ | Research Scope, Objectives, Background, and Methodology~ || Research Scope~ || Research Aims and Objectives~ || Research Background~ || Research Methodology~ || Key OEMs or Participant Groups Compared in this Study~ | Definitions and Segmentation~ || Passenger Vehicle Segment Categorization~ | Mega Trends Impacting Indian Automotive Market~ || Five Main Trends in Urbanization~ || India Urbanization Rate~ || Smart City Investment~ || Indian Infrastructure—Estimated Trillion Dollar Investment~ || India GDP Projections—India Needs to Grow 10% Per Annum~ || The Middle Bulge~ || Working Age Demographic Dividend~ || Aging India~ || Make in India—Insights Behind the Initiative~ || Snapshot of Indian Manufacturing Segments~ || Key Policy Announcements—Doing Business In India~ | Indian Passenger Vehicles Market~ || Passenger Vehicles—Past Trends~ || Segment-wise Market Share—Domestic Sales FY2016~ || OEM-wise Share—Production, Domestic Sales, and Exports FY 2016~ || India’s Growth Outperformance Factors~ || Passenger Vehicles Market—Major Trends~ || Major Investments and Developments in the Indian PV Market~ | Market Drivers and Restraints~ || Market Drivers~ || Market Restraints~ | Indian Passenger Vehicles Market Forecast~ || Market Engineering Measurements~ || Passenger Vehicles—Market Forecast~ || Opportunity Pyramid FY2016~ || Opportunity Pyramid FY2020~ || Gasoline Diesel Equation in India Market~ | Legislative and Technological Trends in the Indian Passenger Vehicles Market~ || Evolution of Bharat Stage VI Norms in India~ || BS IV to BS VI Transformation—Reduction in Emission Caps~ || Euro V and Euro VI Compliance—Technology Solutions~ || Impact of GST on Indian Automotive Industry~ || Global Development of Active Safety Regulations and Ratings~ || Bharat New Vehicle Safety Assessment Program (BNVSAP)~ | Pre-owned Car Market~ || Region-wise Model and Brand Preferences~ || Key Global Used Car Markets~ || Online Selling Platform—Business Model~ || Used Car Price Analysis—Price Range vs Share~ | Passenger Vehicles Distribution/Channel Analysis~ || PV Sales Showroom of Major OEMs~ || Typical Revenue Streams in a Passenger Vehicle Dealership in India~ || Snapshots of New Formats of Auto Retail in India~ | Auto Components Sourcing and Exports—India~ || Indian Auto Components Industry Overview~ || Aftermarket Auto Components Imports, FY2016~ || PV Component Potential~ || Current Trends in Auto Component Distribution and Retail~ || Current and Emerging Distribution Hubs~ || Top Reasons OEMs Choose India as Component Sourcing Base~ | Conclusions and Future Outlook~ || Key Conclusions and Future Outlook~ || The Last Word—3 Big Predictions~ || Legal Disclaimer~ | Appendix~ || List of Exhibits~ | The Frost & Sullivan Story~ |

| List of Charts and Figures | 1. Passenger Vehicles Market: Sales Forecast, India, FY2016–FY2020~ 2. Passenger Vehicles Market: Key Industry Participants, India, FY2016~ 3. Passenger Vehicles Market: Cumulative Infrastructure Planned Outlay by Segment, India, 2013–2017~ 4. Passenger Vehicles Market: Key Market Drivers, India, FY2017–FY2020~ 5. Passenger Vehicles Market: Key Market Restraints, India, FY2017–FY2020~ 6. Passenger Vehicles Market: Market Engineering Measurements, India, FY2016–FY2020~ 7. Passenger Vehicles Market: Sales Forecast, India, FY2016–FY2020~| 1. Passenger Vehicles Market: Market Engineering Measurements, India, FY2016–FY2020~ 2. Passenger Vehicles Market: Production Forecast, India, FY2016–FY2020~ 3. Passenger Vehicles Market: Sales Forecast, India, FY2016–FY2020~ 4. Passenger Vehicles Market: Exports Forecast, India, FY2016–FY2020~ 5. Passenger Vehicles Market: Passenger Vehicle Segment Categorization, India, FY2016~ 6. Passenger Vehicles Market: Urbanization Rate of Highly Urban States and Mega Cities, India, 2025~ 7. Passenger Vehicles Market: Total Infrastructure Investment Needed, India, FY2020~ 8. Urban Infrastructure Investment, India, FY2016~ 9. Passenger Vehicles Market: Infrastructure Planned Outlay, India, 2013–2017~ 10. Passenger Vehicles Market: Nominal GDP Current Trajectory, India, FY2011, FY2014, FY2017, and FY2020~ 11. Passenger Vehicles Market: Nominal GDP Accelerated Trajectory, India, FY2011, FY2014, FY2017, and FY2020~ 12. Passenger Vehicles Market: Income Pyramid, India, 2012 and 2020~ 13. Passenger Vehicles Market: Working Age Demographic Dividend, India, 2015 and 2023~ 14. Passenger Vehicles Market: Population Pyramid, India, 2015 and 2023~ 15. Passenger Vehicles Market: Income Pyramid, India, 2012 and 2020~ 16. Passenger Vehicles Market: Past Trends, India, FY2009–FY2016~ 17. Passenger Vehicles Market: Micro Segment—Percent Unit Sales Share, India, FY2016~ 18. Passenger Vehicles Market: Mini Segment—Percent Unit Sales Share, India, FY2016~ 19. Passenger Vehicles Market: Compact Segment—Percent Unit Sales Share, India, FY2016~ 20. Passenger Vehicles Market: Super-compact Segment—Percent Unit Sales Share, India, FY2016~ 21. Passenger Vehicles Market: Mid-size Segment—Percent Unit Sales Share, India, FY2016~ 22. Passenger Vehicles Market: Premium Segment—Percent Unit Sales Share, India, FY2016~ 23. Passenger Vehicles Market: Executive Segment—Percent Unit Sales Share, India, FY2016~ 24. Passenger Vehicles Market: UV Segment—Percent Unit Sales Share, India, FY2016~ 25. Passenger Vehicles Market: Vans Segment—Percent Unit Sales Share, India, FY2016~ 26. Passenger Vehicles Market: OEM-wise Production Share, India, FY2016~ 27. Passenger Vehicles Market: OEM-wise Domestic Sales Share, India, FY2016~ 28. Passenger Vehicles Market: OEM-wise Exports Share, India, FY2016~ 29. Passenger Vehicles Market: Production Forecast, India, FY2016–FY2020~ 30. Passenger Vehicles Market: Sales Forecast, India, FY2016–FY2020~ 31. Passenger Vehicles Market: Exports Forecast, India, FY2016–FY2020~ 32. Passenger Vehicles Market: Percent Unit Sales by Vehicle Segment, India, FY2016~ 33. Passenger Vehicles Market: Percent Unit Sales Forecast by Vehicle Segment, India, FY2020~ 34. Passenger Vehicles Market: Gasoline Diesel Share, India, FY2012–FY2016~ 35. Passenger Vehicles Market: Evolution of Bharat Stage Norms, India, FY2000–FY2020~ 36. Passenger Vehicles Market: Transformation from BS IV to BS VI, India, FY2016~ 37. Passenger Vehicles Market: Technology Solutions for Transformation, India, FY2016~ 38. Passenger Vehicles Market: Existing and Proposed GST Tax Scheme, India, 2017–2020~ 39. Passenger Vehicles Market: Safety Regulations and Ratings, Global, 2007–2020~ 40. Passenger Vehicles Market: Region-wise Model and Brand Preferences, FY2016~ 41. Passenger Vehicles Market: Sales Channels, US, FY2016~ 42. Passenger Vehicles Market: Sales Channels, UK, FY2016~ 43. Passenger Vehicles Market: Sales Channels, China, FY2016~ 44. Passenger Vehicles Market: Sales Channels, India, FY2016~ 45. Passenger Vehicles Market: Contribution from Various Channels, US, FY2016~ 46. Passenger Vehicles Market: Contribution from Various Channels, UK, FY2016~ 47. Passenger Vehicles Market: Contribution from Various Channels, China, FY2016~ 48. Passenger Vehicles Market: Contribution from Various Channels, India, FY2016~ 49. Passenger Vehicles Market: Online Selling Platform, India, FY2016~ 50. Passenger Vehicles Market: Used Car, Price Range vs Share, India, FY2016~ 51. Passenger Vehicles Market: Sales Showrooms of Major OEMs, India, FY2016~ 52. Passenger Vehicles Market: Percent Revenue Share, India, FY2016~ 53. Passenger Vehicles Market: Shares in Export Volumes by Geography, India, FY2016~ 54. Passenger Vehicles Market: Value of Auto Components Exports, India, FY2009–FY2016~ 55. Passenger Vehicles Market: Aftermarket Auto Components Imports Share, India, FY2016~ 56. Passenger Vehicles Market: Aftermarket Component Potential, India, FY2016~ 57. Passenger Vehicles Market: Current and Emerging Distribution Hubs, India, FY2016~ 58. Total Passenger Vehicles Market: Key Conclusions, India, FY2016~ |

| Author | Mradula Sharma |

| Industries | Automotive |

| WIP Number | P9AB-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9801-A6,9883-A6,9889-A6,9882-A6,9AF6-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB