Fintech

The global experience with COVID-19 gave financial services companies a unique opportunity to refocus and rebuild the trust of their customers, ultimately leading to their loyalty. Banking is now embedded in the customers’ lifestyle; and as part of banks' continued digital transformation, they can serve their customers through multiple channels and technologies. The use of technology to automate processes removes internal obstacles and creates a seamless customer experience. Key to this automation is advances like AI, data analytics, and systems that can react quickly to the market.

The acceleration of work-from-home culture and convergence of technology with financial services (Fintech) aligns with Frost & Sullivan's own breadth and depth of expertise. Frost & Sullivan tracks the digital transformation of financial services companies and fintech disruptors. The Fintech industry is extensive. It is comprised of multiple subsectors; each of which have trends specific to them, and to each global region. Having a 360-degree view of emerging technologies, the global financial services industry, and regional expertise creates a unique perspective that is valuable to our research and advisory for clients.

The Fintech subsectors we cover include:

• Verticals: Digital Banking, Insurtech, Wealthtech

• Enablers: Cloud, Data and Analytics, Blockchain, Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT)

• Services: Lending Platforms, Regtech, Paytech

-

12 Oct 2017 | North America

An End User Perspective on Navigating Digital Transformation in Finance, Banking, and Insurance, Global, 2017

Gain a Competitive Advantage Using Insights from IT Buyers

The overall research objective is to measure the current use and future decision making behavior toward information technology (IT) in Finance, Banking, and Insurance, specifically: Enterprise Mobility Management, eCommerce/mCommerce, Unified Communications & Collaboration (UCC), Infrastructure and Data Centers, Big Data and Analytics’ Omnichanne...

$3,000.00

Special Price $2,250.00 save 25 %

-

28 Sep 2017 | Global

AI and Big Data Technologies Transforming Financial Services

The Convergence of Big Data and AI Enabling Financial Services Automation

Artificial Intelligence (AI) and Big Data has emerged to be the most essential technologies to develop fintech applications. The technologies has advanced significantly over the ages to empower applications and machines to learn from its own experiences, unravel hidden patterns in data, generate insights and take automated decisions. Technology evo...

$4,950.00

Special Price $3,712.50 save 25 %

-

21 Jul 2017 | Global

Disruption in Global Financial Services, 2017—Machine Learning is Imperative

Realigning Customer Engagement with Predictive Analytics and Customization

Technology is disrupting the financial services industry. Also termed fintech, tech-enabled products and services in the industry are further enhanced by advanced technologies such as cloud, IoT, analytics, artificial intelligence (AI), and machine language (ML). This research service explores the impact of ML on the financial services industry. Th...

$3,000.00

Special Price $2,250.00 save 25 %

-

11 Jul 2017 | North America

Banking-as-a-Service to Bring Agility and Flexibility to Financial Services, Forecast to 2023

Open Banking Becomes a Key Influencer of Customer Satisfaction and Retention

Financial services industry has been remarkably disrupted by innovative technologies and new business models to-date. Customers are demanding more customer centric, digital solutions from banks as they are becoming more digitally aware of solutions that are being offered by companies outside financial services. The pace of innovation is rapid in fi...

$3,000.00

Special Price $2,250.00 save 25 %

-

07 Jul 2017 | Asia Pacific

Life Insurance Industry Outlook in Singapore

How Insurtech is Disrupting the Industry

The ecosystem is expected to experience a paradigm shift with increasing number of insurers looking at digital transformation to stay competitive and to engage customers better by offering more partnerships and collaborations with digital disruptors, relaxed insurance regime, customer-centric product innovations, infrastructure enhancement to reduc...

$1,500.00

Special Price $1,125.00 save 25 %

-

20 Jun 2017 | North America

Global IoT in Financial Services Market, 2017

Strategic Investments in Effective Customer Engagement Result in Useful Data Insights for Growth

The financial services industry has been remarkably disrupted by innovative technologies and new business models. While the pace of innovation is rapid in financial services, IoT is still at a nascent level in this complex and highly regulated industry. However, the industry now appears to be at a point of articulation as the stakeholders from the ...

$3,000.00

Special Price $2,250.00 save 25 %

-

19 Jun 2017 | North America

Fintech in the Global Automotive Industry, Forecast to 2025

Average Fintech Investment Portfolio of Automotive OEMs to Grow 15x to $230 Million by 2025

This research service provides a comprehensive overview of the fintech landscape in the automotive industry. It covers the application and use cases of fintech-powered innovation in the following 5 segments: 1. Automotive Leasing & Finance 2. Automotive Insurance 3. Digital Automotive Retailing 4. Digital Payments 5. Automotive Convenience and E...

$4,950.00

Special Price $3,712.50 save 25 %

-

08 May 2017 | Global

Global InsurTech Market, Forecast to 2022

Technologies such as AI, ML, and IoT Enable Insurers to Obtain Effective Insights on Customer Behavior and Help Improve their Operational Efficiency

Unlike other areas in financial services, the insurance market has not been remarkably disrupted by innovative technologies and new business models until now. While the pace of innovation is rapid in financial services, insurance is still a complex and a highly regulated market. However, it appears to be at a point of articulation, as stakeholders ...

$3,000.00

Special Price $2,250.00 save 25 %

-

21 Apr 2017 | Europe

Cloud Platforms Powering FinTech in Europe, 2017

Financial Services Industry to Move Core Services to the Cloud in the Next 2–3 Years

In terms of cloud adoption, the financial services industry has been lagging unlike many other industry sectors. While the benefits of cloud adoption are not unknown, there was initial hesitation on account of legacy infrastructure, lack of clarity on regulations, concerns related to compliance and data security. Cloud providers, upon understanding...

$3,000.00

Special Price $2,250.00 save 25 %

-

15 Feb 2017 | Latin America

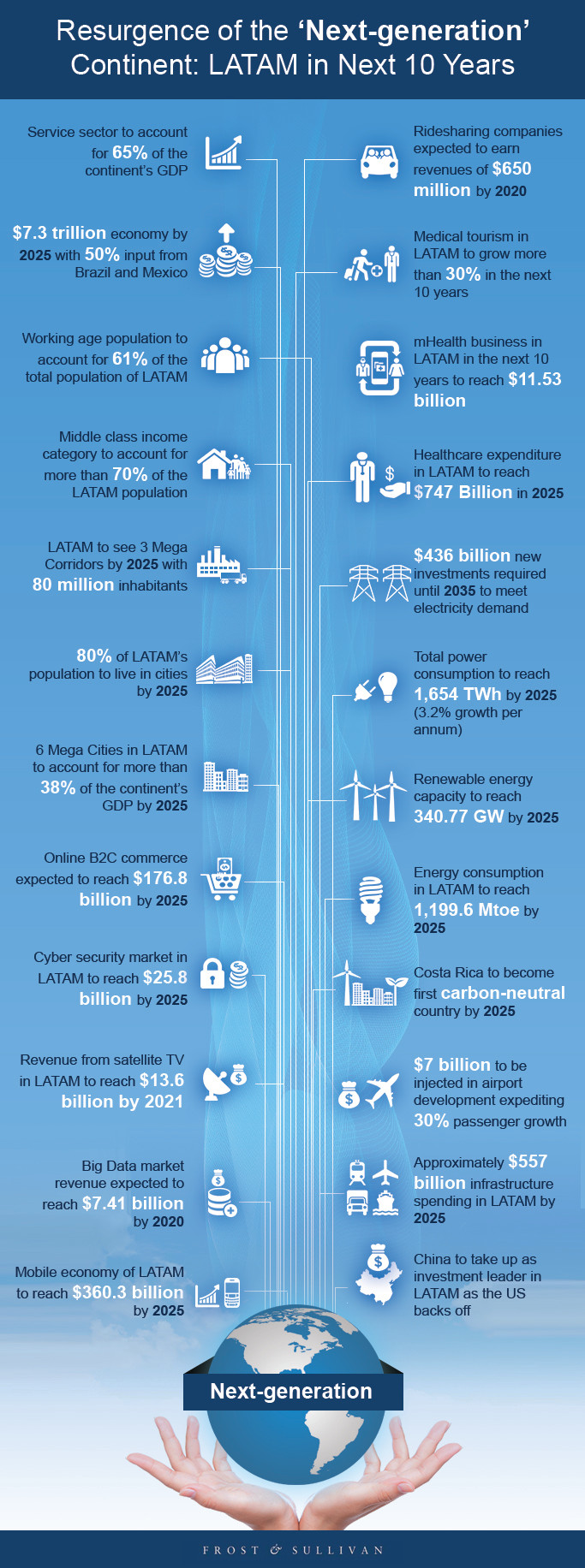

Mega Trends in LATAM, Forecast to 2025

Resurgence of the Next-generation Continent through Economic Growth Supported by Digital Inclusion and Technology Innovation

Most of the economies of LATAM are dependent on external forces such as the Chinese and the US economy, global commodity, and oil prices. With the slightest fluctuations in these economies, LATAM economies will be impacted the most. In the past years, LATAM had been sluggish in growth, due to falling commodity prices and oil price volatility. After...

$7,000.00

Special Price $5,250.00 save 25 %

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB