Information Technology/Operational Technology (IT/OT) Security Convergence in the Smart Building Technology Market, Forecast to 2022

Information Technology/Operational Technology (IT/OT) Security Convergence in the Smart Building Technology Market, Forecast to 2022

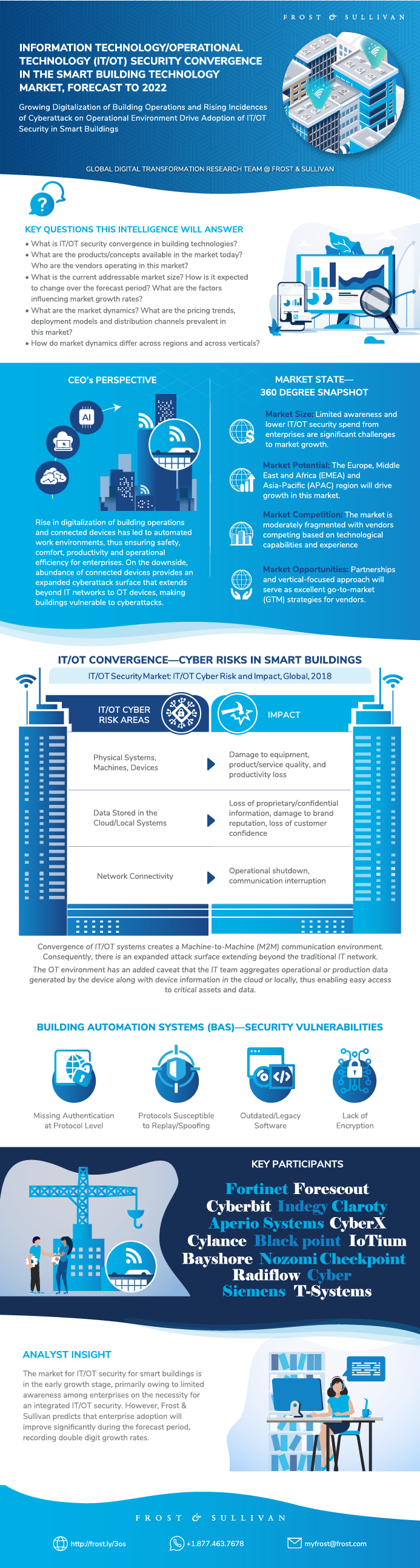

Digitalization and Cyberattacks driving adoption of IT/OT Security in Smart Buildings

30-Jul-2019

Europe

Description

Automation, IoT, and digitalization are rapidly changing, and enterprise operations and building operations have not made an exception either. Today, smart devices control building management activities including temperature control, access control, lighting control, communication, and safety systems in many enterprises. At the same time, such converged Information Technology/Operational Technology (IT/OT) environment has made enterprises more vulnerable to cyberattacks. With diverse protocols, hardware, and software systems, the OT devices controlling building operations provide a heterogeneous environment. Coupled with IT devices and a common network connection, the attack surface expands, providing a thriving ground for cyberadversaries to play on.

This study explores the impact of such IT/OT convergence in smart buildings on the cyber posture of an enterprise. The study provides detailed insights on key market trends, risk posture, market dynamics, and vendor dynamics in this market.

Research Scope

Geographical Analysis:

- Europe, the Middle East, and Africa

- Asia-Pacific

- North America and Latin America

The base year for the study is 2018 and the forecast period is from 2019 to 2022.

Insights included:

- Market Dynamics

- Market Trends

- IT/OT Security Risk Matrix Across Verticals and Regions

- Competitor Analysis and Key Vendor Profiles

- Insights for CISOs

- Growth Opportunities

Research Highlights

The IT/OT security market for smart buildings is in its early growth stage, contributing to a small percentage of Industrial Cybersecurity Systems (ICS) security vendors. Growing frequency of cyberattacks exploiting gaps in building OT devices is driving remarkable increase in adoption of IT/OT security among enterprises. However, security budget constraint continues to be a significant challenge for growth. Verticals such as healthcare, hospitality, finance, and data centers promise high growth opportunities for vendors in this market owing to the high cost of impact of cyberattacks in these verticals. Technological capabilities, scalability, and interoperability are key factors of differentiation among vendors operating in the IT/OT security market.

Author: Swetha Ramachandran Krishnamoorthi

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Market State—360 Degree Snapshot

Research Scope

Research Scope (continued)

Key Questions this Study will Answer

Market Definitions

Geographical Segmentation

Internet of Things (IoT) Penetration

IoT Penetration by Region

Smart Building Control Devices—Commercial

Smart Building Control Devices—Commercial (continued)

IT/OT Convergence

IT/OT Convergence—Merits Versus Risks

Notable IT/OT Cyberattacks

IT/OT Convergence—Cyber Risks in Smart Buildings

BAS

BAS—Security Vulnerabilities

IT/OT Security—Entry Points

IT/OT Security Ecosystem—Types of Stakeholders

Distribution Channels

Distribution Channels—Discussion

Business Models

Regulations and Standards

Market Impact of Growth Trends

Digitization of Building Operations

IT/OT Cybersecurity Spend

IT/OT Security Implementation Challenges

Technology (Mis)Alignment

Forecast Assumptions

Risks to Frost & Sullivan Market Forecasts

Revenue Forecast

Revenue Forecast Discussion

Percent Revenue Forecast by Business Size

Percent Revenue Forecast Discussion by Business Size

Percent Revenue Forecast by Region

Revenue Forecast by Region

Revenue Forecast Discussion by Region

Percent Revenue Forecast by Verticals

Revenue Forecast by Verticals

Revenue Forecast Discussion by Verticals

IT/OT Security Risk Matrix

IT/OT Security Risk Matrix by Verticals

IT/OT Security Risk Matrix Discussion by Verticals

IT/OT Security Risk Matrix by Country/Region

IT/OT Security Risk Matrix Discussion by Country/Region

Competitive Environment

Key Competitor Profile—Aperio Systems (Aperio)

Key Competitor Profile—Aperio Systems (Aperio) (continued)

Key Competitor Profile—Bayshore Networks (Bayshore)

Key Competitor Profile—Bayshore Networks (Bayshore) (continued)

Key Competitor Profile—Check Point Software Technologies (Check Point)

Key Competitor Profile—Check Point Software Technologies (Check Point) (continued)

Key Competitor Profile—Claroty

Key Competitor Profile—Claroty (continued)

Key Competitor Profile—Cyberbit

Key Competitor Profile—Cyberbit (continued)

Key Competitor Profile—Forescout Technologies (Forescout)

Key Competitor Profile—Forescout Technologies (Forescout) (continued)

Key Competitor Profile—Fortinet

Key Competitor Profile—Fortinet (continued)

Key Competitor Profile—Indegy

Key Competitor Profile—Indegy (continued)

Key Competitor Profile—Iotium

Key Competitor Profile—Iotium (continued)

Key Competitor Profile—Radiflow

Key Competitor Profile—Radiflow (continued)

Key Competitor Profile—Siemens Smart Infrastructure

Key Competitor Profile—Siemens Smart Infrastructure (continued)

Key Competitor Profile—Siemens Smart Infrastructure (continued)

Key Competitor Profile—T-Systems Telekom Security (T-Systems)

Key Competitor Profile—T-Systems Telekom Security (T-Systems) (continued)

Implementation Steps

Step 1—Asset Inventory

Step 2—Vulnerability, Risk, and Impact Assessment

Step 3—Stakeholder Responsibility

Step 4—Vendor Selection

Step 5—Continued Audit and Improvement

Frost & Sullivan Cyber Resilience Model

Common Mistakes to Avoid

Growth Opportunity 1—Deep Learning and AI

Growth Opportunity 2—Partnerships

Growth Opportunity 3—Vertical Focus

Growth Opportunity 4—Threat Protection

Strategic Imperatives for Success and Growth

The Last Word

Legal Disclaimer

Partial List of Companies Interviewed

Learn More—Next Steps

List of Exhibits

List of Exhibits (continued)

The Frost & Sullivan Story

Value Proposition—Future of Your Company & Career

Global Perspective

Industry Convergence

360º Research Perspective

Implementation Excellence

Our Blue Ocean Strategy

Popular Topics

Research Scope

Geographical Analysis:

- Europe, the Middle East, and Africa

- Asia-Pacific

- North America and Latin America

The base year for the study is 2018 and the forecast period is from 2019 to 2022.

Insights included:

- Market Dynamics

- Market Trends

- IT/OT Security Risk Matrix Across Verticals and Regions

- Competitor Analysis and Key Vendor Profiles

- Insights for CISOs

- Growth Opportunities

Research Highlights

The IT/OT security market for smart buildings is in its early growth stage, contributing to a small percentage of Industrial Cybersecurity Systems (ICS) security vendors. Growing frequency of cyberattacks exploiting gaps in building OT devices is driving remarkable increase in adoption of IT/OT security among enterprises. However, security budget constraint continues to be a significant challenge for growth. Verticals such as healthcare, hospitality, finance, and data centers promise high growth opportunities for vendors in this market owing to the high cost of impact of cyberattacks in these verticals. Technological capabilities, scalability, and interoperability are key factors of differentiation among vendors operating in the IT/OT security market.

Author: Swetha Ramachandran Krishnamoorthi

| No Index | No |

|---|---|

| Podcast | No |

| Author | Swetha Ramachandran Krishnamoorthi |

| Industries | Information Technology |

| WIP Number | ME8F-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9705-C1,9AA6-C1,9659,9B07-C1 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB