Middle East Homeland Security Market, 2015

Middle East Homeland Security Market, 2015

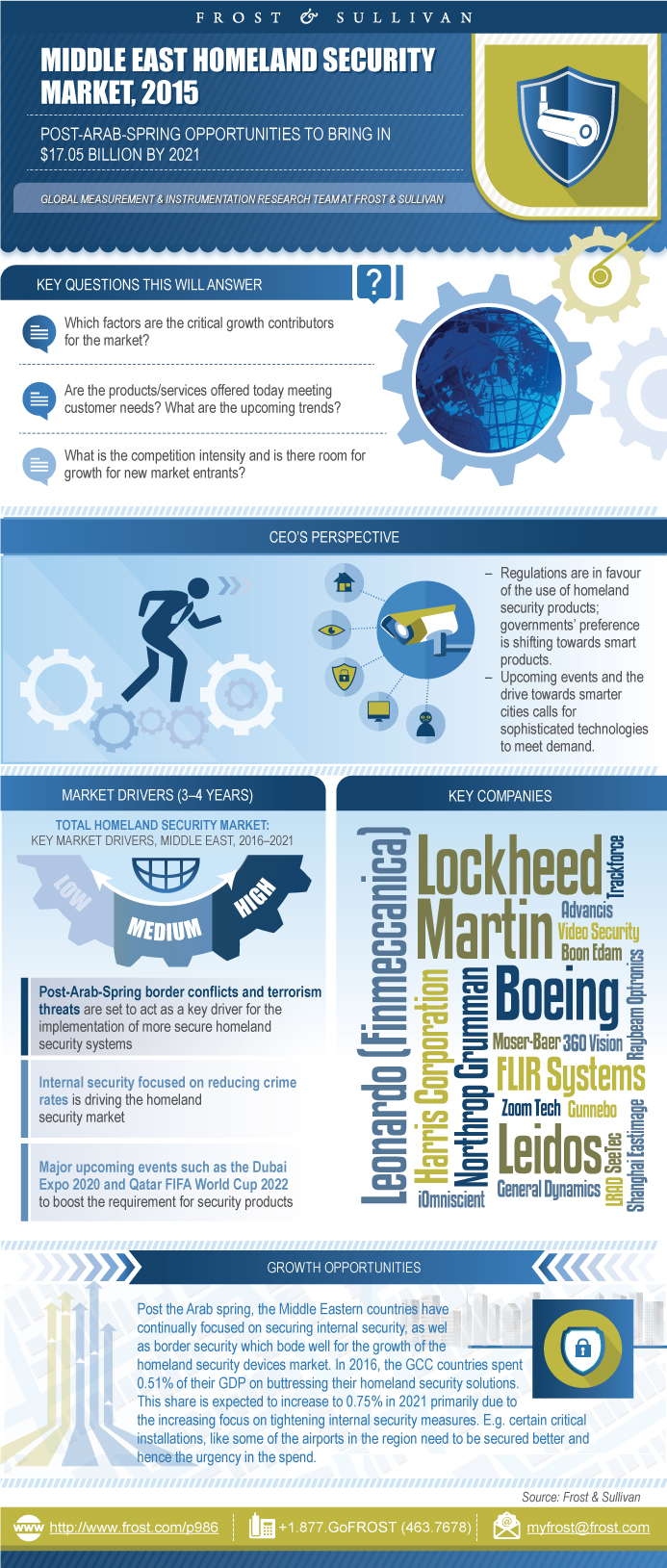

Post-Arab-Spring Opportunities to Bring in $17.05 Billion by 2021

04-Apr-2017

South Asia, Middle East & North Africa

Description

The Middle Eastern Homeland Security market will grow at a CAGR of 15.5% to achieve $17.05 billion by 2021, strongly driven by government initiatives to create a smart and secure environment amidst high terrorist activities in the region. The Middle Eastern Homeland Security market registered a revenue of $7.19 billion in 2015.

Frost and Sullivan defines the Middle Eastern Homeland Security market as comprising three market segments: Monitoring and Surveillance Systems, Restricted Entry Systems and Perimeter Security Solutions. Each segment has unique trends which are expected to drive the market in the identified verticals: Government, O&G and Transportation. This report focuses on the way these segments will grow by 2021, and the opportunities that are available for the companies participating in this space.

Despite cuts in military budgets and spending, the governments’ focus towards procuring smart and intelligent security solutions to preserve internal security has remained undeterred. Clearly laid out regulations help companies identify the needs of a particular vertical, but the challenge is to provide appealing value additions while keeping the cost factor in mind. In country-wise analysis, Saudi Arabia will have largest market share of 45.9% of the total market. Factors such as being host to several major events such as Dubai Expo 2020 and Qatar FIFA World Cup 2022 provide lucrative opportunities which can be utilized effectively with a sound strategic plan.

Market revenue in this report was derived from discussions with industry participants, review of company annual reports, secondary sources and information gathered from Frost & Sullivan’s in-house database.

The base year for the analysis is 2015, and the forecast period is 2016 to 2021. Revenue is provided in US dollars.

Key Questions This Study Will Answer

1. What is the state of the planned investments on Internal Security?

2. What are the growing trends in the Middle Eastern Homeland Security Market?

3. What are the trends and growth pattern of identified segments: Monitoring and Surveillance Systems, Restricted Entry Systems and Perimeter Security Solutions?

4. What opportunities does the market hold for Tier II and Tier III players?

5. What are the strategies that companies can make use of to exploit the opportunity at hand?

Frost & Sullivan has determined that rising trends such as integrated solutions, among the segments, will be a game changer in the coming years. System Integrators and Designers will have ample opportunities for growth. The shift towards smart solutions is a key growth driver in the long run, as the infrastructure of the economies is set to develop over the new few years. The study provides an understanding of the opportunities and requirements of each segment and end-user vertical to help the reader make informed decisions.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Market Engineering Measurements

CEO’s Perspective

Market Definitions

Market Segmentation by Product Type

Market Drivers

Market Restraints

Market Engineering Measurements

Revenue Forecast

Percent Revenue Forecast by Country

Revenue Forecast by Country

Revenue Forecast by End-user Vertical

Industry Structure

Products & Solutions—Route to Market

Market Share

Market Share Analysis

Competitive Environment

Growth Opportunity 1—Integrated Designing

Growth Opportunity 2—Country-wise Product Offering

Growth Opportunity 3—Smart Surveillance

Growth Opportunity 4—Regulations for Specific Events

Growth Opportunity 5—Connected Devices & Real-time Analytics

Strategic Imperatives for Success and Growth

Market Engineering Measurements

Revenue Forecast

Revenue Forecast by End-user Vertical

Key Trends

Competitive Factors and Assessment

Market Engineering Measurements

Revenue Forecast

Revenue Forecast by End-user Vertical

Key Trends

Competitive Factors and Assessment

Market Engineering Measurements

Revenue Forecast

Revenue Forecast by End-user Vertical

Key Trends

Competitive Factors and Assessment

Key Findings

Market Engineering Measurements

Revenue Forecast

Key Findings

Market Engineering Measurements

Revenue Forecast

Key Findings

Market Engineering Measurements

Revenue Forecast

Revenue Forecast

Revenue Forecast

Revenue Forecast

Revenue Forecast

Revenue Forecast

Revenue Forecast

Revenue Forecast

3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

- 1. Total Homeland Security Market: Key Market Drivers, Middle East, 2016–2021

- 2. Total Homeland Security Market: Key Market Restraints, Middle East, 2016–2021

- 3. Total Homeland Security Market: Market Engineering Measurements, Middle East, 2015

- 4. GDP, Middle East, 2015–2021E

- 5. Military Expenditure, GCC, 2010–2015

- 6. Total Homeland Security Market: Revenue Forecast by Country, Middle East, 2015–2021

- 7. Total Homeland Security Market, Industry Structure, Middle East, 2015

- 8. Total Homeland Security Market: Competitive Structure, Middle East, 2015

- 9. Monitoring & Surveillance Systems Segment: Market Engineering Measurements, Middle East, 2015

- 10. Restricted Entry Systems Segment: Market Engineering Measurements, Middle East, 2015

- 11. Perimeter Security Solutions Segment: Market Engineering Measurements, Middle East, 2015

- 12. Government End-user Vertical: Market Engineering Measurements, Middle East, 2015

- 13. Oil and Gas Segment: Market Engineering Measurements, Middle East, 2015

- 14. Transportation Segment: Market Engineering Measurements, Middle East, 2015

- 15. Key Public Projects, KSA, 2015–2035

- 16. Key Public Projects, UAE, 2015–2035

- 17. Key Public Projects, Qatar, 2015–2035

- 18. Key Public Projects, Kuwait, 2015–2035

- 19. Key Public Projects, Oman, 2015–2035

- 20. Key Public Projects, Bahrain, 2015–2035

- 21. Key Public Projects, RoME, 2015–2035

- 1. Total Homeland Security Market: Market Engineering Measurements, Middle East, 2015

- 2. Total Homeland Security Market: Percent Revenue Breakdown by Product Type, Middle East, 2015

- 3. Government Projects* Awarded, Middle East, 2014–2017

- 4. Total Homeland Security Market: Revenue Forecast, Middle East, 2015–2021

- 5. Total Homeland Security Market: Percent Revenue Forecast by Country, Middle East, 2015–2021

- 6. Total Homeland Security Market: Revenue Forecast by End-user Vertical, Middle East, 2015–2021

- 7. Total Homeland Security Market, Industry Structure, Middle East, 2015

- 8. Total Homeland Security Market: Route to Market, Middle East, 2015

- 9. Total Homeland Security Market: Percent Revenue Breakdown, Middle East, 2015

- 10. Monitoring & Surveillance Systems Segment: Revenue Forecast, Middle East, 2015–2021

- 11. Estimated Investment in Surveillance-Related Projects, GCC, 2014–2017

- 12. Monitoring & Surveillance Systems Segment: Revenue Forecast by End-user Vertical, Middle East, 2015–2021

- 13. Monitoring & Surveillance Systems Segment: Success Factors, Middle East, 2015

- 14. Restricted Entry Systems Segment: Revenue Forecast, Middle East, 2015–2021

- 15. Restricted Entry Systems Segment: Revenue Forecast by End-user Vertical, Middle East, 2015–2021

- 16. Restricted Entry Systems Segment: Success Factors, Middle East, 2015

- 17. Perimeter Security Solutions Segment: Revenue Forecast, Middle East, 2015–2021

- 18. Perimeter Security Solutions Segment: Revenue Forecast by End-user Vertical, Middle East, 2015–2021

- 19. Perimeter Security Solutions Market: Success Factors, Middle East, 2015

- 20. Government End-User Vertical: Revenue Forecast, Middle East, 2015–2021

- 21. Oil and Gas Segment: Revenue Forecast, Middle East, 2015–2021

- 22. Public O&G Projects Awarded, Middle East, 2014–2017

- 23. Transportation Segment: Revenue Forecast, Middle East, 2015–2021

- 24. Homeland Security Market: Revenue Forecast, KSA, 2015–2021

- 25. GDP, KSA, 2015–2021

- 26. Homeland Security Market: Revenue Forecast, UAE, 2015–2021

- 27. GDP, UAE, 2015–2021

- 28. Key Public Projects, UAE, 2015–2035

- 29. Homeland Security Market: Revenue Forecast, Qatar, 2015–2021

- 30. GDP, Qatar, 2015–2021

- 31. Homeland Security Market: Revenue Forecast, Kuwait, 2015–2021

- 32. GDP, Kuwait, 2015–2021

- 33. Homeland Security Market: Revenue Forecast, Oman, 2015–2021

- 34. GDP, Oman, 2015–2021

- 35. Homeland Security Market: Revenue Forecast, Bahrain, 2015–2021

- 36. GDP, Bahrain, 2015–2021

- 37. Homeland Security Market: Revenue Forecast, RoME, 2015–2021

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || Market Engineering Measurements~ || CEO’s Perspective~ | Market Overview~ || Market Definitions~ || Market Segmentation by Product Type~ | Drivers and Restraints~ || Market Drivers~ ||| Post-Arab-Spring border conflicts and terrorism threats~ ||| Internal security focused on reducing crime rates~ ||| Major upcoming events such as the Dubai Expo 2020 and Qatar FIFA World Cup 2022~ || Market Restraints~ ||| Budgetary constraints~ ||| The lack of infrastructure to support technology~ ||| The requirements for entry into the Homeland Security~ | Forecast and Trends~ || Market Engineering Measurements~ || Revenue Forecast~ || Percent Revenue Forecast by Country~ || Revenue Forecast by Country~ || Revenue Forecast by End-user Vertical~ || Industry Structure~ || Products & Solutions—Route to Market~ | Market Share and Competitive Analysis~ || Market Share~ || Market Share Analysis~ || Competitive Environment~ | Growth Opportunities and Companies to Action~ || Growth Opportunity 1—Integrated Designing~ || Growth Opportunity 2—Country-wise Product Offering~ || Growth Opportunity 3—Smart Surveillance~ || Growth Opportunity 4—Regulations for Specific Events~ || Growth Opportunity 5—Connected Devices & Real-time Analytics~ || Strategic Imperatives for Success and Growth~ | Monitoring & Surveillance Systems Segment Analysis~ || Market Engineering Measurements~ || Revenue Forecast~ || Revenue Forecast by End-user Vertical~ || Key Trends~ || Competitive Factors and Assessment~ | Restricted Entry Systems Segment Analysis~ || Market Engineering Measurements~ || Revenue Forecast~ || Revenue Forecast by End-user Vertical~ || Key Trends~ || Competitive Factors and Assessment~ | Perimeter Security Solutions Segment Analysis~ || Market Engineering Measurements~ || Revenue Forecast~ || Revenue Forecast by End-user Vertical~ || Key Trends~ || Competitive Factors and Assessment~ | End-User Vertical Analysis—Government~ || Key Findings~ || Market Engineering Measurements~ || Revenue Forecast~ | End-User Vertical Analysis—Oil and Gas~ || Key Findings~ || Market Engineering Measurements~ || Revenue Forecast~ | End-User Vertical Analysis—Transportation~ || Key Findings~ || Market Engineering Measurements~ || Revenue Forecast~ | Country Analysis—The Kingdom of Saudi Arabia~ || Revenue Forecast~ | Country Analysis—United Arab Emirates~ || Revenue Forecast~ | Country Analysis—Qatar~ || Revenue Forecast~ | Country Analysis—Kuwait~ || Revenue Forecast~ | Country Analysis—Oman~ || Revenue Forecast~ | Country Analysis—Bahrain~ || Revenue Forecast~ | Country Analysis—Rest of Middle East~ || Revenue Forecast~ | The Last Word~ || 3 Big Predictions~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ |

| List of Charts and Figures | 1. Total Homeland Security Market: Key Market Drivers, Middle East, 2016–2021~ 2. Total Homeland Security Market: Key Market Restraints, Middle East, 2016–2021~ 3. Total Homeland Security Market: Market Engineering Measurements, Middle East, 2015~ 4. GDP, Middle East, 2015–2021E~ 5. Military Expenditure, GCC, 2010–2015~ 6. Total Homeland Security Market: Revenue Forecast by Country, Middle East, 2015–2021~ 7. Total Homeland Security Market, Industry Structure, Middle East, 2015~ 8. Total Homeland Security Market: Competitive Structure, Middle East, 2015~ 9. Monitoring & Surveillance Systems Segment: Market Engineering Measurements, Middle East, 2015~ 10. Restricted Entry Systems Segment: Market Engineering Measurements, Middle East, 2015~ 11. Perimeter Security Solutions Segment: Market Engineering Measurements, Middle East, 2015~ 12. Government End-user Vertical: Market Engineering Measurements, Middle East, 2015~ 13. Oil and Gas Segment: Market Engineering Measurements, Middle East, 2015~ 14. Transportation Segment: Market Engineering Measurements, Middle East, 2015~ 15. Key Public Projects, KSA, 2015–2035~ 16. Key Public Projects, UAE, 2015–2035~ 17. Key Public Projects, Qatar, 2015–2035~ 18. Key Public Projects, Kuwait, 2015–2035~ 19. Key Public Projects, Oman, 2015–2035~ 20. Key Public Projects, Bahrain, 2015–2035~ 21. Key Public Projects, RoME, 2015–2035~| 1. Total Homeland Security Market: Market Engineering Measurements, Middle East, 2015~ 2. Total Homeland Security Market: Percent Revenue Breakdown by Product Type, Middle East, 2015~ 3. Government Projects* Awarded, Middle East, 2014–2017~ 4. Total Homeland Security Market: Revenue Forecast, Middle East, 2015–2021~ 5. Total Homeland Security Market: Percent Revenue Forecast by Country, Middle East, 2015–2021~ 6. Total Homeland Security Market: Revenue Forecast by End-user Vertical, Middle East, 2015–2021~ 7. Total Homeland Security Market, Industry Structure, Middle East, 2015~ 8. Total Homeland Security Market: Route to Market, Middle East, 2015~ 9. Total Homeland Security Market: Percent Revenue Breakdown, Middle East, 2015~ 10. Monitoring & Surveillance Systems Segment: Revenue Forecast, Middle East, 2015–2021~ 11. Estimated Investment in Surveillance-Related Projects, GCC, 2014–2017~ 12. Monitoring & Surveillance Systems Segment: Revenue Forecast by End-user Vertical, Middle East, 2015–2021~ 13. Monitoring & Surveillance Systems Segment: Success Factors, Middle East, 2015~ 14. Restricted Entry Systems Segment: Revenue Forecast, Middle East, 2015–2021~ 15. Restricted Entry Systems Segment: Revenue Forecast by End-user Vertical, Middle East, 2015–2021~ 16. Restricted Entry Systems Segment: Success Factors, Middle East, 2015~ 17. Perimeter Security Solutions Segment: Revenue Forecast, Middle East, 2015–2021~ 18. Perimeter Security Solutions Segment: Revenue Forecast by End-user Vertical, Middle East, 2015–2021~ 19. Perimeter Security Solutions Market: Success Factors, Middle East, 2015~ 20. Government End-User Vertical: Revenue Forecast, Middle East, 2015–2021~ 21. Oil and Gas Segment: Revenue Forecast, Middle East, 2015–2021~ 22. Public O&G Projects Awarded, Middle East, 2014–2017~ 23. Transportation Segment: Revenue Forecast, Middle East, 2015–2021~ 24. Homeland Security Market: Revenue Forecast, KSA, 2015–2021~ 25. GDP, KSA, 2015–2021~ 26. Homeland Security Market: Revenue Forecast, UAE, 2015–2021~ 27. GDP, UAE, 2015–2021~ 28. Key Public Projects, UAE, 2015–2035~ 29. Homeland Security Market: Revenue Forecast, Qatar, 2015–2021~ 30. GDP, Qatar, 2015–2021 ~ 31. Homeland Security Market: Revenue Forecast, Kuwait, 2015–2021~ 32. GDP, Kuwait, 2015–2021~ 33. Homeland Security Market: Revenue Forecast, Oman, 2015–2021~ 34. GDP, Oman, 2015–2021~ 35. Homeland Security Market: Revenue Forecast, Bahrain, 2015–2021~ 36. GDP, Bahrain, 2015–2021~ 37. Homeland Security Market: Revenue Forecast, RoME, 2015–2021~ |

| Author | Attaurrahman Ojindaram Saibasan |

| Industries | Aerospace, Defence and Security |

| WIP Number | P986-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB