Strategic Analysis of Global Shared Mobility Value Chain, Forecast to 2030

Strategic Analysis of Global Shared Mobility Value Chain, Forecast to 2030

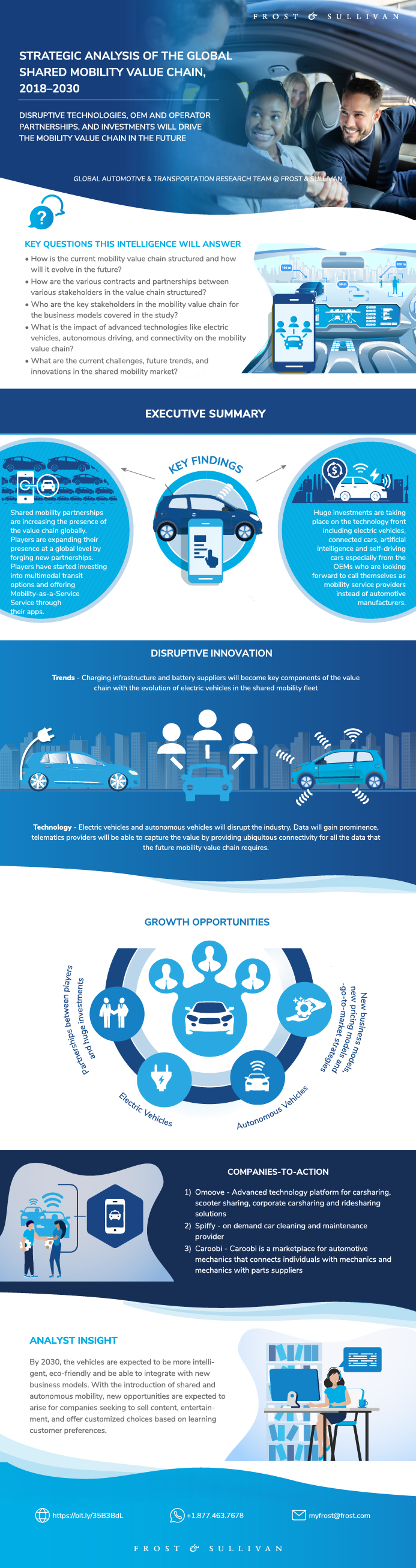

Disruptive Technologies, OEM and Operator Partnerships, and Investments will Drive the Mobility Value Chain in the Future

31-Dec-2019

Global

Description

The study aims to analyse and forecast the global mobility value chain and technology trends for 2018. Shared mobility companies depend heavily on aftermarket service providers for procuring fleet, conducting maintenance and repairs, and deploying technology for smooth operations. Shared mobility partnerships are increasing the presence of the value chain globally. Participants are expanding their presence at the global level by forging new partnerships. They have started investing in multimodal transit options and offering Mobility as a Service (MaaS) through their apps. Fleet providers such as leasing companies, rental companies, and OEMs have started diversifying their business models to become shared mobility operators.

This study analyses the shared mobility value chain and looks into the key trends, partnerships, and disruptions in the value chain that exist for companies and key stakeholders to action upon in the near future.

Research Scope

- To provide a strategic overview of the global mobility value chain market (Europe, US, China)

- To offer insight into the various offerings of mobility value chain providers

- To analyse the new growth paradigm, business models, and revenue models

- To identify key partnerships in the mobility value chain

- To identify innovations in the mobility value chain

- To offer strategic conclusions and recommendations

Market measurements are analysed for the year of 2018 and forecasted till 2030. The carsharing and ridehailing market are forecasted region wise by the number of members and vehicles. An extensive list of key value chain participants and their business models is discussed in this study.

An overview of the carsharing and ridehailing market and their value chain, key trends and market disruptions are have been provided. The base year for the study is 2018 and 2030 is the end of the forecast period. Cities around the globe are dealing with issues like urbanisation, pollution, and congestion, and the end customer for the shared mobility space is changing from individuals and businesses to governments and cities. The shared mobility space is witnessing high growth, driven by increased partnership between shared mobility operators, OEMs, and other participants in the value chain.

With the introduction of shared and autonomous mobility, new opportunities are expected to arise for companies seeking to sell content, entertainment, and offer customised choices based on learning customer preferences.

With disruptive forces like electric vehicles, on-demand mobility and autonomous vehicles companies are seizing emerging opportunities and making changes in their business models with the right partnerships. Charging infrastructure and battery suppliers will become key components of the value chain with the evolution of electric vehicles in the shared mobility fleet.

The introduction of autonomous vehicles is expected to provide new business opportunities for value chain providers. Data service providers and parking providers will play a major role with the introduction of autonomous vehicles in the shared mobility fleet. Fleet providers will play a major role with the introduction of AVs, as the vehicles will be owned by the mobility companies. Technology providers are expected to partner with OEMs to provide technology stacks.

With the introduction of more connected vehicles and growing telematics, data will play a critical role for value chain participants and fleet managers to eliminate paperwork and get notifications for maintenance, fuelling, insurance, and so on.

The shared mobility space is expected to be more diverse with more participating industries and disrupting trends like electrification, connectivity, and autonomous driving, e.g., electric vehicles , maintenance, car repair, fueling, etc. Value chain providers should invest in providing mobile services for fleet managers and drivers to utilise their time properly.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Carsharing Value Chain—Snapshot

eHailing Value Chain—Snapshot

Key Participants Playing a Role in the Value Chain

Electric Vehicles

Autonomous Vehicles (AVs)

Current Trends and Future Outlook

Research Scope

Research Aims and Objectives

Key Questions this Study will Answer

Research Background

Research Methodology

Current Mobility Value Chain

Evolution of the Mobility Value Chain

Mobility Service Categories

Carsharing—Definition

Traditional Carsharing—Key Market Participants

Global Traditional Carsharing Market—Members and VIO Forecast

Europe Traditional Carsharing Market—Members and VIO Forecast

US Traditional Carsharing Market—Members and VIO Forecast

China Traditional Carsharing Market—Members and VIO Forecast

Carsharing Value Chain

Roles of the Actors in the Carsharing Value Chain

Fleet Providers—Service Providers

Vehicle Financing/Rental Options

Technology Providers—Service Providers

Technology Providers as a Part of the Value Chain

Comparative Analysis of Technology Service Providers

Roadside Assistance—Service Providers

Maintenance and Repairs—Service Providers

Cleaning—Service Providers

Maintenance and Cleaning as a Part of the Value Chain

Insurance—Service Providers

Insurance Model

Insurance as a Part of the Value Chain

Parking—Service Providers

Parking as a Part of the Value Chain

Charging—Service Providers

EV Charging as a Part of the Value Chain

Payment Solutions Providers—Service Providers

Fleet Providers—Groupe Renault and Vulog

Technology Providers—Omoove + OT technologies and IDEMIA

Operational and Infrastructure Support Providers

Intensifying Competition Between Technology Providers—Key Trends

Carsharing Operators—Key Trends

eHailing Market—Definitions

eHailing Market—Key Market Participants

Global eHailing Market—Revenue and VIO Forecast

Europe eHailing Market—Revenue and VIO Forecast

US eHailing Market—Revenue and VIO Forecast

China eHailing Market—Revenue and VIO Forecast

eHailing Value Chain

Roles of the Actors in the eHailing Value Chain

Fleet Providers—Service Providers

Vehicle Financing/Rental Options

Insurance—Service Providers

Insurance Model

Sample Insurance Coverage by eHailing Companies

Maintenance—Service Providers

Cleaning—Service Providers

Vehicle Maintenance as a Part of the Value Chain

Technology—Service Providers

Technology Providers—Key Insights

Comparative Analysis of Technology Service Providers

Roadside Assistance—Service Providers

Fleet Providers—Zipcar and Uber

Technology Providers—iCabbi and AutoCab

Cleaning Providers—Tie Up With Regional and Mobile Providers

Insurance Providers—If P&C and Metlife Auto

Maintenance Providers—CarAdvise and Uber

Fleet Rebalancing—Current Challenges and Future Trends

Fleet Cleaning—Current Challenges and Future Trends

Fleet Maintenance—Current Challenges and Future Trends

Insurance—Current Challenges and Future Trends

Fleet Cycling—Current Challenges and Future Trends

Fleet Suppliers

Technology Providers

Insurance Providers

Maintenance and Repair

Cleaning Providers

Roadside Assistance

Parking

EV Charging

Shift in Value Chain Ownership

Evolving Partnerships

OEMs Investing in the Mobility Value Chain

Advent of MaaS

Omoove—Company Profile

Ridecell—Company Profile

iCabbi—Company Profile

Caroobi—Company Profile

Arwe—Company Profile

Spiffy—Company Profile

Geely—Company Profile

ETCP—Company Profile

Xiaoju Autocare (by Didi)—Company Profile

Alipay (by Alibaba)—Company Profile

Ping An—Company Profile

Baidu—Company Profile

Future Outlook of EVs

Impact of EVs in the Shared Mobility Value Chain

Impact of EVs in the Shared Mobility Value Chain (continued)

Impact of the Evolution of EVs Value Chain

Impact of the Evolution of EVs Value Chain (continued)

Impact of the Evolution of EVs Value Chain (continued)

Future Outlook of Autonomous Vehicles

Impact of AVs in the Shared Mobility Value Chain

Impact of AVs in the Shared Mobility Value Chain (continued)

Impact of the Evolution of AVs in the Value Chain

Impact of the Evolution of AVs in the Value Chain (continued)

Scenario 1—Market Modelling Key Assumptions: ICE

Scenario 1—Market Modelling: Fleet Providers Total

Scenario 1—Market Modelling: Fuel and Gas Total

Scenario 1—Market Modelling: Maintenance

Scenario 1—Market Modelling: Parking Services Total

Scenario 1—Market Modelling: Repair Providers Total

Scenario 1—Market Modelling: Roadside Assistance Providers Total

Scenario 1—Market Modelling: Technology Providers Total

Scenario 1—Market Modelling: Cleaning Services Total

Scenario 1—Market Modelling: Insurance Services Total

Scenario 2—Market Modelling Key Assumptions: Electric Vehicles

Scenario 2—Market Modelling: Fleet Providers Total

Scenario 2—Market Modelling: Cleaning Services Total

Scenario 2—Market Modelling: Charging Services Total

Scenario 2—Market Modelling: Insurance Services Total

Scenario 2—Market Modelling: Maintenance Services Total

Scenario 2—Market Modelling: Parking Services Total

Scenario 2—Market Modelling: Repair Services Total

Scenario 2—Market Modelling: Roadside Assistance Providers Total

Scenario 2—Market Modelling: Technology Providers Total

Scenario 3—Market Modelling Key Assumptions: Autonomous Vehicles

Scenario 3—Market Modelling: Fleet Providers

Scenario 3—Market Modelling: Charging Services

Scenario 3—Market Modelling: Cleaning Services

Scenario 3—Market Modelling: eCommerce Services

Scenario 3—Market Modelling: Fuel and Gas Services

Scenario 3—Market Modelling: Insurance Services

Scenario 3—Market Modelling: Maintenance Services

Scenario 3—Market Modelling: Parking Services

Scenario 3—Market Modelling: Repair Providers

Scenario 3—Market Modelling: Roadside Assistance Services

Scenario 3—Market Modelling: Technology Services

Growth Opportunity—Mobility Business Models

Strategic Imperatives for Success and Growth

Key Conclusions and Future Outlook

The Last Word—3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

Research Scope

- To provide a strategic overview of the global mobility value chain market (Europe, US, China)

- To offer insight into the various offerings of mobility value chain providers

- To analyse the new growth paradigm, business models, and revenue models

- To identify key partnerships in the mobility value chain

- To identify innovations in the mobility value chain

- To offer strategic conclusions and recommendations

Market measurements are analysed for the year of 2018 and forecasted till 2030. The carsharing and ridehailing market are forecasted region wise by the number of members and vehicles. An extensive list of key value chain participants and their business models is discussed in this study.

An overview of the carsharing and ridehailing market and their value chain, key trends and market disruptions are have been provided. The base year for the study is 2018 and 2030 is the end of the forecast period. Cities around the globe are dealing with issues like urbanisation, pollution, and congestion, and the end customer for the shared mobility space is changing from individuals and businesses to governments and cities. The shared mobility space is witnessing high growth, driven by increased partnership between shared mobility operators, OEMs, and other participants in the value chain.

With the introduction of shared and autonomous mobility, new opportunities are expected to arise for companies seeking to sell content, entertainment, and offer customised choices based on learning customer preferences.

With disruptive forces like electric vehicles, on-demand mobility and autonomous vehicles companies are seizing emerging opportunities and making changes in their business models with the right partnerships. Charging infrastructure and battery suppliers will become key components of the value chain with the evolution of electric vehicles in the shared mobility fleet.

The introduction of autonomous vehicles is expected to provide new business opportunities for value chain providers. Data service providers and parking providers will play a major role with the introduction of autonomous vehicles in the shared mobility fleet. Fleet providers will play a major role with the introduction of AVs, as the vehicles will be owned by the mobility companies. Technology providers are expected to partner with OEMs to provide technology stacks.

With the introduction of more connected vehicles and growing telematics, data will play a critical role for value chain participants and fleet managers to eliminate paperwork and get notifications for maintenance, fuelling, insurance, and so on.

The shared mobility space is expected to be more diverse with more participating industries and disrupting trends like electrification, connectivity, and autonomous driving, e.g., electric vehicles , maintenance, car repair, fueling, etc. Value chain providers should in

| No Index | No |

|---|---|

| Podcast | No |

| Author | Ayush Patodia |

| Industries | Automotive |

| WIP Number | MEE0-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9800-A6,9A57-A6,9AF6-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB