Strategic Analysis of the North American Class 4-8 Select Original Equipment Wheel-end Components Market

Strategic Analysis of the North American Class 4-8 Select Original Equipment Wheel-end Components Market

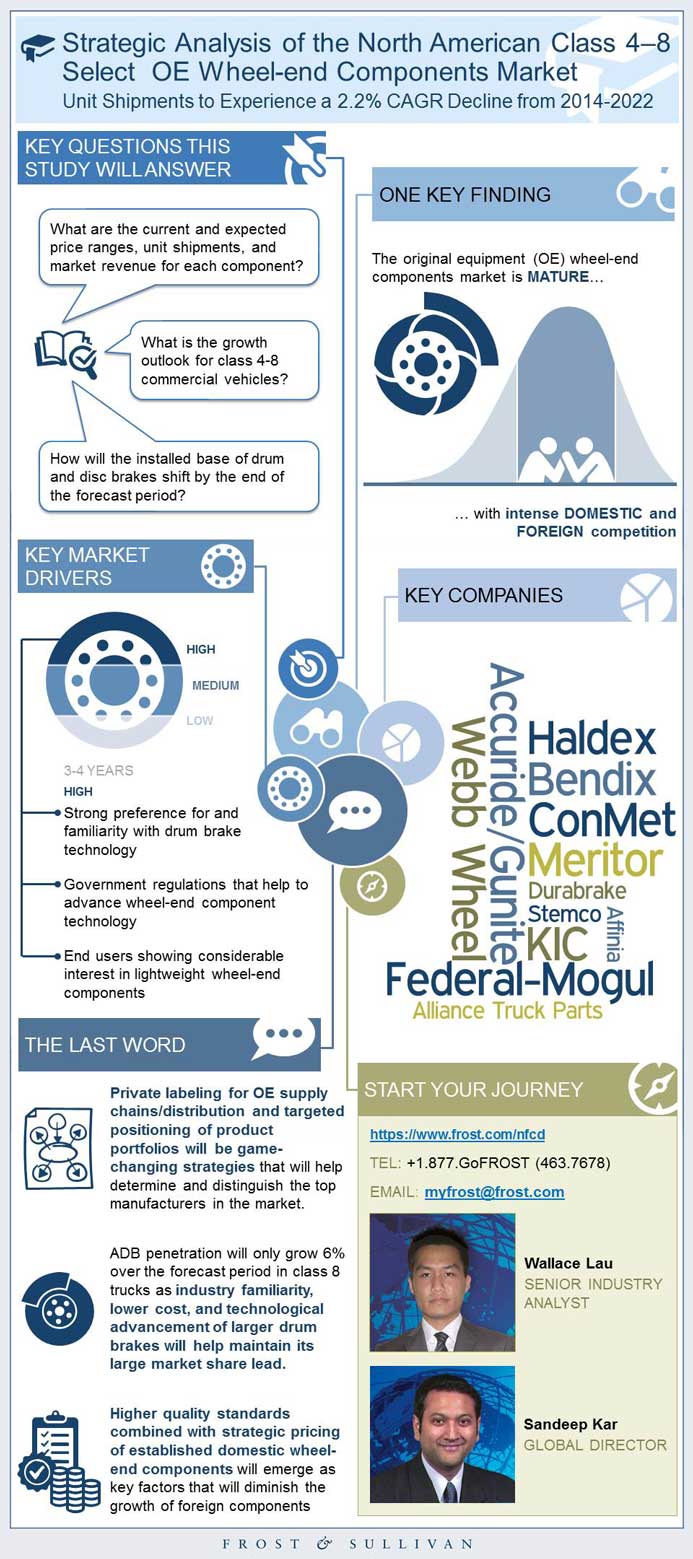

Unit Shipments to Experience a 2.2% CAGR Decline from 2014 to 2022

30-Sep-2015

North America

Market Research

$3,950.00

Special Price $2,962.50 save 25 %

This research service analyzes the North American market for select original equipment wheel-end components (drum brakes, slack adjusters, and hubs) for Class 4 to 8 (medium- and heavy-duty) trucks. It assesses market dynamics, including drivers and restraints, and provides unit shipment and revenue forecasts. The study examines original equipment manufacturer influencers on supplier selection, and breaks down expected truck production volumes by class through 2022. It includes insights about the current and future competitive environment, as well as profiles of leading market participants. The base year is 2014; the forecast period is from 2015 to 2022.

Summary of Key Findings

Executive Summary—Market Engineering Measurements

Unit Shipment Forecast

Current and Future Outlook

Research Scope and Definitions

Research Aims and Objectives

Research Background

Research Methodology

Product Definitions

Vehicle and Technology Segmentation

Market Drivers

Market Restraints

Market Engineering Measurements

Truck Production by Class

Drum vs. Disc Installed Base Forecast

Unit Shipment Forecast

Price Range Forecast

Revenue Forecast

Competitive Environment

Overall OEM Preferences Influencing Supplier Selection

OE Competitive Landscape—Market Shares by Segment

Meritor

Bendix

Webb Wheel

KIC

Haldex

ConMet

Accuride/Gunite

Key Conclusions

The Last Word—Three Big Predictions

Legal Disclaimer

Market Engineering Methodology

- 1. Summary of Key Findings

- 2. Class 4–8 Select OE Wheel-end Components Market: Current and Future Outlook, North America, 2014 and 2022

- 3. Class 4–8 Select OE Wheel-end Components Market: Truck Production, North America, 2014–2022

- 4. Class 4–8 Select OE Wheel-end Components Market: Key Questions This Study Will Answer, North America, 2014

- 5. Class 4–8 Select OE Wheel-end Components Market: Key Industry Participants, North America, 2014

- 6. Class 4–8 Select OE Wheel-end Components Market: Product Definitions, North America, 2014

- 7. Class 4–8 Select OE Wheel-end Components Market: Vehicle Segmentation, North America, 2014

- 8. Class 4–8 Select OE Wheel-end Components Market: Market Drivers, North America, 2015–2022

- 9. Class 4–8 Select OE Wheel-end Components Market: Market Restraints, North America, 2015–2022

- 10. Class 4–8 Select OE Wheel-end Components Market: Market Engineering Measurements, North America, 2014

- 11. Class 4–8 Select OE Wheel-end Components Market: Competitive Structure, North America, 2014

- 12. Class 4–8 Select OE Wheel-end Components Market: OEM Influencers on Supplier Selection, North America, 2014

- 13. The Last Word—Three Big Predictions

- 1. Class 4–8 Select OE Wheel-end Components Market: Market Engineering Measurements, North America, 2014

- 2. Class 4–8 Select OE Wheel-end Components Market: Unit Shipments, North America, 2014 and 2022

- 3. Class 4–8 Select OE Wheel-end Components Market: Truck Production, North America, 2014–2022

- 4. Class 4–8 Select OE Wheel-end Components Market: Drum vs. Disc Installed Base, North America, 2014 and 2022

- 5. Class 4–8 Select OE Wheel-end Components Market: Unit Shipments, North America, 2014 and 2022

- 6. Class 4–8 Select OE Wheel-end Components Market: Price Range Forecast, North America, 2014 and 2022

- 7. Class 4–8 Select OE Wheel-end Components Market: Revenue Forecast, North America, 2014 and 2022

- 8. Class 4–8 Select OE Wheel-end Components Market: Market Shares, North America, 2014 and 2022

- 9. Class 4–8 Select OE Wheel-end Components Market: Meritor Profile, North America, 2014

- 10. Class 4–8 Select OE Wheel-end Components Market: Bendix Profile, North America, 2014

- 11. Class 4–8 Select OE Wheel-end Components Market: Webb Wheel Profile, North America, 2014

- 12. Class 4–8 Select OE Wheel-end Components Market: KIC Profile, North America, 2014

- 13. Class 4–8 Select OE Wheel-end Components Market: Haldex Profile, North America, 2014

- 14. Class 4–8 Select OE Wheel-end Components Market: ConMet Profile, North America, 2014

- 15. Class 4–8 Select OE Wheel-end Components Market: Accuride Profile, North America, 2014

- 16. Class 4–8 Select OE Wheel-end Components Market: Key Findings, North America, 2014–2022

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Table of Contents | | Executive Summary~ || Summary of Key Findings~ || Executive Summary—Market Engineering Measurements~ || Unit Shipment Forecast~ || Current and Future Outlook~ | Research Scope, Objectives, Background, and Methodology~ || Research Scope and Definitions~ || Research Aims and Objectives~ || Research Background~ || Research Methodology~ | Definitions and Segmentation~ || Product Definitions~ || Vehicle and Technology Segmentation~ | Market Drivers and Restraints~ || Market Drivers~ || Market Restraints~ | Forecasts and Trends~ || Market Engineering Measurements~ || Truck Production by Class~ || Drum vs. Disc Installed Base Forecast~ || Unit Shipment Forecast~ || Price Range Forecast~ || Revenue Forecast~ | Market Share and Competitive Analysis~ || Competitive Environment~ || Overall OEM Preferences Influencing Supplier Selection~ || OE Competitive Landscape—Market Shares by Segment~ | Competitor Profiles~ || Meritor~ || Bendix~ || Webb Wheel~ || KIC~ || Haldex~ || ConMet~ || Accuride/Gunite~ | Key Conclusions and Future Outlook~ || Key Conclusions~ || The Last Word—Three Big Predictions~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ |

| List of Charts and Figures | 1. Summary of Key Findings~ 2. Class 4–8 Select OE Wheel-end Components Market: Current and Future Outlook, North America, 2014 and 2022~ 3. Class 4–8 Select OE Wheel-end Components Market: Truck Production, North America, 2014–2022~ 4. Class 4–8 Select OE Wheel-end Components Market: Key Questions This Study Will Answer, North America, 2014~ 5. Class 4–8 Select OE Wheel-end Components Market: Key Industry Participants, North America, 2014~ 6. Class 4–8 Select OE Wheel-end Components Market: Product Definitions, North America, 2014~ 7. Class 4–8 Select OE Wheel-end Components Market: Vehicle Segmentation, North America, 2014~ 8. Class 4–8 Select OE Wheel-end Components Market: Market Drivers, North America, 2015–2022~ 9. Class 4–8 Select OE Wheel-end Components Market: Market Restraints, North America, 2015–2022~ 10. Class 4–8 Select OE Wheel-end Components Market: Market Engineering Measurements, North America, 2014~ 11. Class 4–8 Select OE Wheel-end Components Market: Competitive Structure, North America, 2014~ 12. Class 4–8 Select OE Wheel-end Components Market: OEM Influencers on Supplier Selection, North America, 2014~ 13. The Last Word—Three Big Predictions~| 1. Class 4–8 Select OE Wheel-end Components Market: Market Engineering Measurements, North America, 2014~ 2. Class 4–8 Select OE Wheel-end Components Market: Unit Shipments, North America, 2014 and 2022~ 3. Class 4–8 Select OE Wheel-end Components Market: Truck Production, North America, 2014–2022~ 4. Class 4–8 Select OE Wheel-end Components Market: Drum vs. Disc Installed Base, North America, 2014 and 2022~ 5. Class 4–8 Select OE Wheel-end Components Market: Unit Shipments, North America, 2014 and 2022~ 6. Class 4–8 Select OE Wheel-end Components Market: Price Range Forecast, North America, 2014 and 2022~ 7. Class 4–8 Select OE Wheel-end Components Market: Revenue Forecast, North America, 2014 and 2022~ 8. Class 4–8 Select OE Wheel-end Components Market: Market Shares, North America, 2014 and 2022~ 9. Class 4–8 Select OE Wheel-end Components Market: Meritor Profile, North America, 2014~ 10. Class 4–8 Select OE Wheel-end Components Market: Bendix Profile, North America, 2014~ 11. Class 4–8 Select OE Wheel-end Components Market: Webb Wheel Profile, North America, 2014~ 12. Class 4–8 Select OE Wheel-end Components Market: KIC Profile, North America, 2014~ 13. Class 4–8 Select OE Wheel-end Components Market: Haldex Profile, North America, 2014~ 14. Class 4–8 Select OE Wheel-end Components Market: ConMet Profile, North America, 2014~ 15. Class 4–8 Select OE Wheel-end Components Market: Accuride Profile, North America, 2014~ 16. Class 4–8 Select OE Wheel-end Components Market: Key Findings, North America, 2014–2022~ |

| Author | Wallace Lau |

| Industries | Automotive |

| WIP Number | NFCD-01-00-00-00 |

| Is Prebook | No |