Strategic Overview of Electric & Hybrid Vehicle Driveline Systems Market in North America

Strategic Overview of Electric & Hybrid Vehicle Driveline Systems Market in North America

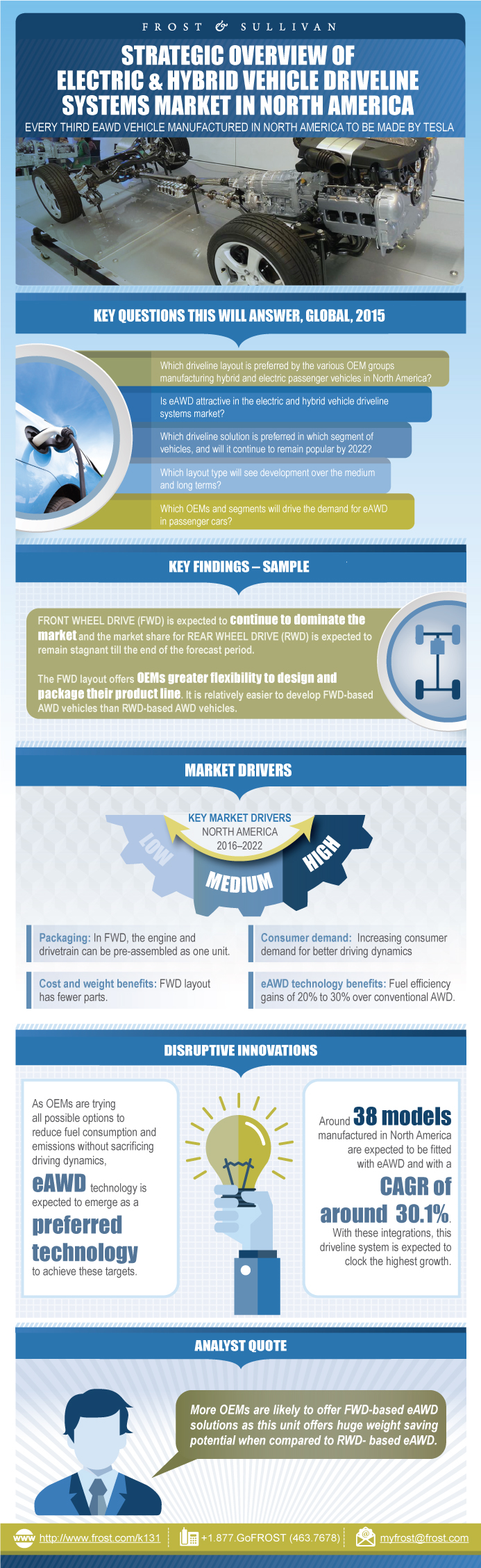

Every Third eAWD Vehicle Manufactured in North America to be Made by Tesla

25-Oct-2016

North America

Description

A growing number of original equipment manufacturers (OEMs) are starting to look at driveline electrification as a solution to meet the increasing pressure from governmental authorities to meet the stringent emission and fuel efficiency targets. Moreover, there is an increasing demand from consumers for technologies that offer superior performance, safety, and enhanced driving dynamics. This augurs well for the market for electric and hybrid vehicles, which is expected to expand at a compound annual growth rate of 22.3% during 2015-2022. This growth is also expected to be propelled by favorable government policies, increasing incentives, declining lifetime cost of ownership, and falling prices of batteries, which reduces the overall cost of the vehicle.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Driveline Systems Market—Unit Shipment Analysis

Driveline Electrification Path

Executive Summary—Key Conclusions and Future Outlook

Executive Summary—Associated Multimedia

Research Scope

Research Aims and Objectives

Key Questions this Study will Answer

Research Background

Research Methodology

Key OEM Groups Compared in this Study

Product Segmentation

Product Segmentation (continued)

System Definitions

System Definitions (continued)

Vehicle Segmentation

Driveline Electrification Path

Electric & Hybrid Vehicle Market—Unit Production Forecast

Driveline Systems Market—Unit Shipment Analysis

Driveline Systems Market—Unit Shipment Breakdown by OEM Group

Market Breakdown—Discussion

Driveline Systems Life Cycle Analysis

Market Drivers

Drivers Explained

Market Restraints

Restraints Explained

Front Wheel Drive Market Penetration by Segment

FWD Market Penetration by OEM

Top 10 FWD Cars Manufactured in 2015

RWD Market Penetration by Segment

RWD Market Penetration by OEM

Top 10 RWD Cars Manufactured in 2015

eAWD Architectures

eAWD Architectures (continued)

eAWD Scalability and Implementation

eAWD Market Penetration by Segment

eAWD Market Penetration by OEM

Top 10 eAWD cars manufactured in 2015

Chevrolet

Ford

Honda

Tesla

Toyota

Key Conclusions and Future Outlook

The Last Word—Three Big Predictions

Legal Disclaimer

Market Engineering Methodology

| No Index | No |

|---|---|

| Podcast | No |

| Author | Kamalesh Mohanarangam |

| Industries | Automotive |

| WIP Number | K131-01-00-00-00 |

| Keyword 1 | Electric Vehicle Driveline Systems |

| Keyword 2 | Hybrid Vehicle Driveline Systems |

| Keyword 3 | Driveline Systems |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB