Transport & Logistics Sector to Fuel Thailand’s Connected Trucks Telematics Market

Transport & Logistics Sector to Fuel Thailand’s Connected Trucks Telematics Market

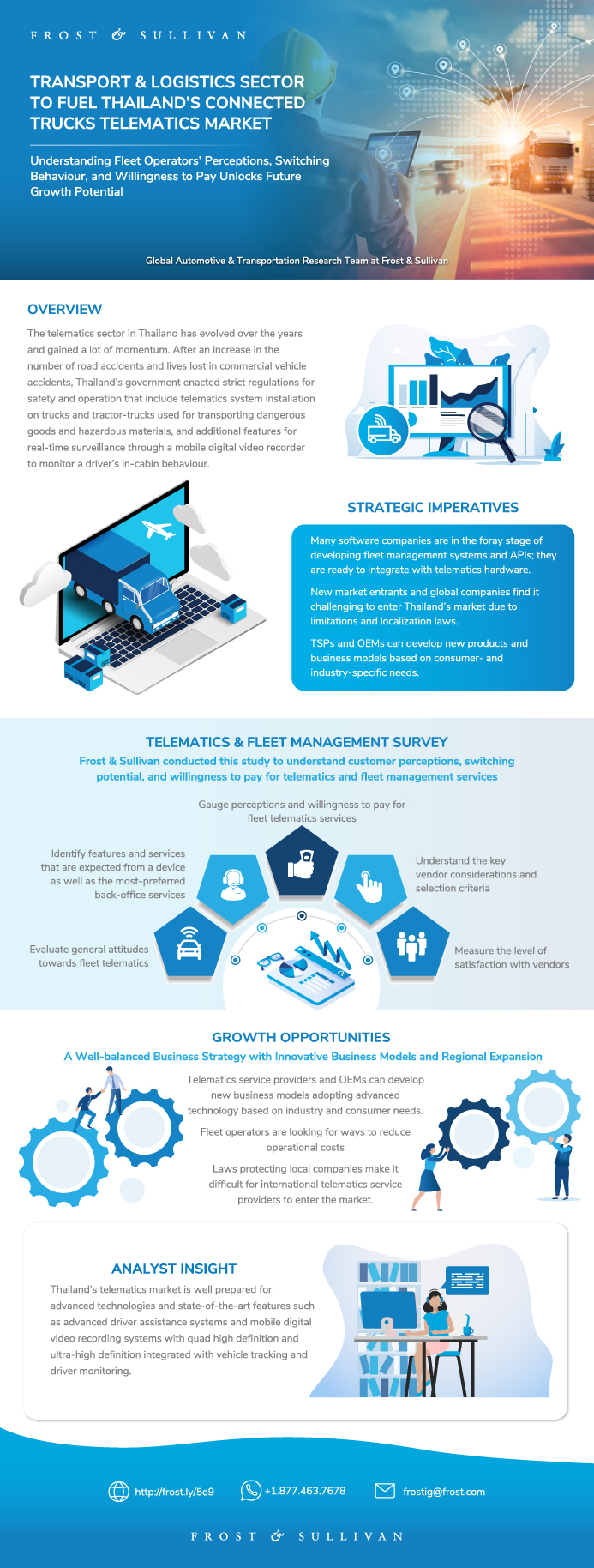

Understanding Fleet Operators’ Perceptions, Switching Behaviour, and Willingness to Pay Unlocks Future Growth Potential

08-Apr-2021

Asia Pacific

Description

The telematics market in Thailand has evolved over the years and gained a lot of momentum. After an increase in the number of road accidents and lives lost in commercial vehicle accidents, Thailand’s government enacted strict regulations for safety and operation that include telematics system installation on trucks and tractor-trucks used for transporting dangerous goods and hazardous materials, and additional features for real-time surveillance through a mobile digital video recorder in order to monitor a driver’s in-cabin behaviour.

In 2015, Thailand’s Department of Land Transport (DLT) introduced a program that mandates 6-wheel or above vehicles to install a telematics system, a driver card reader, and a driver monitoring system to verify the identity of the driver and monitor road safety practices. Data will be linked in real time to the DLT’s Transport Management Centre. All public transportation vehicles and 10-wheel vehicles now must have telematics equipment, but the COVID-19 pandemic delayed expansion of the mandate to medium-duty trucks including the 6-wheeler segment until after 2021.

Thailand’s telematics market is well prepared for advanced technologies and state-of-the-art features such as advanced driver assistance systems and mobile digital video recording systems with quad high definition and ultra-high definition integrated with vehicle tracking and driver monitoring.

This study reports the findings of a 2020 survey about the use of telematics and fleet management systems in commercial vehicles used for transport & logistics and postal & delivery services in Thailand. It provides additional analysis on customer perceptions, switching potential, and willingness to pay for services.

Author: Mugundhan Deenadayalan

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why Is It Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top Three Strategic Imperatives on Thailand’s Connected Trucks Telematics Market

Growth Opportunities Fuel the Growth Pipeline Engine™

Research Objectives—Telematics & Fleet Management Survey

Survey Research Scope

Research Methodology

Vehicle Segmentation and Solution Usage

Sample Profile

Regulations Pertaining to Transport & Logistics and Postal & Delivery Services

Key Regulations in Thailand

Key Regulations in Thailand (continued)

Key Regulations in Thailand (continued)

Key Regulations in Thailand (continued)

Key Regulations in Thailand (continued)

Pattern of Fleet Operation

Daily Driving Hours and Distance Average

Type of FMS Used

FMS Management

Percentage of Vehicles with FMS

Usage of Telematics for Vehicle-related Functions

Usage of Telematics for Operations-related Functions

Usage of Telematics for Driver-related Functions

Third-party or Self-developed Solutions

Third-party Service Providers

Standard vs. Customised Features

Telematics Acquisition and Comparison Behaviour

Switching Telematics Vendors

Criteria for Selecting a Telematics System

Reaction to TSP Features

Additional Comments on Features

Willingness to Pay for Telematics—Initial Costs

Willingness to Pay for Telematics—Initial Costs without Outliers

Willingness to Pay for Telematics—Operational Costs

Willingness to Pay for Telematics—Operational Costs without Outliers

Interest in Telematics Solutions

Growth Opportunity 1—A Well-balanced Business Strategy with Innovative Business Models and Regional Expansion

Growth Opportunity 1—A Well-balanced Business Strategy with Innovative Business Models and Regional Expansion (continued)

Summary of Findings

Summary and Conclusions

Your Next Steps

Why Frost, Why Now?

List of Exhibits

List of Exhibits (continued)

Legal Disclaimer

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Mugundhan Deenadayalan |

| Industries | Automotive |

| WIP Number | K5D5-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9673-A6,9800-A6,9B01-A6,9963-A6 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB