Analysis of the Indian Point-of-Sale (PoS) Terminals Market

Analysis of the Indian Point-of-Sale (PoS) Terminals Market

23-Jun-2016

South Asia, Middle East & North Africa

$4,950.00

Special Price $3,712.50 save 25 %

Description

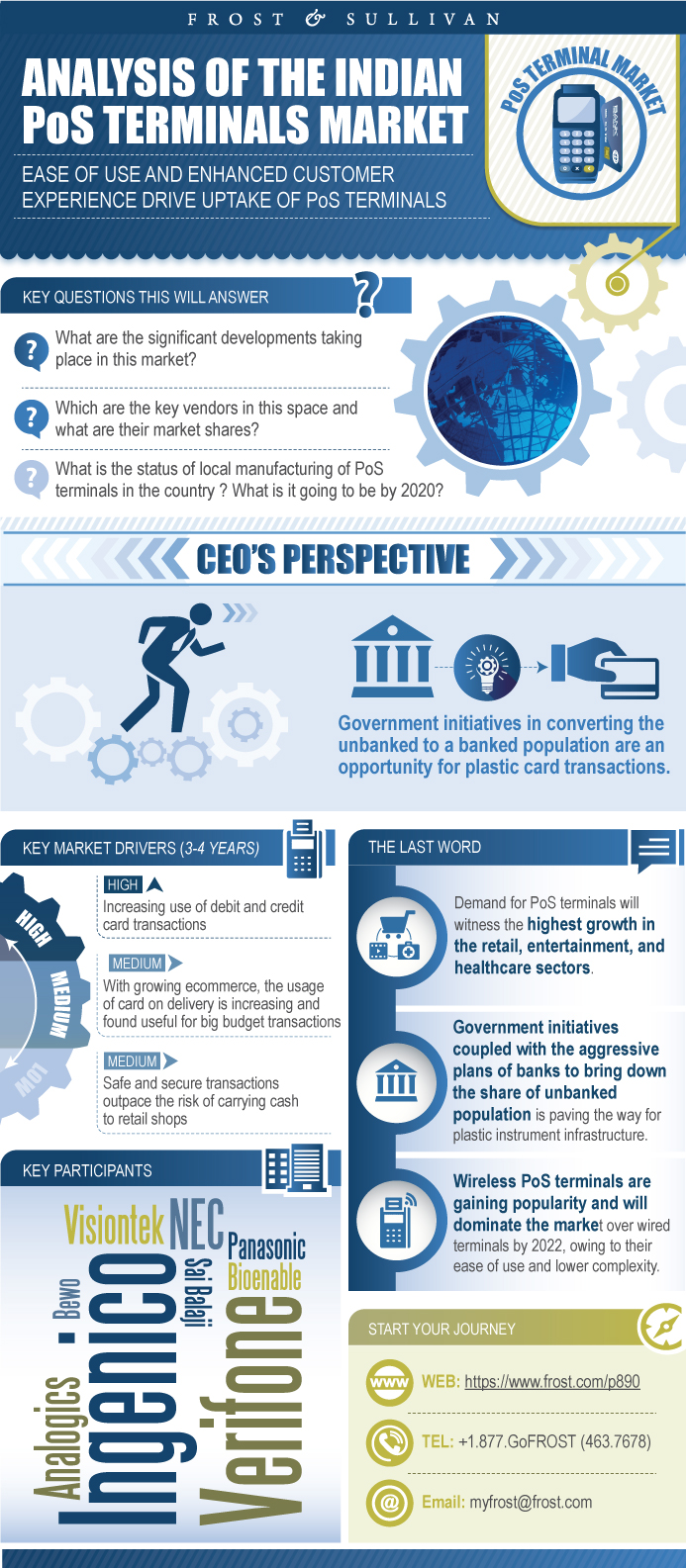

This research service analyses the Indian point-of-sale terminals market. India is the 13th-largest non-cash-payment market in the world. It has high potential to grow significantly as more merchants install PoS systems and accept card payments. Only 35% of the country’s population has bank accounts. The government’s initiative of providing bank accounts and debit cards paves the way for payment infrastructure opportunities. Banks’ aggressive stance in providing payment infrastructure by offering PoS systems to large businesses as well as SMBs coupled with the growing awareness and security offered over card-based transactions help move India toward a plastic economy. The base year for the study is 2015 and the study period is 2014 to 2020.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Market Engineering Measurements

CEO’s Perspective

Market Definitions

Key Questions This Study will Answer

Market Growth Opportunities

PoS Terminal Penetration

Transition toward a Plastic Economy

Market Segmentation for PoS Terminals

Domestic Manufacturing and Imports

Market Segmentation by Product Type

Market Segmentation by End User

Market Distribution Channels

Market Drivers

Drivers Explained

Drivers Explained (continued)

Drivers Explained (continued)

Market Restraints

Restraints Explained

Restraints Explained (continued)

Industry Challenges

Market Engineering Measurements

Forecast Assumptions

Unit Shipment and Revenue Forecast

Unit Shipment and Revenue Forecast Discussion

Revenue Forecast by End-user Segment

Revenue Forecast Discussion by End-user Segment

eTailing—Effects on the Market

Impact of Mega Trends on the PoS Terminals Market

Impact of Mega Trends on the PoS Terminals Market (continued)

Mega Trend Impact on the PoS Terminals Market

Market Share

Market Share Analysis

Competitive Environment

Wired Terminals Segment Key Findings

Market Engineering Measurements

Unit Shipment and Revenue Forecast

Unit Shipment and Revenue Forecast Discussion

Wireless Terminals Segment Key Findings

Market Engineering Measurements

Unit Shipment and Revenue Forecast

Unit Shipment and Revenue Forecast Discussion

Card Payment Usage

Market Opportunities—Bank Account with RuPay Cards Scheme

Benefits of RuPay Card

Impact of RuPay Cards on Financial Inclusions

Micro ATMs—Doorstep Banking

Challenges Associated with Certification

Mobile PoS in India—Adoption, Potential, and Penetration

How Does Mobile PoS Work?

Mobile PoS Trends and Challenges

Applications and Platforms

mPOS—Launch in India and Key Partnerships

mPOS—Advantages and Disadvantages

Comparison of mPOS and Traditional PoS Systems

Growth Opportunities

Growth Opportunities (continued)

Domestic Manufacturing at a Glance

PoS Terminals—Value Chain

Tax Rate and Duty Structure

Going Deeper—Components for Manufacturing

Manufacturing Industry—Limitations and Solutions

Domestic Manufacturing—SWOT Analysis

Domestic Manufacturing—SWOT Analysis (continued)

Conclusions and Recommendations

Conclusions and Recommendations (continued)

The Last Word—3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Aiswarya Ganesh |

| Industries | Electronics and Sensors |

| WIP Number | P890-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB