Economic Outlook Market Research Reports

Global economic volatility, geopolitical conflicts and policy challenges are creating formidable pressures on CEOs and his growth team. While the economic stability of the BRICS is being questioned, the Middle East is grappling with geopolitical tensions and volatile oil prices. Questions loom over the fate of the European Union and the Future of the United States.

Economic Outlook studies comprise of a series of titles including the Global Economic Outlook, Country Outlook Studies and Investment trackers to name a few. Providing a macro-economic overview of a region and/or country, key quantitative information and giving you a comprehensive understanding of the socio-economic trends, the Economic Outlook section focuses on the most pertinent emerging and developed markets. Some of the regions covered include North America, Europe, Asia Pacific, the Middle East, & Africa.

-

23 Jan 2023 | Global | Market Outlook

Top 10 Economic Predictions for 2023

Emerging Markets to Help Avert Global Recession while Advanced Economies Face Near-zero Growth

Global economic growth will be subdued in 2023, weighed down by recessionary pressures in advanced economies, inflation concerns impacting consumer sentiment, and the continuation of monetary policy tightening at least through H1 2023. To navigate through various volatilities, organizations must prepare risk mitigation plans that will support g...

$2,450.00 -

19 Sep 2022 | Global | Economic and Databases

Global Economy 2022–2023: Recession or Soft Landing?

Imperative to Realign Growth Strategies in the face of Rapidly Evolving Global Economic Sentiment

Fears of a global recession have been compounding in the recent past, with emerging signs of weakness in economic growth and other high-frequency parameters. The Russo-Ukrainian war has weakened global economic sentiment, with aggressive central bank interest rate hikes to curtail inflation also fueling recessionary fears. To provide decision-ma...

$2,450.00 -

22 Aug 2022 | North America | Frost Radar

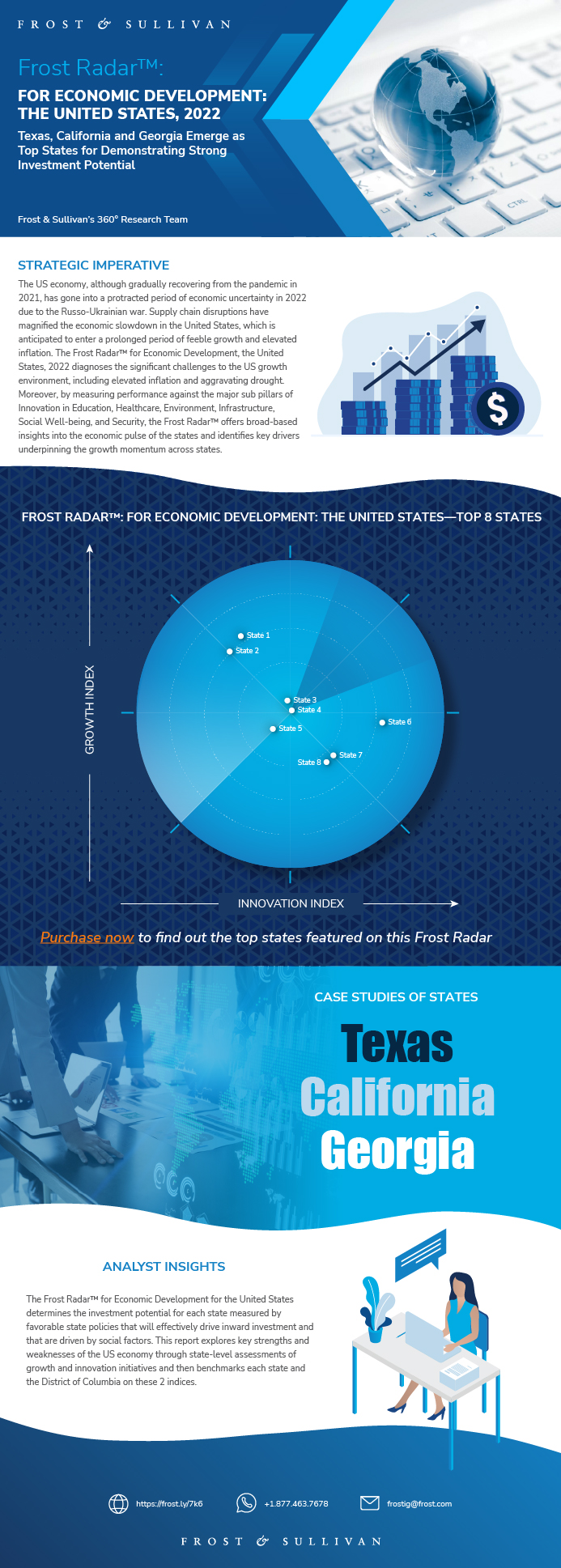

Frost Radar™ for Economic Development: The United States, 2022

Texas, California and Georgia Emerge as Top States for Demonstrating Strong Investment Potential

The Frost Radar™ for Economic Development for the United States determines the investment potential for each state measured by favorable state policies that will effectively drive inward investment and that are driven by social factors. This report explores key strengths and weaknesses of the the US economy through state-level assessments of gro...

$4,950.00 -

10 Mar 2022 | Global | Economic and Databases

Global Economic Outlook, 2022

Economic Recovery to Fuel Transformational Growth in Clean Energy, Digital Economy, and Infrastructure

After a deep contraction in 2020, the global economy staged a strong recovery in 2021, aided by robust fiscal stimulus measures, a dovish monetary policy, and a nearly 50% full vaccination rate. While recovery is set to continue into 2022, geopolitical tensions, high inflationary pressures, supply-chain disruptions, and a projected tightening of gl...

$4,950.00 -

03 Feb 2022 | North America | Economic and Databases

Oil Price Sensitivity Analysis and Macroeconomic Opportunities

Downward Oil Price Movements Bode Well for Food Products, Chemicals, and Pharmaceuticals Production

International crude oil prices are sensitive to oil production policies, geopolitical issues, government regulations, and several other factors. For improved foresight and scenario-planning capabilities, this Frost & Sullivan research service encompasses an oil price forecast model until 2025. The model was developed through a comprehensive scenari...

$2,450.00 -

11 Nov 2021 | North America | Economic and Databases

United States Transformative Policy Shifts and Opportunities

Fiscal Stimulus Boost and Tax Reforms Enable Strong Future Growth Potential

2020 was a year of uncertainty for the US economy. It grappled with a contraction in its output as an economic fallout from the coronavirus pandemic. In addition, the new US administration has signaled tectonic shifts in economic policy, which will influence growth recovery. As the economy stages a strong recovery in 2021—buoyed by large-scale fe...

$2,450.00 -

27 Oct 2021 | Asia Pacific | Frost Radar

Frost Radar™ for Economic Development: Broader Asia, 2021

Australia, South Korea, and New Zealand Emerge as the Broader Asian Leaders

The Frost Radar™ for Economic Development determines a region's future growth and development potential measured by its ability to enhance citizen satisfaction of quality of life. This report explores Broader Asia’s strengths and weaknesses through country-level assessments of growth and innovation initiatives and benchmarks each country on the...

$4,950.00 -

07 Sep 2021 | Global | Economic and Databases

2023 Global Macroeconomic Transformation

Accelerated Policy Emphasis on Clean Energy, Digitalization, and Infrastructure Development

The COVID-19 pandemic pushed the global economy into a deep recession in 2020, with recovery underway. While economic parameters are improving, the pandemic has brought about transformative shifts in government policy, industries, and the business environment. This research provides insights into the new policy priorities of governments to build re...

$2,450.00 -

31 Mar 2021 | Global | Market Outlook

Global Economic Recovery in Post-Pandemic 2021

5.3% Global Growth Expected for 2021, with China and India to See Growth of 8% or More

2020 was, without a doubt, an extremely turbulent year for the global economy, with lockdowns, sharp trade contraction, accelerated job losses, and supply-chain disruptions. Recovery started picking up towards the second half of the year with the easing of COVID-19 restrictions. The global economy nonetheless experienced a very deep 2020 recession....

$4,950.00 -

05 Nov 2020 | South Asia, Middle East & North Africa | Market Research

Transformative Trends Driving Economic Diversification in Saudi Arabia, 2025

COVID-19, Saudization, and Vision 2030 Present Future Growth Potential in Domestic Manufacturing

Kingdom of Saudi Arabia (KSA)s uniquely difficult position in 2020 stems from the joint impact of a crash in the oil prices and health crisis mitigation lockdowns that has brought its economy to a halt. How deep and far reaching can the consequences of such a combination of restraints be for the Kingdom? What opportunities will Saudization, Vision ...

$2,450.00