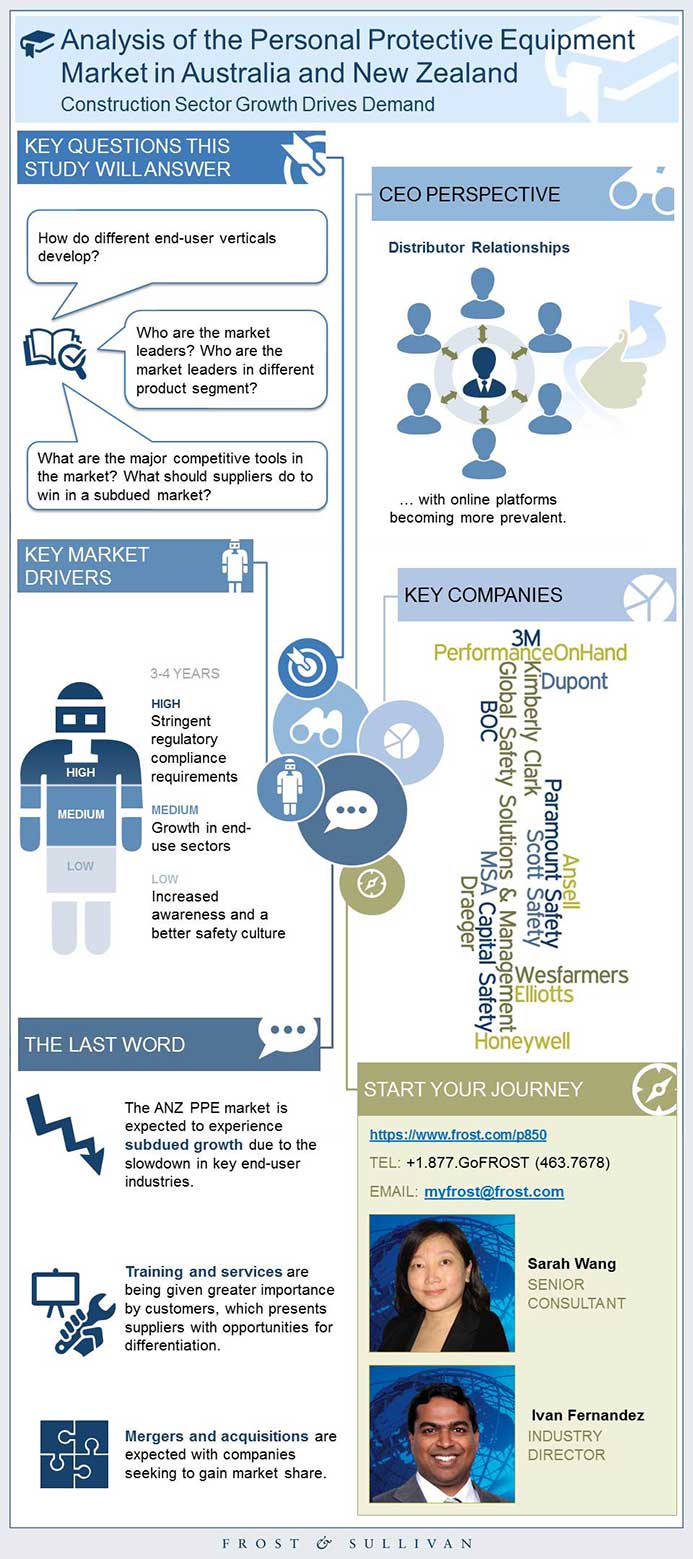

Analysis of the Personal Protective Equipment Market in Australia and New Zealand

Analysis of the Personal Protective Equipment Market in Australia and New Zealand

Construction Sector Growth Drives Demand

RELEASE DATE

28-May-2015

28-May-2015

REGION

Asia Pacific

Asia Pacific

Research Code: P850-01-00-00-00

SKU: PP00137-AP-MR_17242

$4,950.00

Special Price $3,712.50 save 25 %

In stock

SKU

PP00137-AP-MR_17242

Description

The total personal protective equipment (PPE) market will experience a drastic slow down between 2012 and 2014 due the decline in one of the key end-user sectors—mining. Nevertheless, the robust growth in construction sector, especially in residential construction, is expected to sustain demand from 2015 to 2021. Niche PPE suppliers that cater to specialised PPE markets have gained market share. In this challenging environment where organic growth is subdued, competitors are compelled to explore different channels to realise growth, such as value chain extension, mergers and acquisitions, and product range expansions.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Key Findings (continued)

Market Engineering Measurements

Market Engineering Measurements (continued)

CEO’s Perspective

Market Scope and Definitions

Regions Covered

Product Segments Covered

Product Segments Covered (continued)

Product Segments Covered (continued)

Market Definition

Market Definition (continued)

Key Questions This Study Will Answer

Mega Trend Impact on PPE Market

Mega Trend Impact on PPE Market Explained

Regulatory Framework

Regulatory Framework (continued)

Regulatory Framework (continued)

Regulatory Framework (continued)

Regulatory Framework—New Zealand

Regulatory Framework—New Zealand (continued)

Regulatory Framework—New Zealand (continued)

Drivers—Impact and Duration

Drivers Explained

Drivers Explained (continued)

Drivers Explained (continued)

Restraints—Impact and Duration

Restraints Explained

Restraints Explained (continued)

Market Overview

Market Overview (continued)

Workplace Safety by Industry—Australia

Workplace Safety by Mechanism—Australia

Workplace Safety by Industry—New Zealand

Workplace Safety by Type of Injury—New Zealand

Market Engineering Measurements

Market Engineering Measurements (continued)

Revenue Forecast

Percent Revenue Forecast by Region

Percent Revenue Forecast by Major End-user Sector Industry

Revenue Forecast by Major End-user Sector Industry

Percent Revenue Split by Product Segment

Revenue Forecast by Product Segment

Revenue Forecast Discussion

Distribution Structure

Distribution Structure Discussion

Distribution Structure Discussion (continued)

Distribution Structure Discussion (continued)

Distribution Structure Discussion (continued)

Distribution Structure Discussion (continued)

Competitive Analysis

Competitive Analysis (continued)

Competitive Analysis (continued)

Above-the-Neck Protection Segment—Overview

Head Protection Segment—Overview

Head Protection Segment—Market Engineering Measurements

Head Protection Segment—Percent Revenue Split by Product Type

Head Protection Segment—Pricing Analysis

Head Protection Segment—Competitive Environment

Eye Protection Segment—Overview

Eye Protection Segment—Market Engineering Measurements

Eye Protection Segment—Percent Revenue Split by Product Type

Eye Protection Segment—Pricing Analysis

Eye Protection Segment—Competitive Environment

Hearing Protection Segment—Overview

Hearing Protection Segment—Market Engineering Measurements

Hearing Protection Segment—Percent Revenue Split by Product Type

Hearing Protection Segment—Pricing Analysis

Hearing Protection Segment—Competitive Environment

Respiratory Protection Segment—Overview

Respiratory Protection Segment—Overview (continued)

Respiratory Protection Segment—Overview (continued)

Respiratory Protection Segment—Market Engineering Measurements

Respiratory Protection Segment—Percent Revenue Split by Product Type

Respiratory Protection Segment—Lifecycle Analysis

Respiratory Protection Segment—Pricing Analysis

Respiratory Protection Segment—Competitive Environment

Hand Protection Segment—Overview

Respiratory Protection Segment—Competitive Environment

Hand Protection Segment—Percent Revenue Split by Product Type

Hand Protection Segment—Pricing Analysis

Hand Protection Segment—Competitive Environment

Protective Clothing Segment—Overview

Protective Clothing Segment—Overview (continued)

Protective Clothing Segment—Market Engineering Measurements

Protective Clothing Segment—Percent Revenue Split by Product Type

Protective Clothing Segment—Pricing Analysis

Protective Clothing Segment—Competitive Environment

Foot Protection Segment—Overview

Foot Protection Segment—Market Engineering Measurements

Foot Protection Segment—Percent Revenue Split by Product Type

Foot Protection Segment—Pricing Analysis

Foot Protection Segment—Competitive Environment

Fall Protection Segment—Overview

Fall Protection Segment—Market Engineering Measurements

Fall Protection Segment—Percent Revenue Split by Component

Fall Protection Segment—Pricing Analysis

Fall Protection Segment—Competitive Environment

Competitor Profiles

Competitor Profiles (continued)

Competitor Profiles (continued)

Competitor Profiles (continued)

The Last Word—Three Predictions

Legal Disclaimer

Australian Manufacturing Industry Overview

Australian Manufacturing Industry Overview (continued)

Australian Manufacturing Industry Overview (continued)

Australian Forestry Industry Overview

Australian Forestry Industry Overview (continued)

Australian Construction Sector Overview

Australian Construction Sector Overview (continued)

Australian Construction Outlook by Segment

Australian Construction Outlook by Segment (continued)

Australian Mining Industry Overview

Australian Mining Industry Overview (continued)

Australian Mining Industry Overview (continued)

Australian Oil & Gas Sectors

Australian Oil & Gas Sectors (continued)

Australian Oil & Gas Sectors (continued)

New Zealand Industry Overview

New Zealand Industry Overview (continued)

New Zealand Industry Overview (continued)

New Zealand Industry Overview (continued)

Market Engineering Methodology

Popular Topics

The total personal protective equipment (PPE) market will experience a drastic slow down between 2012 and 2014 due the decline in one of the key end-user sectors—mining. Nevertheless, the robust growth in construction sector, especially in residential construction, is expected to sustain demand from 2015 to 2021. Niche PPE suppliers that cater to specialised PPE markets have gained market share. In this challenging environment where organic growth is subdued, competitors are compelled to explore different channels to realise growth, such as value chain extension, mergers and acquisitions, and product range expansions.

| No Index | No |

|---|---|

| Podcast | No |

| Author | Sarah Wang |

| Industries | Personal Protective Equipment |

| WIP Number | P850-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB