Future of Diabetes Care Paradigms, Forecast to 2022

Future of Diabetes Care Paradigms, Forecast to 2022

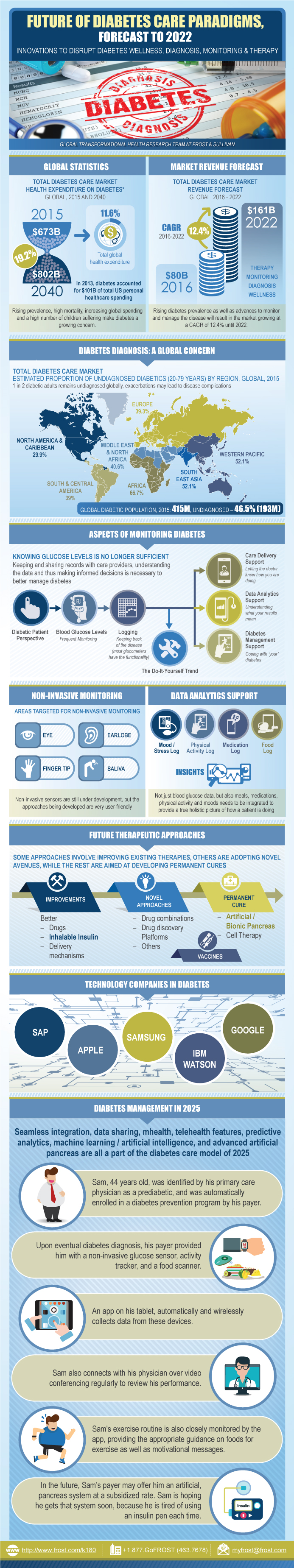

Innovations to Disrupt Diabetes Wellness, Diagnosis, Monitoring, and Therapy

31-Mar-2017

North America

Description

Diabetes management is on the verge of being disrupted by innovative technologies such as artificial pancreas, non-invasive glucose monitoring sensors, wearables, apps, and inhalable insulin. This research study captures all the innovative developments across the segments of wellness, diagnosis, monitoring, and therapy of the diabetes care continuum, covering the global market.

Diabetes remains one of the top causes of mortality, and health expenditure on the disorder and its complications is set to rise 19% annually until 2040, to reach $802 billion.

• Beyond the traditional focus and high-interest areas of monitoring and therapy, rising diabetes prevalence and costs are resulting in the focus gradually shifting to preventing diabetes, and on the overall wellbeing of diabetics and pre-diabetics, resulting in the highest double-digit growth of the wellness segment.

• Diagnosis, however, remains a neglected aspect of diabetes and novel approaches may be necessary to improve screening and diagnosing patients earlier to save on long-term costs.

• Monitoring developments that help improve the quality of life of diabetics include blood glucose monitoring tech advances (traditional glucometers and also semi-invasive, implants, and non-invasive continuous glucose monitoring systems), data analytics support, care delivery support, and overall diabetes management support in the form of apps, telehealth, and insulin dosing calculation support.

• Therapy, the largest segment, is also seeing several improvements in terms of better drugs, combination drugs, better insulin forms, and better delivery mechanisms. Of course, the main development in this segment is that of artificial pancreas—there is one commercially available system and several being developed with varying approaches and features. The other notable “permanent cure” approach is cell therapy involving regenerative medicine techniques with variations in the approaches for transplantation.

The study provides an exhaustive coverage of the overall diabetes ecosystem, with strong focus on startups, apart from the existing stakeholders. It also analyzes the role that technology giants such as Alphabet (née Google) and IBM are playing in the diabetes space. An overview of several innovative diabetes care delivery models from across the world is also included. The study would be valuable for diabetes stakeholders to chart out their strategies for future collaborations and partnerships, while keeping a watchful eye on the competition.

Key questions this study will answer:

• How is the diabetes burden evolving across the globe?

• How are market forces and trends shaping the diabetes market and the segments of wellness, diagnosis, monitoring, and therapy?

• What gaps in diabetic care need to be filled to address the unmet needs of diabetics?

• What are the technological developments in the industry that attempt to address such unmet needs?

• How have some care models perfected diabetes management, catering to local needs? What are some future perspectives for the industry?

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Scope and Segmentation

Market Engineering Measurements

CEO’s Perspective

Executive Summary—3 Big Predictions

Diabetes Global Statistics

Regional Distribution of Diabetics

Care Continuum

Market Drivers

Market Restraints

Market Impact of Top 10 Trends

Market Engineering Measurements

Revenue Forecast

Revenue Forecast by Segment

Percent Revenue Breakdown by Segment

Wellness Segment

Diagnosis Segment

Monitoring Segment

Therapy Segment

Diabetes Wellness Spectrum

Social Wellness

Emotional Wellness

Physical Wellness—Activity

Physical Wellness—Nutrition

Diabetes Prevention Platforms

Real-time Personalization in Physical Wellness Platforms

Financial Wellness

Improving Diabetes Wellness

Diabetes Diagnosis—A Global Concern

Screening for Diabetes

Diagnosing Diabetes

Diagnosing Diabetic Complications

Beyond Glucose and HbA1c

Aspects of Monitoring Diabetes

Blood Glucose Monitoring Advancements

Data Analytics Support

Care Delivery Support

Diabetes Management Support

Diabetes Management Support—Apps and Gamification

Diabetes Management Support—Telemedicine

Diabetes Management Support—Medication Adherence

Diabetes Management Support—Insulin Dose Logging

Diabetes Management Support—Calculating Dosage

Diabetes Management Support—Integrative Approach

Diabetes Management Support—Hypoglycemic Alerts

Key Innovations in Diabetes Therapy—A Snapshot

Future Therapeutic Approaches

Improvements—Better Drugs

Improvements—Better Insulin

Improvements—Better Delivery Mechanisms

Novel Approaches—Drug Combinations

Novel Approaches—Platforms

Novel Approaches—Other

Permanent Cure—Artificial Pancreas

Permanent Cure—Cell Therapy

Vaccines Approach

Recent Advancements in the Insulin Market

Future Directions in Therapy

Case—Diabeter

Case—Sughavazhvu (SV) Healthcare

Case—CASALUD

Case—Clinicas del Azucar (Sugar Clinics)

Case—Pro Mujer

Case—Thedacare

Do-it-Yourself

Transformation in the Industry Ecosystem

Innovative Growth Strategy

Industry Trajectories—Monitoring and Drug Therapy

Industry Trajectories—Device Therapy

Learnings—Inhaled Insulin Failures and Strategies

Technology Companies in Diabetes

Connected Diabetes Devices and Cybersecurity

Key Concluding Thoughts and Vision for the Industry

Diabetes Management in 2025

3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

Acronyms & Abbreviations

Food Scanners—A Detailed Overview

Learn More—Next Steps

- 1. Total Diabetes Care Market: Key Market Drivers, Global, 2017–2022

- 2. Total Diabetes Care Market: Key Market Drivers, Global, 2017–2022

- 3. Total Diabetes Care Market: Market Engineering Measurements, Global, 2016

- 1. Total Diabetes Care Market: Market Engineering Measurements, Global, 2016

- 2. Total Diabetes Care Market: Health Expenditure on Diabetes, Global, 2015 and 2040

- 3. Adult Mortality by Disease, Global, 2013 and 2015

- 4. Total Diabetes Care Market: Estimated Diabetics (20–79 years) by Region, Global, 2015 and 2040

- 5. Total Diabetes Care Market: Estimated Diabetics (20–79 years) by Region, Global, 2015 and 2040

- 6. Total Diabetes Care Market: Distribution of Diabetics (20–79 years) by Region, Global, 2015 and 2040

- 7. Total Diabetes Care Market: Impact of Top 10 Trends, Global, 2016

- 8. Total Diabetes Care Market: Revenue Forecast, Global, 2016–2022

- 9. Total Diabetes Care Market: Revenue Forecast by Segment, Global, 2016–2022

- 10. Total Diabetes Care Market: Percent Revenue Breakdown by Segment, Global, 2016

- 11. Total Diabetes Care Market: Percent Revenue Breakdown by Segment, Global, 2022

- 12. Total Diabetes Care Market: CAGR by Segment, Global, 2016–2022

- 13. Wellness Segment: Revenue Forecast by Sub-Segment, Global, 2016–2022

- 14. Diagnosis Segment: Revenue Forecast by Sub-Segment, Global, 2016–2022

- 15. Monitoring Segment: Revenue Forecast by Sub-Segment, Global, 2016–2022

- 16. Therapy Segment: Revenue Forecast by Sub-Segment, Global, 2016–2022

- 17. Total Diabetes Care Market: Status of Diabetes Wellness Areas, Global, 2016

- 18. Total Diabetes Care Market: Estimated Proportion of Undiagnosed Diabetics (20–79 years) by Region, Global, 2015

Popular Topics

plastic waste management market

biometric authentication market

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || Scope and Segmentation~ || Market Engineering Measurements~ || CEO’s Perspective~ || Executive Summary—3 Big Predictions~ | Diabetes—A Growing Concern~ || Diabetes Global Statistics~ | Regional Insights~ || Regional Distribution of Diabetics~ | Diabetes Care Continuum~ || Care Continuum~ | Drivers, Restraints, and Trends—Total Diabetes Care Market~ || Market Drivers~ ||| Rising prevalence of diabetes globally~ ||| Chronic nature of diabetes necessitates lifelong management~ ||| Gaps in available tools drive demand for innovation and better tools for improved management of disease~ ||| Rising awareness on diabetes management, complications and on technological developments to improve diabetic control~ || Market Restraints~ ||| High costs for diabetes management along with evolving reimbursement landscapes promote lack of adherence or discontinuation~ ||| Competitive pricing due to reimbursement pressures lead to lower revenue and profits~ ||| Rigid regulatory requirements and evolving guidance for technological advances slow down time to market~ || Market Impact of Top 10 Trends~ | Forecasts—Total Diabetes Care Market~ || Market Engineering Measurements~ || Revenue Forecast~ | Segment Forecasts~ || Revenue Forecast by Segment~ || Percent Revenue Breakdown by Segment~ || Wellness Segment~ || Diagnosis Segment~ || Monitoring Segment~ || Therapy Segment~ | Future Wellness~ || Diabetes Wellness Spectrum~ || Social Wellness~ || Emotional Wellness~ || Physical Wellness—Activity~ || Physical Wellness—Nutrition~ || Diabetes Prevention Platforms~ || Real-time Personalization in Physical Wellness Platforms~ || Financial Wellness~ || Improving Diabetes Wellness~ | Future Diagnosis~ || Diabetes Diagnosis—A Global Concern~ || Screening for Diabetes~ || Diagnosing Diabetes~ || Diagnosing Diabetic Complications~ | Future Monitoring~ || Beyond Glucose and HbA1c~ || Aspects of Monitoring Diabetes~ || Blood Glucose Monitoring Advancements~ || Data Analytics Support~ || Care Delivery Support~ || Diabetes Management Support~ || Diabetes Management Support—Apps and Gamification~ || Diabetes Management Support—Telemedicine~ || Diabetes Management Support—Medication Adherence~ || Diabetes Management Support—Insulin Dose Logging~ || Diabetes Management Support—Calculating Dosage~ || Diabetes Management Support—Integrative Approach~ || Diabetes Management Support—Hypoglycemic Alerts~ | Future Therapy~ || Key Innovations in Diabetes Therapy—A Snapshot~ || Future Therapeutic Approaches~ || Improvements—Better Drugs~ || Improvements—Better Insulin~ || Improvements—Better Delivery Mechanisms~ || Novel Approaches—Drug Combinations~ || Novel Approaches—Platforms~ || Novel Approaches—Other~ || Permanent Cure—Artificial Pancreas~ || Permanent Cure—Cell Therapy~ || Vaccines Approach~ || Recent Advancements in the Insulin Market~ || Future Directions in Therapy~ | Innovative Care Delivery Models~ || Case—Diabeter~ || Case—Sughavazhvu (SV) Healthcare~ || Case—CASALUD~ || Case—Clinicas del Azucar (Sugar Clinics)~ || Case—Pro Mujer~ || Case—Thedacare~ | Perspectives for the Future~ || Do-it-Yourself~ || Transformation in the Industry Ecosystem~ || Innovative Growth Strategy~ || Industry Trajectories—Monitoring and Drug Therapy~ || Industry Trajectories—Device Therapy~ || Learnings—Inhaled Insulin Failures and Strategies~ || Technology Companies in Diabetes~ || Connected Diabetes Devices and Cybersecurity~ | Conclusion~ || Key Concluding Thoughts and Vision for the Industry~ || Diabetes Management in 2025~ || 3 Big Predictions~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ || Acronyms & Abbreviations~ || Food Scanners—A Detailed Overview~ || Learn More—Next Steps~ | The Frost & Sullivan Story~ |

| List of Charts and Figures | 1. Total Diabetes Care Market: Key Market Drivers, Global, 2017–2022~ 2. Total Diabetes Care Market: Key Market Drivers, Global, 2017–2022~ 3. Total Diabetes Care Market: Market Engineering Measurements, Global, 2016~| 1. Total Diabetes Care Market: Market Engineering Measurements, Global, 2016~ 2. Total Diabetes Care Market: Health Expenditure on Diabetes, Global, 2015 and 2040~ 3. Adult Mortality by Disease, Global, 2013 and 2015~ 4. Total Diabetes Care Market: Estimated Diabetics (20–79 years) by Region, Global, 2015 and 2040~ 5. Total Diabetes Care Market: Estimated Diabetics (20–79 years) by Region, Global, 2015 and 2040~ 6. Total Diabetes Care Market: Distribution of Diabetics (20–79 years) by Region, Global, 2015 and 2040~ 7. Total Diabetes Care Market: Impact of Top 10 Trends, Global, 2016~ 8. Total Diabetes Care Market: Revenue Forecast, Global, 2016–2022~ 9. Total Diabetes Care Market: Revenue Forecast by Segment, Global, 2016–2022~ 10. Total Diabetes Care Market: Percent Revenue Breakdown by Segment, Global, 2016~ 11. Total Diabetes Care Market: Percent Revenue Breakdown by Segment, Global, 2022~ 12. Total Diabetes Care Market: CAGR by Segment, Global, 2016–2022~ 13. Wellness Segment: Revenue Forecast by Sub-Segment, Global, 2016–2022~ 14. Diagnosis Segment: Revenue Forecast by Sub-Segment, Global, 2016–2022~ 15. Monitoring Segment: Revenue Forecast by Sub-Segment, Global, 2016–2022~ 16. Therapy Segment: Revenue Forecast by Sub-Segment, Global, 2016–2022~ 17. Total Diabetes Care Market: Status of Diabetes Wellness Areas, Global, 2016~ 18. Total Diabetes Care Market: Estimated Proportion of Undiagnosed Diabetics (20–79 years) by Region, Global, 2015~ |

| Lightbox Content | World Cancer Day 2019|Get 15% discount for all Healthcare studies |https://store.frost.com/contacts/?utm_source=PD&utm_medium=lightbox&utm_campaign=HEALTHCARE_CANCER2019 |

| Author | Siddharth Shah |

| Industries | Healthcare |

| WIP Number | K180-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB