Global Battery Testing and Inspection Equipment Growth Opportunities

Global Battery Testing and Inspection Equipment Growth Opportunities

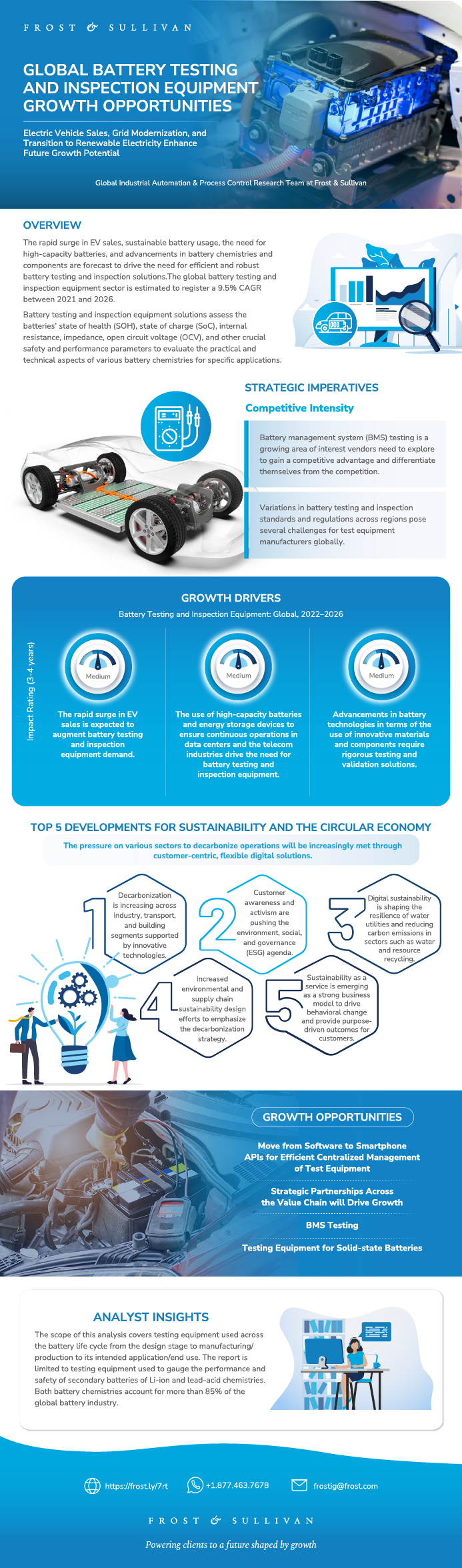

Electric Vehicle Sales, Grid Modernization, and Transition to Renewable Electricity Enhance Future Growth Potential

19-Sep-2022

Global

Description

The rapid surge in EV sales, sustainable battery usage, the need for high-capacity batteries, and advancements in battery chemistries and components are forecast to drive the need for efficient and robust battery testing and inspection solutions.The global battery testing and inspection equipment market is estimated to register 9.5% CAGR between 2021 and 2026.

Battery testing and inspection equipment solutions assess the batteries’ state of health (SOH), state of charge (SoC), internal resistance, impedance, open circuit voltage (OCV), and other crucial safety and performance parameters to evaluate the practical and technical aspects of various battery chemistries for specific applications.

The scope of this study covers testing equipment used across the battery life cycle from the design stage to manufacturing/production to its intended application/end use. The report is limited to testing equipment used to gauge the performance and safety of secondary batteries of Li-ion and lead-acid chemistries. Both battery chemistries account for more than 85% of the global battery market.

With 2021 as the base year, the research outlines market size estimates and future growth prospects up to 2026 (excludes revenue earned from battery testing and inspection services and testing equipment maintenance services). It follows a targeted methodology encompassing detailed discussions with senior management of battery test equipment manufacturers and end users supported by secondary research.

It analyzes the market based on product type, application, end user, and geography.

Product type:

• Portable battery testing and inspection equipment

• Stationary battery testing and inspection equipment

End user:

• Automotive

• Consumer Electronics

• Energy and Utility

• Telecom and Data Communication

• Others (factory automation and control/Industry 4.0, building automation, industrial equipment, healthcare, aerospace and defense, oil and gas,

and marine applications

Application type:

• Battery cell testing equipment

• Battery module testing equipment

• Battery pack testing equipment

Geographic coverage:

• Americas: Canada, United States, and Latin America

• Europe: Germany, the United Kingdom, France, Italy, Scandinavia, CIS Countries, and the rest of Europe

• Asia-Pacific: India, China, Japan, South Korea, Southeast Asia, Australia, New Zealand, and the rest of Asia-Pacific (Taiwan, Sri Lanka,

Pakistan, North Korea, Afghanistan, and Bangladesh)

• Middle East and Africa (MEA): Bahrain, Egypt, Iran, Iraq, Israel, Turkey, Saudi Arabia, United Arab Emirates, Palestine, Kuwait, Oman, Lebanon,

South Africa, West Africa, and Sub-Sahara

Author: Navdeep Saboo

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why is it Increasingly Difficult to Grow?

The Strategic Imperative 8™

Impact of the Top 3 Strategic Imperatives on the Battery Testing and Inspection Equipment Market

Growth Opportunities Fuel the Growth Pipeline Engine™

Scope of Analysis

Scope of Analysis (continued)

Scope of Analysis (continued)

Scope of Analysis (continued)

Scope of Analysis (continued)

Testing Schedule for Cell, Module, and Pack Level Testing for Li-ion Batteries

Market Segmentation by Application

Market Segmentation by Geography

Market Segmentation by End-user Industries

Key Competitors

Growth Metrics

Distribution Channels

Growth Drivers

Growth Driver Analysis

Growth Driver Analysis (continued)

Growth Driver Analysis (continued)

Growth Driver Analysis (continued)

Growth Restraints

Growth Restraint Analysis

Growth Restraint Analysis (continued)

Growth Restraint Analysis (continued)

Forecast Assumptions

Revenue Forecast

Revenue Forecast Analysis

Revenue Forecast by Product Type

Revenue Forecast Analysis by Product Type

Revenue Forecast by End User

Revenue Forecast Analysis by End User

Revenue Forecast Analysis by End User (continued)

Revenue Forecast Analysis by End User (continued)

Revenue Forecast Analysis by End User (continued)

Revenue Forecast Analysis by End User (continued)

Revenue Forecast by Application

Revenue Forecast Analysis by Application

Revenue Forecast Analysis by Application (continued)

Revenue Forecast by Region

Revenue Forecast by Country

Revenue Forecast by Country

Revenue Forecast by Country

Revenue Forecast by Country

Revenue Forecast Analysis by Region

Pricing Trends and Forecast Analysis

Competitive Environment

Revenue Share

Revenue Share Analysis

Revenue Share Analysis (continued)

Top Participants—Product and Application Highlights

Growth Metrics

Revenue Forecast

Revenue Forecast by Region

Revenue Forecast by Product Type

Revenue Forecast by End User

Forecast Analysis

Forecast Analysis (continued)

Competitive Environment

Growth Metrics

Revenue Forecast

Revenue Forecast by Region

Revenue Forecast by Product Type

Revenue Forecast by End User

Forecast Analysis

Forecast Analysis (continued)

Competitive Environment

Growth Metrics

Revenue Forecast

Revenue Forecast by Region

Revenue Forecast by Product Type

Revenue Forecast by End User

Forecast Analysis

Forecast Analysis (continued)

Competitive Environment

Top 5 Trends for Sustainability and the Circular Economy

Battery Ecosystem Alignment with UN SDGs Critical to Paving the Path to Decarbonization

UN Sustainable Development Goals

Battery Passport for Sustainable, Resource Efficient, and Responsible Batteries

The European Green Deal Initiative and the Battery Ecosystem

Keysight Technologies—Enabling Responsible Battery Production for the Automotive Sector

Growth Opportunity 1: Move from Software to Smartphone APIs for Efficient Centralized Management of Test Equipment

Growth Opportunity 1: Move from Software to Smartphone APIs for Efficient Centralized Management of Test Equipment (continued)

Growth Opportunity 2: Strategic Partnerships Across the Value Chain will Drive Growth

Growth Opportunity 2: Strategic Partnerships Across the Value Chain will Drive Growth (continued)

Growth Opportunity 3: BMS Testing

Growth Opportunity 3: BMS Testing (continued)

Growth Opportunity 4: Testing Equipment for Solid-state Batteries

Growth Opportunity 4: Testing Equipment for Solid-state Batteries (continued)

Your Next Steps

Why Frost, Why Now?

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

Legal Disclaimer

Popular Topics

| Author | Navdeep Saboo |

|---|---|

| Industries | Test and Measurement Instrumentation |

| No Index | No |

| Is Prebook | No |

| Keyword 1 | battery test system |

| Keyword 2 | ev battery testing equipment |

| Keyword 3 | battery tester manufacturers |

| Podcast | No |

| WIP Number | K79C-01-00-00-00 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB