Global Contact Center and Office Headset Market

Global Contact Center and Office Headset Market

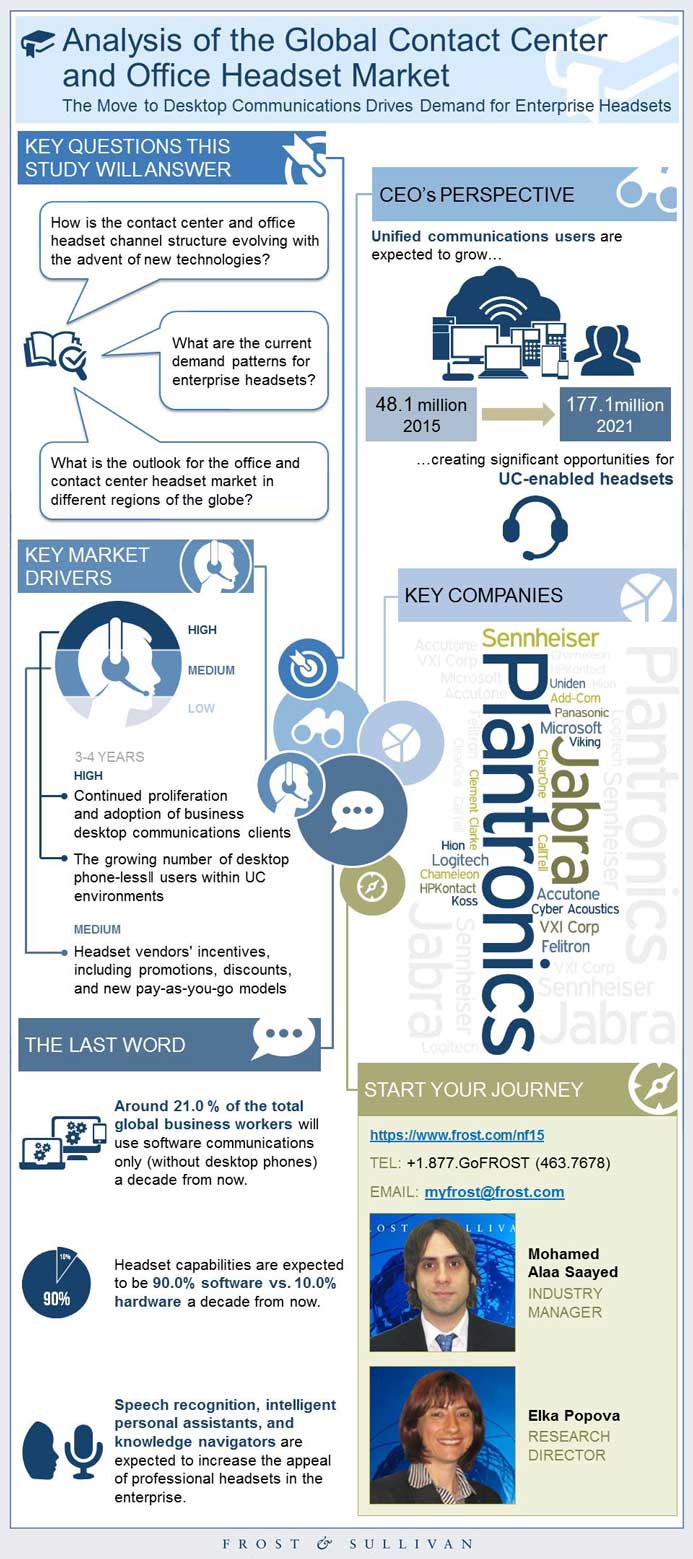

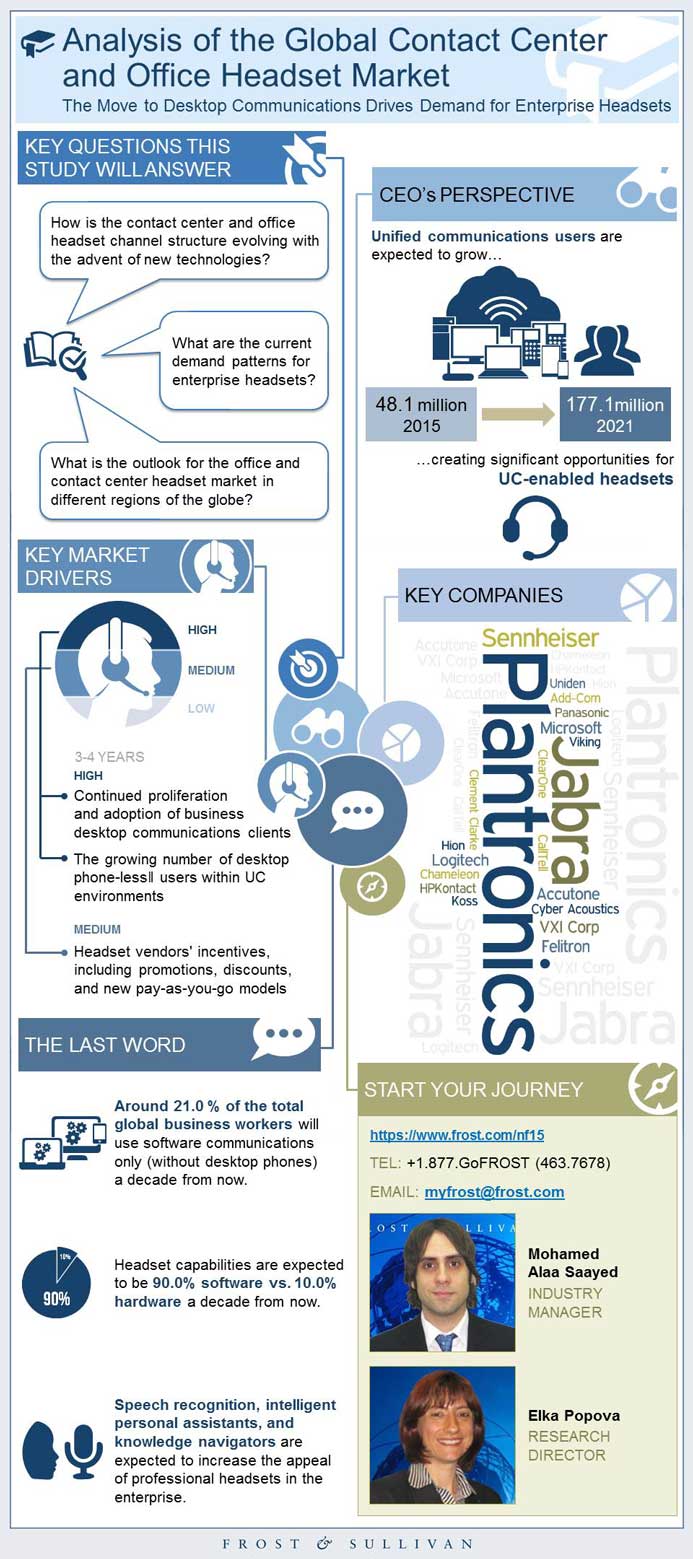

The Move to Desktop Communications Drives Demand for Enterprise Headsets

04-Sep-2015

Global

$4,950.00

Special Price $3,712.50 save 25 %

Description

This study provides an in-depth analysis of the global contact center and office headset market. As part of this analysis, Frost & Sullivan has identified market drivers, restraints, demand patterns, competitive trends, and growth opportunities within the global business headset market. Through extensive primary and secondary research, this analysis provides telecommunication providers and manufacturers with a detailed look at the dynamics of a changing market. Frost & Sullivan expects that this analysis will provide vendors with valuable insights to increase their growth and penetration opportunities within the headset marketplace.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Market Engineering Measurements

- Market Stage

- Market Revenue

- Market Units/Volume

- Average Price Per Unit

- Customer Price Sensitivity

- Market Concentration

CEO’s Perspective

Distribution Channel Analysis, Global, 2014

Percent Revenue Breakdown by Region, Global, 2014

Percent Revenue Breakdown by Contact Center Versus Office, Global, 2014

Percent Revenue Breakdown by Cordless Versus Corded, Global, 2014

Key Market Drivers, Global, 2015-2021

Key Market Restraints, Global, 2015-2021

Unit Shipment and Revenue Forecast, Global, 2011–2021

Corded versus Cordless Unit Shipment and Revenue Forecast, Global, 2011-2021

UC-enabled Headset Unit Shipment and Revenue Forecast, Global, 2011–2021

Average Revenue Per Unit, Global, 2011–202

Penetration Analysis, Global, 2011–2021

Current Usage of Enterprise Endpoints, United States and Europe, 2014

Current and Future Usage of Communications Clients, United States and Europe, 2014

The Office of the Future, Global, 2014-2021

Percent Revenue Breakdown, Global, 2014

Competitive Structure, Global, 2014

SWOT Analysis, Global, 2014

Unit Shipment and Revenue Forecast, Global, 2011–2021

Unit Shipment and Revenue Forecast, Global, 2011–2021

North America & Latin America Key Findings

Europe, Middle East, and Africa Key Findings

Asia-Pacific Key Findings

Mega Trend Impact, Global, 2014-2021

Predictions

Recommendations

Legal Disclaimer

- 1. Total Contact Center and Office Headset Market: Market Engineering Measurements, Global, 2014

- 2. Total Contact Center and Office Headset Market: Key Market Drivers, Global, 2015-2021

- 3. Total Contact Center and Office Headset Market: Key Market Restraints, Global, 2015-2021

- 4. Total Contact Center and Office Headset Market: Competitive Structure, Global, 2014

- 5. Total Contact Center and Office Headset Market: SWOT Analysis, Global, 2014

- 6. Contact Center Headset Segment: Market Engineering Measurements, Global, 2014

- 7. Office Headset Segment: Market Engineering Measurements, Global, 2014

- 8. Communications and Collaboration Industry: Mega Trend Impact, Global, 2014-2021

- 1. Total Contact Center and Office Headset Market: Distribution Channel Analysis, Global, 2014

- 2. Total Contact Center and Office Headset Market: Percent Revenue Breakdown by Region, Global, 2014

- 3. Total Contact Center and Office Headset Market: Percent Revenue Breakdown by Contact Center Versus Office, Global, 2014

- 4. Total Contact Center and Office Headset Market: Percent Revenue Breakdown by Cordless Versus Corded, Global, 2014

- 5. Total Contact Center and Office Headset Market: Unit Shipment and Revenue Forecast, Global, 2011–2021

- 6. Total Office and Contact Center Headset Market: Corded versus Cordless Unit Shipment and Revenue Forecast, Global, 2011-2021

- 7. Total Contact Center and Office Headset Market: UC-enabled Headset Unit Shipment and Revenue Forecast, Global, 2011–2021

- 8. Total Office and Contact Center Headset Market: Average Revenue Per Unit, Global, 2011–2021

- 9. Total Contact Center and Office Headset Market: Penetration Analysis, Global, 2011–2021

- 10. Total Contact Center and Office Headset Market: Current Usage of Enterprise Endpoints, United States and Europe, 2014

- 11. Total Contact Center and Office Headset Market: Current and Future Usage of Communications Clients, United States and Europe, 2014

- 12. Total Contact Center and Office Headset Market: The Office of the Future, Global, 2014-2021

- 13. Total Contact Center and Office Headset Market: Percent Revenue Breakdown, Global, 2014

- 14. Contact Center Headset Segment: Unit Shipment and Revenue Forecast, Global, 2011–2021

- 15. Office Headset Segment: Unit Shipment and Revenue Forecast, Global, 2011–2021

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || Market Engineering Measurements~ ||| Market Stage~ ||| Market Revenue~ ||| Market Units/Volume~ ||| Average Price Per Unit~ ||| Customer Price Sensitivity~ ||| Market Concentration~ || CEO’s Perspective~ | Market Overview~ || Distribution Channel Analysis, Global, 2014~ || Percent Revenue Breakdown by Region, Global, 2014~ || Percent Revenue Breakdown by Contact Center Versus Office, Global, 2014~ || Percent Revenue Breakdown by Cordless Versus Corded, Global, 2014~ | Drivers and Restraints~ || Key Market Drivers, Global, 2015-2021~ ||| Continued Proliferation and Adoption of Business Desktop Communications~ ||| The Productivity Benefits Associated with Business Headsets~ ||| The Growing Number of ―Desktop Phone-less‖ Users within UC Environments~ ||| Promotions, Discounts, and New Pay-as-you-go Models~ ||| The Growing Need for Desk-free, Mobile Communications~ || Key Market Restraints, Global, 2015-2021~ ||| Limited Resources or Inadequate Budgeting~ ||| High Cost of Advanced Business Headsets~ ||| Continuous Competitive-related Struggles Between the Top two Business Headset Vendors~ ||| Inadequate Headset Financing in more Cost-conscious Organizations and Lack of Leasing~ | Forecasts and Trends~ || Unit Shipment and Revenue Forecast, Global, 2011–2021~ || Corded versus Cordless Unit Shipment and Revenue Forecast, Global, 2011-2021~ || UC-enabled Headset Unit Shipment and Revenue Forecast, Global, 2011–2021~ || Average Revenue Per Unit, Global, 2011–202~ || Penetration Analysis, Global, 2011–2021~ || Current Usage of Enterprise Endpoints, United States and Europe, 2014~ || Current and Future Usage of Communications Clients, United States and Europe, 2014~ || The Office of the Future, Global, 2014-2021~ | Market Share and Competitive Analysis~ || Percent Revenue Breakdown, Global, 2014~ || Competitive Structure, Global, 2014~ ||| Number of Companies in the Market~ ||| Competitive Factors~ ||| Key End-user Groups~ ||| Major Market Participants~ ||| Distribution Structure~ ||| Acquisitions and Mergers~ || SWOT Analysis, Global, 2014~ ||| Plantronics~ ||| Jabra~ ||| Sennheiser~ ||| Logitech~ ||| VXi Corporation~ | Contact Center Headset Segment Analysis~ || Unit Shipment and Revenue Forecast, Global, 2011–2021~ | Office Headset Segment Analysis~ || Unit Shipment and Revenue Forecast, Global, 2011–2021~ | Regional Analysis~ || North America & Latin America Key Findings~ || Europe, Middle East, and Africa Key Findings~ || Asia-Pacific Key Findings~ | Mega Trends and Industry Convergence Implications~ || Mega Trend Impact, Global, 2014-2021~ | The Last Word~ || Predictions~ || Recommendations~ || Legal Disclaimer~ |

| List of Charts and Figures | 1. Total Contact Center and Office Headset Market: Market Engineering Measurements, Global, 2014~ 2. Total Contact Center and Office Headset Market: Key Market Drivers, Global, 2015-2021~ 3. Total Contact Center and Office Headset Market: Key Market Restraints, Global, 2015-2021~ 4. Total Contact Center and Office Headset Market: Competitive Structure, Global, 2014~ 5. Total Contact Center and Office Headset Market: SWOT Analysis, Global, 2014~ 6. Contact Center Headset Segment: Market Engineering Measurements, Global, 2014~ 7. Office Headset Segment: Market Engineering Measurements, Global, 2014~ 8. Communications and Collaboration Industry: Mega Trend Impact, Global, 2014-2021~| 1. Total Contact Center and Office Headset Market: Distribution Channel Analysis, Global, 2014~ 2. Total Contact Center and Office Headset Market: Percent Revenue Breakdown by Region, Global, 2014~ 3. Total Contact Center and Office Headset Market: Percent Revenue Breakdown by Contact Center Versus Office, Global, 2014~ 4. Total Contact Center and Office Headset Market: Percent Revenue Breakdown by Cordless Versus Corded, Global, 2014~ 5. Total Contact Center and Office Headset Market: Unit Shipment and Revenue Forecast, Global, 2011–2021~ 6. Total Office and Contact Center Headset Market: Corded versus Cordless Unit Shipment and Revenue Forecast, Global, 2011-2021~ 7. Total Contact Center and Office Headset Market: UC-enabled Headset Unit Shipment and Revenue Forecast, Global, 2011–2021~ 8. Total Office and Contact Center Headset Market: Average Revenue Per Unit, Global, 2011–2021~ 9. Total Contact Center and Office Headset Market: Penetration Analysis, Global, 2011–2021~ 10. Total Contact Center and Office Headset Market: Current Usage of Enterprise Endpoints, United States and Europe, 2014~ 11. Total Contact Center and Office Headset Market: Current and Future Usage of Communications Clients, United States and Europe, 2014~ 12. Total Contact Center and Office Headset Market: The Office of the Future, Global, 2014-2021~ 13. Total Contact Center and Office Headset Market: Percent Revenue Breakdown, Global, 2014~ 14. Contact Center Headset Segment: Unit Shipment and Revenue Forecast, Global, 2011–2021~ 15. Office Headset Segment: Unit Shipment and Revenue Forecast, Global, 2011–2021~ |

| Author | Mohamed Alaa Saayed |

| Industries | Telecom |

| WIP Number | NF15-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB