Global Li-ion Battery Materials Growth Opportunities

Global Li-ion Battery Materials Growth Opportunities Updated Research Available

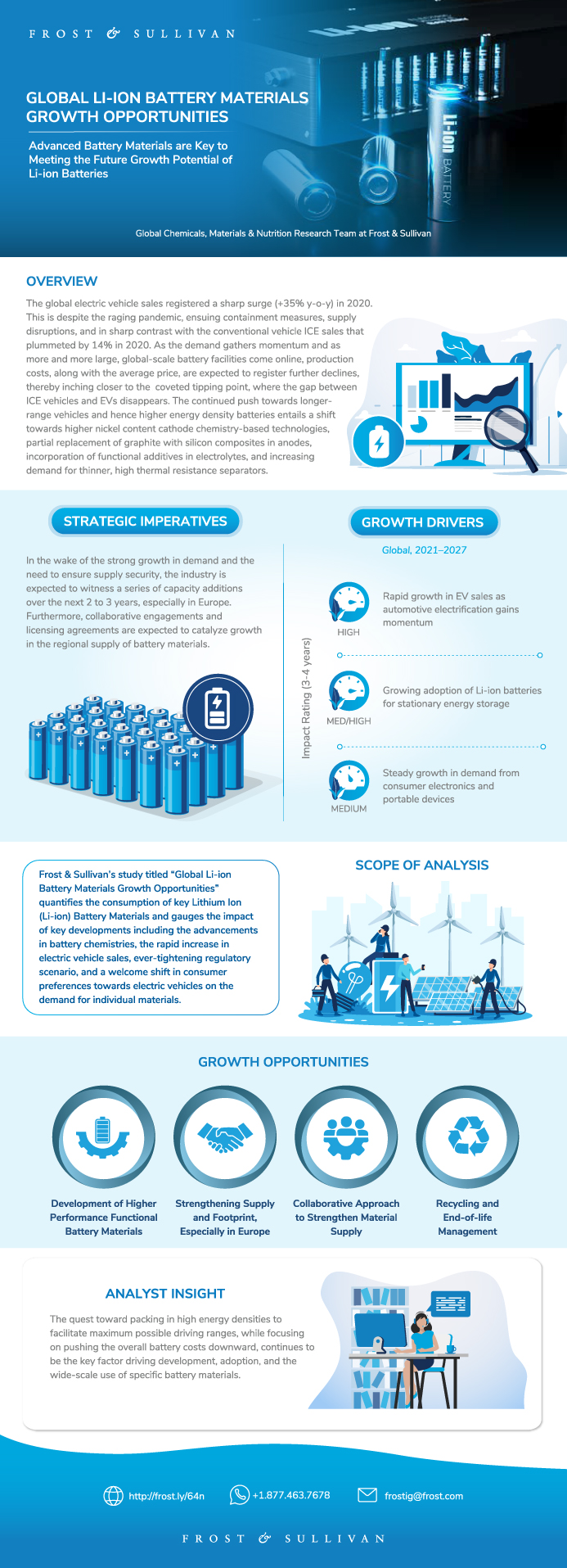

Advanced Battery Materials are Key to Meeting the Future Growth Potential of Li-ion Batteries

12-Jul-2021

Global

$4,950.00

Special Price $3,712.50 save 25 %

Description

This study quantifies the consumption of key lithium-ion (Li-ion) battery materials and focuses on gauging the impact that key market developments, like the advancements in battery chemistries, the rapid increase in electric vehicle (EV) sales, an ever-tightening regulatory scenario, and a shift in consumer preferences towards EVs, etc., are expected to have on the demand for individual materials between 2020 and 2027.

The study (an update of Frost & Sullivan’s study on Li-ion battery materials, published in 2020) quantifies the consumption of key material types, namely cathode materials, anode materials, electrolytes, separators, binders, and adhesives & sealants. On the basis of applications, the study analyses the demand for battery materials from applications such as EVs, industrial and energy storage systems (ESS), consumer electronics, and others (medical & healthcare devices and portable tools). The study quantifies the consumption of each of these material types on the basis of a robust methodology comprising an analysis of total Li-ion battery production, EV production volumes, uptake of the considered materials, and supply of those materials.

After having registered a lackluster growth in 2019, the global EV sales registered a sharp surge (+35% y-o-y) in 2020. The global EV sales (BEVs and PHEVs) nearly quadrupled between 2016 and 2020. The global EV sales volume was estimated at nearly 3.1 Mn units for 2020. This is despite the raging pandemic, ensuing containment measures, and supply disruptions, and in sharp contrast with the internal combustion engine (ICE) vehicle sales that plummeted by 14% in 2020. As the demand gathers momentum and as more and more large global-scale battery facilities come online, production costs and average price are expected to register further declines, thereby inching closer to the coveted tipping point, where the gap between ICE vehicles and EVs disappears.

On the flip-side, while the global EV sales have been registering a robust growth, especially for the last 3 to 5 years, the bulk of the sales volume has been concentrated in the United States, China, and Western Europe. However, EVs currently available in countries such as India and Brazil are priced significantly higher than conventional mass-market ICE vehicles. Furthermore, the lack of a well-developed network of charging infrastructure in these regions is likely to continue to compound the impediments associated with the mass adoption of EVs, at least over the short term.

The continued push towards longer-range vehicles (and hence higher energy density batteries) entails a shift towards technologies based on higher nickel content cathode chemistry, partial replacement of graphite with silicon composites in anodes, the incorporation of functional additives in electrolytes, and increasing demand for thinner, high thermal resistance separators.

While battery manufacturers are focusing on increasing capacity and reducing costs, a disruption in the supply of any of these crucial chemicals results in sky-rocketing prices and availability concerns, thereby disrupting the entire value chain. This is exacerbated by other diverse concerns ranging from ethical sourcing (artisanal or small-scale subsistence mining, child labor) to political instability in countries such as the Democratic Republic of Congo (DRC)—the single largest supplier of cobalt. Accordingly, incumbents across the value chain, especially in Europe, are increasingly mandating the ethical sourcing of raw materials, reducing the use of critical materials, and developing processes and infrastructure for the recycling and end-of-life management for Li-ion batteries.

Frost & Sullivan analysis indicates that the global battery materials market is slated to register a robust double-digit growth of about 15.6% in terms of revenue between 2020 and 2027.

Author: Gautam Rashingkar

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why Is It Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top three Strategic Imperatives on the Li-ion Battery Materials Market

Growth Opportunities Fuel the Growth Pipeline Engine™

Li-ion Battery Materials Market—Scope of Analysis

Li-ion Battery Materials Market Segmentation

Li-ion Battery Materials Market Segmentation (continued)

Market Definitions

Market Definitions (continued)

Market Definitions (continued)

Market Definitions (continued)

Market Definitions (continued)

Market Overview and Scope

Market Overview and Scope (continued)

Market Overview and Scope (continued)

Li-ion Batteries—Cost Composition

Market Overview

Key Growth Metrics for Li-ion Battery Materials Market

Growth Drivers for Li-ion Battery Materials Market

Growth Driver Analysis for Li-ion Battery Materials Market

Growth Driver Analysis for Li-ion Battery Materials Market (continued)

Growth Driver Analysis for Li-ion Battery Materials Market (continued)

Growth Driver Analysis for Li-ion Battery Materials Market (continued)

Growth Restraints for Li-ion Battery Materials Market

Growth Restraint Analysis for Li-ion Battery Materials Market

Growth Restraint Analysis for Li-ion Battery Materials Market (continued)

Growth Restraint Analysis for Li-ion Battery Materials Market (continued)

Challenges and/or Opportunities for Material Suppliers

Drivers and Restraints—Impact Assessment

Drivers and Restraints—Impact Assessment (continued)

Forecast Assumptions—Li-ion Battery Materials Market

Revenue Forecast—Li-ion Battery Materials Market

Revenue Forecast Analysis—Li-ion Battery Materials Market

Revenue Forecast by Material Type—Li-ion Battery Materials Market

Volume and Revenue Forecast Analysis—Li-ion Battery Materials Market

Volume and Revenue Forecast Analysis—Li-ion Battery Materials Market (continued)

Volume and Revenue Forecast Analysis—Li-ion Battery Materials Market (continued)

Attractiveness Analysis by Material Type—Li-ion Battery Materials Market

Battery Technology and Materials Evolution Timeline

Applications Overview

Revenue Forecast by Application—Li-ion Battery Materials Market

Revenue Forecast Analysis by Application—Li-ion Battery Materials Market

Revenue Forecast Analysis by Application—Li-ion Battery Materials Market (continued)

Attractiveness Analysis by Application—Li-ion Battery Materials Market

Revenue Forecast by Region—Li-ion Battery Materials Market

Revenue Forecast Analysis by Region—Li-ion Battery Materials Market

Revenue Forecast Analysis by Region—Li-ion Battery Materials Market (continued)

Revenue Forecast Analysis by Region—Li-ion Battery Materials Market (continued)

Attractiveness Analysis by Region—Li-ion Battery Materials Market

Value Chain—Li-ion Battery Materials Market

Value Chain Analysis—Li-ion Battery Materials Market

Li-ion Battery Manufacturing Process Overview

List of Material Suppliers by Type

List of Material Suppliers and Battery Manufacturers

Revenue Share—Li-ion Battery Materials Market

Competitive Environment—Li-ion Battery Materials Market

Characteristics and Overview—Cathode Materials

Characteristics Comparison—Cathode Materials

Specifications Comparison—Cathode Materials

Material Selection Criteria for Applications—Cathode Materials

Key Features—Cathode Materials

Presence in Applications—Cathode Materials

Trends—Cathode Materials

Trends—Cathode Materials (continued)

Trends—Cathode Materials (continued)

Key Growth Metrics for Cathode Materials

Revenue and Volume Forecast—Cathode Materials

Volume and Revenue Forecast Analysis—Cathode Materials

Pricing Trends and Forecast—Cathode Materials

Pricing Trends and Forecast Analysis—Cathode Materials

Volume Forecast by Chemistry—Cathode Materials

Volume Forecast Analysis by Chemistry—Cathode Materials

Attractiveness Analysis by Chemistry—Cathode Materials

Competitive Environment—Cathode Materials

Characteristics and Overview—Anode Materials

Characteristics Comparison—Anode Materials

Trends—Anode Materials

Trends—Anode Materials (continued)

Key Growth Metrics for Anode Materials

Revenue and Volume Forecast—Anode Materials

Volume and Revenue Forecast Analysis—Anode Materials

Pricing Trends and Forecast—Anode Materials

Pricing Trends and Forecast Discussion—Anode Materials

Volume Forecast by Chemistry—Anode Materials

Volume Forecast Analysis by Chemistry—Anode Materials

Attractiveness Analysis by Chemistry—Anode Materials

Competitive Environment—Anode Materials

Characteristics and Overview—Electrolytes

Materials Overview—Electrolytes

Materials Overview—Electrolytes (continued)

Lithium Salts—Properties Comparison: Electrolytes

Noteworthy Developments—Electrolytes

Trends—Electrolytes

Key Growth Metrics for Electrolytes

Revenue and Volume Forecast—Electrolytes

Volume and Revenue Forecast Analysis—Electrolytes

Pricing Trends and Forecast—Electrolytes

Pricing Trends and Forecast Analysis—Electrolytes

Competitive Environment—Electrolytes

Characteristics and Overview—Separators

Key Parameters—Separators

Wet and Dry Process Separators Comparison—Separators

Wet Process and Dry Process Flow—Separators

Trends—Separators

Key Growth Metrics for Separators

Revenue and Volume Forecast—Separators

Volume and Revenue Forecast Analysis—Separators

Pricing Trends and Forecast—Separators

Pricing Trends and Forecast Analysis—Separators

Volume Forecast by Process—Separators

Volume Forecast Analysis by Process—Separators

Attractiveness Analysis by Process—Separators

Competitive Environment—Separators

Characteristics and Overview—Binders

Definition and Characteristics—Binders

Materials and Composition—Binders

Materials and Composition—Binders (continued)

Cathode Binders—PVDF

Anode Binders—SBR/CMC

Binder Materials—Trends

Key Growth Metrics for Binders

Revenue and Volume Forecast—Binders

Volume and Revenue Forecast Analysis—Binders

Pricing Trends and Forecast—Binders

Pricing Trends and Forecast Analysis—Binders

Volume Forecast by Chemistry—Binders

Volume Forecast Analysis by Chemistry—Binders

Volume Forecast by Application—Binders

Volume Forecast Analysis by Application—Binders

Competitive Environment—Binders

Competitive Environment

Characteristics and Overview—Adhesives & Sealants

Characteristics and Overview—Adhesives & Sealants (continued)

Key Growth Metrics for Adhesives & Sealants

Revenue and Volume Forecast—Adhesives & Sealants

Volume and Revenue Forecast Analysis—Adhesives & Sealants

Pricing Trends and Forecast—Adhesives & Sealants

Pricing Trends and Forecast Analysis—Adhesives & Sealants

Volume Forecast by Application—Adhesives & Sealants

Volume Forecast Analysis by Application—Adhesives & Sealants

Attractiveness Analysis by Application—Adhesives & Sealants

Competitive Environment—Adhesives & Sealants

Growth Opportunity 1—Development of Higher Performance Functional Battery Materials

Growth Opportunity 1—Development of Higher Performance Functional Battery Materials (continued)

Growth Opportunity 2—Strengthening Supply and Footprint, Especially in Europe

Growth Opportunity 2—Strengthening Supply and Footprint, Especially in Europe (continued)

Growth Opportunity 3—Collaborative Approach to Strengthen Material Supply

Growth Opportunity 3—Collaborative Approach to Strengthen Material Supply (continued)

Growth Opportunity 4—Recycling and End-of-life Management

Growth Opportunity 4—Recycling and End-of-life Management (continued)

Your Next Steps

Why Frost, Why Now?

Abbreviations and Acronyms Used

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

List of Exhibits (continued)

Legal Disclaimer

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Predecessor | MF51-39 |

| Author | Gautam Rashingkar |

| Industries | Chemicals and Materials |

| WIP Number | MG10-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9100-A2,9869-A2,9595,9870 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB