Growth Opportunities for MedTech in the Transformation of the US Healthcare Provider Ecosystem

Growth Opportunities for MedTech in the Transformation of the US Healthcare Provider Ecosystem

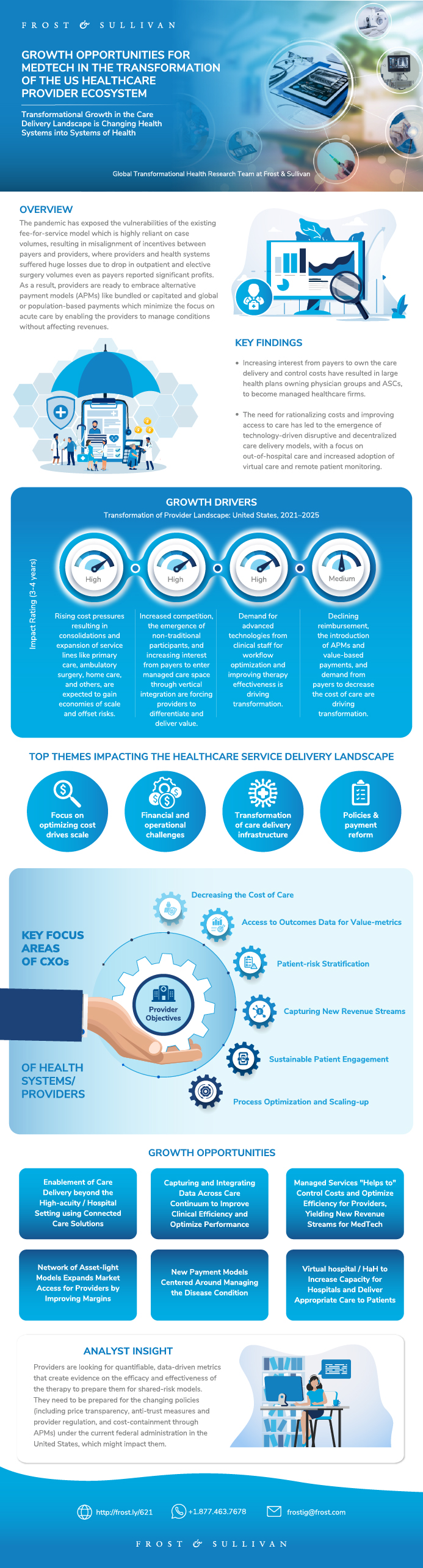

Transformational Growth in the Care Delivery Landscape is Changing Health Systems into Systems of Health

14-Jun-2021

North America

Description

Healthcare providers are on the verge of reinventing their role in the care delivery process due to various external factors, such as the following:

• Unsustainable growth in healthcare spending driving continuous downward pressure and declining operating margins

• The emergence of alternative payment models that focus on patient outcome and reduce costs for payers

• Threats from non-traditional players transforming the care delivery model through innovative business models, delivering operational efficiency and applying advanced technologies for patient-centric care

• Empowered patient-consumers taking an active role in their health and demanding personalized care and effective treatment.

The COVID-19 pandemic has necessitated the adoption of novel care delivery models among providers, further accelerating the payers’ plans to reduce avoidable in-patient admissions, thereby saving costs.

The pandemic has exposed the vulnerabilities of the existing fee-for-service model which is highly reliant on case volumes, resulting in misalignment of incentives between payers and providers, where providers and health systems suffered huge losses due to drop in outpatient and elective surgery volumes even as payers reported significant profits. As a result, providers are ready to embrace alternative payment models (APMs) like bundled or capitated and global or population-based payments which minimize the focus on acute care by enabling the providers to manage conditions without affecting revenues. More than ever, providers are willing to explore hybrid models of care and benefit from the advances in virtual care. The change in reimbursement models that incentivize providers for generating savings is driving them to adopt new technologies that can help deliver efficient care across the continuum.

To achieve cost-synergies and scale up operations, providers are building alternative sites of care and integrated delivery networks (IDNs) that help them offer care in appropriate settings to align with the principles of value-based care and retain patients who would have otherwise switched to competitors. Increasingly, providers are looking to partner with MedTech companies that can support them in building new capabilities for the value-based care models. In order to build solutions that solve the needs of key stakeholders in the current landscape, MedTech companies need to demonstrate the value of their device in achieving the goals of the providers by supporting them with operational efficiency, improving the patient experience, owning the outcome, and easing reporting and health information exchange.

Providers are looking for quantifiable, data-driven metrics that create evidence on the efficacy and effectiveness of the therapy to prepare them for shared-risk models. Providers and health systems need to be prepared for the changing policies (including price transparency, anti-trust measures and provider regulation, and cost-containment through APMs) under the current federal administration in the United States, which might impact them.

Research Highlights

- Strategic imperatives for key stakeholders (providers, payers, and MedTech)

- Priority areas for health system CXOs and their emergent strategies for modernizing the care process

- The impact of payment reforms and policies in the service delivery landscape

- Growth drivers and restraints for the provider transformation

- Top growth opportunities due to the ensuing transformation

Author: Srinath Venkatasubramanian

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why Is It Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top Three Strategic Imperatives on the US Healthcare Market

Growth Opportunities Fuel the Growth Pipeline Engine™

Executive Brief of the Report

Coverage Areas and Scope of Analysis

Top Themes and Factors Impacting the Healthcare Service Delivery Landscape

Costs, Consolidation, and Care Delivery Infrastructure—Dominance of Hospitals and Skewed Expenditure

Segmentation of the US Provider Landscape—Care Delivery Segments

Segmentation of the US Provider Landscape—Care Delivery Segments (continued)

US Healthcare Spending—Last Decade

US Healthcare Spending—Current Decade

Healthcare Expenditure by Type and Source of Funds

Majority of US Hospitals are System-affiliated Community Hospitals

Consolidation in the US Provider Landscape

Attractiveness of Alternative Sites of Care—Physician Practices and ASCs

Key Trends Impacting Providers

Healthcare Industry’s Transition to Quadruple Aim and What it means for Providers

Growth Drivers for the Provider Transformation

Growth Restraints for the Provider Transformation

External Challenges or Forces of Transformation for Providers

Internal Challenges or Forces of Transformation for Providers

Short-term and Long-term Issues Confronting the Provider Leadership

The COVID-19 Pandemic has Exposed the Constraints and Inefficiencies in the Current Healthcare Landscape

Key Focus areas of CXOs of Health Systems / Providers

Drivers Determining Novel Provider Strategies

Organizational Redesign Creating New Personas and Influencers in Health Systems

Health Systems Need to Shift from a Capital Intensive Low-margin Business Model to a Patient-centered High Value Model

Consumerism and Payer Priorities Impacting Care Volumes of Health Systems, Favoring Non-traditional Care Setting

Hospitals’ Impact on the Revenue Stream by Shift in Sites of Care

Care Delivery Platforms transforms Health Systems to Systems of Health through Integration and Rationalization

Emergent Strategies of Providers for Modernizing Care Process and Staying Relevant and Sustainable

Future of Hospital—Health System to Health Platform Where Hospitals are at the Core of Managing Health

Future of Hospital—Health System to Health Platform Where Hospitals are at the Core of Managing Health (continued)

The Next Growth Wave in the Care Delivery Landscape Relies on the Restructuring of Strategic Priorities by Providers

Health Systems Focusing on Investments, Reallocation of Resources, and Alternative Sites of Care, Post COVID-19

What Should MedTech Companies do to Build the Capabilities of Providers to Deliver Care in Alternative Sites?

Best Practice Implementations—Philips e-ICU

Best Practice Implementations—Medtronic Care Management Services

Policies from Capitol Hill Impacting the Care Delivery Landscape

Impact of Changing Policies on Providers and Opportunity for MedTech Firms

The Transition to APMs Brings New Opportunities for MedTech Companies to Work with Payers and Providers in Integrating Functionalities for Data Extraction, Evidence Generation, and Reporting

Rise of APMs

APM Adoption has been Positive Across Payer Categories

CMS Programs to Transform the Provider’s Role in the Care Delivery Process

Key Demonstration Programs Across Categories and MedTech Opportunity

Key Demonstration Programs Across Categories and MedTech Opportunity (continued)

Priority CMS and Pioneering MedTech Models

Change in Provider Priorities and MedTech Company Strategies

Transformation in Traditional Models of MedTech Engagement with Providers, Payers, and Patients is Driving Reformed Value Propositions

Providers Need to Transition from Legacy Siloed IT Infrastructure to New Connected Data Architecture to Benefit from Changing Financing Models Centered on Accountability

Altered Value Stream in MedTech will Transform the Two-sided Linear Links between Provider and OEM Companies into a Platform Mediated Business Structure

Altered Value Stream in MedTech will Transform the Two-sided Linear Links between Provider and OEM Companies into a Platform Mediated Business Structure (continued)

Solution Prioritization for Provider Needs

Adoption of New Models by Providers and Health Systems will Unlock New Growth Opportunities for MedTech Companies

Growth Opportunity 1: Enablement of Care Delivery beyond the High-acuity / Hospital Setting using Connected Care Solutions

Growth Opportunity 1: Enablement of Care Delivery beyond the High-acuity / Hospital Setting using Connected Care Solutions (continued)

Growth Opportunity 2: Capturing and Integrating Data Across Care Continuum to Improve Clinical Efficiency and Optimize Performance

Growth Opportunity 2: Capturing and Integrating Data Across Care Continuum to Improve Clinical Efficiency and Optimize Performance (continued)

Growth Opportunity 3: Managed Services Help Control Costs and Optimize Efficiency for Providers, Yielding New Revenue Streams for MedTech

Growth Opportunity 3: Managed Services Help Control Costs and Optimize Efficiency for Providers, Yielding New Revenue Streams for MedTech (continued)

Growth Opportunity 4: Network of Asset-light Models Expands Market Access for Providers by Improving Margins

Growth Opportunity 4: Network of Asset-light Models Expands Market Access for Providers by Improving Margins (continued)

Growth Opportunity 5: New Payment Models Centered Around Managing the Disease Condition

Growth Opportunity 5: New Payment Models Centered Around Managing the Disease Condition (continued)

Growth Opportunity 6: Virtual hospital / HaH to Increase Capacity for Hospitals and Deliver Appropriate Care to Patients

Growth Opportunity 6: Virtual hospital / HaH to Increase Capacity for Hospitals and Deliver Appropriate Care to Patients (continued)

List of Exhibits

List of Exhibits (continued)

Legal Disclaimer

Popular Topics

Research Highlights

- Strategic imperatives for key stakeholders (providers, payers, and MedTech)

- Priority areas for health system CXOs and their emergent strategies for modernizing the care process

- The impact of payment reforms and policies in the service delivery landscape

- Growth drivers and restraints for the provider transformation

- Top growth opportunities due to the ensuing transformation

Author: Srinath Venkatasubramanian

| No Index | No |

|---|---|

| Podcast | No |

| Author | Srinath Venkatasubramanian |

| Industries | Healthcare |

| WIP Number | K5B8-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9564-B1,9600-B1,9612-B1,9566-B1,9A47-B1,9A4B-B1,9614-B1 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB