Aftermarket

Increasing global vehicle population, connectivity trends and changing vehicle technology are creating strong disruptive forces within automotive aftermarket. As a result, this historically stable automotive vertical is rapidly transforming itself, creating both challenges and opportunities for existing and new stakeholders.

Frost & Sullivan’s Global Automotive Aftermarket program area takes a 360-view of the industry, examining and analyzing product, geographic, technological, and business trends covering the entirety of the market. Key areas that the program explores are:

- OES and aftermarket distribution

- Replacement product trends

- Emerging business models such as eretailing, telematics, connected services etc.

- Country and region level aftermarket trends

- Competitive part pricing trends and analytics

-

27 Nov 2020 | North America

Ageing Vehicle Population and DIY Expansion to Cushion COVID-19 Setbacks to North American Automotive Aftermarket in 2020

With a Significant Decline in the Average Miles Driven, the Year 2020 will Experience Drop in Demand Across All Major Replacement Parts

This report covers Class 1-3 vehicles compressors, radiators, batteries, air filters, oil filters, cabin air filters, spark plugs, starters, alternators and wipers aftermarket in terms of volume (in Million units) and value ($ Million) across United States and Canada. It discuss about unit shipments, revenue average price, distribution channel shar...

$4,950.00

Special Price $3,712.50 save 25 %

-

27 Nov 2020 | North America

Advanced Driver Assist Systems Stimulating the North American Automotive Repair Aftermarket

Growth Potential of the Automotive Repair Aftermarket Spurred by ADAS

Demand for Advanced Driver Assist Systems (ADAS) replacement sensors from light vehicle collision repairs in North America is forecast to generate a new market opportunity in the automotive repair aftermarket. Frost and Sullivan analysis estimates the L0-2 ADAS-related replacement sensors from the light vehicle collision repair market to grow at a ...

$4,950.00

Special Price $3,712.50 save 25 %

-

27 Nov 2020 | North America

Class 4–8 Truck Brakes Aftermarket Trending Toward Disc Brake Technology in North America

Disc Brake Technology to Gain Market Share Across all Vehicle Segments, Creating Strong Competition Between OES and HD WD Channels

Frost & Sullivan's research service on the Class 4-8 truck brakes aftermarket in North America forecasts market size through to 2026; the base year is 2019. The study analyzes key medium- and heavy-duty (MD/HD) truck hydraulic and pneumatic brake components, including brake drums, brake shoes, brake rotors, and brake pads. Market forecast is derive...

$4,950.00

Special Price $3,712.50 save 25 %

-

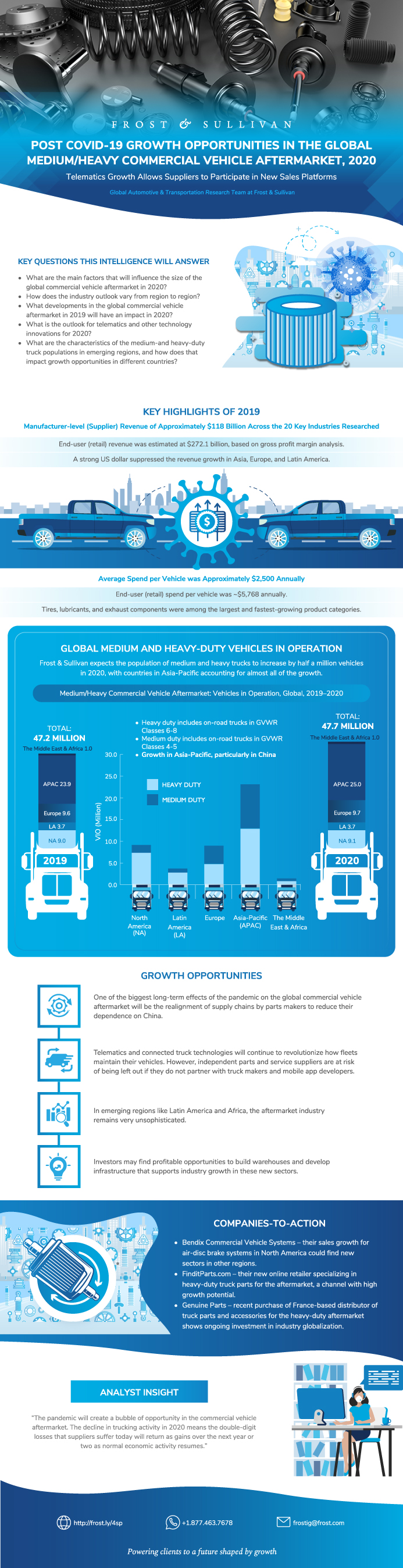

27 Oct 2020 | Global

Post COVID-19 Growth Opportunities in the Global Medium/Heavy Commercial Vehicle Aftermarket, 2020

Telematics Growth Allows Suppliers to Participate in New Sales Platforms

The COVID-19 pandemic will affect industries worldwide, but few can feel it as directly as the global commercial vehicles aftermarket. The collapse of economic activity in many regions means companies will drive their work trucks less, and they will spend less to maintain them. The aim of this study is to identify the size of the global commercial ...

$4,950.00

Special Price $3,712.50 save 25 %

-

23 Oct 2020 | North America

Increasing Complexity of Repairs due to Enhanced Technology Features to Sustain the North American Collision Repair Equipment Market, 2026

Future Growth Potential Enhanced by Opportunities in Welding, Measuring, and ADAS Recalibration Categories

Unit shipment in the North American collision repair equipment market is expected to grow in the coming years. Increase in vehicles in operation (VIO) coupled with the incremental miles travelled by vehicles, along with usage of alternate and light weighting materials, will largely drive unit shipments during the forecast period. Increase in the co...

$4,950.00

Special Price $3,712.50 save 25 %

-

21 Oct 2020 | South Asia, Middle East & North Africa

Innovative Business Models to Invigorate the Indian Automotive Aftermarket, 2026

The Competitive Intensity of a More Organized Independent Aftermarket is Set to Take OESs’ Share of Business

This research service analyzes the Indian passenger and small commercial vehicles aftermarket, the aftermarket's future outlook, and the opportunities it offers to various participants in the value chain. The base year for the analysis is 2019, and the forecast period is 2020 to 2026. The study discusses the impact of various factors—economic cl...

$4,950.00

Special Price $3,712.50 save 25 %

-

09 Oct 2020 | North America

Private-label Focused Business Models Driving Visibility and Sales of Channel Partners in the North American Class 4-8 Starters and Alternators Aftermarket, 2026

Strong Competition at Play Between OES and IAM Retailers in a Market that Otherwise Sees Slow Demand Growth for Replacements

This research study covers the class 4-8 starters and alternators aftermarket in terms of volume and value across the United States and Canada. It discusses unit shipments, revenue, average price, and distribution channel share. It also analyzes major participants separately for medium- and heavy-duty vehicles. The base year for the analysis is 201...

$4,950.00

Special Price $3,712.50 save 25 %

-

30 Sep 2020 | North America

Digitization and Electrification Reshaping the Fleet Maintenance Paradigm in North America, 2020–2030

Vehicle Maintenance Aided by AI, Telematics, and Predictive Solutions to Enhance Stakeholder Growth Opportunities

The aim of this study is to gauge the aftermarket opportunity from maintenance of new mobility fleets in North America between 2020 and 2030. The study provides a detailed analysis of the key trends influencing the North American new mobility ecosystem. It estimates the potential revenue accruable from servicing and repair of car sharing and ride ...

$4,950.00

Special Price $3,712.50 save 25 %

-

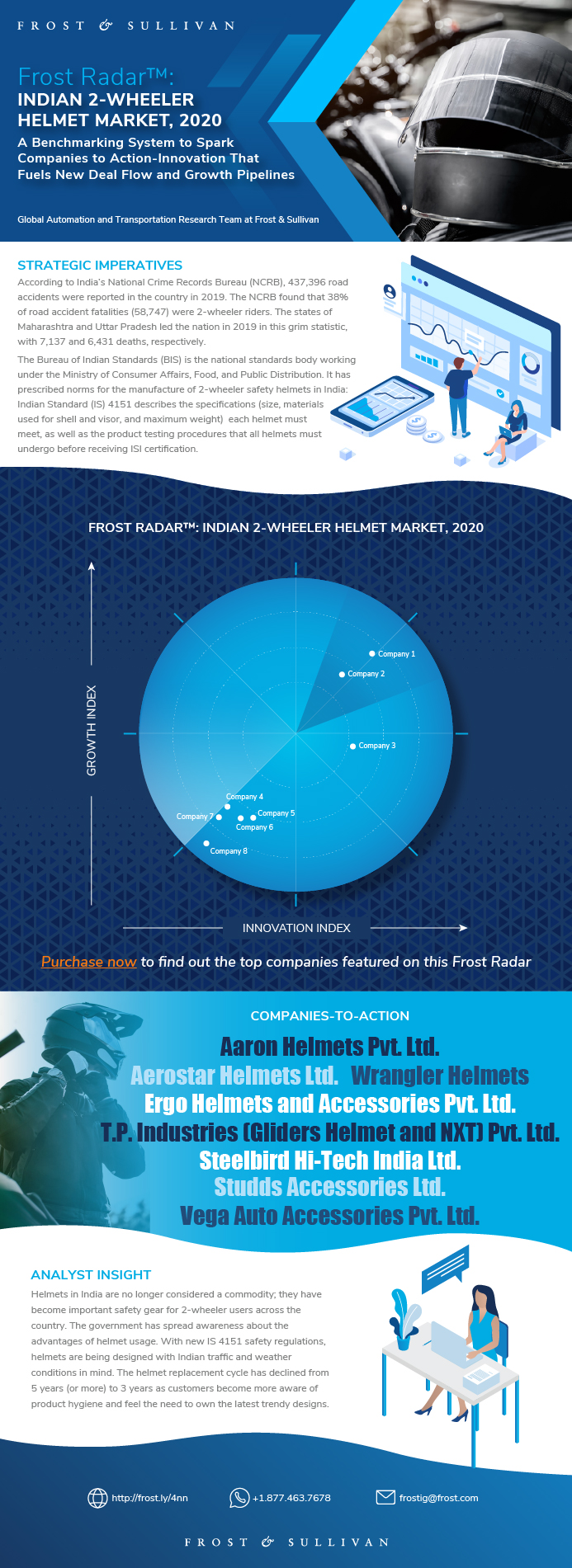

30 Sep 2020 | South Asia, Middle East & North Africa

Frost Radar™: Indian 2-Wheeler Helmet Market, 2020

A Benchmarking System to Spark Companies to Action-Innovation That Fuels New Deal Flow and Growth Pipelines

India is the largest market for 2-wheelers (e.g., scooterettes, mopeds, and motorcycles), with more than 190 million in operation at the end of 2019. It also is home to one of the worlds largest and most competitive 2-wheeler helmet manufacturing industries, with a current capacity of 35 million helmets per year. Helmet sales increased at a healt...

$4,950.00

Special Price $3,712.50 save 25 %

-

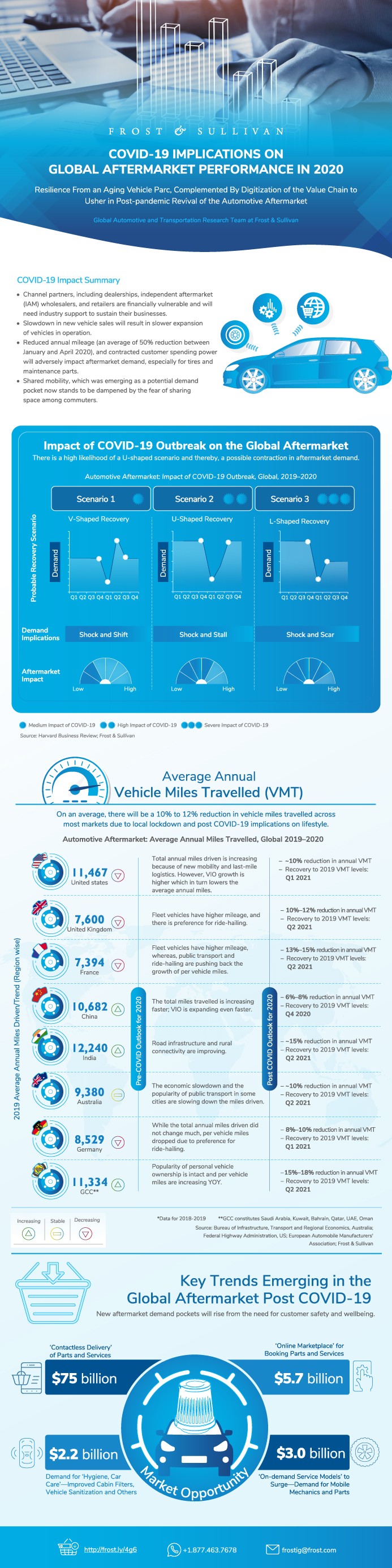

19 Aug 2020 | Global

Digital Business Models Mitigating COVID-19 Implications on Global Aftermarket Performance in 2020

Resilience From an Aging Vehicle Parc, Complemented By Digitization of the Value Chain to Usher in Post-pandemic Revival of the Automotive Aftermarket

This study evaluates the trajectories of global economic recovery in the aftermath of the pandemic and elucidates the medium-term impact of muted demand and supply on aftermarket revenues for 2020. Taking the long-term view, the study also underscores growth opportunities and evolving business models that, if leveraged on, will aid the aftermarket�...

$4,950.00

Special Price $3,712.50 save 25 %

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB