Leasing and Finance

The Frost & Sullivan Fleet Leasing and Vehicle Financing team provides insights on key trends and innovations underpinning the shift from vehicle ownership to vehicle usage. Dedicated resource tracks and analyses the key components including fleet leasing, used car financing, private leasing, fleet management, long term and short term car rental, future vehicle financing and mergers & acquisitions in the industry.

The team integrates secondary research with in-depth interviews of vehicle fleet funding providers and fleet operators in order to deliver market and competitor data highlighting the development of company car, full service leasing, financial leasing and fleet management services. The scope of the research is global, spanning developed and emerging markets. Country Market insight reports and Global outlook studies help clients better understand growth potential (drivers and restraints) and associated business opportunities within fleet and retail sectors both in Passenger Vehicle (PV) and Light Commercial Vehicle (LCV) segments. In our reports the market analysis covers Vehicle New Registrations and Vehicles in Operation (VIO) data.

We work closely with the world’s largest fleet leasing service providers and auto finance companies to help them find product, service and geographic opportunities. We provide solutions to clients based on historic data, current market conditions (PESTLE), insights and opinion of key market players and associations and expected growth rate. Tailored, customized solutions provide clients insights into latest trends in automobile finance.

-

19 Feb 2020 | Latin America

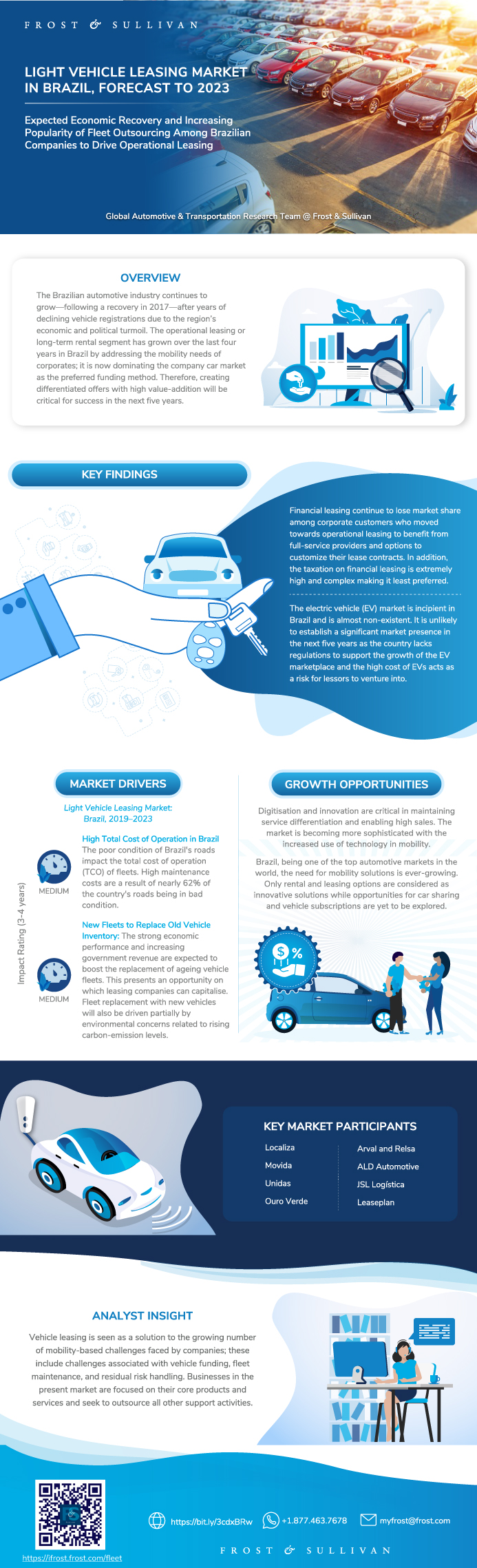

Light Vehicle Leasing Market in Brazil, Forecast to 2023

Expected Economic Recovery and Increasing Popularity of Fleet Outsourcing Among Brazilian Companies to Drive Operational Leasing

The Brazil automotive industry continues to grow—following a recovery in 2017—after years of declining vehicle registrations due to the region’s economic and political turmoil. The operational leasing or long-term rental segment has grown over the last four years in Brazil by addressing the mobility needs of corporates; it is now dominating t...

$3,000.00 -

17 Feb 2020 | North America

Light Vehicle Leasing Market in Canada, Forecast to 2023

Company Car Leasing is Expected to Register a Stable Growth Over the Forecast Period as Corporate Firms Continue to Renew Fleets to Support Growing Business

Company cars are usually provided as tool-of-work vehicles in Canada. Growth in company cars was spurred by the growing demand for fleet vehicles from the industrial sector, which received a fillip from Canada's strong overall economic performance. Leasing, covering operational leasing and financial leasing, is the major sourcing channel in Canada....

$3,000.00 -

14 Feb 2020 | Europe

Light Vehicle Leasing Market in Ireland, Forecast to 2023

As All Leasing Options Saturate, Market Participants Hope for Favorable Fiscal Policies to Revive Growth in Fleet Sales in Ireland

The Irish vehicle leasing industry is experiencing headwinds amid the uncertainties associated with Brexit. Consumers are changing their preferences in acquiring new vehicles as a result of falling residual values of old vehicles. This trend has curtailed vehicle trading; however, the effect on fleet registration is different when compared to retai...

$3,000.00 -

05 Feb 2020 | Asia Pacific

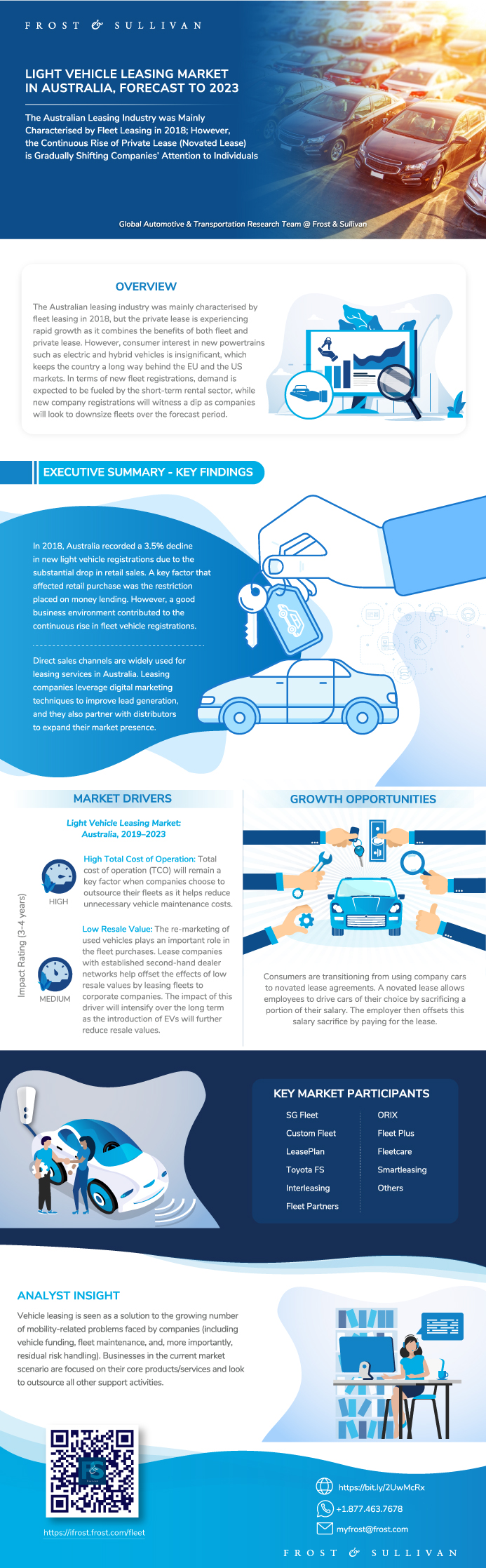

Light Vehicle Leasing Market in Australia, Forecast to 2023

The Australian Leasing Industry was Mainly Characterised by Fleet Leasing in 2018; However, the Continuous Rise of Private Lease (Novated Lease) is Gradually Shifting Companies’ Attention to Individuals

The Australian leasing industry was mainly characterised by fleet leasing in 2018, but private lease is experiencing rapid growth as it combines the benefits of both fleet and private lease. However, consumer interest in new powertrains such as electric and hybrid vehicles is insignificant, which keeps the country a long way behind the EU and the U...

$3,000.00 -

05 Feb 2020 | North America

Light Vehicle Leasing Market in Mexico, Forecast to 2023

Despite the Decreasing Volumes of New Fleet Leasing, Increasing Consumer Awareness and Expected Recovery in Macro-economics will Drive Growth from 2020

The Mexican vehicle leasing industry is experiencing challenges due to a variety of reasons including macro-economic factors, such as tight public investments, trade tensions with the United States, and the global economic slowdown. However, the change in the government after the 2018 general elections is expected to open new opportunities in the m...

$3,000.00 -

04 Feb 2020 | North America

Light Vehicle Leasing Market in the United States, Forecast to 2023

The Penetration of Electric Vehicle Among Company Car Fleets is Lower Than Retail Channel, As Concerns Over Total Cost of Asset Operation Has Slowed Down Uptake

Company car registrations increased from 2013 to 2018, spurred by a strongly performing industrial sector. While utility vehicles comprise a major part of company fleets in the US, growth in various sectors of the economy has driven demand for new vehicles and fleet renewals. Financial leasing is the dominant leasing solution in the US. This is att...

$3,000.00 -

03 Feb 2020 | South Asia, Middle East & North Africa

Light Vehicle Leasing Market in Israel, Forecast to 2023

Improved Corporate Demand and Increased Consumer Opportunities to Drive Revival of Israel’s Vehicle Leasing Market

Company car registrations continue to be an important part of total vehicle sales in Israel. Following continuous growth from 2013 to 2017, new registrations experienced a small drop due to the overall market slowdown. In 2018, total leasing penetration dipped due to higher lease rates and the preference for used cars among small business consumers...

$3,000.00 -

03 Feb 2020 | Asia Pacific

Chinese Light Vehicle Leasing Market, Forecast to 2023

New Company Car Registrations in Financial and Operational Leasing are Expected to Record Good Growth, Reaching About 300,000 Units by 2023

The Chinese fleet leasing market is in the early stages of development. New company car registrations in China are expected to grow slowly mainly due to fierce competition from mobility service providers offering instant and convenient private car hailing services. Moreover, the country has a well-developed public transportation network that consti...

$3,000.00 -

31 Jan 2020 | Asia Pacific

Light Vehicle Leasing Market in South Korea, Forecast to 2023

While Favorable Policies Create a Mature Leasing Market, Rising User Demand Causes Leasing Companies to Evolve into End-to-End Mobility Providers

Fleet registration is expected to grow, aided mainly by registrations in the company car fleet. Company cars, which are provided mainly for work purposes in South Korea, are experiencing increased demand from industries and corporate firms. Leasing, comprising operational leasing and financial leasing, is the major sourcing channel for company cars...

$3,000.00 -

30 Jan 2020 | Asia Pacific

Japanese Light Vehicle Leasing Market, Forecast to 2023

The Japanese Leasing Industry is Healthy and Expects Promising Growth Prospects Driven by Operational Leasing in Both the Corporate and Private Market Segments

Fleet renewals were the major driver for new company car registrations as a strained economy caused fluctuations in total registrations over the past few years. The benefits of leasing (unlike owning) has boosted the transition from a loan purchase system to a full service operational leasing system since it has enabled corporates to focus on their...

$3,000.00

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB