North American Mobile Water and Wastewater Treatment Systems Market, Forecast to 2021

North American Mobile Water and Wastewater Treatment Systems Market, Forecast to 2021

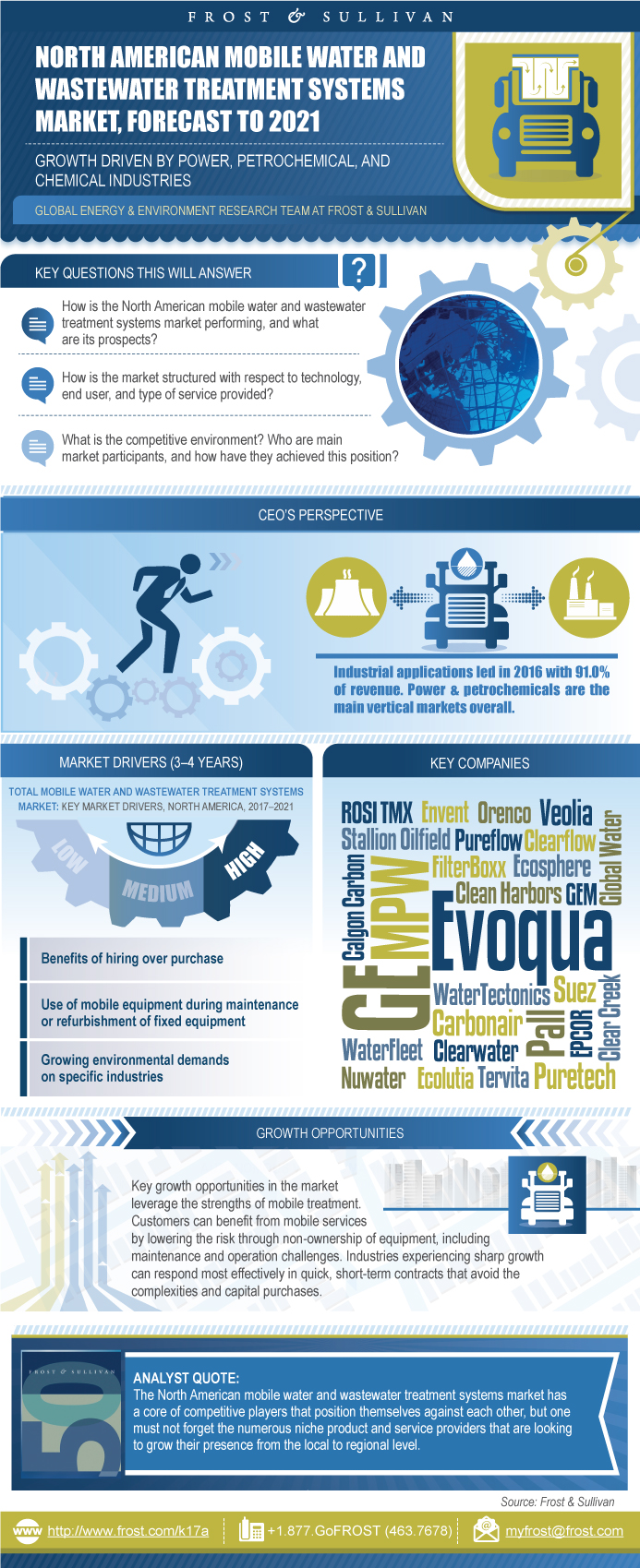

Growth Driven by Power, Petrochemical, and Chemical Industries

27-Mar-2017

North America

Market Research

$4,950.00

Special Price $3,712.50 save 25 %

The North American market for mobile water and wastewater treatment systems serves a critical purpose in keeping facilities running and responding to fluctuating capacity needs for numerous industries. Critical industries including power, petrochemical, and chemical rely on mobile treatment services to ensure smooth operations and regulatory compliance. An understanding of key market and technology trends, customer and regional demand, and revenue forecasts are needed to devise an intelligent growth strategy.

While the market is led by core participants, there is scope for growth at all levels to secure growth. The market traditionally focuses on industrial applications rather than municipal. Industrial verticals are more likely to address sudden or seasonal capacity need fluctuations, unlike municipal facilities that look at long-term investment strategies for major infrastructure components. Some recent developments, however, have seen growth opportunities in providing potable water for small communities.

Customers are buying a range of technology solutions including resin and membrane solutions for potable and process water treatment, while wastewater needs are being met with physiochemical and membrane solutions. Fluctuations at the customer level, however, do not carry over to the competitor landscape, which is characterized by a core group of leading participants and numerous regional and niche competitors. Market leaders benefit from their extensive network of mobile units and geographic coverage. All companies seek a competitive edge on pricing, response time, and technology portfolio.

This study analyzes the North American mobile water and wastewater treatment systems market from 2013 to 2021. The research scope includes:

• Municipal and industrial customers

• Water treatment (membrane technologies, resin systems, and other systems) and wastewater treatment technologies

• Breakdowns by country (Canada and the United States)

• Market drivers and restraints for the 2017–2021 forecast period

• A competitive landscape analysis

Key questions this study will address:

• How is the market performing, and what are its prospects?

• What is driving and restraining the market, and what are the key challenges for the market going forward?

• What is the market structure with respect to technology, end user, and type of service?

• In what ways is the market evolving?

• How does the market differ by country and regionally?

• What is the competitive environment? Who are the main participants, and how have they achieved their positions?

Key Findings

Market Engineering Measurements

CEO’s Perspective

Market Overview

Market Segmentation

Revenue Share by Segment

- Definitions

- Market Scope

- Market Breakdowns

- Geographical Scope

Revenue Share by Application

Revenue Share by Technology

Distribution Channels

Market Drivers

Market Restraints

Market Engineering Measurements

Revenue Forecast

Pricing Trends

Revenue Share Forecast by Country

Revenue Forecast by Country

Revenue Share Forecast by Segment

Revenue Forecast by Technology

Revenue Forecast by Application

Revenue Share Forecast by Vertical Market

Revenue Forecast by Distribution Channel

Market Share

Market Share Analysis

Competitive Environment

SWOT Analysis

Competitive Factors and Assessment

Growth Opportunity 1—US Market

Growth Opportunity 2—Industrial Demands

Growth Opportunity 3—Water Reuse

Growth Opportunity 4—Small-Scale End Users

Growth Opportunity 5—Membranes

5 Major Growth Opportunities

Strategic Imperatives for Success and Growth

Key Findings

Market Engineering Measurements

Revenue Forecast

Wastewater Segment Key Findings

Market Engineering Measurements

Revenue Forecast

Key Findings

Revenue Forecast

Revenue Share Forecast by Segment

Revenue Forecast by Application

Revenue Share Forecast by Vertical Market

Revenue Share Forecast by Technology

Market Share

Market Share Analysis

Competitive Environment

Key Findings

Revenue Forecast

Revenue Share Forecast by Segment

Revenue Share Forecast by Vertical Market

Revenue Share Forecast by Technology

Market Share

Market Share Analysis

Competitive Environment

3 Big Predictions

Legal Disclaimer

Market Engineering Methodology

List of Other Companies

Partial List of Companies Interviewed

- 1. Total Mobile Water and Wastewater Treatment Systems Market: Key Market Drivers, North America, 2017–2021

- 2. Total Mobile Water and Wastewater Treatment Systems Market: Key Market Restraints, North America, 2017–2021

- 3. Total Mobile Water and Wastewater Treatment Systems Market: Market Engineering Measurements, North America, 2016

- 4. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast by Country, North America, 2013–2021

- 5. Mobile Water and Wastewater Treatment Systems Market: Revenue Share Forecast by Vertical Market, North America, 2013, 2016, and 2021

- 6. Total Mobile Water and Wastewater Treatment Systems Market: Market Share Analysis of Top 8 Participants, North America, 2016

- 7. Total Mobile Water and Wastewater Treatment Systems Market: Competitive Structure, North America, 2016

- 8. Total Mobile Water and Wastewater Treatment Systems Market: SWOT Analysis, North America, 2016

- 9. Total Mobile Water and Wastewater Treatment Systems Market: Competitive Factors, North America, 2016

- 10. Water Segment: Market Engineering Measurements, North America, 2016

- 11. Wastewater Segment: Market Engineering Measurements, North America, 2016

- 12. Mobile Water and Wastewater Treatment Systems Market: Revenue Share Forecast by Vertical Market, Canada, 2013, 2016, and 2021

- 13. Mobile Water and Wastewater Treatment Systems Market: Market Share Analysis of Top 3 Participants, Canada, 2016

- 14. Mobile Water and Wastewater Treatment Systems Market: Competitive Structure, Canada, 2016

- 15. Mobile Water and Wastewater Treatment Systems Market: Percent Revenue Forecast by Vertical Market, United States, 2013, 2016, and 2021

- 16. Mobile Water and Wastewater Treatment Systems Market: Market Share Analysis of Top 8 Participants, United States, 2016

- 17. Mobile Water and Wastewater Treatment Systems Market: Competitive Structure, United States, 2016

- 1. Total Mobile Water and Wastewater Treatment Systems Market: Market Engineering Measurements,

- 2. North America, 2016

- 3. Total Mobile Water and Wastewater Treatment Systems Market: Segmentation, North America, 2016

- 4. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Share by Segment, North America, 2016

- 5. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Share by Application, North America, 2016

- 6. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Share by Technology, North America, 2016

- 7. Total Mobile Water and Wastewater Treatment Systems Market: Distribution Channel Analysis, North America, 2016

- 8. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast, North America, 2013–2021

- 9. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Share Forecast by Country, North America, 2013–2021

- 10. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Share Forecast by Segment, North America, 2013–2021

- 11. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast by Technology, North America, 2013–2021

- 12. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast by Application, North America, 2013–2021

- 13. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast by Distribution Channel, North America, 2013–2021

- 14. Total Mobile Water and Wastewater Treatment Systems Market: Market Share, North America, 2016

- 15. Water Segment: Revenue Forecast, North America, 2013–2021

- 16. Wastewater Segment: Revenue Breakdown, North America, 2016

- 17. Wastewater Segment: Revenue Forecast, North America, 2013–2021

- 18. Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast, Canada, 2013–2021

- 19. Mobile Water and Wastewater Treatment Systems Market: Revenue Share Forecast by Segment, Canada, 2013–2021

- 20. Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast by Application, Canada, 2013–2021

- 21. Mobile Water and Wastewater Treatment Systems Market: Revenue Share Forecast by Technology, Canada, 2013–2021

- 22. Mobile Water and Wastewater Treatment Systems Market: Market Share, Canada, 2016

- 23. Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast, United States, 2013–2021

- 24. Mobile Water and Wastewater Treatment Systems Market: Revenue Share Forecast by Segment, United States, 2013–2021

- 25. Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast by Application, United States, 2013–2021

- 26. Mobile Water and Wastewater Treatment Systems Market: Revenue Share Forecast by Technology, United States, 2013–2021

- 27. Mobile Water and Wastewater Treatment Systems Market: Market Share, United States, 2016

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

| Deliverable Type | Market Research |

|---|---|

| No Index | No |

| Podcast | No |

| Table of Contents | | Executive Summary~ || Key Findings~ || Market Engineering Measurements~ || CEO’s Perspective~ | Market Overview~ || Market Overview~ ||| Definitions~ ||| Market Scope~ ||| Market Breakdowns~ ||| Geographical Scope~ || Market Segmentation~ || Revenue Share by Segment~ || Revenue Share by Application~ || Revenue Share by Technology~ || Distribution Channels~ | Drivers and Restraints~ || Market Drivers~ ||| Benefits of hiring over purchase~ ||| Use of mobile equipment during maintenance~ ||| Growing environmental demands on specific industries~ ||| Growth expected in certain verticals~ ||| Growing issue of water reuse~ || Market Restraints~ ||| Price competition~ ||| Uncertainty regarding prospects for some verticals~ ||| Reluctance to meet environmental obligations~ ||| The Trump effect~ ||| Availability of financing~ | Forecast and Trends~ || Market Engineering Measurements~ || Revenue Forecast~ || Pricing Trends~ || Revenue Share Forecast by Country~ || Revenue Forecast by Country~ || Revenue Share Forecast by Segment~ || Revenue Forecast by Technology~ || Revenue Forecast by Application~ || Revenue Share Forecast by Vertical Market~ || Revenue Forecast by Distribution Channel~ | Market Share and Competitive Analysis~ || Market Share~ || Market Share Analysis~ || Competitive Environment~ || SWOT Analysis~ || Competitive Factors and Assessment~ | Growth Opportunities and Companies to Action~ || Growth Opportunity 1—US Market~ || Growth Opportunity 2—Industrial Demands~ || Growth Opportunity 3—Water Reuse~ || Growth Opportunity 4—Small-Scale End Users~ || Growth Opportunity 5—Membranes~ || 5 Major Growth Opportunities~ || Strategic Imperatives for Success and Growth~ | Water Segment Analysis~ || Key Findings~ || Market Engineering Measurements~ || Revenue Forecast~ | Wastewater Segment Analysis~ || Wastewater Segment Key Findings~ || Market Engineering Measurements~ || Revenue Forecast~ | Canada Analysis~ || Key Findings~ || Revenue Forecast~ || Revenue Share Forecast by Segment~ || Revenue Forecast by Application~ || Revenue Share Forecast by Vertical Market~ || Revenue Share Forecast by Technology~ || Market Share~ || Market Share Analysis~ || Competitive Environment~ | United States Analysis~ || Key Findings~ || Revenue Forecast~ || Revenue Share Forecast by Segment~ || Revenue Share Forecast by Vertical Market~ || Revenue Share Forecast by Technology~ || Market Share~ || Market Share Analysis~ || Competitive Environment~ | The Last Word~ || 3 Big Predictions~ || Legal Disclaimer~ | Appendix~ || Market Engineering Methodology~ || List of Other Companies~ || Partial List of Companies Interviewed~ |

| List of Charts and Figures | 1. Total Mobile Water and Wastewater Treatment Systems Market: Key Market Drivers, North America, 2017–2021~ 2. Total Mobile Water and Wastewater Treatment Systems Market: Key Market Restraints, North America, 2017–2021~ 3. Total Mobile Water and Wastewater Treatment Systems Market: Market Engineering Measurements, North America, 2016~ 4. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast by Country, North America, 2013–2021~ 5. Mobile Water and Wastewater Treatment Systems Market: Revenue Share Forecast by Vertical Market, North America, 2013, 2016, and 2021~ 6. Total Mobile Water and Wastewater Treatment Systems Market: Market Share Analysis of Top 8 Participants, North America, 2016~ 7. Total Mobile Water and Wastewater Treatment Systems Market: Competitive Structure, North America, 2016~ 8. Total Mobile Water and Wastewater Treatment Systems Market: SWOT Analysis, North America, 2016~ 9. Total Mobile Water and Wastewater Treatment Systems Market: Competitive Factors, North America, 2016~ 10. Water Segment: Market Engineering Measurements, North America, 2016~ 11. Wastewater Segment: Market Engineering Measurements, North America, 2016~ 12. Mobile Water and Wastewater Treatment Systems Market: Revenue Share Forecast by Vertical Market, Canada, 2013, 2016, and 2021~ 13. Mobile Water and Wastewater Treatment Systems Market: Market Share Analysis of Top 3 Participants, Canada, 2016~ 14. Mobile Water and Wastewater Treatment Systems Market: Competitive Structure, Canada, 2016~ 15. Mobile Water and Wastewater Treatment Systems Market: Percent Revenue Forecast by Vertical Market, United States, 2013, 2016, and 2021~ 16. Mobile Water and Wastewater Treatment Systems Market: Market Share Analysis of Top 8 Participants, United States, 2016~ 17. Mobile Water and Wastewater Treatment Systems Market: Competitive Structure, United States, 2016~| 1. Total Mobile Water and Wastewater Treatment Systems Market: Market Engineering Measurements, ~ 2. North America, 2016~ 3. Total Mobile Water and Wastewater Treatment Systems Market: Segmentation, North America, 2016~ 4. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Share by Segment, North America, 2016~ 5. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Share by Application, North America, 2016~ 6. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Share by Technology, North America, 2016~ 7. Total Mobile Water and Wastewater Treatment Systems Market: Distribution Channel Analysis, North America, 2016~ 8. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast, North America, 2013–2021~ 9. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Share Forecast by Country, North America, 2013–2021~ 10. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Share Forecast by Segment, North America, 2013–2021~ 11. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast by Technology, North America, 2013–2021~ 12. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast by Application, North America, 2013–2021~ 13. Total Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast by Distribution Channel, North America, 2013–2021~ 14. Total Mobile Water and Wastewater Treatment Systems Market: Market Share, North America, 2016~ 15. Water Segment: Revenue Forecast, North America, 2013–2021~ 16. Wastewater Segment: Revenue Breakdown, North America, 2016~ 17. Wastewater Segment: Revenue Forecast, North America, 2013–2021~ 18. Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast, Canada, 2013–2021~ 19. Mobile Water and Wastewater Treatment Systems Market: Revenue Share Forecast by Segment, Canada, 2013–2021~ 20. Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast by Application, Canada, 2013–2021~ 21. Mobile Water and Wastewater Treatment Systems Market: Revenue Share Forecast by Technology, Canada, 2013–2021~ 22. Mobile Water and Wastewater Treatment Systems Market: Market Share, Canada, 2016~ 23. Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast, United States, 2013–2021~ 24. Mobile Water and Wastewater Treatment Systems Market: Revenue Share Forecast by Segment, United States, 2013–2021~ 25. Mobile Water and Wastewater Treatment Systems Market: Revenue Forecast by Application, United States, 2013–2021~ 26. Mobile Water and Wastewater Treatment Systems Market: Revenue Share Forecast by Technology, United States, 2013–2021~ 27. Mobile Water and Wastewater Treatment Systems Market: Market Share, United States, 2016~ |

| Author | Seth Cutler |

| Industries | Environment |

| WIP Number | K17A-01-00-00-00 |

| Is Prebook | No |