Strategic Analysis of the Global Tire Materials Market

Strategic Analysis of the Global Tire Materials Market

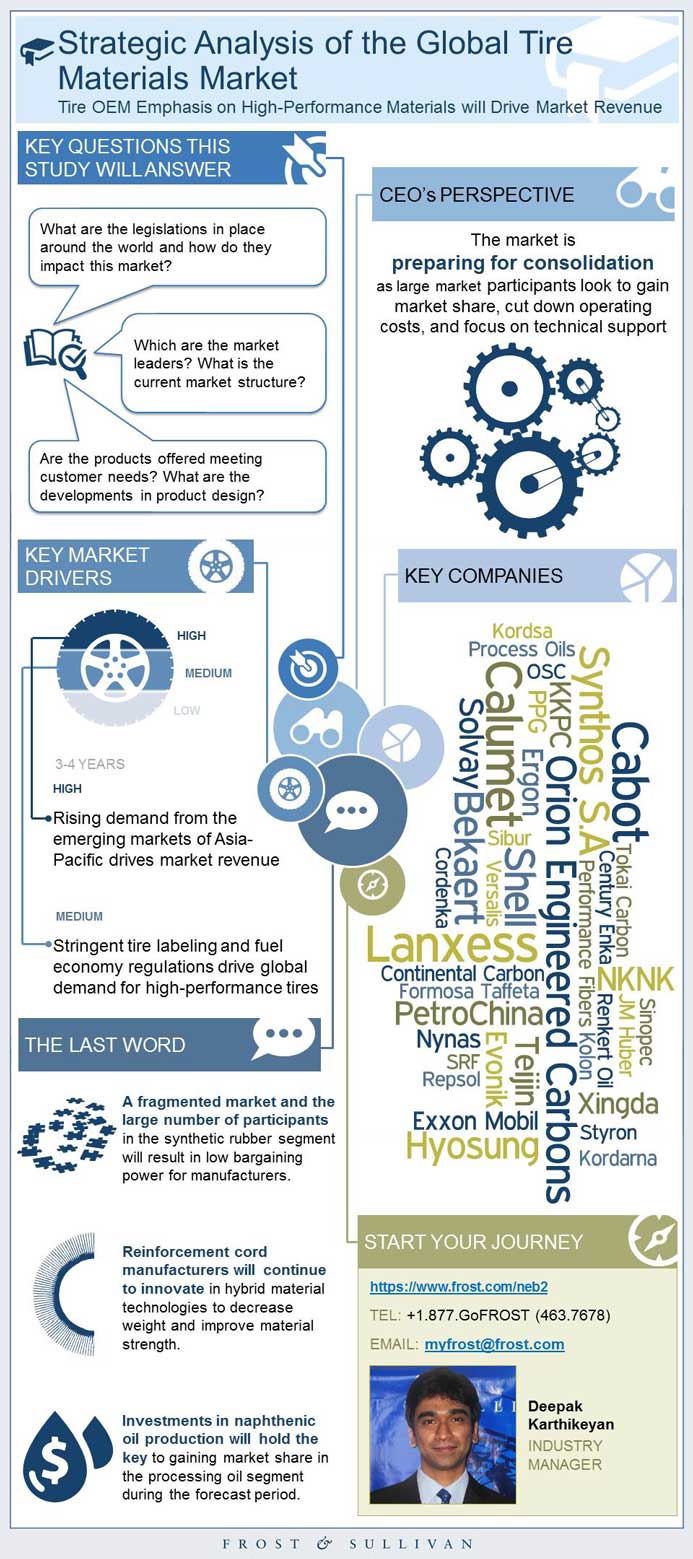

Tire OEM Emphasis on High-Performance Materials will Drive Market Revenue

17-Feb-2015

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

This research service provides a comprehensive analysis of materials involved in tire manufacturing. The scope of the study covers 4 tire material segments—synthetic rubber, reinforcing fillers, reinforcement cords, and processing oils. The study provides in-depth insight into each of these segments across North America, Europe, Asia-Pacific, and the Rest of the World. It includes an analysis of diverse material and technology trends and covers the important factors driving and restraining the market. Key competitive factors are identified and a product matrix of the top market participants provided for each region. The study period is from 2011 to 2021, and the base year is 2014.

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Executive Summary—Key Findings

Executive Summary—Strategic Factsheet

Executive Summary—Market Engineering Measurements

Executive Summary—Market Engineering Measurements (continued)

Executive Summary—Market Engineering Measurements (continued)

Executive Summary—Market Engineering Measurements (continued)

Executive Summary—Market Engineering Measurements (continued)

Executive Summary—Market Engineering Measurements (continued)

Executive Summary—Market Engineering Measurements (continued)

Executive Summary—Market Engineering Measurements (continued)

Executive Summary—CEO’s Perspective

Market Overview—Definitions

Market Overview—Definitions (continued)

Market Overview—Segmentation

Market Overview—Segmentation (continued)

Market Overview—Key Questions This Study Will Answer

Market Drivers

Drivers Explained

Market Restraints

Restraints Explained

Forecast Assumptions

Revenue Forecast

Unit Shipment Forecast

Revenue Forecast by Segment

Unit Shipment Forecast by Segment

Key Findings

Market Engineering Measurements

Market Engineering Measurements (continued)

Segment Definitions

Segment Value Chain

Segment Value Chain Discussion

Market Drivers

Drivers Explained

Drivers Explained (continued)

Drivers Explained (continued)

Market Restraints

Restraints Explained

Restraints Explained (continued)

Synthetic Rubber Segment—Market Trends

Synthetic Rubber Segment—Regulatory Trends

Synthetic Rubber Segment—Product and Technology Trends

Revenue Forecast

Unit Shipment Forecast

Revenue and Unit Shipment Forecast Discussion

Pricing Trends and Forecast

Pricing Trends and Forecast Discussion

Percent Revenue Forecast by Sub-Segment

Revenue Forecast by Sub-Segment

Percent Unit Shipment Forecast by Sub-Segment

Unit Shipment Forecast by Sub-Segment

Revenue and Unit Shipment Forecast Discussion by Sub-Segment

Percent Revenue Forecast by Region

Revenue Forecast by Region

Percent Unit Shipment Forecast by Region

Unit Shipment Forecast by Region

Revenue and Unit Shipment Forecast Discussion by Region

Percent Unit Shipment Forecast by Passenger Cars and LCVs

Unit Shipment Forecast by Passenger Cars and LCVs

Unit Shipment Forecast Discussion by Passenger Cars and LCVs

Percent Unit Shipment Forecast by OE and Replacement Tires

Unit Shipment Forecast by OE and Replacement Tires

Unit Shipment Forecast Discussion by OE and Replacement Tires

Market Share

Market Share Analysis

Competitive Environment

Competitive Factors and Assessment

Leading Companies

Leading Companies (continued)

Key Findings

Market Engineering Measurements

Market Engineering Measurements (continued)

Segment Definitions

Segment Value Chain

Segment Value Chain Discussion

Market Drivers

Drivers Explained

Drivers Explained (continued)

Drivers Explained (continued)

Market Restraints

Restraints Explained

Restraints Explained (continued)

Restraints Explained (continued)

Market Trends

Regulatory Trends

Product and Technology Trends

Revenue Forecast

Unit Shipment Forecast

Revenue and Unit Shipment Forecast Discussion

Pricing Trends and Forecast

Pricing Trends and Forecast Discussion

Percent Revenue Forecast by Sub-Segment

Revenue Forecast by Sub-Segment

Percent Unit Shipment Forecast by Sub-Segment

Unit Shipment Forecast by Sub-Segment

Revenue and Unit Shipment Forecast Discussion by Sub-Segment

Percent Revenue Forecast by Region

Revenue Forecast by Region

Percent Unit Shipment Forecast by Region

Unit Shipment Forecast by Region

Revenue and Unit Shipment Forecast Discussion by Region

Percent Unit Shipment Forecast by Passenger Cars and LCVs

Unit Shipment Forecast by Passenger Cars and LCVs

Unit Shipment Forecast Discussion by Passenger Cars and LCVs

Percent Unit Shipment Forecast by OE and Replacement Tires

Unit Shipment Forecast by OE and Replacement Tires

Unit Shipment Forecast Discussion by OE and Replacement Tires

Market Share

Market Share Analysis

Competitive Environment

Competitive Factors and Assessment

Leading Companies

Leading Companies (continued)

Key Findings

Market Engineering Measurements

Market Engineering Measurements (continued)

Segment Definitions

Segment Definitions (continued)

Segment Value Chain

Segment Value Chain Discussion

Market Drivers

Drivers Explained

Market Restraints

Restraints Explained

Market Trends

Regulatory Trends

Product and Technology Trends

Revenue Forecast

Unit Shipment Forecast

Revenue and Unit Shipment Forecast Discussion

Pricing Trends and Forecast

Pricing Trends and Forecast Discussion

Percent Revenue Forecast by Sub-Segment

Revenue Forecast by Sub-Segment

Percent Unit Shipment Forecast by Sub-Segment

Unit Shipment Forecast by Sub-Segment

Revenue and Unit Shipment Forecast Discussion by Sub-Segment

Percent Revenue Forecast by Region

Revenue Forecast by Region

Percent Unit Shipment Forecast by Region

Unit Shipment Forecast by Region

Revenue and Unit Shipment Forecast Discussion by Region

Percent Unit Shipment Forecast by Passenger Cars and LCVs

Unit Shipment Forecast by Passenger Cars and LCVs

Unit Shipment Forecast Discussion by Passenger Cars and LCVs

Percent Unit Shipment Forecast by OE and Replacement Tires

Unit Shipment Forecast by OE and Replacement Tires

Unit Shipment Forecast Discussion by OE and Replacement Tires

Market Share

Market Share Analysis

Competitive Environment

Competitive Factors and Assessment

Leading Companies

Leading Companies (continued)

Key Findings

Market Engineering Measurements

Market Engineering Measurements (continued)

Segment Definitions

Segment Value Chain

Segment Value Chain Discussion

Market Drivers

Drivers Explained

Market Restraints

Restraints Explained

Market Trends

Regulatory Trends

Product and Technology Trends

Revenue Forecast

Unit Shipment Forecast

Revenue and Unit Shipment Forecast Discussion

Pricing Trends and Forecast

Pricing Trends and Forecast Discussion

Percent Revenue Forecast by Sub-Segment

Revenue Forecast by Sub-Segment

Percent Unit Shipment Forecast by Sub-Segment

Unit Shipment Forecast by Sub-Segment

Revenue and Unit Shipment Forecast Discussion by Sub-Segment

Percent Revenue Forecast by Region

Revenue Forecast by Region

Percent Unit Shipment Forecast by Region

Unit Shipment Forecast by Region

Revenue and Unit Shipment Forecast Discussion by Region

Percent Unit Shipment Forecast by Passenger Cars and LCVs

Unit Shipment Forecast by Passenger Cars and LCVs

Unit Shipment Forecast Discussion by Passenger Cars and LCVs

Percent Unit Shipment Forecast by OE and Replacement Tires

Unit Shipment Forecast by OE and Replacement Tires

Unit Shipment Forecast Discussion by OE and Replacement Tires

Market Share

Market Share Analysis

Competitive Environment

Competitive Factors and Assessment

Leading Companies

Leading Companies (continued)

The Last Word—3 Big Predictions

Legal Disclaimer

Table of Acronyms Used

Partial List of Companies Interviewed

Market Engineering Methodology

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Shray Sharma |

| Industries | Agriculture and Nutrition |

| WIP Number | NEB2-01-00-00-00 |

| Is Prebook | No |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB