Strategic Overview of Start-ups Disrupting the Global Connected Car Industry, 2022

Strategic Overview of Start-ups Disrupting the Global Connected Car Industry, 2022

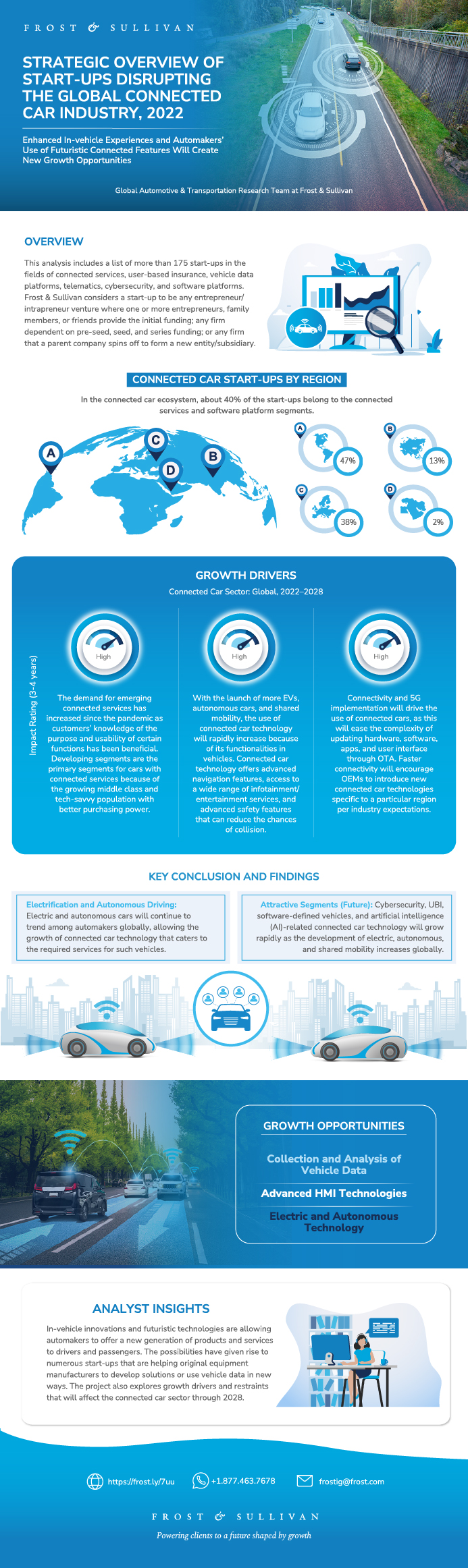

Enhanced In-vehicle Experiences and Automakers’ Use of Futuristic Connected Features Will Create New Growth Opportunities

02-Sep-2022

North America

Market Research

In-vehicle innovations and futuristic technologies are allowing automakers to offer a new generation of products and services to drivers and passengers. The possibilities have given rise to numerous start-ups that are helping original equipment manufacturers to develop solutions or use vehicle data in new ways.

This study includes a list of more than 175 start-ups in the fields of connected services, user-based insurance, vehicle data platforms, telematics, cybersecurity, and software platforms. Frost & Sullivan considers a start-up to be any entrepreneur/intrapreneur venture where 1 or more entrepreneurs, family members, or friends provide the initial funding; any firm dependent on pre-seed, seed, and series funding; or any firm that a parent company spins off to form a new entity/subsidiary.

Frost & Sullivan used 2 benchmarking levels to further assess companies in the following areas:

• management team

• regional impact

• market attractiveness

• employee strength

• year of establishment

• business scalability

• total addressable market

• portfolio strength

• stakeholder ecosystem partnerships

• cyber-risk intensity

From this, a final top 10 is determined in each segment, and the 3 leaders are examined in more detail.

The project also explores growth drivers and restraints that will affect the connected car market through 2028, examines recent funding and regional presence, and presents growth opportunities that warrant further exploration and action.

Why is it Increasingly Difficult to Grow?

The Strategic Imperative 8™

The Impact of the Top 3 Strategic Imperatives on Start-ups in the Connected Car Industry

Growth Opportunities Fuel the Growth Pipeline Engine™

Research Scope

Market Segmentation and Definitions

Key Competitors

Connected Car Unit Shipment Forecast

Connected Car Unit Shipment Forecast by Region

Unit Shipment Forecast for Cars With Embedded Telematics

Analysis by Segment and Region

Growth Drivers

Growth Restraints

Start-up Definition

The Start-up Methodology

Step 1 of the Benchmarking Criteria—Definition

Step 2 of the Benchmarking Criteria—Definition

Benchmark Overview

The Start-up Ecosystem

Top 3 Players in Key Connected Car Segments

Key Participants Investing in Start-ups

Recently Funded Start-ups

Connected Car Start-ups by Region

APAC Emerging as a Global Destination for Start-up Investments for the Connected Car Market

Start-up Penetration by Segment

Key Conclusion and Findings

Shortlisting Exercise - Step 1 of the Benchmarking Criteria

Shortlisting Exercise - Step 1 of the Benchmarking Criteria (continued)

Frost & Sullivan's Criteria to Shortlist Companies

Frost & Sullivan Start-up Evaluation Radar—Scorecard

Frost & Sullivan Start-up Evaluation Radar—Scorecard (continued)

Cubic Telecom Profile

Cubic Telecom Profile (continued)

INRIX Profile

INRIX Profile (continued)

Sibros Profile

Sibros Profile (continued)

Shortlisting Exercise - Step 1 of the Benchmarking Criteria

Shortlisting Exercise - Step 1 of the Benchmarking Criteria (continued)

Frost & Sullivan's Criteria to Shortlist Companies

Frost & Sullivan Start-up Evaluation Radar—Scorecard

Upstream Security Profile

Upstream Security Profile (continued)

AutoCrypt Profile

AutoCrypt Profile (continued)

Argus Cyber Security Profile

Argus Cyber Security Profile (continued)

Shortlisting Exercise - Step 1 of the Benchmarking Criteria

Shortlisting Exercise - Step 1 of the Benchmarking Criteria (continued)

Frost & Sullivan's Criteria to Shortlist Companies

Frost & Sullivan Start-up Evaluation Radar—Scorecard

PATEO Profile

PATEO Profile (continued)

Autotalks Profile

Autotalks Profile (continued)

Cambridge Mobile Telematics Profile

Cambridge Mobile Telematics Profile (continued)

Shortlisting Exercise - Step 1 of the Benchmarking Criteria

Shortlisting Exercise - Step 1 of the Benchmarking Criteria (continued)

Frost & Sullivan's Criteria to Shortlist Companies

Frost & Sullivan Start-up Evaluation Radar—Scorecard

Wejo Profile

Wejo Profile (continued)

Otonomo Profile

Otonomo Profile (continued)

Miovision Profile

Miovision Profile (continued)

Shortlisting Exercise - Step 1 of the Benchmarking Criteria

Shortlisting Exercise - Step 1 of the Benchmarking Criteria (continued)

Frost & Sullivan's Criteria to Shortlist Companies

Frost & Sullivan Start-up Evaluation Radar—Scorecard

Metromile Profile

Metromile Profile (continued)

Zego Profile

Zego Profile (continued)

Root Insurance Profile

Root Insurance Profile (continued)

Shortlisting Exercise - Step 1 of the Benchmarking Criteria

Shortlisting Exercise - Step 1 of the Benchmarking Criteria (continued)

Shortlisting Exercise - Step 1 of the Benchmarking Criteria (continued)

Frost & Sullivan's Criteria to Shortlist Companies

Frost & Sullivan Start-up Evaluation Radar—Scorecard

Frost & Sullivan Start-up Evaluation Radar—Scorecard (continued)

Sonatus Profile

Sonatus Profile (continued)

Mapbox Profile

Mapbox Profile (continued)

Cover Genius Profile

Cover Genius Profile (continued)

Growth Opportunity 1—Collection and Analysis of Vehicle Data

Growth Opportunity 1—Collection and Analysis of Vehicle Data (continued)

Growth Opportunity 2—Advanced HMI Technologies

Growth Opportunity 2—Advanced HMI Technologies (continued)

Growth Opportunity 3—Electric and Autonomous Technology

Growth Opportunity 3—Electric and Autonomous Technology (continued)

Your Next Steps

Why Frost, Why Now?

List of Exhibits

List of Exhibits (continued)

Legal Disclaimer

Purchase includes:

- Report download

- Growth Dialog™ with our experts

Growth Dialog™

A tailored session with you where we identify the:- Strategic Imperatives

- Growth Opportunities

- Best Practices

- Companies to Action

Impacting your company's future growth potential.

| Deliverable Type | Market Research |

|---|---|

| Author | Gautham Prakash Hegde |

| Industries | Automotive |

| No Index | No |

| Is Prebook | No |

| Keyword 1 | Connected Car Industry |

| Keyword 2 | connected car market |

| Keyword 3 | connected vehicle market size |

| Podcast | No |

| WIP Number | MGA2-01-00-00-00 |