Wholesale Carrier Ethernet Services Market Update, United States, 2020

Wholesale Carrier Ethernet Services Market Update, United States, 2020

Revenue Growth Rates Slowing Down as the Market Matures

12-Feb-2021

North America

$4,950.00

Special Price $3,712.50 save 25 %

Description

After several years of double digit growth, the US wholesale Carrier Ethernet services market revenues growth rates began to slow down in 2015, primarily due to market maturity and slowing demand from mobile network operators completing 4G rollouts. By 2017-2018 revenue growth rates were around mid single digits and the market was still seeing migration from TDM to Ethernet networks from wireline carriers. In 2019, wholesale carriers started to experience lesser wholesale Ethernet revenue growth rates, and only a few saw greater growths, mostly MSOs that are attracting important demand in specific metro regions.

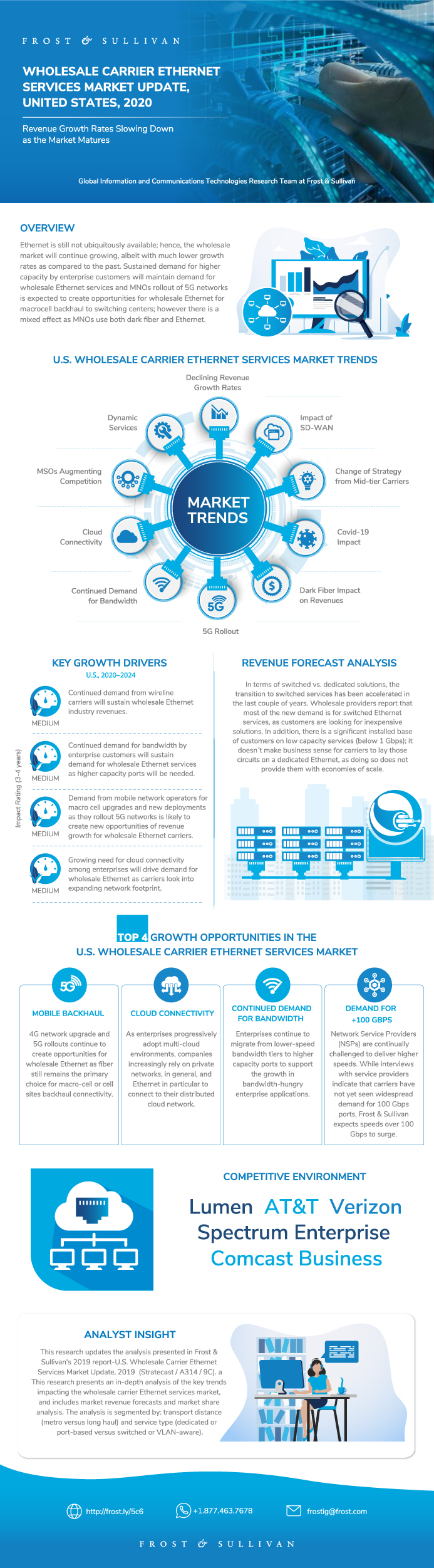

However, Ethernet is still not ubiquitously available; hence, the wholesale market will continue growing, albeit with much lower growth rates as compared to the past. Sustained demand for higher capacity by enterprise customers will maintain demand for wholesale Ethernet services and MNOs rollout of 5G networks is expected to create opportunities for wholesale Ethernet for macrocell backhaul to switching centers; however there is a mixed effect as MNOs use both dark fiber and Ethernet.

This study updates the analysis presented in Frost & Sullivan's 2019 study U.S. Wholesale Carrier Ethernet Services Market Update, 2019 (Stratecast / A314 / 9C). This study presents an in-depth analysis of the key trends impacting the wholesale carrier Ethernet services market, and includes market revenue forecasts and market share analysis. The analysis is segmented by: Transport distance (metro versus long haul) and Service type (dedicated or port-based versus switched or VLAN-aware).

Author: Gina Sanchez

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Why Is It Increasingly Difficult to Grow?

The Strategic Imperative 8™

Growth Opportunities Fuel the Growth Pipeline Engine™

Top 4 Growth Opportunities in the U.S. Wholesale Carrier Ethernet Services Market

Key Growth Metrics

U.S. Wholesale Carrier Ethernet Services Market Overview

U.S. Wholesale Carrier Ethernet Services Market Overview (continued)

U.S. Wholesale Carrier Ethernet Services Market Segmentation by Transport Distance

U.S. Wholesale Carrier Ethernet Services Market Segmentation by Service Type

U.S. Wholesale Carrier Ethernet Services Market Trends

U.S. Wholesale Carrier Ethernet Services Market Trends (continued)

U.S. Wholesale Carrier Ethernet Services Market Trends (continued)

Growth Drivers in the U.S. Wholesale Carrier Ethernet Services Market

Growth Restraints in the U.S. Wholesale Carrier Ethernet Services Market

Forecast Assumptions

Revenue Forecast

Percent Revenue Forecast by Transport Distance

Percent Revenue Forecast by Dedicated Vs. Switched

Revenue Forecast by Switched Ethernet

Revenue Forecast by Dedicated Ethernet

Revenue Forecast Analysis

Competitive Environment

Market Share Analysis

Key Growth Metrics—Metro Segment

Revenue Forecast—Metro Segment

Percent Revenue Forecast by Dedicated Vs. Switched—Metro Segment

Revenue Forecast by Switched Ethernet—Metro Segment

Revenue Forecast by Dedicated Ethernet—Metro Segment

Key Findings and Revenue Forecast Analysis—Metro Segment

Market Share Analysis—Metro Segment

Key Growth Metrics—Long Haul Segment

Revenue Forecast—Long Haul Segment

Percent Revenue Forecast by Dedicated Vs. Switched—Long Haul Segment

Revenue Forecast by Switched Ethernet—Long Haul Segment

Revenue Forecast by Dedicated Ethernet—Long Haul Segment

Key Findings and Revenue Forecast Analysis—Long Haul Segment

Market Share Analysis—Long Haul Segment

Growth Opportunity 1—5G Rollouts for Mobile Backhaul

Growth Opportunity 1—5G Rollouts for Mobile Backhaul (continued)

Growth Opportunity 2—Wholesale Ethernet Solutions for Cloud Connectivity

Growth Opportunity 2—Wholesale Ethernet Solutions for Cloud Connectivity (continued)

Growth Opportunity 3—Wholesale Ethernet Solutions for High Capacity Connectivity

Growth Opportunity 3—Wholesale Ethernet Solutions for High Capacity Connectivity (continued)

Your Next Steps

Why Frost, Why Now?

List of Exhibits

List of Exhibits (continued)

Legal Disclaimer

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Gina Sanchez |

| Industries | Telecom |

| WIP Number | K566-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9705-C1,9655,9681-C1,9721 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB