Digitization of Oil and Gas—Understanding the Impact of IIoT-based Monitoring

Digitization of Oil and Gas—Understanding the Impact of IIoT-based Monitoring

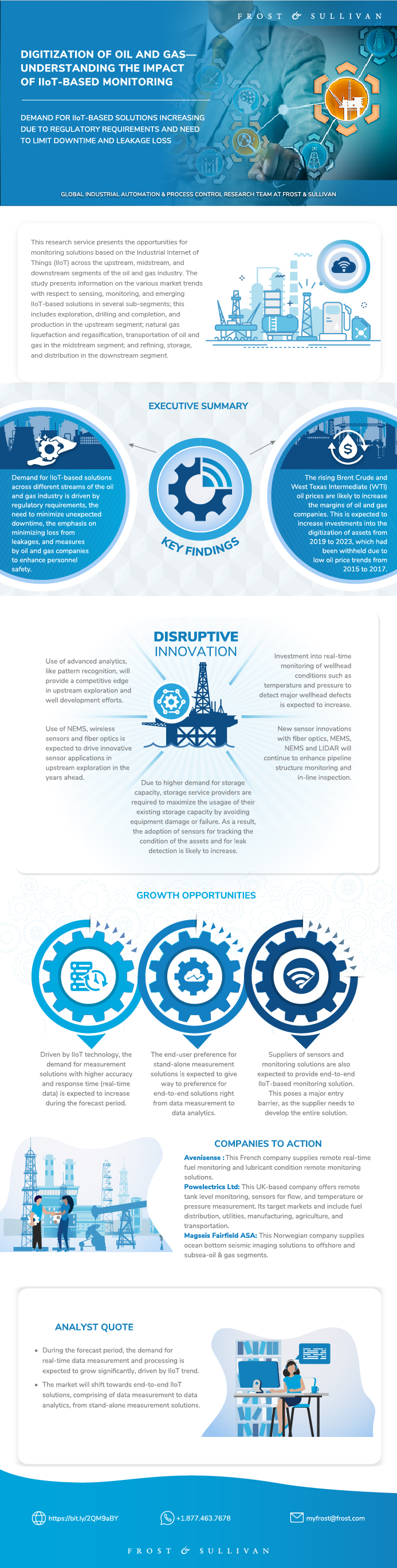

Demand for IIoT-based Solutions Increasing Due to Regulatory Requirements and Need to Limit Downtime and Leakage Loss

02-Dec-2019

Global

$4,950.00

Special Price $3,712.50 save 25 %

Description

This research service presents the opportunities for monitoring solutions based on the Industrial Internet of Things (IIoT) across the upstream, midstream, and downstream segments of the oil and gas industry. The study presents information on the various market trends with respect to sensing, monitoring, and emerging IIoT-based solutions in several sub-segments; this includes exploration, drilling and completion, and production in the upstream segment; natural gas liquefaction and regasification, transportation of oil and gas in the midstream segment; and refining, storage, and distribution in the downstream segment.

This global research service also provides information on the size, such as annual production volume, annual production capacity, of the above end-user segments by key regions and countries across the globe. The regions include North America (the United States, Canada); Latin America (Brazil, Argentina, Mexico, Venezuela, Peru, Trinidad and Tobago, Rest of Latin America); EMEA and Russia (Russia, Germany, Italy, Norway, United Kingdom (UK), Spain , France, Turkey, Saudi Arabia, United Arab Emirates (UAE), Iran, Oman, Kuwait, Qatar, Algeria, Egypt, Nigeria and Rest of EMEA); and Asia-Pacific (China, India, Japan, South Korea, Malaysia, Indonesia, Australia, Taiwan, and the Rest of APAC).

The study also analyzes key trends in the end-user segments. For instance, Russia, followed by Iran, will be significant gas producers in EMEA and this trend is likely to continue in 2019 and 2020. The study analyzes the top emerging monitoring and/or IIoT applications in different end-user segments on parameters, such as key features, benefits for end-users, potential market- entry barriers for the particular application, and growth prospects for the application.

The study also includes the profiles of innovative companies providing the solutions in the emerging application areas. Company profiles include parameters such as revenue, ownership type, geographic presence, key solutions offered, target market segments, and strength, weakness, opportunity, and threat (SWOT) analysis. Some of the companies profiled in the study include WFS Technologies, Magseis Fairfield ASA, Cosasco, ClampOn, Sensorlink, Sensor Networks Inc., and Avenisense.

The study also highlights the main growth opportunities in the market and lists the key success factors to be taken into account by IIoT monitoring solution suppliers for oil and gas. The report also gives an overview of possible revenue streams and strategic approaches to be taken by different companies across the digitized oil and gas ecosystem to capitalize on market opportunities. Motor, pump, and compressor manufacturers, IIoT platform vendors, sensor solution providers, and cybersecurity solution providers can all benefit from the strategies offered.

The overarching conclusion of the study is that the demand for IIoT-based solutions will be driven by regulatory requirements, the need to minimize unexpected downtime, and the emphasis on minimizing loss from leakages.

Author: Krishna Raman

RESEARCH: INFOGRAPHIC

This infographic presents a brief overview of the research, and highlights the key topics discussed in it.Click image to view it in full size

Table of Contents

Key Findings

Emerging Business Opportunities in Oil and Gas

Research Scope

Research Scope (continued)

Upstream Oil and Gas Industry—Drilling

Upstream Oil and Gas Industry—Drilling (continued)

Upstream Oil and Gas Industry—Completion

Upstream Oil and Gas Industry—Completion (continued)

Upstream Oil and Gas Industry—Production

Upstream Oil and Gas Industry—Production (continued)

Upstream Oil and Gas Industry—Production (continued)

Upstream Oil and Gas Industry—Production (continued)

Trends in the Upstream Oil and Gas Industry—Exploration

IIoT Applications in Upstream Oil and Gas Exploration—Subsea IoT (SIoT)

Trends in the Upstream Oil and Gas Industry—Drilling and Completion

IIoT Applications in Upstream Oil and Gas Drilling and Completion—Real-time Downhole Monitoring

Trends in the Upstream Oil and Gas Industry—Production

IIoT Applications in Upstream Oil and Gas Production—Live Seismic Imaging

Innovative Company Profiles in the Upstream Oil and Gas Industry—WFS Technologies

Innovative Company Profiles in the Upstream Oil and Gas Industry—XACT Downhole Telemetry Inc.

Innovative Company Profiles in the Upstream Oil and Gas Industry—Magseis Fairfield ASA

Midstream Oil and Gas Industry—Natural Gas Liquefaction

Midstream Oil and Gas Industry—Regasification

Midstream Oil and Gas Industry—Transportation

Midstream Oil and Gas Industry—Transportation (continued)

Trends in the Midstream Oil and Gas Industry—Processing

IIoT Applications in Midstream Oil and Gas Processing—Predictive Maintenance of Pumping/Compressor Stations

Trends in the Midstream Oil and Gas Industry—Transportation

IIoT Applications in Midstream Oil and Gas Transportation—Pipeline Inspection Using Robots

IIoT Applications in Midstream Oil and Gas Transportation—Geospatial Pipeline Monitoring

IIoT Applications in Midstream Oil and Gas Transportation—Connected Pipeline Monitoring

Innovative Company Profiles in the Midstream Oil and Gas Industry—Cosasco

Innovative Company Profiles in the Midstream Oil and Gas Industry—ClampOn

Innovative Company Profiles in the Midstream Oil and Gas Industry—Sensorlink

Innovative Company Profiles in the Midstream Oil and Gas Industry—Sensor Networks Inc

Innovative Company Profiles in the Midstream Oil and Gas Industry—Caproco

Downstream Oil and Gas Industry—Refining

Downstream Oil and Gas Industry—Refining (continued)

Trends in the Downstream Oil and Gas Industry—Refining

IIoT Applications in Downstream Oil and Gas Refining—Asset Predictive Maintenance

IIoT Applications in Downstream Oil and Gas Refining—Aerial Asset Inspection

Trends in the Downstream Oil and Gas Industry—Storage

IIoT Applications in Downstream Oil and Gas Storage—Real-time Level Monitoring

Trends in the Downstream Oil and Gas Industry—Distribution

IIoT Applications in Downstream Oil and Gas Distribution—Real-time Corrosion Monitoring

IIoT Applications in Downstream Oil and Gas Industry—Remote Tracking of Fuel Quality in Distribution

Innovative Company Profiles in the Downstream Oil and Gas Industry—Avenisense

Innovative Company Profiles in the Downstream Oil and Gas Industry—Intelligent Sensing Anywhere (ISA)

Innovative Company Profiles in the Downstream Oil and Gas Industry—Powelectrics Ltd

Innovative Company Profiles in the Downstream Oil and Gas Industry—GuardMagic Ltd

Innovative Company Profiles in the Downstream Oil and Gas Industry—Cyberhawk Innovation Limited

Growth Opportunity 1—Corrosion Monitoring

Growth Opportunity 2—Remote Tank Monitoring

Strategic Imperatives for IIoT Monitoring Solution Suppliers for Oil and Gas

Strategic Conclusions

Recommendations for Market Participants

Legal Disclaimer

Market Engineering Methodology

List of Exhibits

List of Exhibits (continued)

List of Exhibits (continued)

Popular Topics

| No Index | No |

|---|---|

| Podcast | No |

| Author | Krishna Raman |

| Industries | Industrial Automation |

| WIP Number | MD9B-01-00-00-00 |

| Is Prebook | No |

| GPS Codes | 9A33,9B07-C1,9593,9420 |

USD

USD GBP

GBP CNY

CNY EUR

EUR INR

INR JPY

JPY MYR

MYR ZAR

ZAR KRW

KRW THB

THB